What is personal finance? 4 pillars for limitless wealth

Your personal finances are incredibly important. That's because what you do now for your personal finances not only impacts your life today but also has far reaching impacts into your future.

But what is personal finance really? What does that look for you? And how can you best set yourself up for financial success in the future?

Also why am I the one talking to you about any of this?

Hi, I'm New York Times best-selling author Ramit Sethi. More than a decade ago, I wrote a book on personal finance called I Will Teach You To Be Rich, based off of the website you're on right now.

I've helped millions of people build systems that helped them earn more, invest for the future, and spend their money guilt-free without the BS.

Now, I want to help you do the same and that starts with understanding what exactly personal finance is.

Personal finance definition

Personal finance encompasses everything about the way you manage your money.

As the name implies, your personal finance is unique to you. That means it has nothing to do with the economy. It also means what your buddies, coworkers, family members, and whoever else do is going to look very different from what you end up doing.

And at the end of the day, personal finance boils down to you and the way you approach your financial pillars.

What are the financial pillars? I'm glad you asked. The four biggest pillars of personal finance are:

- Saving. How you keep your money.

- Investing. How you let your money grow.

- Earning. How you make more money.

- Spending. How you use your money to purchase things.

Lets break down each pillar now and see how you should be approaching each.

Financial pillar #1: Saving

This pillar encompasses all of the actions and tactics you take in order to save money.

It also happens to be the system people mess up all. The. TIME.

You probably have heard of saving advice like:

- Cut out lattes

- Keep a budget

- Don't eat out and cook your own food

- Collect your spare change in a jar

While this advice might make sense at first, its not that great.

Actually, its worse than not great. It can be downright harmful if you rely on these as your only methods of saving money.

Plus, you could end up like this weirdo:

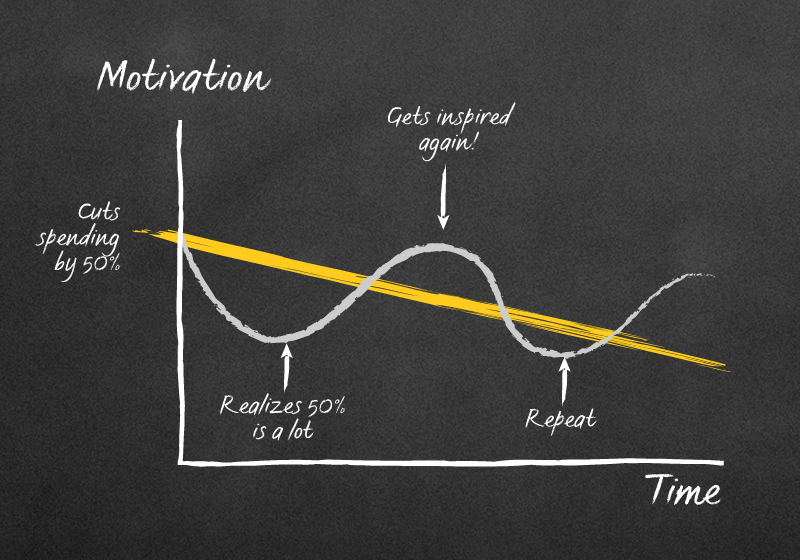

Financial advice like keep a budget and cut out lattes to save money doesn't work because it solely relies on human willpower. And human willpower is limited. That means we only have so much of it we can devote to one action before it runs out.

So when we have to do things like give up lattes and check our budget spreadsheets every day, we overexert our willpower and end up giving up our goal of saving money entirely.

When that happens, it can look something like this:

Instead, you shouldn't feel guilty about enjoying the things you love. You should be able to save money without relying on your willpower. To do that, you just need the right savings systems. Check out my article below to help you get started.

FURTHER READING: 3 Best Strategies to Start Saving Money Today

Financial pillar #2: Investing

Investing is the single most important thing you can do today to ensure your financial success in the future.

Its like that old adage: The best time to plant a tree was 100 years ago. The second best time is now.

That's why you need to invest as early and often as possible for your success.

Don't believe me? There's more than 100 years of evidence in the stock market that shows investing is crucial to your financial future.

