IRA vs CD vs Roth IRA: Which is best for you? (30s quiz)

I have gotten a great question from a reader named Sherene a while back asking about which was better: An IRA vs CDs? She wrote:

“I am a recent college graduate and I want to put the little money I have saved (approx $3,000) into something that will give me good returns over the years. Would you suggest I get an IRA vs CD?”

The answer: They’re not mutually exclusive.

Roth IRAs are a type of investment account and CDs are simply a type of investment. You can have both!

A quick overview of each:

- CD: This is a type of investment known as a time deposit. This means you essentially loan money to a bank for a set period of time and when that time is done, the bank will give you your money back plus interest. This makes them very low risk.

- Roth IRA: This is an investment account with significant tax advantages. It allows you to invest in funds of your choosing and accumulate money for retirement age.

Whether or not you choose to invest in CDs all depends on what your goals are.

Let’s take a look at the two investments and how you can get started with them should you choose.

- Roth IRA: An account everyone should have

- CDs: What the heck are they?

- IRAs vs CDs: Choose both!

- Diversification and YOU

- Make the smartest investment today

Roth IRA: An account EVERYONE should have

The Roth IRA is one of the best investments you can make as a young person. It’s simply the best deal I’ve found for long-term investing.

It works a lot like a 401k, which leverages pre-tax dollars to invest and you pay income tax when you withdraw the money at retirement.

Unlike a 401k though, a Roth IRA uses your after-tax money to invest, giving you an even better deal.

Here’s how it works:

When you make money every year, you have to pay taxes on it.

With a Roth, you take this after-tax money, invest it, and pay no taxes on any gains when you withdraw it.

That means you can put already taxed income into bonds, index funds, or whatever else, allowing it to accrue compounded interest over time.

If Roth IRAs had been around in 1970 and you’d invested $10,000 in Southwest Airlines, you’d only have had to pay taxes on the principal amount.

When you withdrew the money 30 years later, you wouldn’t have to pay any taxes on it…

…which is good because that $10,000 would have turned into $10 MILLION.

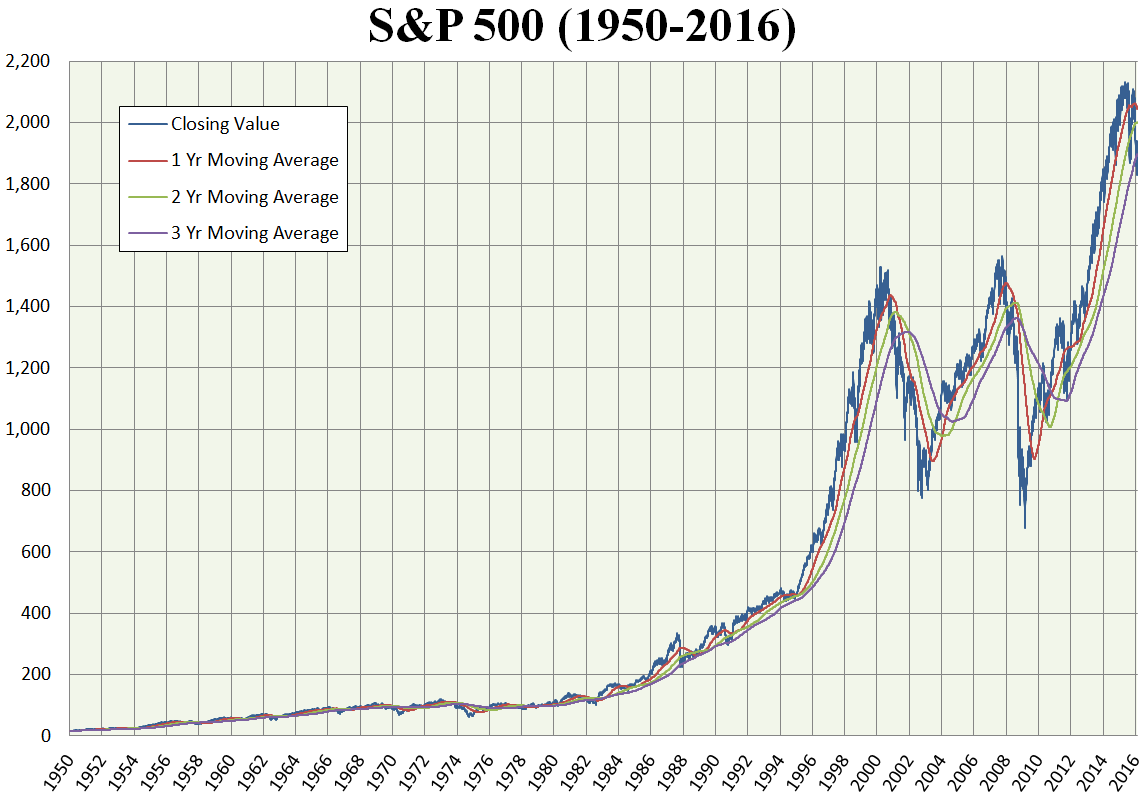

That’s why Sherene’s greatest advantage is time.

If the market dips slightly, Sherene has nothing to worry about because she knows it will, in the greatest likelihood, bounce back.

The S&P 500 since 1950.

To recap: You pay taxes on the initial amount, but not the earnings. And over many years, that is a stunningly good deal.

How to open a Roth IRA account

If Sherene (or you) wants to open up a Roth IRA, she’ll need to open up a brokerage account.

There are plenty of great ones out there with fantastic customer service and fiduciaries ready to guide and answer any questions you might have about your investments.

Other factors you want to consider when looking at brokers:

- Minimum investment fees. Some brokers require you to invest a minimum amount in order to open and hold an account. This can be a deal breaker for many.

- Investment options. All brokers differ in what they’ll offer in the way of investments. Some have funds that perform better than others.

- Transaction fees. A few brokers charge you a transaction fee in order to put money in an investment.

A few brokers I suggest: Charles Schwab, Vanguard, and E*TRADE.

Not only do those three provide a great customer support line, but they also have small or no minimum investment fees and are known for their great stock options.

How much can I invest?

Currently, there’s a yearly maximum investment of $6,000 to a Roth.

However, this amount changes often, so be sure to check out the IRS contribution limits page to keep updated.

Once your account is set up, your money will just be sitting there. You need to do things then:

- First, set up an automatic payment plan (which we’ll explain how to do later) so you’re automatically depositing money into your Roth account.

- Second, decide where to invest the money in your Roth account; technically you can invest in stocks, index funds, mutual funds, whatever. But I suggest investing your money in a low-cost, diversified portfolio that includes index funds, such as the S&P 500. The S&P 500 averages a return of 10% and is managed with barely any fees.

For more, read my introductory article on stocks and bonds to gain a better understanding of your options.

I also created a two-minute video that’ll show you exactly how to choose a Roth IRA. Check it out below.

When can I take my money out?

Like your 401k, you’re expected to treat this as a long-term investment vehicle.

You are penalized if you withdraw your earnings before you’re 59 ½ years old.

You can, however, withdraw your principal, or the amount you actually invested from your pocket, at any time, penalty-free (most people don’t know this).

There are also exceptions for down payments on a home, funding education for you/partner/children/grandchildren, and some other emergency reasons.

But it’s still a fantastic investment to make — especially when you do it early.

After all, the sooner you can invest, the more money your investment will accrue.

To quickly recap IRA vs CD:

- Roth IRA = Investment account

- CD = A thing you can invest in

But should you put money in CDs at all?

CDs: What the heck are they?

A CD, or certificate of deposit, is a low-risk financial investment offered by banks.

If you invest in a CD, you loan money to a bank for a fixed time known as a term length (typically anywhere between three months to five years).

In this time, you can’t withdraw your investment without being penalized. However, you are accruing money at a fixed rate.

Your interest rate on a CD varies depending on the length you agree to keep your money in the bank (the longer you keep it there, the more money you earn).

But you are all but assured that money when the term length is up.

Another reason why they’re so risk-free: CDs are typically insured by the FDIC up to $250,000.

That means if you put $100,000 into a CD and accrued $5,000 in interest, your $105,000 would be insured if your bank fails.

That makes CDs an incredibly safe investment.

Who should invest in them?

Older people typically invest in CDs due to their aversion to risk. However, there are several factors to consider if you’re wondering if you should invest in a CD:

- Length of investment. Can you part with the money during the full term length?

