Do Rich People Have Access to Better Investments?

Some of you really believe that rich people have access to “secret” investments that get incredible returns.

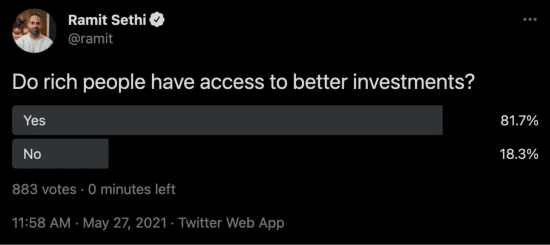

Look! 81.7% of people believe that.

Well, I’m rich, and I have access to those investments, and unfortunately, 81.7% of people are wrong.

Read on to learn why rich people DON’T have access to some secret investment that consistently beats the market — and why they often choose WORSE investments.

Table of Contents

Why rich people don’t have access to better investments, continued…

In most of life, the more money you have, the better things you can buy. For example, if I spend $200 on sushi, the fish is going to be fresher and better than $5 sushi from a gas station.

Pay more, get better food, better housing, better travel experiences. We all intuitively understand this.

But in personal finance—with rare exceptions—this is not true. Let me show you why.

There’s a whole industry set up to exploit rich investors who want better returns.

The rich find it impossible to believe their money can’t beat what ordinary investors get. So a massive industry has sprung up to deliver this fantasy via private equity, venture capital, and alternative investments.

There are 1% wealth management fees (remember, 1% means you’ll pay 28% of your returns to fees), 2-&-20 (meaning you pay 2% AND 20% of returns — lol), 10-year lockups where your money is illiquid, obfuscated fees (IRR is not your return), etc.

These investments look glamorous—and frequently underperform.

Here’s one example, where “Pershing Square kept approximately 72 percent of the fund’s gains for itself, leaving investors with the measly remains.”

The alternative investment game is fantastic for the people running it. Not so great for the actual investors, who can often get better returns in a Vanguard index fund. I wouldn’t expect the average Ma and Pa investor to understand these complexities—and indeed, there are some minor rules such as “accredited investor” rules—but what’s remarkable is that even highly sophisticated investors like pension funds often also underperform against a basic index fund.

What about hedge funds?

You’ve probably heard how the ultra-wealthy have access to these secret hedge funds, which outperform the market when it’s going up, but then they also outperform when the market is down. They’re magic!

Yeah, I watch Billions too.

The truth: most hedge funds underperform a simple S&P 500 fund. And despite underperforming for over a decade, extremely wealthy people keep pouring money in. How do they get away with it? My favorite is the hedge fund that went bust in 31 minutes.

In general, hedge funds are for suckers.

You may remember that in 2008, Warren Buffett bet that “an S&P 500 index fund would outperform a hand-picked portfolio of hedge funds over 10 years.” Predictably, the hedge fund lost. Not just lost a little, but lost in an absolute bloodbath. This was like the Superbowl for me.

What about venture capital?

Yes, the venture capital asset class also underperforms the market.

Hedge funds underperform. VC underperforms. PE underperforms.

Keep in mind, there are different reasons to own these funds, so it’s a little bit like me saying that a “Ferrari underperformed a minivan”—well, they both have different purposes. But we all know that you buy a Ferrari for fun and luxury. Most of the people who buy into sophisticated investments like VC/PE actually believe they’re going to get outsized returns. They don’t. So while different and theoretically uncorrelated, the vast majority of alternative investments….still lose compared to a simple index fund.

Now, if you really want to get into these funds and you’re wealthy, they’ll happily take your money and happily charge you insane fees. They’ll bamboozle you with fancy offices and beautiful reports filled with arcane terms and hockey-stick charts.

In the end, many people—and I’m talking about highly sophisticated investors—don’t even realize their returns are below what a guy working at Best Buy can get by investing 7% of his paycheck in an index fund.

Same with private equity.

Private equity frequently misleads even sophisticated investors with their IRR numbers (not clarifying that IRR isn’t what investors make). Preston McSwain has been outspoken about this.

Budgeting is outdated. Build your conscious spending plan to take control of your finances and spend guilt-free on the things you love. Find out how in our FREE guide.

“What about Sequoia? It beats the market. What about Renaissance?”

Yes, in certain cases, there are firms with extremely impressive results. They actually do beat the market, often for decades.

So what’s the catch?

First, it’s hard to identify the best players ahead of time (in VC, ~5% of funds = the total industry’s returns.)