When it comes to your personal finances, though, what should you invest in?

I'm glad you asked ...

Investment #1: 401k

Your 401k is a powerful investment plan offered by most employers.

Here's how it works: Your employer will offer you a 401k plan with a variety of investment options. These investment options will likely be split up by how aggressive the plans are. The more aggressive the plan is, the more risk is involved but you also stand to earn more when you invest.

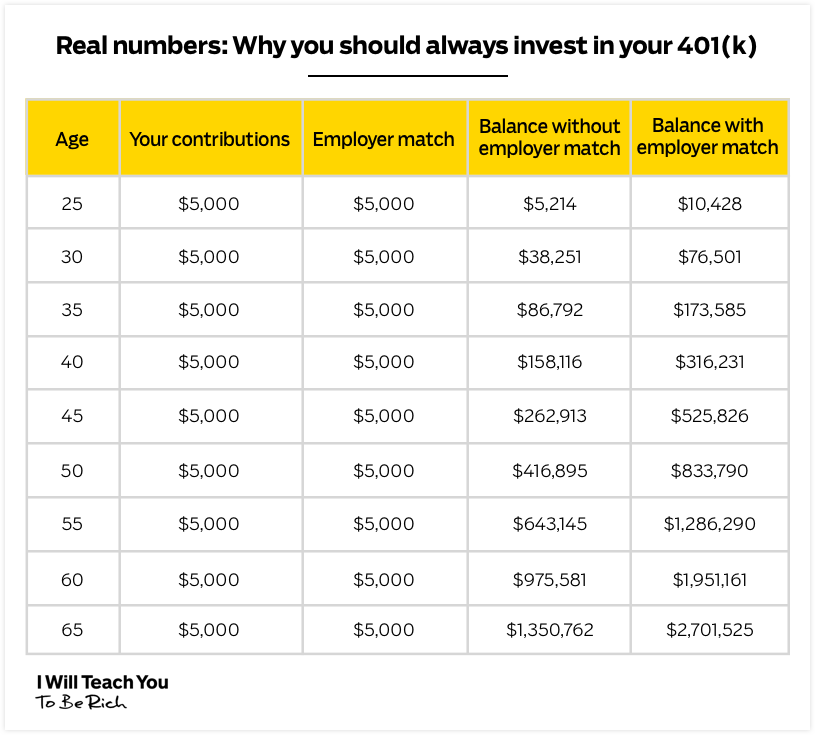

Your employer will also offer something called a match. This is a certain percentage of your income that your employer will match you dollar-for-dollar when you invest.

For example, lets say you earn $3,000 / month and your employer offers a 5% match. If you invest $150 / month (5% of $3,000), your employer will give you $150 to match.

That's right. Its free money from your employer.

The money you invest is pre-tax as well, which means that your money will grow and compound even more until you take it out at retirement age of 59 .

So if your employer offers a 401k, I suggest putting in at least enough money to get the full employer match.

NOTE: As of 2018, you can contribute up to $18,500 / year.

This ensures you're taking full advantage of what is essentially free money from your employer. That match is POWERFUL and can double your money over the course of your working life:

Investment #2: Roth IRA

Your Roth IRA is another tax-advantaged retirement plan. There are three big differences with this plan though:

- It is a personal investment account. That means your employer wont supply it for you and you wont be getting a match from anyone.

- The max contribution is $6,000 / year. You wont be able to invest and earn nearly as much as a 401k account.

- You contribute after-tax income but you pay no taxes on it when you withdraw it which gives you an even better deal.

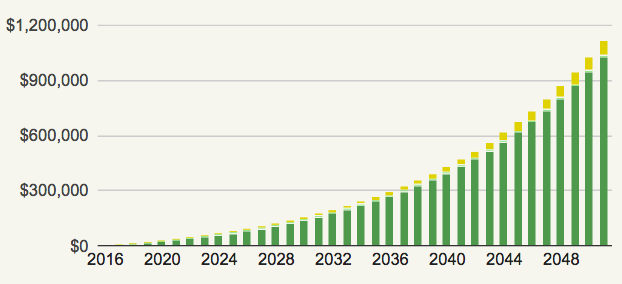

Imagine you're 25 years old and you decide to invest $500 / month in a low-cost, diversified index fund. If you do that until you're 60, how much money do you think you'd have (assuming a 5% return)?

