Automate Your Finances Using Technology and Psychology

Learning how to automate your finances has the potential to be a money game-changer.

Why? Because on a daily basis, we face too many choices. Using automation to reduce choices sets you up for success with money without even having to think about it daily. You can truly “set it and forget it” to save money and invest in your future.

Why Is Automating Your Finances Important?

Think about the 50+ money decisions you have to make today: Should you save more? What should you cut down on? What about investing—real estate or stocks or index funds? Pay off debt? Did you send in that Comcast bill on time? Is it time to rebalance your portfolio?

Faced with an overwhelming number of choices, most people respond in the same way: They do nothing. As Barry Schwartz wrote in The Paradox of Choice: Why More is Less, “Choice has made us not freer but more paralyzed.”

Why do so many people believe that personal finance is only about willpower? The idea goes like this: “If I just try harder, I’ll start saving more, pay off my debt, stop spending all that money, keep a budget, learn about investing, start investing, rebalance every year…” Unlikely.

In fact, go ask your friends if they’re taking full advantage of their employer’s 401(k) match. The vast majority of people are not – even though it’s literally free money. Their answer? “Yeah…I really should do that…”

It’s not about willpower. More than anything else, the psychology of automation is critical to successfully getting control of your finances.

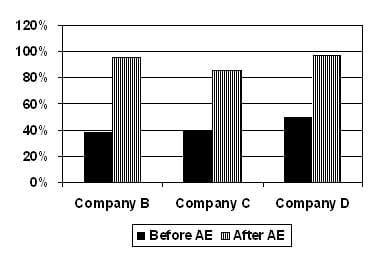

In one study, researchers found that making 401(k) accounts opt-out instead of opt-in—in other words, making employees automatically participate, although they could stop at any time—raised contribution rates from less than 40% to nearly 100%.

How to Automate Your Finances?

Using “The Next $100” Principle, which I’ll show you below, your automated money flow will automatically route money where it needs to go—investments, paying bills, savings, and guilt-free spending.

And you can focus on the things that matter to you, instead of constantly worrying about your personal finances like the couple I mentioned in this recent CNBC article.

Case Study: Michelle’s Automation System

To see how this will work, let’s use Michelle as an example:

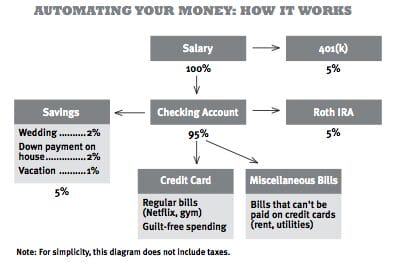

Michelle gets paid once a month. Her employer deducts 5 percent of her pay automatically and puts it in her 401(k). The rest of Michelle’s paycheck goes to her checking account by direct deposit.

About a day later, her Automatic Money Flow begins transferring money out of her checking account. Her Roth IRA retirement account will pull 5 percent of her salary for itself.

Her savings account will pull 5 percent, automatically breaking that money into chunks: 2 percent for a wedding sub-account, 2 percent to a house down-payment sub-account, and 1% for an upcoming vacation. (That takes care of her monthly savings goals.)

Her system also automatically pays her fixed costs like Netflix, cable, and insurance. She’s set it up so that most of her subscriptions and bills are paid by her credit card. Some of her bills can’t be put on credit cards—for example, utilities and loans—so they’re automatically paid out of her checking account.

Finally, she’s automatically e-mailed a copy of her credit card bill for a monthly five-minute review. After she’s reviewed it, the bill is also paid from her checking account.

The money that remains in her account is used for guilt-free spending money.

To make sure she doesn’t overspend, she’s focused on two big wins: eating out and spending money on clothes.

She sets alerts in PocketGuard account, the free money app she’s downloaded, to notify her if she goes over her spending goals, and she keeps a reserve of $500 in her checking account just in case. (The couple of times she went over her spending, she paid herself back using her “unexpected expenses” money from her sub-savings account.) To track spending more easily, she uses her credit card as much as possible to pay for all of her fun stuff.

Guilt-free spending is a key aspect of your personal finance journey. If you’re ready to leave the guilty feelings behind, episode 90 of my podcast answers your questions about money and guilt.

The world wants you to be vanilla...

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

If Michelle uses cash for cabs or coffee, she keeps the receipts and tries to enter them into PocketGuard as often as possible.

In the middle of the month, Michelle’s calendar reminds her to check her PocketGuard account to make sure she’s within her limits for spending money. If she’s doing fine, she gets on with her life. If she’s over her limit, she decides what she needs to cut back on to stay on course for the month.

Luckily, she has fifteen days to get it right, and by politely passing on an invitation to dine out, she gets back on track.

