How to Build a Bulletproof Budget (in 5 simple steps)

Even after more than 20 years of sharing my philosophy on building your Rich Life, I still run into people who need help with their budget. They typically fall into two categories:

- They don't know how to build a budget.

- They don't know how much money they're spending each month.

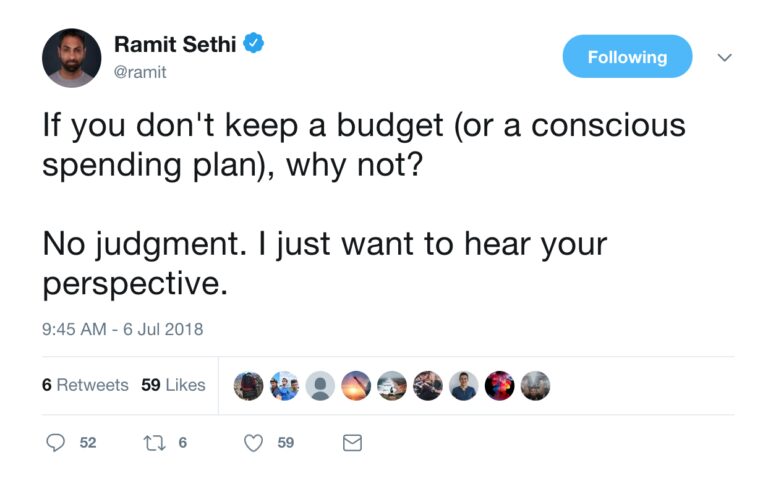

For example, I tweeted this:

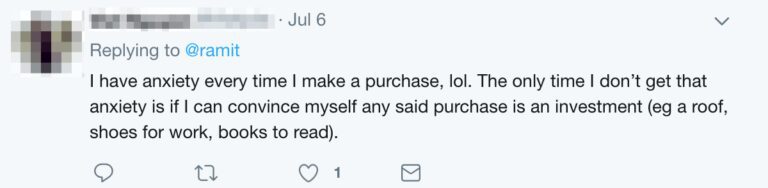

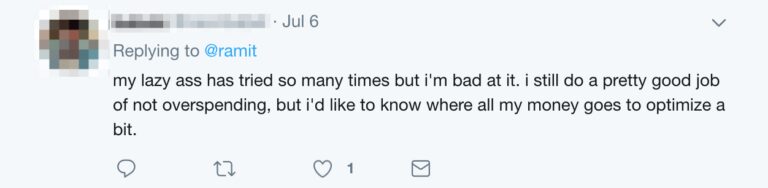

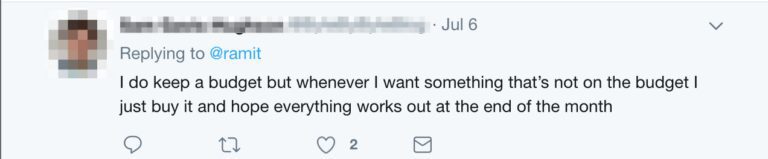

The answers I received were fascinating:

What do you notice about the responses? Some common themes are fear, laziness, confusion, and even anger.

If that sounds familiar to you, that’s okay! I’m here to help you.

In this guide, I'll walk you through how to build a bulletproof budget in 5 simple steps.

Why you need help with your budget

When people think budgeting, images of their parents studiously going over receipts, writing down expenses in a notebook, and screaming, "WHY DID WE SPEND SO MUCH ON GAS LAST WEEK?" come to mind.

That might have worked for them, but it doesn't work now.

- How many times have you opened your bills, winced, then shrugged and said, I guess I spent that much?

- How often do you feel guilty about buying something but do it anyway?

This is unconscious spending (aka spreadsheet budgeting).

The main issue with it is simple: Human willpower.

Who wants to track their spending? The few people who actually try it find that their budgets completely fail after two days because tracking every penny is overwhelming.

Alternative budget-building tips

I'm going to introduce you to a new, simple way of spending.

You'll learn how to redirect your finances to the aspects of your life you choose, like investing, saving, and even spending more on the things you love (and how to spend less on the things you don’t).

This is going to be the foundation of your Conscious Spending Plan.

1. Know where your money is going

You know your money matters are out of whack when it feels like you’re starring in Macklemore’s Thrift Shop music video. When there is simply too much a month for your paycheck, there’s a good chance you’re not aware of what your lifestyle actually costs.

It’s time to sit down and categorize your spending into four buckets.

- Fixed costs

- Investments

- Savings

- Guilt-free spending

Now, you’re going to see me talk about these four categories a lot because all your expenses are contained in these categories. When you can pinpoint what belongs where, you’ll quickly start to understand where the gaps in your financial plan are.

For instance, if you’re spending $500 per month on guilt-free items and nothing on savings or investments, is it really guilt-free spending? Or, if you have a fixed costs bill of $5,000, but your net income is $5,000, you might have a lifestyle you can’t afford.

