5 Best Personal Finance Podcasts to Listen in 2024 (+ my recommendations)

In my quest for financial freedom, I’ve explored a multitude of finance podcasts and cherry-picked the crème de la crème – the ones that truly resonate with my philosophy on personal finance and wealth building.

Now, for a little fun twist: I’ve found myself guest-starring in some of these top-tier podcasts. So, I figured, why not start there? It’s like being invited to a party and knowing at least one person in the room. Think of it as your ‘guided tour’ through my favorite finance podcasts, with yours truly as the occasional tour guide. Let’s jump into this financial fiesta, starting with a few familiar voices – including mine!

Table of Contents

The 5 Best Personal Finance Podcasts

What can I say? Sometimes you have to start the party with a familiar face. So first on the list is my own podcast, “I Will Teach You to Be Rich”. It’s where real money meets real talk. Is this a shameless plug? Yes, but after a decade of blogging, this podcast is my way of putting theory into action with real people, real stories, and, hopefully, real impact.

Named after my New York Times-Bestselling book and the catalyst for my Netflix hit, “How to Get Rich”, this podcast is a dive into the nitty-gritty of financial challenges faced by ordinary people. No vague theories here, just genuine conversations about everyday money problems.

Episodes usually last a little over an hour each and are also posted on YouTube, so you can witness the raw emotions, the hesitant smiles, and the ‘aha’ moments as they happen. So, if you prefer to listen while doing chores or sit down with a pen and snacks in hand, there’s something for everyone here!

For those who want a taste, here are some of my favorite episodes, representing the different aspects we cover on the show. Jump into the one that speaks to you most:

Episode #121: “He wasn’t supposed to have student loans. Now he has $157k.”

Here, we tackle the beast of unexpected debt head-on. It’s a raw look at how student loans can snowball and what it really takes to navigate out of this financial quagmire. Prepare for some eye-opening insights and tough love.

Episode #120: “We have 3 kids, $1k saved, $0 invested. Is it too late for us?”

Think it’s too late to get your finances in order? Think again. This episode is all about playing financial catch-up, no matter where you’re starting from. We’re busting myths and lighting fires under seats – because it’s never too late to start.

Episode #119: “He’s not ready for marriage. So why did we buy a house together?”

Yup, the messy intersection of love and money. This episode isn’t just about financial planning – it’s about navigating the complex emotional waters of relationships and big financial decisions. Expect some real talk and hard-hitting advice.

Curious? There’s plenty more on my YouTube, Spotify, and Apple Podcast channels!

Hosted by Sam Parr and Shaan Puri, this isn’t just another business podcast; it’s a rollercoaster ride through the world of startups, investments, and the entrepreneurial journey.

Sam and Shaan don’t just scratch the surface; they explore a vast array of business ideas and strategies, all tailored to current trends and real-world applications. They’re not just talking heads – they bring on subject matter experts for deep dives, making complex topics not just accessible but genuinely fascinating.

Here’s where it gets interesting: I had the pleasure of being a guest on the show earlier this year, diving deep into topics I’m passionate about. You can check out that episode here. Their style? Think of it as sitting down for coffee with a couple of friends who just happen to be business whizzes. It’s conversational, it’s informal, and above all, it’s packed with insights.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

What sets this podcast apart is its blend of fun and substance. Katie approaches finance with a flair that’s both informative and refreshingly candid, offering a unique, feminine perspective that’s often missing in finance conversations. The episodes alternate between deep dives on specific financial topics and ‘Rich Girl Roundups’, where Katie answers listener questions.

Released twice a week, with Rich Girl Roundups on Mondays and regular episodes on Wednesdays, they range from quick 15-minute nuggets of wisdom to more in-depth discussions lasting up to an hour. It’s perfect for millennials, especially women, who are looking to navigate the financial world in a way that’s relatable and empowering. Katie has this unique ability to make topics like taxes, investing, and spending habits not just digestible, but downright enjoyable.

And guess what? I had the honor of joining Katie on her show. We dove into everything from business strategies to my philosophy on personal finance, and even why I’m not shy about being outspoken online. It was an enlightening conversation, and I have to say, the episode is definitely a standout. You can give it a listen right here.

If you’re looking for a podcast that turns the complex world of finance into a captivating conversation, then “So Money with Farnoosh Torabi” is your next must-listen. Farnoosh isn’t just a financial expert; she’s a storyteller who brings money to life. Her podcast covers everything from personal finance and entrepreneurship to career growth and family finances. It’s like a financial Swiss Army knife – there’s something for everyone.

Now, I don’t want to sound like I’m shamelessly plugging episodes where I’ve appeared as a guest, but let’s be real – if you’re here, chances are you’re a bit curious about what I have to say. So, why not start your “So Money” journey with the episode where I join Farnoosh? We dive into some really juicy topics. You can listen to our conversation right here. Trust me, it’s a great entry point into the world of “So Money”.

Episodes are released a few times a week, with each one lasting around 30 minutes – perfect for a morning commute or a quick workout. And every week, Farnoosh dedicates an episode to answering listener questions, offering tailored advice for real-life financial dilemmas. It’s ideal for anyone who wants to grow their financial savvy in a way that feels both informative and engaging.

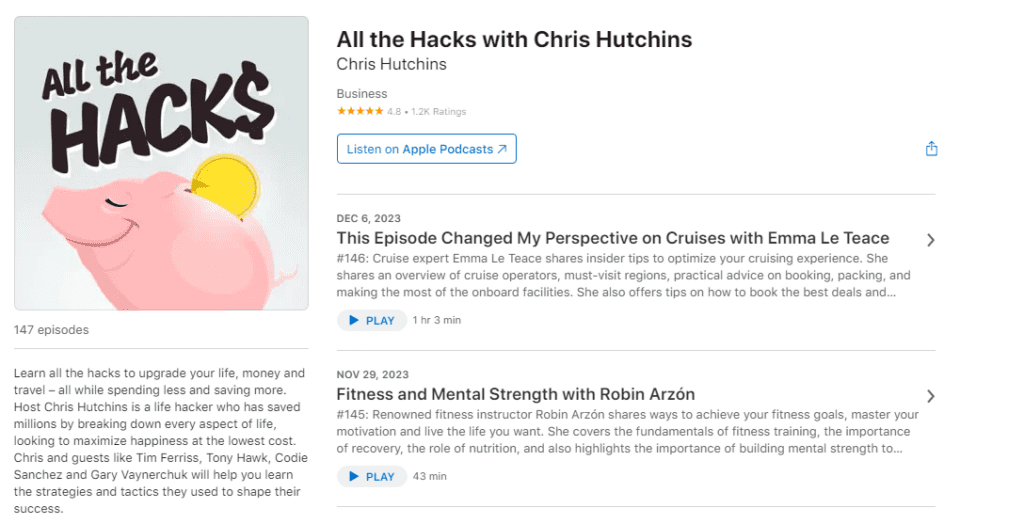

In the spirit of full disclosure, yes, I’ve been a guest on Chris’s show, and we had a blast unpacking some complex financial concepts. It’s one thing to read about these strategies; it’s another to hear them in action. You might find starting with this episode I guest-starred in to be a neat springboard into the diverse world Chris presents. It’s like having a backstage pass to financial wisdom!

Ranging from a quick, impactful 30 minutes to a more exploratory hour-long session, each week Chris releases new episodes where he is sharing the hacks he’s discovered on his own journey.

“All the Hacks” is more than just a personal finance podcast; it’s a comprehensive guide to various aspects of life where money plays a key role. Whether you’re fine-tuning your investment strategy, pondering your next travel adventure, or navigating the complexities of buying a home, Chris has you covered with practical, actionable advice.

Expand Your Financial Knowledge Today

If the array of choices has you feeling a bit overwhelmed, fear not. To ease you into this transformative journey, I’m going to leave you with one of my most popular episodes, “We make $113,500. Why do we feel poor?”. It’s a perfect starting point to get a real taste of what “I Will Teach You to Be Rich” is all about.

This one tackles a pervasive issue: the false narratives that often blind us to the long-term consequences of our financial decisions. I sit with Bebe and Paul as we unravel the complexities of their situation, offering not just solutions but a paradigm shift in how they perceive and navigate their financial landscape.

Feel free to tune in, take notes, and embark on a journey of financial empowerment that will reshape your narrative from feeling stuck to steering confidently towards a more prosperous future. See you there!

FAQs

What is the best way to learn about finance?

To master finance, start by diving into resources like my book, “I Will Teach You to Be Rich” which breaks down complex finance concepts into digestible pieces. Mix reading with real-world practice: budget, invest, even a little. Lean on online courses for deeper knowledge and join finance communities for shared learning.

Why listen to financial podcasts?

Financial podcasts are a game-changer for upping your money game anytime, anywhere. They dish out practical tips, fresh insights, and cover everything from ditching debt to growing your wealth. Perfect for learning on the move, they’re your go-to for making savvy financial moves and seriously stepping up your money management skills.

If you liked this post, you’d LOVE my New York Times Bestselling book

You can read the first chapter for free – just tell me where to send it:

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.

Written by Ramit Sethi

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.