By the end of the month, she’s spent less than two hours monitoring her finances, yet she’s invested 10 percent, saved 5 percent (in sub-buckets for her wedding and down payment), paid all of her bills on time, paid off her credit card in full, and spent exactly what she wanted to spend. She had to say “no” only once, and it was no big deal. In fact, none of it was.

"The Next $100" Principle Applied: Automating Your Finances

Too many people try to save money on 50 things and end up saving 5% on everything—and causing themselves stress that makes them give up entirely.

Instead, I prefer to focus on my top two discretionary expenses (for me, eating out and going out) and cut 25%-33% off over six months. This generates hundreds of dollars of extra cash flow that I reroute to investing and travel.

To show you how automating your accounts works, I’ve prepared a 12-minute video that guides you on how to build a personal finance infrastructure that automates your money so you can spend less than 1 hour per week monitoring your money. Everything will be done automatically—investment, savings, bills paid. Everything.

Ramit’s 12-Minute Guide to Automating Your Finances

1. Log into all of your accounts

First, you’ll need to log in to each account and link your accounts together so you can set up automatic transfers from one account to another. When you log in to any of your accounts, you’ll usually find an option called something like “Link Accounts,” “Transfer,” or “Set Up Payments.”

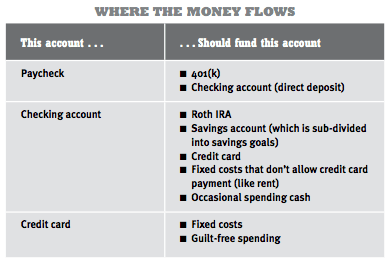

These are the links you need to make:

Examples: Your 401(k) should be connected to your checking account via direct deposit (talk to your HR rep about setting this up—it takes 10 minutes to fill out a form). Then log into your Roth IRA, savings account, and credit card, where you can link your checking account to them.

Finally, some bills can’t be paid through your checking account, like your rent. For those, use your checking account’s free bill-pay feature so they automatically issue your landlord a check on the precise date it’s due. Now, you never have to manually write a check again.

2. Set up automatic transfers

Now that all your accounts are linked, it’s time to go back into your accounts and automate all transfers and payments. This is really simple: It’s just a matter of working with each individual account’s website to make sure your payment or transfer is set up for the amount you want and on the date you want.

Most people neglect one thing when automating: dates. If you set automatic transfers at weird times, it will inevitably necessitate more work, which will make you resent and eventually ignore your personal finance infrastructure.

For example, if your credit card is due on the 1st of the month, but you don’t get paid until the 15th, how does that work? If you don’t synchronize all your bills, you’ll have to pay things at different times and that will require you to reconcile accounts. Which you won’t do.

The easiest way to avoid this is to get all your bills on the same schedule.

3. Get all of your bills on the same schedule

To accomplish this, get all your bills together, call the companies, and ask them to switch your billing dates. It shouldn’t take more than 10 minutes to set this up.

There may be a couple of months of odd billing as your accounts adjust, but it will smooth itself out after that. If you’re paid on the 1st of the month, I suggest switching all your bills to arrive on or around that time, too.

Call and say this: “Hi, I’m currently being billed on the 17th of each month, and I’d like to change that to the 1st of the month. Do I need to do anything besides ask right here on the phone?” Of course, depending on your situation, you can request any billing date that will be easy for you.

Now that you’ve got everything coming at the beginning of the month, it’s time to actually go in and set up your transfers. Here’s how to arrange your Automatic Money Flow, assuming you get paid on the 1st of the month.

2nd of the month

Part of your paycheck is automatically sent to your 401(k). The remainder (your “take-home pay”) is directly deposited into your checking account. Even though you’re paid on the 1st, the money may not show up in your account until the 2nd, so be sure to account for that.

Remember, you’re treating your checking account like your email inbox—first, everything goes there, then it’s filtered away to the appropriate place.

Note: The first time you set this up, leave a buffer amount of money—I recommend $500—in your checking account just in case a transfer doesn’t go right. And don’t worry: If something does go wrong, use the negotiation tips above to get any overdraft fees waived.

5th of the month

- Automatic transfer to your savings account. Log in to your savings account and set up an automatic transfer from your checking account to your savings account on the 5th of every month. Waiting until the 5th of the month gives you some leeway. If, for some reason, your paycheck doesn’t show up on the 1st of the month, you’ll have four days to correct things or cancel that month’s automatic transfer.

Don’t just set up the transfer. Remember to set the amount, too. Use the percentage of your monthly income that you established for savings in your Conscious Spending Plan (from Chapter 4 of my book; typically 5 to 10 percent).

But if you can’t afford that much right now, don’t worry—just set up an automatic transfer for $5 to prove to yourself that it works. The amount is important: $5 won’t be missed, but once you see how it’s all working together, it’s much easier to add to that amount.

