Inverted Yield Curve: what is it and how does it predict disaster?

The inverted yield curve is a graph that shows that younger treasury bond yields are yielding more interest than older ones.

And it’s TERRIFYING for financial pundits all over the world. It’s a graph that could mean the difference between a thriving bull market or the downswing of a bear market.

AND it’s been known to throw entire economies into a state of abject terror and chaos.

Want to see what it looks like? Okay. Don’t say I didn’t warn you …

(Source: Britannica)

(Source: Britannica)

While it might not seem like much at first glance, the inverted yield curve is actually the bellwether for an economic recession. You know, that thing that happened in 2008 that was kind of a huge deal?

Luckily, the inverted yield curve is a rare occurrence … BUT it’s useful to know what it means and how to spot one when it happens.

Why?

Simple: You don’t want to get swept up in the herd mentality of one, and being able to recognize when it happens is the first step in preventing yourself from making bad decisions based on what everyone else is doing.

So let’s take a look at the inverted yield curve, how it happens, and what it means for you and your finances.

What is an inverted yield curve?

To understand what an inverted yield curve is, you must first understand one of the most basic financial asset classes out there: Bonds.

A bond is like an IOU given to you by a bank. When you lend the bank money, it’ll give you back that same amount at a later time along with a fixed amount of interest.

For example, if you bought a two-year bond for $100 with a 2% annual return on it, that means you’ll get $104.04 back after two years (this accounts for compounding).

Yes, that’s a low return rate. However, bonds have a number of benefits that justify the small rate of return:

- They’re an extremely stable investment. This is especially true when it comes to government bonds. The only way you can lose your money with them is if the government defaulted on its loans — which the U.S. government has never done.

- They’re guaranteed to have a return. This means that you’ll know exactly how much you’re getting on your ROI when you purchase a bond.

- Longer investments yield higher returns. The longer you’re willing to wait on your bond typically means that you’re going to have higher return rates. I say typically because there are exceptions to this (Hint: It has to do with what we’re talking about right now).

And when people refer to inverted yield curves, they’re typically referring to the yields on U.S. Treasury bonds, or bonds guaranteed to investors by the U.S. government.

BONUS: If you want even more information on investment basics, check out Ramit’s video on the hierarchy of investments. Don’t be thrown off by the potato quality of the video — the advice is timeless.

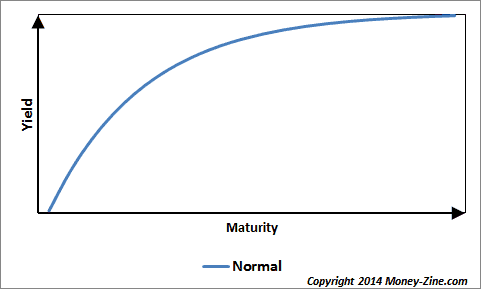

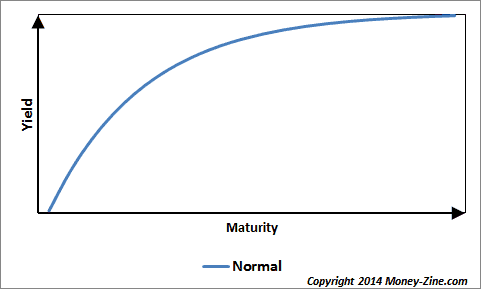

A yield curve graph shows the returns of those bonds (i.e., the yield) based on maturity, or how old the bond is.

A typical one looks like this:

The above is a normal yield curve. It shows that older bonds have higher interest rates and will yield more than younger ones.