Second, the best funds won’t take your money. Nope, not even if you can write them a $25,000,000 check. Being wealthy isn’t enough to get you in the door. They’re perennially “oversubscribed” (meaning they have more investors beating down their door than they want to let in because size is the enemy of returns), so they won’t take your money. It’s like calling French Laundry and telling them you’ll pay $50,000 if they can slide you in for a reservation tonight. Thank you, but we don’t do that. Again, hard to believe. But it’s true.

Personal finance is one of the rare areas of life where someone earning $35,000 and someone earning $1 million has access to the same winning strategies. Pick a low-cost index fund, automate, and move on with life.

My favorite part of this is the reactions when I tell people about this.

The idea that the wealthy don’t have access to some super-secret investment that’s actually responsible for all their wealth is EXTREMELY hard for people to believe. I posted this and got extremely angry, borderline apoplectic responses.

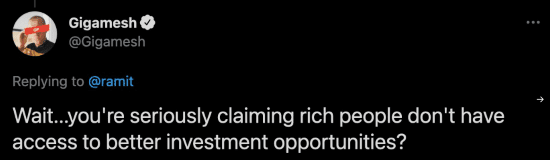

Like this one:

Yes, Gigamesh, I am. You may believe that because something is hard to get into, it’s automatically better, but that’s not true — especially for investments, where Wall Street has invented dozens of different ways to charge investors hefty fees.

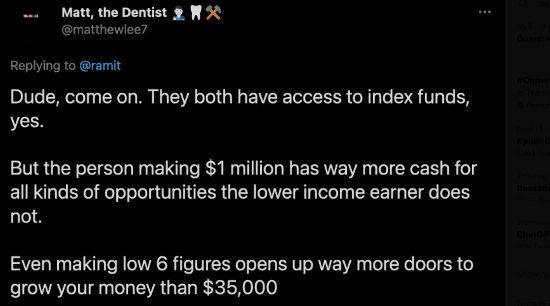

Or this:

This is true, and totally irrelevant. Of course if you have more money, you can make more money. If Person A invests $1,000/month and Person B invests $100,000/month, Person B will have more. Nobody is arguing that.

Or this rage-filled response:

Notice the rage here. Deep down, many of us believe that one of the reasons the ultra-rich are rich is that they have access to some secret network and investments. Well, I grew up middle class, I went to Stanford, and I have access to some of the investments I’ve mentioned here (VC, PE, etc) and I can tell you—along with the research I shared above —it’s not true.

Now, this person does have some legitimate critiques of the ultra wealthy, who get massive tax advantages (why does Buffett pay a lower tax rate than his assistant?), as well as structural advantages based on race, housing, and many other factors.

If you’re born poor in America, the deck is stacked against you. Race matters. Family wealth matters. Education matters.

I’ve always said that you can simultaneously acknowledge the need for systemic reform and take personal responsibility for what we can control.

But I want us to focus on what’s real. Wealthy people have access to a LOT of advantages and they—we—should be fairly critiqued for it. This is why I constantly advocate for raising my taxes! I should pay more!

But wealthy people, as a rule, do not have access to better investments.

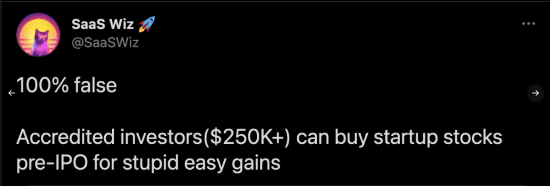

This response made me laugh. The idea that being an “accredited investor” is some magical pass to get free money is hilarious. That’s like saying, “Uh yeah, I’m RICH…I have an AMEX Gold.”

Accredited investors are not especially impressive. We’re talking about investments that are beyond the reach of the majority of accredited investors, and even those investments fail to beat the market on average.

Also, what happened to those “stupid easy gains?” Oh yeah, many pre-IPO companies completely tanked. It’s called risk management, SaasWiz (whose account is now private).

David worked under the legendary David Swensen at Yale, working alongside some of the world’s best investors with access to the best information and world-class managers. He agrees this is true! If you’re going to listen to anyone, ignore the guys with the icon of a shoebox and listen to David, who actually knows what he’s talking about.

Btw, if you’re wondering what the solution is, set your money up to automatically invest in index funds, focus on earning more, and get on with your life. You can set this up in less than a month and it will provide wealth for the rest of your life.

Learn to take control of your finances and spend your money GUILT-FREE with our free Ultimate Guide To Personal Finance below:

Written by Ramit Sethi

Host of Netflix's "How to Get Rich", NYT Bestselling Author & host of the hit I Will Teach You To Be Rich Podcast. For over 20 years, Ramit has been sharing proven strategies to help people like you take control of their money and live a Rich Life.