The Basics of Portfolio Rebalancing (what does it mean & what to do in 2023)

So you want to learn about portfolio rebalancing? That’s awesome! Seriously, not a lot of people bother to do it or even take the time to learn what portfolio rebalancing means.

And it’s not just a meaningless financial buzz phrase. Portfolio rebalancing is one of the most important things you can do for your investment strategy.

That’s why I’m going to give you the lowdown on exactly what portfolio rebalancing is, how you can do it today, and also how you can set up your finances to never worry about it ever again.

Table of Contents

What Is Portfolio Rebalancing?

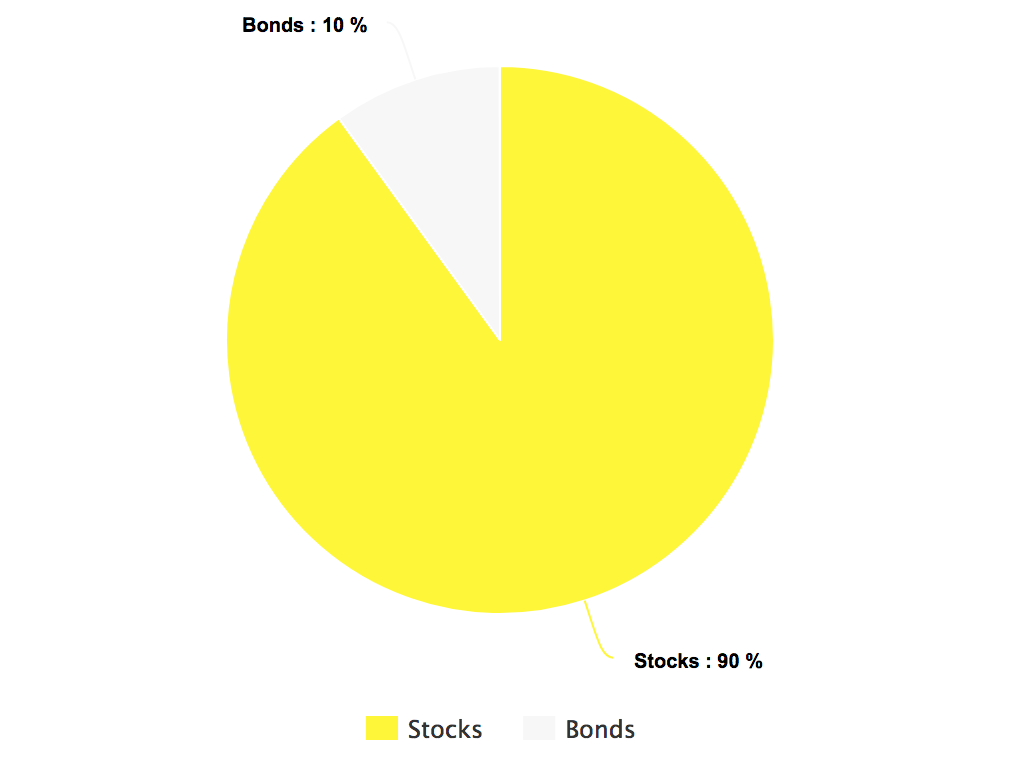

Imagine you’re a 25-year-old whose target portfolio is 90% stocks and 10% bonds.

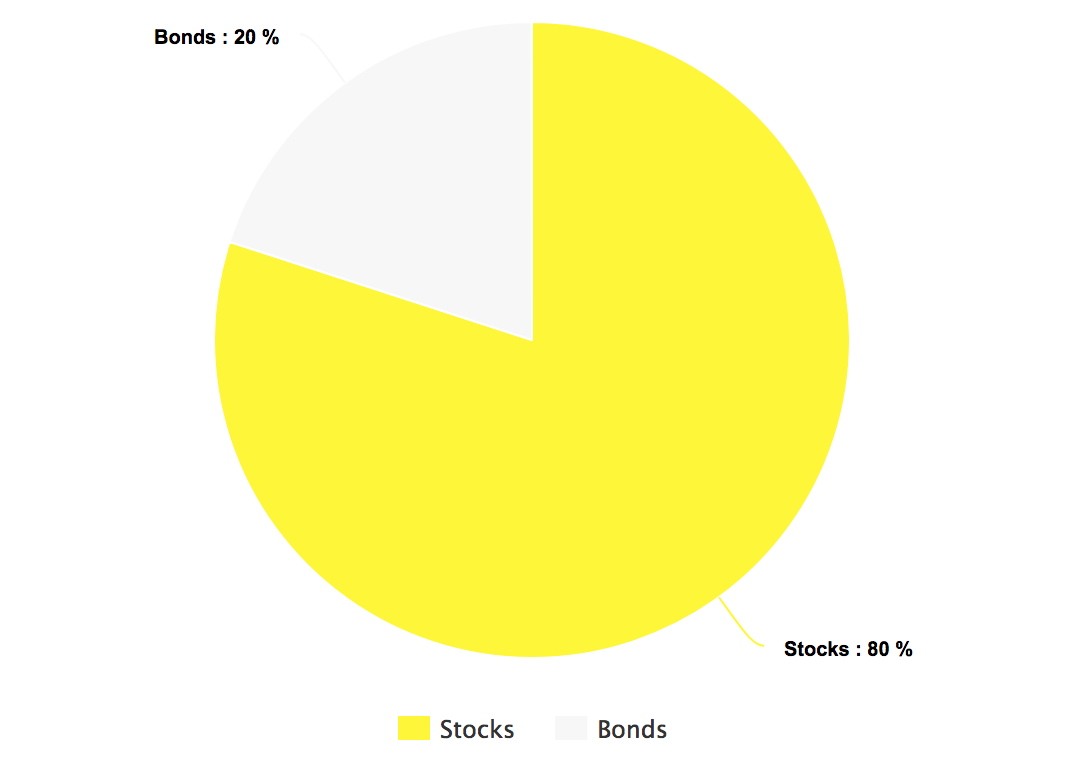

But after a year, you’ve found that your investment in bonds has grown. Good job, you! So now they make up 20% of your overall portfolio:

Since you’re still young and have a higher risk tolerance, you’ll want to continue investing more in stocks. That’s why you should rebalance your portfolio to go back to your original plan.