- Automatic transfer to your Roth IRA. To set this up, log in to your investment account and create an automatic transfer from your checking account to your investment account. Refer to your Conscious Spending Plan to calculate the amount of the transfer. It should be approximately 10 percent of your take-home pay, minus the amount you send to your 401(k).

If you’ve read this far, you’d LOVE my New York Times Bestselling book

You can read the first chapter for free – just tell me where to send it:

7th of the month

- Auto-pay for any monthly bills you have. Log in to any regular payments you have, like cable, utilities, car payments, or student loans, and set up automatic payments to occur on the 7th of each month. I prefer to pay my bills using my credit card because I earn points, I get automatic consumer protection and little-known benefits, and I can easily track my spending on online sites like PocketGuard, Quicken, or Wesabe.

But if your merchant doesn’t accept credit cards, they should let you pay the bill directly from your checking account, so set up an automatic payment from there if needed.

- Automatic transfer to pay off your credit card. Log in to your credit card account and instruct it to draw money from your checking account and pay the credit card bill on the 7th of every month—in full. (Because your bill arrived on the 1st of the month, you’ll never incur late fees using this system.) If you have credit card debt and you can’t pay the bill in full, don’t worry. You can still set up an automatic payment; just make it for the monthly minimum or any other amount of your choice. (Incidentally, paying your bills on time is one of the top factors in determining and improving your credit score.)

By the way, while you’re logged in to your credit card account, also set up an e-mail notification (this is typically under “Notifications” or “Bills”) to send you a monthly link to your bill, so you can review it before the money is automatically transferred out of your checking account.

This is helpful in case your bill unexpectedly exceeds the amount available in your checking account—that way you can adjust the amount you pay that month.

Tweaking Your System: Freelancers, Irregular Income, and Unexpected Expenses

That’s the basic Automatic Money Flow schedule, but you may not be paid on a straight once-a-month schedule. That’s not a problem. You can just adjust the above system to match your payment schedule.

How to Automate Your Finances if You’re Paid Twice a Month

I suggest replicating the above system on the 1st and the 15th—with half the money each time. This is easy enough, but the one thing to watch with this is paying your bills.

If the second payment (on the 15th) will miss the due dates for any of your bills, be sure that you set it so that those bills are paid in full during the payment on the 1st.

Another way to work your system is to do half the payments with one paycheck (retirement, fixed costs) and half the payments with the second paycheck (savings, guilt-free spending), but that can get clunky.

How to Automate Your Finances if You Have Irregular Income?

Irregular incomes, like those of freelancers, are difficult to plan for. Some months you might earn close to nothing, others you’re flush with cash. This situation calls for some changes to your spending and savings.

First—and this is different from the Conscious Spending Plan—you’ll need to figure out how much you need to survive each month. This is the bare minimum: rent, utilities, food, loan payments—just the basics. Those are your bare-bones monthly necessities.

Now, back to the Conscious Spending Plan. Add a savings goal of three months of bare-bones income before you do any investing.

For example, if you need at least $1,500/month to live on, you’ll need to have $4,500 in a savings buffer, which you can use to smooth out months where you don’t generate much income. The buffer should exist as a sub-account in your savings account. To fund it, use money from two places:

- Forget about investing while you’re setting up the buffer, and instead take any money you would have invested and send it to your savings account.

2. In good months, any extra dollar you make should go into your buffer savings.

Here’s an example of how I set up my sub-savings accounts:

Once you’ve saved up three months of money as a cushion, congratulations! Now go back to a normal Conscious Spending Plan where you send money to investing accounts.

Because you’re self-employed, you probably don’t have access to a traditional 401(k), but you should look into a Solo 401(k) and SEP-IRA, which are great alternatives.

Just keep in mind that it’s probably wise to sock away a little more into your savings account in good months to make up for the less profitable ones.

If you have an irregular income, I highly recommend using YouNeedABudget as a planning tool. It uses a forward-looking system that’s very helpful if you don’t know what you’re going to make next month.

Your Money Is Now Automatic

Congratulations! Your money management is now on autopilot. Not only are your bills paid automatically and on time, but you’re actually saving and investing money each month.

The beauty of this system is that it works without your involvement and it’s flexible enough to add or remove accounts at any time. You’re accumulating money by default.

Most importantly, whenever you’re eating out, or you decide to buy a new pair of shoes, fly out to visit your friends, or get the “Pro” version of that web app you’ve been eyeing, you won’t feel guilty because you’ll KNOW that your finances are being handled—automatically.

Excerpt from Ramit Sethi’s book, I Will Teach You To Be Rich. Used with permission.

If you liked this post, you’d LOVE my Ultimate Guide to Personal Finance

It’s one of the best things I’ve published (and 100% free), just tell me where to send it: