How to Make Money Investing: 4 Ways to Earn More

Making money and investing – two terms that get tossed around a lot, but not everyone truly gets the hang of them. If you chat with anyone who’s living their version of a rich life, they’ll likely tell you their secret sauce involves some form of investing. And now, everyone’s ears perk up because, of course, who doesn’t want in on that secret?

I’ll be real with you – I used to think investing was this big, scary thing that only people with fancy suits and briefcases could do. But, here’s the truth I’ve come to find: investing is way more accessible than most of us think. But let me set one thing straight—it’s definitely not your golden ticket to becoming rich by tomorrow morning.

There’s a bit more to it, especially when you factor in your age, how much you’re earning, any debts you’re juggling, your goals, and how much risk you’re willing to take. So, let’s cut through the noise and break it down.

And join over 800,000 readers getting our Insiders newsletter, where we share exclusive content that’s not on the blog:

Table of Contents

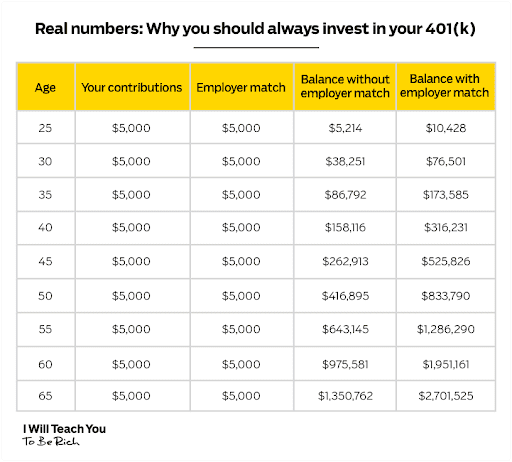

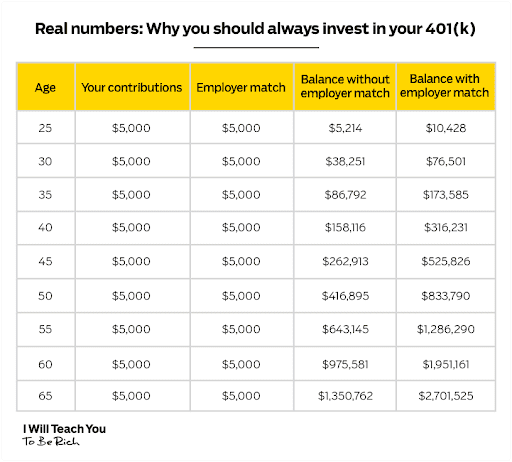

Step 1: Contribute to your 401k

Kicking off your investing journey? Start with your 401k. It’s like the low-hanging fruit of investing that too many folks overlook. Every month, chucking a chunk of your paycheck into your 401k is a no-brainer, especially to snag your company’s match. Here’s the scoop: that money gets tucked away before taxes come knocking, meaning you get taxed on it when you’re chilling in retirement, not now.

So, if your company’s throwing in a 5% match, you’ve gotta at least meet them there. Think of it as the best deal you’re ever going to get. I’m talking real, tangible growth on your money, and I’ll break down the numbers to prove it. Always, and I mean always, max out any company matching before you start funneling cash elsewhere. It’s like the express lane for growing your investments.

And sure, not every company out there matches, but it’s almost like finding a unicorn if they don’t.

Step 2: Pick an investment option

After maxing out your 401k contributions, consider exploring additional investment options below. But, before opening an account, there are some nuances about asset allocation, diversification and age that you might want to know.

Stocks

Investing in stocks means buying fractions of ownership in a company. Public firms like Apple or Google sell shares to gather capital, with these transactions happening on exchanges like the NYSE or NASDAQ. While stocks offer the potential for high returns, they’re also associated with greater risk due to volatility. Prices fluctuate based on company performance, economic conditions, and overall market sentiment.

Bonds

By investing in bonds, you’re essentially lending money to either a government or a corporation. In return, you’ll receive periodic interest payments plus the original amount loaned (the principal) when the bond reaches its maturity date. Bonds are generally less risky than stocks due to their lower volatility and the reliable income they offer through interest. However, bond prices can be influenced by factors such as changes in interest rates, the credit rating of the issuer, and overall economic conditions.

If you need to dive deeper into stocks and bonds, the article you are looking for is “All About Stocks and Bonds: What You Need to Know”.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) offer a fixed interest rate for locking away your money for a specified term, making them similar to bonds but are issued by banks or credit unions. They’re low-risk investments, insured by the FDIC or NCUA, ensuring a guaranteed return, provided you’re willing to commit your funds for the entire term. Withdrawing funds early from a CD incurs penalties and forfeits some interest, making it crucial to be sure about your investment timeline before opting for a CD.