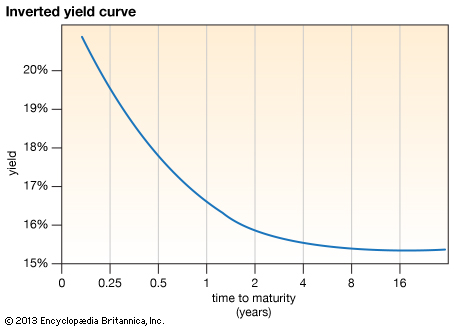

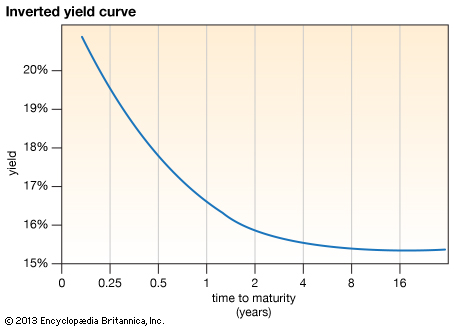

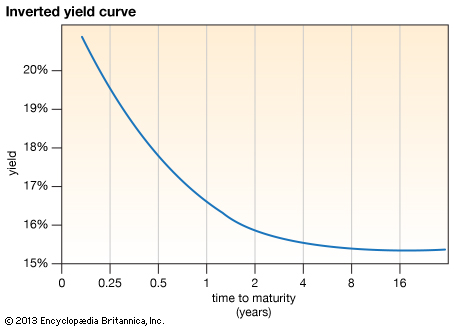

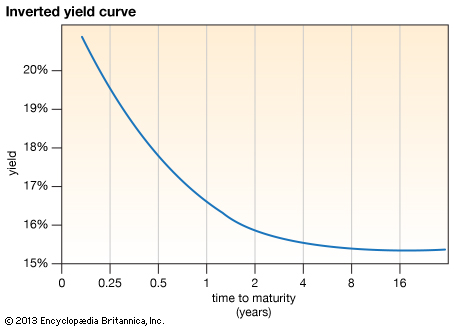

On the other hand, an “inverted” yield curve looks like this:

This occurs when the curve inverts or goes the other way. It shows that younger bonds (i.e., bonds that are two years or less) yield more in interest than older ones.

This shows the lack of investor confidence in older bonds and is a good indicator that a recession is incoming (more on that soon).

You can find the daily fund rate straight from the U.S. Department of Treasury itself here.

But a yield curve doesn’t invert on its own. Let’s take a look at a few elements that are needed for an inverted yield curve to occur.

Want to build a business that enables you to live YOUR Rich Life? Get my FREE guide on finding your first profitable idea.

How does an inverted yield curve happen?

Humans are more motivated by a fear of loss than anything else. This is a psychological phenomenon called “loss aversion.”

When the possibility of loss comes up, we get scared. We remember the things we’ve lost more acutely than what we’ve gained (just ask any gambler).

When we’re scared we tend to make weird decisions like selling off all of our investments due to a dip in the markets or splitting up the group in a haunted house so the murderer can pick you off one by one.

When it comes to a recession, many investors will start to invest in long-term U.S. Treasury bonds as it approaches — since they know that the interest rates on other assets like stocks will soon drop.

As more and more people begin to buy long-term bonds, however, the Federal Reserve responds by lowering the yield rates for those securities. And since people aren’t buying a lot of short-term U.S. Treasury bonds, the Fed will make those yields higher to attract investors. To recap:

- Bonds are considered safe.

- People who are not confident in the market will move more money into bonds.

- With more people investing in bonds, their return rate goes down.

This is basic supply and demand. The less people want a bond, the more financial institutions like the Fed are going to make that bond appealing to investors.

A great example of a yield curve inverting occurred before the 2008 housing market crisis in December 2005 — almost three years before the crash.

The Fed raised the federal fund rate to 4.25% due to a number of factors.

Mainly, they were aware that there was a growing price bubble within certain assets like housing, and they were concerned that low interest rates were causing this.

So when the fund rate was raised to 4.25% in 2005, it caused the two-year U.S. Treasury bond to yield 4.4% while the longer term seven-year bond only yielded 4.39%.

Soon the curve began to invert more and more as the recession began approaching and investors continued to invest more heavily into longer-term bonds.

Eventually, the United States found itself thrown into a recession after the housing market crash roughly two years later.

Note: The inverted yield curve wasn’t the cause of the recession but rather a symptom of it. Think of the inverted yield curve as a cough or fever in a greater sickness.