- How aggressive you want to be. Do you have more wiggle room to invest in riskier funds or do you just want to play it safe?

- Inflation. As of writing this, the inflation rate sits at 2.2%. That percentage is also on the high end for most annual percentage yields for CDs, which are typically anywhere between 1% to 2% for a 5-year bond. This means you could actually lose money when you factor in inflation with CDs.

CDs are a safe investment.

If you value security and peace of mind over taking a few more risks for potentially higher gains, you might just want to put your money to work in a CD.

Also, bonds like CDs can be used for short-term goals such as buying a house or putting more money into your emergency fund.

Getting the most out of your CDs through laddering

To optimize your CDs, it’s a good idea to build a CD ladder — no carpentry skills required.

The idea is simple: Open several CDs with different term lengths. Every time the term length is finished, you can either reinvest the money or take it out of the CD.

Let’s take a look at an example: Imagine you have $10,000.

To build your ladder, you invest four ways: three-month, six-month, nine-month, and one-year CDs with $2,500 in each.

As the term for each CD goes up, you can reinvest your earnings in a new one-year CD or just liquidate the money.

This gives you access to the principal every three months along with interest.

Doing this provides you with a low-risk investment that provides a higher return rate than if you just kept it as liquid cash. It also keeps your money relatively accessible.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

IRAs vs CDs: How to choose both

If saving for retirement via an extremely low-risk asset sounds appealing, you can invest in a CD IRA.

And it’s exactly what it sounds like: A CD within an IRA. They work like any other investment in it as well.

You simply go to your broker where you have your Roth or traditional IRA and purchase a CD as part of your portfolio.

These are great for very conservative investors. So if you’re older and just want to make sure your money is best positioned for when you need it, a CD IRA is the way to go.

If you’re younger though, I wouldn’t suggest investing this way. When your CD is in an IRA, your money is essentially shut off to you in two ways:

- Penalties for when you withdraw money from your Roth IRA too early.

- The CD’s term length.

So if you’re not close to retiring and can still sustain the risk, I suggest you invest more aggressively in stocks.

Diversification and YOU

A 1991 study discovered that 91.5% of the results from long-term portfolio performance came from how the investments were allocated.

This means that asset allocation is CRUCIAL to how your portfolio performs.