Investments and savings are easy to tally up, but you need to go through your fixed costs and guilt-free spending categories to see whether you’re overspending.

Fixed costs examples

To make sure the money goes where it needs to, you need to complete your fixed costs category first. You also need to allocate funds to this category first.

There are four major components that you simply can’t eliminate completely. They’re housing, utilities, food, and transport.

Other items in this category include internet costs, education, healthcare, debt repayments, insurance, and other expenses that pop up every month without fail.

If you’re living paycheck to paycheck, this is also the area you want to comb through to make sure you’re not paying for things you don’t actually need or want.

You may find moving to a cheaper apartment or selling a car might allow you to breathe a little easier month-to-month, but the cutting needs to make sense to you. What does it help to save $100 on rent every month only to spend $100 extra on traveling?

What is guilt-free spending?

These are expenses like subscription services, endless cups of Starbucks, expensive shoes, dining out, etc. Now, just to be clear, just because we have this as a category doesn’t mean you have to allocate money to it.

If you’re scraping the peanut butter jar so badly that you’re starting to get plastic shavings on your sandwich, it might be time to clear up some fixed expenses first.

In episode 90 of my podcast, I discuss how to stick to your spending plan and navigate money guilt:

2. Build your budgeting systems

Have you ever caught yourself saying things like I'll get that on payday or wait until next week when I have my paycheck? If a major expense falls in the middle of the month, who has money at that time? People who know where their money goes do!

That may seem a little harsh, but it's not meant to be. You can be the person who doesn't panic when a surprise event comes up any time of the month.

The only difference payday makes is it's the day a significant payment lands in your account. If that money isn't carefully allocated into different categories, you'll eat into money meant for savings and investments.

So, how do you get off this slippery slope?

Allocate sub-accounts in your savings

While I’m big on investments, I also know the value of saving for short-term goals. Chucking everything into one account with no clear direction is like throwing a mixed laundry load into the washing machine on a hot cycle. You never know when your whites are going to turn pink.

Your savings account should have sub-categories that allow you to save for your various needs. For instance:

- Emergency fund: Ideally, you’ll have at least 3-6 months’ worth of fixed-cost expenses saved in an emergency fund. But if you’re really ambitious, go for one year. A solid emergency fund can ease potential hardship.

- Gifting and birthdays: If your budget is tight, it’s important that you budget birthdays and gifting ahead of time.

- Car service and maintenance: If you don’t have a motor plan, you need to put money away for services, maintenance matters such as tires, and car-related things that might pop up. You don’t want to dip into emergency savings for predictable expenses.

- Big deposits: Think major expenses like vacations, a wedding, or a down payment on a home.

Many banks allow you to open these sub-accounts to categorize your money at no extra charge and still offer to pay some interest on it.

It might take you some time to set this up, but guess what, when it’s done, you don’t have to think about it again until you need to use it. Here are the savings accounts that we recommend – I’m not affiliated with them in any way, but I use them and like them.

Budgeting is unsustainable. Start “Conscious Spending” instead.

As seen on the IWT podcast, the Conscious Spending Plan helps you buy the things you love, guilt-free.

This is a big one. Automating your personal finances is a game-changer for both spending and saving. It has several benefits including:

- It takes the fear of the unknown out of your finances

- You don't have to spend a ton of time on your finances (increasing the chances that you'll actually stick to a system)

- You're able to identify holes or money traps in your budget

- It helps you build good financial habits

You can automate your finances to such an extent that you simply have to give your bank accounts a glance over once in a while to make sure things are still running as they should.

Every single thing that needs to be paid, can be automated. Let's have a look:

- Credit cards: Set up your credit card to have the balance auto-paid every month from your checking account. Settling the balance in full every month is an important step in money management and will do wonders for your budget. Not only will you save on interest, but it also boosts your credit score if you manage to keep your usage to no more than 30%. Automatic payments also ensure that the card is paid on time, every time. The importance of this extends beyond your relationship with the credit card. It can also influence future financial products like buying a house.

- Investments: Instruct your company or investment firm to automatically withdraw a certain amount from your bank or every paycheck for your retirement accounts. Your goal is to automate your finances to such an extent that you've maxed out your allowable contributions to these accounts before moving on to other investment types such as index funds.

- Savings: Predetermining your savings and setting up an auto-transfer to your savings pockets will free up time and will make you less inclined to spend the money before you save it. There will always be something to save for, even if you've reached the limit to your emergency savings.

- Utilities: You can set up autopay with most utility companies online. You know your utilities are up to date, you simply need to check the statement to make sure the amounts don't differ. Other than that, you can set it and forget it.

Want to learn more about automating your finances? Check out my instructional video below:

3. Cut mercilessly on things you don't love or need

Don't like watching TV? Cancel the Netflix subscription. What about the gym subscription? Is it possible for you to get the same results at home?

Now move on to things that are a little more serious. Let's talk about your property, for instance. There is a truckload of other expenses that you need to consider when buying a property. You're not just going to have a long-term mortgage.