The world wants you to be vanilla...

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

$1,116,612.89.

That's right. You'd be a millionaire after only investing a few thousand dollars per year.

For more information on both of these accounts, be sure to check out my article on retirement accounts below.

FURTHER READING: My Simple Retirement Guide (real life story inside)

Financial pillar #3: Earning

There's a limit to how much you can save but there's no limit to how much you can earn.

If I wasn't so afraid of needles and the social implications, Id get that saying tattooed across my forehead.

The power of earning more is one thing people don't often realize. Instead of trying to pinch every penny and cut out the things you love in order to save your money, you should focus on making more money so you can spend guilt-free.

When it comes to making money, the two best ways are negotiating a higher salary and starting a side hustle. Lets take a look at both and see how you can get started.

Negotiate a higher salary

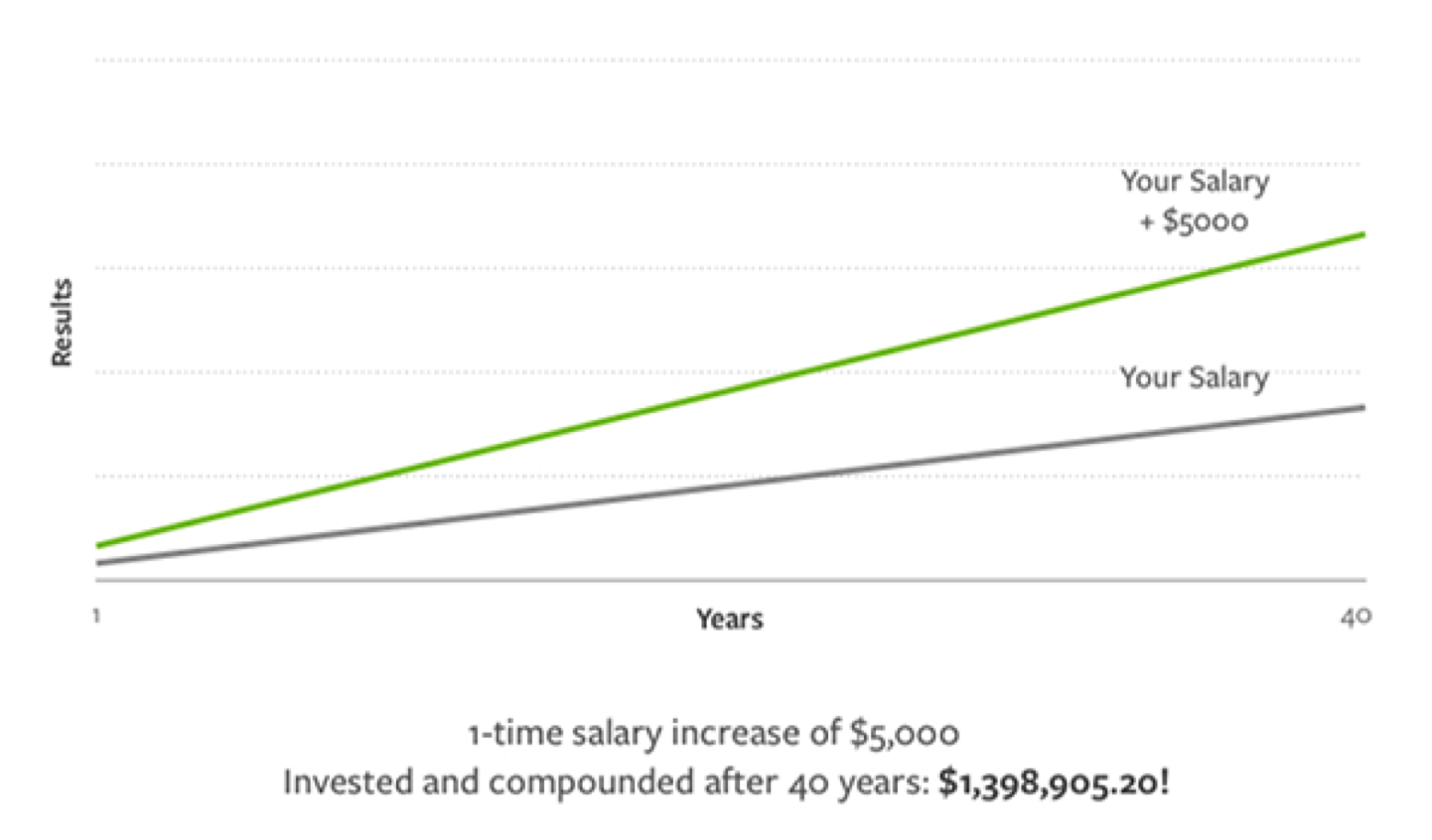

Salary negotiations are a great way to nail a Big Win that helps you earn thousands of dollars more over your lifetime.

Check out how much a $5,000 increase in salary can add up over the years:

When it comes to negotiating salary, you need to remember three things:

- Know your value. You need to know exactly what you're contributing to the company AND what you plan on contributing after you get the raise. Only when you can showcase how invaluable you are to your boss can you hope to make the case that you deserve a pay raise. How do you showcase your value? Simple: The Briefcase Technique. Check out my article on the topic for more.

- Have a number in mind. If you come into the negotiations without a hard number in mind, you're putting your potential future salary into the hands of your manager. That's like going grocery shopping not knowing what you want to buy and asking the checkout clerk what you should get. When you figure out a precise number, you can better make the case as to why you deserve it. Don't know what to ask for? Simply go to Glassdoor or PayScale to see what the range is for your role.

- Practice, practice, practice. I always say: never shoot your first basket in the NBA. And never go into salary negotiations without having practiced the conversation. Practice with friends or family. Practice in front of a mirror. Record yourself so you can listen and critique yourself later. Your chances of having a successful negotiation go up the more you do it.