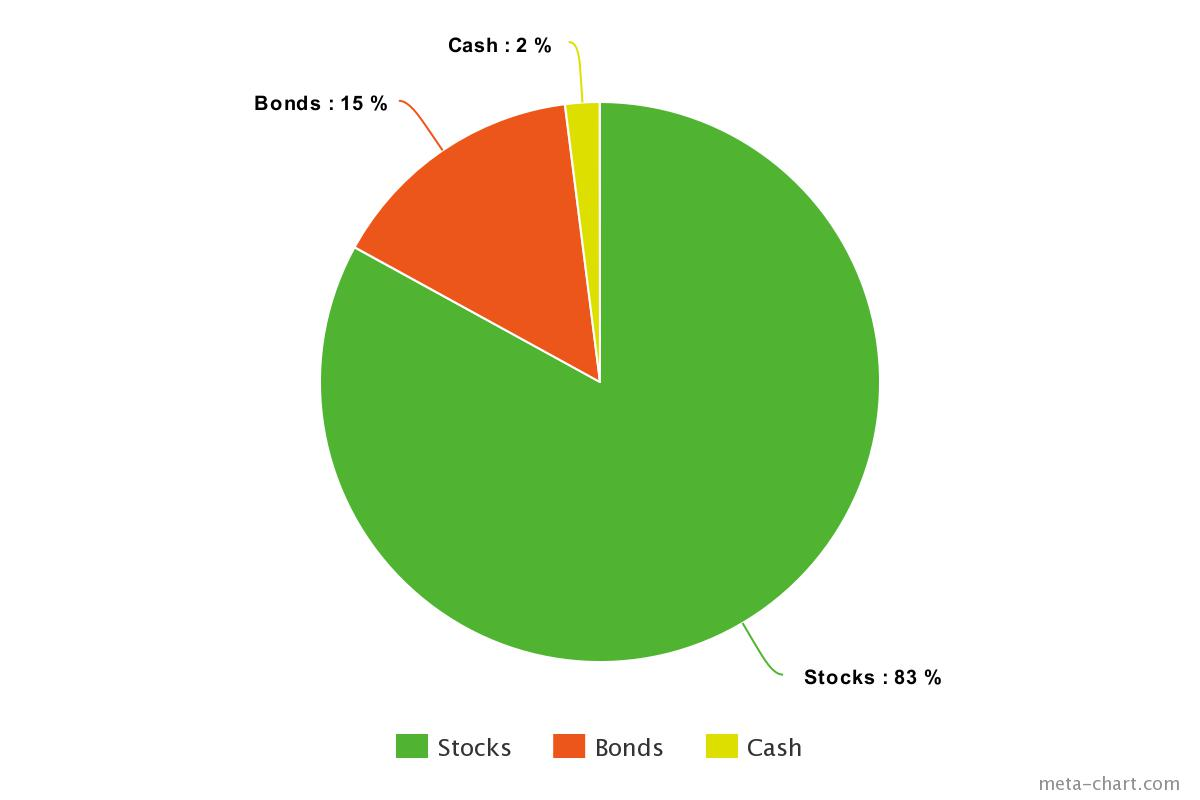

Here’s what my portfolio looks like:

If you bought all different kinds of stocks or stock funds, you’d be diversified — but still only in stocks.

That’s like being the hottest person in Friendship, Wisconsin. It’s better than not being hot, but not going to get you cast in the next season of “The Bachelor.”

It is important to diversify within stocks, but it’s even more important to allocate across the different asset classes, the major ones being:

- Stocks and mutual funds (“equities”). When you own a company’s stock, you own part of that company. These are generally considered to be “riskier” because they can grow or shrink quickly. You can diversify that risk by owning mutual funds, which are essentially baskets of stocks.

- Bonds. These are like IOUs that you get from banks. You’re lending them money in exchange for interest over a fixed amount of time. These are generally considered “safer” because they have a fixed (if modest) rate of return.

- Cash. This includes liquid money and the money that you have in your checking and savings accounts.

Investing in only one category is dangerous over the long term. This is where the all-important concept of asset allocation comes into play.

Remember it like this: Diversification is D for going deep into a category (e.g., stocks have large-cap stocks, mid-cap stocks, small-cap stocks, and international stocks).

Asset allocation is A for going across all categories (e.g., stocks, bonds, and cash).

When determining where to allocate your assets, one of the most important considerations is the returns each category offers.

Of course, based on the different types of investments you make, you can expect different returns.

A higher risk generally equals the higher potential for reward.

The fact that performance varies so much in every asset class means two things:

- If you’re investing to make money fast, you’re probably going to lose. This is because you have no idea what will happen in the near future. Anyone who tells you they do is lying.

- You should own a variety of assets in your portfolio. If you put all your money in U.S. small-cap stocks and they don’t perform well for a decade, that would really suck. Instead, if you owned small-cap, large-cap, with a variety of bonds, you’re more insured against one investment dragging you down.

You don’t want to keep all your investments in one basket.

Keep your asset allocation in check by buying different types of stocks and funds to have a balanced portfolio — and then further diversifying in each of those asset classes.

For more information, check out my article on diversified portfolios.

Make the smartest investment today

There’s no one-size-fits-all solution.

Some people are going to have a diversified portfolio of index funds and never touch it.

Others might want to put more money into the market and more actively handle their funds.

There’s no right or wrong answer to how you do things. The choice is up to you.

But it can be confusing if you’re new to this world and have no idea how to get started.

That’s why I’m excited to offer you something for free. I have an offer: My Ultimate Guide to Personal Finance.

In it, you’ll learn how to:

- Master your 401k: Take advantage of free money offered to you by your company … and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Automate your expenses: Take advantage of the wonderful magic of automation and make investing pain-free.

With this guide, you’ll be well on your way to living a Rich Life.

And you don’t need any fancy get-rich-quick schemes or snake oil or other BS “solutions.”

All you need is determination and the right systems put in place to help you get the most out of your financial situation and not have to worry about living “frugally” (aka sacrificing the things you love).

If you liked this post, you’ll LOVE the Insider’s Newsletter

Join over 800,000 readers getting content that’s not available on the blog, free:

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.

Written by Ramit Sethi

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.