Before you even own the house, you need to have the down payment, closing costs, and reserves on hand. While the down payment and reserves are in your best interest, it may take time to build it up.

Ongoing costs to consider include HOA costs, insurance, property taxes, maintenance, and utilities. Now, ask yourself whether you're still okay with it, or whether you might just be better off renting until you're 100% sure you want to settle in a specific location.

Now, this might be an unpopular opinion, but owning a house is not the be-all and end-all our parents made it out to be. It's damn expensive and you need to be financially secure enough to take it on. It's not for everyone.

You may not want to cut out everyday items that you love, like lattes and dinners out with friends, but if you can make cuts on major expenses like housing, that's a huge win.

The world wants you to be vanilla... …but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

4. Increase spending on the stuff that matters

Don't let anyone tell you you're wasting money if spending it on things that matter to you.

When you've done your bit and allocated money to all the other categories and you have money left over, it's your prerogative to spend it how you want. Do you like $1,000 shoes? If you can afford them and it matters to you, then it belongs in your guilt-free spending category.

When you're doing this right and you've allocated what you need to in the other categories, imagine getting the figure up to 30% or even 40% of your take-home pay.

For example, staying fashionable matters to me, so I hired Next Level Wardrobe as my personal stylist for events and day-to-day clothes. Most people would consider spending extra money to dress themselves up as outrageous, but dressing well is part of my Rich Life and I don’t feel guilty about it.

5. Boost your income

Money isn’t everything, but if you like to live a life of experiences, it’s hard to be broke. So, how do you strike a balance between your top-heavy budget and some fun money?

If you’ve already gone through the culling discussed in step 3, don’t reduce your savings or investments. Instead, look for ways to boost your income. Knowing how to make a budget is knowing how to make your money work for you.

Ask for a raise

When was the last time you had a raise? If it was last year after a performance review and it didn’t even compete with inflation, it’s time to start doing the math. A raise today could lead to more retirement savings, higher future salaries, a bigger dent in your debt, and more fun money.

It’s worth the discussion and if you follow my negotiation steps, you might just be looking at a dream salary.

If you can’t increase your salary at your current job, why not pursue a new job at a salary that matches your experience? Who knows, instead of a tiny increase, you might be looking at a salary hop of a couple of thousand dollars per year.

Negotiate your financial and non-financial products

You can reduce your fixed costs spending category in a matter of minutes simply by picking up the phone.

Let’s start with banks. There is a wide variety of products they offer and each one is either designed to keep their liquidity high (savings accounts) or earn them the big dollars (by offering credit with interest).

You can either spend time negotiating half a percentage on your small savings account, or you can tackle big-ticket items. For starters, if your mortgage is at a high interest rate, check out the pros and cons of refinancing.

Just make sure that if you go down this route, that the lender doesn’t hit you with processing fees.

Checking accounts and credit cards are two other products that can do with a price check. If you’re paying monthly or annual fees, it’s time to call them and bring that figure down.

But there are other areas you can save.

- Internet service providers typically onboard new customers at a lower rate. Ask them to lower your monthly to retain you as a loyal customer.

- Gym membership fees. Depending on the club and the length of time you’ve been with them, ask them to see if there’s a way to cut down on the fees.

Start a side hustle

A side hustle can be a great way to boost your income, especially if you start out with a low-overhead hustle like an online business. It might take you a couple of months to start making money, but it can pay big dividends in the long run.

Now, figuring out which side hustle to start is easier than you think. Think about the skills you bring to the table, to start.

Side hustles that require very little startup cash, if any, include freelance writing, design work, or a drop shipping store.

Budgeting FAQs

How should a beginner budget?

It all starts with the basics. Know exactly how much is coming in and how much is going out. You may have to write it down until it becomes second nature. Then, you follow the steps above which include financial automation and conscious spending.

What are the 50/20/30 and 70/20/10 budget rules?

The 50/20/30 rule is a budget guideline that states 50% of your after-tax income should go towards commitments and obligatory expenses. Then 20% on savings and debt repayments and the remaining 30% on everything else.

The 70/20/10 states that 70% should go towards expenses, 20% on savings, and 10% on giving.

While these are handy when you’re still trying to figure things out, it’s important that you find a ratio that works for you. The goal is simple, decrease your debt, increase your savings and investments, and allow yourself some guilt-free spending.

What is the envelope system?

The idea is that you have an envelope for each payment category. So you’d have one for your housing, one for utilities, another for food, and so on. Great envelope systems include investments and savings too.

However, technology has shown us that everything is easier when you automate it. Apps like Fudget and Monefy are great for those who wish to use the envelope system. This allows you to stay on top of your obligations, have a proactive approach to budgeting, and not overspend.

Summary

A budget is not a spreadsheet. It’s a proactive approach to your finances and allows you the financial freedom to meet your financial obligations and commitments.

It also allows your money to work for you and buy you great life experiences and the rich life you desire, all while building up the financial foundation for future you.