For more on this topic, be sure to check out my article on it below.

FURTHER READING: How to negotiate the raise you deserve in 3 months

Start a side hustle

I love side hustles. They're my all-time favorite way to earn more money while working a 9-to-5.

Side hustles are very flexible. That means you can work on them in your free time once you're done with work. They're also good ways to help you do what you love on the side.

The best part: You can scale them however you want. That means how much you earn simply depends on how much you want to work at it.

Chances are you already have all the skills you need to start one too. Think about your talents and hobbies.

Do you:

- Know a language? People will pay you to tutor them in foreign languages.

- Write amazing content? I cant think of a single business out there who wouldn't pay top dollar for a great copywriter.

- Develop computer programs and apps just for fun? You can leverage those skills to help other businesses develop websites and apps.

To help you even more, be sure to check out my article on creating a side hustle below.

FURTHER READING: How to find a side hustle idea (plus 42 side hustle ideas you can start today)

Financial pillar #4: Spending

My favorite financial pillar: Spending.

Spending gets a very bad rap. People often point to it for their financial woes and the financial woes of others.

While there are plenty of people who take spending too far, I argue that its not spending that's led to financial downturns its not being conscious with your spending that can lead to unhealthy financial habits.

One of my all-time favorite ways to get started living a Rich LIfe is through a system I call the Conscious Spending Plan.

I don't EVER want you to cut out the things you love in order to save money. That defeats the purpose of a Rich Life. With the Conscious Spending Plan, you'll be able to save money purposefully by avoiding the mindless spending that can come from disorganized finances.

Setting up the system might seem hard but in the end, its all about:

- Automating your finances.

- Knowing where your money goes so you're in complete control of the situation.

To help you do both, I want to give you my 12-minute guide to automating your finances. In it, I break down exactly how you can implement this system today.

Simply put your name and email below and Ill send the video straight to your inbox.

Budgeting is unsustainable. Start “Conscious Spending” instead.

As seen on the IWT podcast, my Conscious Spending Plan helps you buy the things you love, guilt-free.