The last seven recessions the country has seen were preceded by an inverted yield curve — and many experts agree that another inversion of the yield curve could be on its way.

While the inverted yield curve is a great indication that there’s a recession and a subsequent bear market is on the way, what does that mean for you? What should a typical non–Wall Street, every-person do when you see a headline like this?

(Source: South China Morning Post)

How an inverted yield curve affects YOU

First, the good news: Inverted yield curves don’t last forever. In fact, the last one lasted until the summer of 2007 when it flattened out and began to revert back to its normal stasis.

An inverted yield curve isn’t without consequence to you and could affect you in a number of different ways depending on your financial situation.

For example, if you’re a long-term investor and have money tied up in long-term bonds, you’re going to see interest rates for those bonds go lower than short-term ones. This can be alarming to any investor trying to plan for the future, since you’re earning less due to falling interest rates.

Also, if you purchased a home with an adjustable rate mortgage, there’s a good chance your interest rate schedule is predicated on the current short-term bond interest rate.

That means that it’ll mirror bond interest rates when they fall and grow. So if those rates are high, you’re going to end up paying more in interest.

(Pro-tip: Ramit suggests you get a fixed-rate mortgage to prevent situations like this from occurring.)

If you REALLY want to make sure you’re protected, make sure you check out our article on creating an all weather portfolio.

What should you do when an inverted yield curve happens?

Whenever it comes to recessions, depressions, random Facebook friends asking you to join their MLM schemes, or any other outside negative force on your life, always remember one thing:

And one thing that you can control to help you get ready if the inverted yield curve ever happens is creating an emergency fund.

This is money you save away for financial disasters like medical emergencies, auto or home repairs, and, you guessed it, an inverted yield curve signaling a financial recession.

If you’re ever in a situation where you lose your income or you run into a huge financial emergency, it’s nice to have a safety net that you can fall back on.

We’ve written all about emergency funds before, so I won’t go into too much detail. But the basics are simple:

- Calculate three to six months of expenses. If you get laid off due to a recession, it’s going to take some time to find another job. That’s why you need to have your living expenses taken care of. This includes things like rent, mortgage payments, car payments, utilities, and groceries.

- Use a sub-savings account. A sub-savings account is a smaller account you create along with your normal savings account that’s set aside for specific goals. By using a sub-savings account, you’re much more likely to set aside money for your emergency fund due to psychology. Read more about it on our article on sub-saving accounts here.

- Automate your finances. This is my system for investing, saving, and spending automatically. When you receive your paycheck, your money goes to exactly where it needs to go.

To help you automate your savings and build a fund to protect you against the inverted yield curve, we want to offer you something: The Ultimate Guide to Personal Finance.

Along with learning how to automate your finances, you’ll also get tactics on how to:

- Master your 401k: Take advantage of free money offered to you by your company … and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Spend the money you have — guilt-free: By leveraging the systems in this book, you’ll learn exactly how you’ll be able to save money to spend without the guilt.

The things you’ll learn in this Ultimate Guide will set you up for financial success way more than worrying about an inverted yield curve.

Enter your info below and get on your way to living a Rich Life today.

Frequently Asked Questions:

Why does an inverted yield curve predict recession?

An inverted yield curve occurs when long-term bonds yield less than short-term bonds because of a perceived poor economic outlook. This is the opposite of normal. Every major recession in the past 100 years was preceded by an inverted yield curve. Make sure you have built an emergency fund to prepare yourself in case it happens again.

What causes an inverted yield curve?

When confidence in the markets drops, people seek more secure long term investments like long-term government bonds. This causes the yield of long-term bonds to drop below the yield of short-term bonds, causing an inverted yield curve.

Is the yield curve currently inverted?

Not currently, no. The last inversion was in August 2019.

How often does an inverted yield curve predict a recession?

An inverted yield curve doesn’t always mean there will be a recession, but there has been an inverted yield curve before every recession in the past 100 years. It’s the signal most trusted indicator that a recession may be coming.