Mutual Funds

Mutual funds amalgamate money from various investors to purchase a diversified portfolio, blending stocks, bonds, and other securities. Managed by professionals, they relieve individual investors from the intricacies of choosing and managing investments. Shareholders gain the flexibility to buy or sell shares at the fund’s net asset value on any business day, simplifying access to a broad spectrum of assets without the need for direct oversight.

Index Funds

Index funds offer a cost-effective and straightforward way to invest in the broader market. Instead of handpicking individual stocks, these funds aim to replicate the performance of a specific index, like the S&P 500, by holding the same stocks in proportionate amounts. This passive management approach results in lower expenses for investors compared to actively managed funds. With index funds, you benefit from competitive returns without the high fees or the need to actively manage your investment portfolio.

The world wants you to be vanilla...

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

Exchange Traded Funds (ETFs)

Exchange Traded Funds (ETFs) provide a way to invest across various assets, like stocks, bonds, or commodities, offering diversification within a single security. They target specific market segments, enhancing liquidity and offering the flexibility to be bought and sold like individual stocks throughout the trading day at current market prices. ETFs combine the benefits of diversification with the ease of trading, appealing to investors looking for a balanced approach to capturing market gains.

High-yield Savings

High-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts, enabling you to earn more from your saved funds. They combine the advantage of increased earnings with the flexibility to access your money when needed, providing a safe and insured option for saving without the worry of losing your principal.

Step 3: Open an Investment account

After exploring your investment options, the next step is to open an investment account that suits your financial goals and investment strategy. This could be a Roth IRA, SEP IRA, or a general brokerage account. Each account type offers its own benefits, from tax advantages to flexibility in investment choices, catering to different stages of your financial journey and specific investment needs.

Roth IRA

A Roth IRA is a retirement savings account with distinct tax benefits, where you make contributions with after-tax money. This setup allows your investments to grow tax-free, and you can make tax-free withdrawals in retirement. However, there are income limits to be eligible for a Roth IRA, so it’s not accessible to everyone. This account is particularly appealing for those who anticipate being in a higher tax bracket in the future, as it offers tax-free growth and withdrawal benefits.

SEP IRA

A Simplified Employee Pension (SEP) IRA is tailored for self-employed individuals and small business owners, offering a way to contribute toward retirement savings. Employers, including self-employed individuals, can contribute up to 25% of an employee’s (or their own) income each year, with a cap at $57,000. Contributions to a SEP IRA are tax-deductible, reducing taxable income, but taxes apply to withdrawals during retirement. This makes SEP IRAs a valuable tool for business owners to save for retirement while also offering benefits to their employees.

Brokerage Accounts

A brokerage account is a flexible, taxable investment account offered by brokerage firms, allowing the purchase and sale of various investments like stocks, bonds, mutual funds, ETFs, and more. Unlike retirement-specific accounts, brokerage accounts have no limits on contributions or restrictions on when you can withdraw funds, providing a versatile platform for investing beyond retirement savings.

Step 4: Automate Your Contributions

Automating your contributions is a key strategy for consistent investing. By setting up automatic transfers, you ensure regular investments into your chosen accounts without having to remember each time. Here’s the exact order I follow when making contributions:

- Max out any company match in your 401k

- Max out your Roth IRA

- Go back and max out your total 401k

- Consider a SEP IRA if you’re self-employed

- Put anything else into a brokerage account

This systematic approach ensures disciplined saving and investing, leaving the remainder of your funds for guilt-free spending from your checking account.

Frequently Asked Questions

What's the first step I should take when starting to invest?

Always start by contributing to your 401k, especially if your company offers a match. Max out that match before investing anywhere else – it’s free money!

What are some investment options to consider after maxing out my 401k?

After your 401k, look into stocks, bonds, CDs, mutual funds, index funds, ETFs, and high-yield savings accounts. Each has its own risk and return profile, so choose based on your goals and risk tolerance.

How do I actually start investing?

Once you’ve decided on your investment strategy, open an investment account that aligns with your needs. This could be a Roth IRA, SEP IRA, or a general brokerage account. Each has unique benefits and limitations.

What's the best way to stay consistent with investing?

Automate your contributions! Set up automatic transfers to your investment accounts in this order: max out 401k match, max out Roth IRA, max out total 401k, consider SEP IRA if self-employed, then put the rest in a brokerage account.

Do I need to be an expert to start investing?

Absolutely not! I used to think investing was only for people in fancy suits, but it’s way more accessible than most people think. Start small, educate yourself, and be consistent – that’s the key to success.

If you liked this guide, you’ll LOVE my Insider’s Newsletter

Join over 800,000 readers getting content that’s not available on the blog, free:

Written by Ramit Sethi

Host of Netflix's "How to Get Rich", NYT Bestselling Author & host of the hit I Will Teach You To Be Rich Podcast. For over 20 years, Ramit has been sharing proven strategies to help people like you take control of their money and live a Rich Life.