How much will I get back in taxes in 2024? (with simple examples)

Tax season doesn’t have to be your yearly nightmare. In this post, I’ll show you how you might get back in taxes this year, step-by-step

And join over 800,000 readers getting our Insiders newsletter, where we share exclusive content that’s not on the blog:

How much do I get back in taxes?

Every month, a portion of your income gets deducted from your paycheck. These deductions usually (but aren’t limited to) cover your:

- 401(k) contribution.

- Insurance payments.

- Tax withholdings.

The government withholds your pay based on how you filled out your IRS form W4, which stipulates how much you and your employer agree to withhold for taxes.

To estimate your tax refund:

- Find your total income tax owed for the year (I suggest using this tax calculator for a rough estimate).

- See if that’s more or less than what you’ve had withheld (look on your end-of-year W2 form).

Refund = Amount withheld – Your tax obligation

This is a very simple breakdown of how tax refunds are calculated and doesn’t take into account things like tax deductions, exemptions, and benefits claimed throughout the year. But it can give you a rough idea of how much you might get back from the IRS come tax season.

Let’s take a look at this using two more VERY simplistic examples.

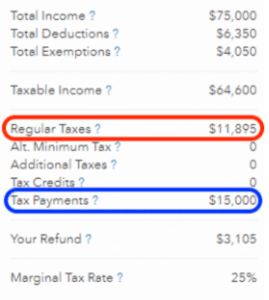

Tax Refund Example #1: No Kids

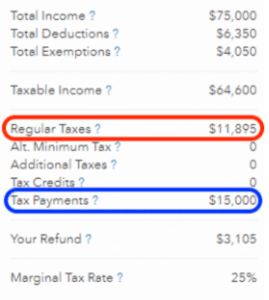

John is a single 30-year-old with no dependents. Last year, he made $75,000, withheld $15,000, and collected no government benefits.

Check out how much he could get for his 2024 tax refunds (using this calculator).

Subtract the red circle from the blue for the refund.

In this example, his refund is $3,105. That is just about the average for tax refunds! AND with the new tax laws and tax brackets, he stands to potentially receive more in his refunds in 2024 (about $6,989).

How about someone who’s married with children?

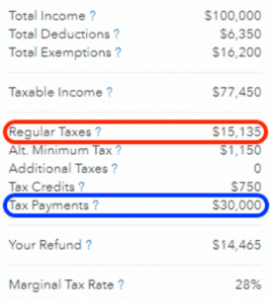

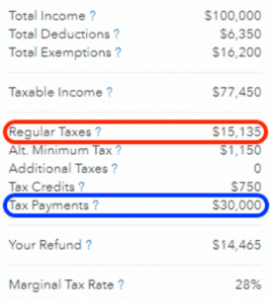

Tax Refund Example #2: With Kids

Margaret is a married 45-year-old with three kids under the age of 17. Last year, she made $100,000 and withheld $30,000 in taxes. She’s ALSO the head of her household and collected no government benefits.

How much does she stand to get back?

Subtract the red circle from the blue for the refund.

Uncle Sam might owe Margaret $18,875 when all is said and done. And if her situation doesn’t change in 2025, her refund will likely grow to $19,975.

NOTE: Everyone’s tax situation is unique and any online tax refund calculator will, at best, provide you with a rough estimate of how much you’ll get back. The two examples above are incredibly simple and don’t fully capture the nuances of someone’s actual financial situation.

Play around with them and be as specific as you can. The more details you can provide the better of an idea you’ll have of what you’ll receive for your refund.

So now you know roughly how much you’ll be getting back and you’re ready to collect the money Uncle Sam owes you. (Or, if you didn’t withhold enough, how much you owe.)

Before you hoist your “Don’t tread on me” flag and march down to the IRS building to get your money, you should know about all the ways you can get your tax refund.

Want to see me talk to all kinds of people about living their rich lives? If you like this article, we know you’ll LOVE these episodes.

Episode 120. “We have 3 kids, $1k saved, $0 invested. Is it too late for us?”

Episode 122. “I shouldn’t have to ask for $20 to get McDonalds for the kids”

How do I get my tax refund?

Luckily for you, the IRS is excellent about getting your tax refund to you.

In fact, you can check out the IRS’s “Where’s my refund?” tool to find the status of your tax refund right now. And according to the IRS, they issue nine out of ten refunds back to the taxpayer within 21 days after they file their taxes.

Ultimately, though, how soon you get your refund back depends on two things:

- How you file your taxes

- How you elect to receive your refund

If you decide to file your taxes through good old fashioned pen and paper, it’s going to take considerably longer to get your refund back. In fact, you’re going to have to wait four to six weeks before you’re even able to check your status on their “Where’s my refund?” tool.

There is another route though: Electronic tax filings.

You receive your tax refund even faster when you file it electronically via platforms like TurboTax or IRS e-file. There you can elect to receive your refund through direct deposit (a free service provided by the IRS). It’s secure, fast, and the same way the government deposits millions of Social Security and Veteran Affairs benefits each year.

When you get your money back, be sure to put it to good use!

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

So now you know roughly how much you’re getting back and how to get your money. Now, let’s get into what you might be getting WRONG about your tax refund.

What People Get Wrong About Tax Refunds

I have a confession to make: I actually love the kooky financial “experts” you see on TV or on their online soapbox who lecture you about taxes. Because 99.99% of the time they are DEAD WRONG about money.

One of their favorite go-to buzz phrases:

“If you’re getting a tax refund, you’re giving the government free money!”

TRANSLATION: If you get a refund, that means the government took your money and earned interest on it for an entire year!

Then these “experts” are typically out of breath because of their own brilliance.

Let me break this down for you.

The average tax refund is about $3,028. Let’s assume that money would have been sitting in a savings account with a 1.45% APY (that’s on the higher end for savings accounts).

How much interest did you lose through your tax withholdings? $3.62 a month.

I think we can agree the government is “stealing” the equivalent of a latte each month from you. I think we can hold off on our plans to dump a bunch of tea in Boston Harbor.

Here’s a hard truth: If you had that money, you probably would have spent it. That’s not a slight against you — that’s just human psychology. We as humans have an incredibly finite amount of willpower. That’s why cost-saving measures like cutting out lattes or lunch at your favorite sandwich spot aren’t realistic long-term strategies to build wealth.

And yes, technically, they’re right. You could have been earning interest on the money. I live in a world of reality, however, which means that “technically” isn’t always correct.

So in all there are two reasons I’d rather get a tax refund than owe the government money:

- If people end up owing the government money at tax time, most won’t have extra cash lying around. We know this because they are terrible at managing their money and have record debt rates. Sorry, it has to be said.

- As stated before, the interest they stand to earn is incredibly low. If you’re worried about saving a few dollars each month, then I highly suggest you go find another blog.

Here’s what I believe you should REALLY do with your money:

Master Your Finances

Remember: When it comes to your personal finances, worry about the things you can control.

Instead of thinking about the “what ifs” and how much the government is supposedly earning off of your money, make sure your personal finance house is in order so you can maximize the earnings of what you have.

My team and I worked hard on something to help you do just that:

The Ultimate Guide to Personal Finance

In it, you’ll learn how to:

- Master your 401k: Take advantage of free money offered to you by your company … and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Spend the money you have — guilt-free: By leveraging the systems in this book, you’ll learn exactly how you’ll be able to save money to spend without guilt.

FAQs About How Much Will I Get Back In Taxes

What if you owe taxes and can’t pay?

Even though you may not be able to pay your taxes in full, you should still file a tax return with the IRS. The IRS offers payment plans for taxpayers who cannot afford to pay their entire balance immediately. Taxpayers can also negotiate an offer in compromise with the help of a tax attorney.

When should you expect your tax refund?

If you file electronically and choose direct deposit for your refund, the IRS can issue your refund within 21 days of receiving your e-filed return. If you mail your paper return to the IRS, it can take six to eight weeks for the IRS to process your return and send a refund.

How much is the child tax credit?

For the 2024 tax year, people with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent, and $1,700 of that credit may be refundable.

What tax bracket am I in?

Discovering your tax bracket unlocks the mystery of how much you’re taxed. It’s determined by your taxable income and filing status. By consulting the latest IRS tax tables, you’ll see where you stand among the progressive tax rates, guiding you to smarter, more informed financial strategies.

How do deductions and credits work?

Imagine having secret keys to lower your tax bill – those are deductions and credits. Deductions shrink your taxable income, possibly even nudging you into a lower tax bracket, and include wonders like mortgage interest and charitable donations. Credits, the superheroes of tax savings, directly subtract from your taxes owed, providing a dollar-for-dollar reduction.

What’s the difference between standard and itemized deductions?

The standard deduction offers a swift, one-size-fits-all amount, simplifying your tax return and making it the go-to for many. However, if you’ve racked up enough deductible expenses (think mortgage interest, donations, and more), itemizing paves the way for potentially greater tax savings.

How does an income tax return calculator work?

Input your earnings, withholdings, and eligible deductions and credits, and let the calculator do the magic. It weaves through the complexities of tax laws, offering you a snapshot of your potential refund or what you might owe.

It’s one of the best things I’ve published (and 100% free), just tell me where to send it:

Written by Ramit Sethi

Host of Netflix's "How to Get Rich", NYT Bestselling Author & host of the hit I Will Teach You To Be Rich Podcast. For over 20 years, Ramit has been sharing proven strategies to help people like you take control of their money and live a Rich Life.