In essence, rebalancing your portfolio is the process of modifying your asset allocation as the amount of money in each investment fluctuates with the constantly changing market.

It all boils down to one thing: Asset allocation. This is how much money you invest into certain “asset classes” in your portfolio, the major ones being:

- Stocks and mutual funds (“equities”). When you own a company’s stock, you own part of that company. These are generally considered to be “riskier” because they can grow or shrink quickly. You can diversify that risk by owning mutual funds, which are essentially baskets of stocks.

- Bonds. These are like IOUs that you get from banks. You’re lending them money in exchange for interest over a fixed amount of time. These are generally considered “safer” because they have a fixed (if modest) rate of return.

- Cash. This includes liquid money and the money that you have in your checking and savings accounts.

Side note: Sometimes I use the phrase “asset allocation” at cocktail parties to sound smart. The host, whose party I am crashing, usually looks at me, surprised, and asks me one question: “How did you get in here?” But is soon so charmed by my weirdness that I’m allowed to stay.

Aside from a phrase I use to alienate people, asset allocation is the single most important aspect of your investment strategy.

A 1991 study discovered that 91.5% of the results from long-term portfolio performance came from how the investments were allocated. This means that asset allocation is CRUCIAL to how your portfolio performs.

So we know that asset allocation is very important…but how do we rebalance our portfolios in order to stay in line with our target goals? Two ways:

- Manually — through buying and selling

- Automatically — through lifecycle funds

Let’s break down each.

Want to build a business that enables you to live YOUR Rich Life? Get my FREE guide on finding your first profitable idea.

Manual Portfolio Rebalancing

Manually rebalancing your portfolio might appeal to you if you want a more hands-on approach to your investment strategy.

Maybe long-term investing is a little too boring for you?

Maybe you want to occasionally change up your asset mix?

Whatever the case, you’re going to have to take three steps in order to rebalance your portfolio:

- Step 1: Find your target asset allocation. Hopefully, you set out a target percentage for each of your asset classes when you began investing. If not, that’s okay! Check out my article on asset allocation to help find one that works for you.In the example above, your asset allocation target was 10% bonds and 90% stocks. This is what you want your portfolio to look like once you rebalance it.

- Step 2: Compare your portfolio to your asset allocation target. How has your portfolio changed since you last saw it? Which investments got bigger and which need “pruning”?In the example above, your portfolio changed to 20% bonds and 80% stocks over time. You’re going to want to rebalance your portfolio now to reflect your target asset allocation.

- Step 3: Buy and/or sell shares in order to get your target asset allocation. To get your original asset allocation back in the above example, you’re going to need to either invest more into stocks OR sell your shares in bonds in order to go back to your original 80/20 split.Once it’s reverted back to your target asset allocation, congratulations! You’ve successfully rebalanced your portfolio!

A good rule of thumb is that you check your portfolio once each year to rebalance it and stay in line with your target asset allocation.

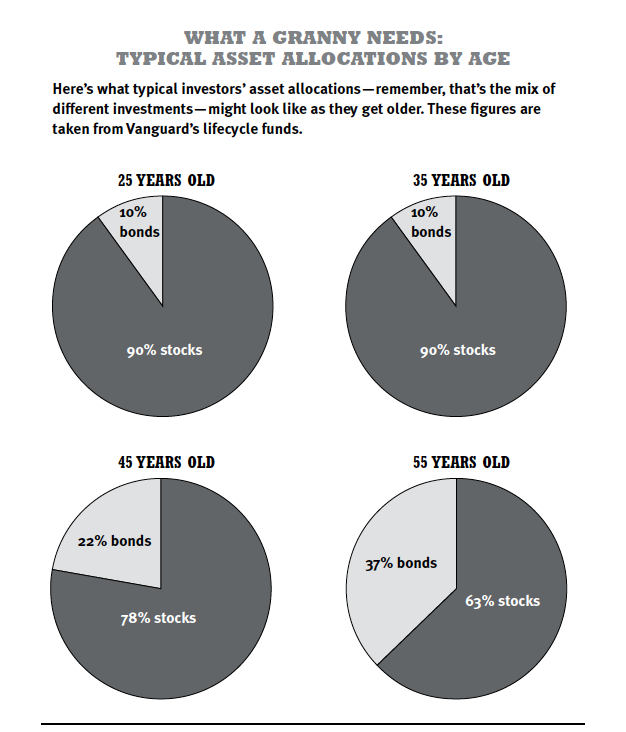

And of course, your asset allocation will change over time as you get older and become more risk averse. To help you get a sense of how your asset allocation might change, check out this page from my New York Times bestseller.

I don’t actually suggest manually rebalancing your portfolio. The reason is due to psychology. As humans, we have very limited willpower. That’s why things like cutting out lattes to save money or manually paying our bills each month are hard for us to do.

And when it comes to portfolio rebalancing, our willpower takes a hit in two ways:

- People want more $$$. It’s psychologically difficult to take money out of one asset class that is performing really well and put it in one that isn’t performing nearly as well.

- People procrastinate. Rebalancing portfolios isn’t exactly on top of everyone’s list of things they really want to do. It’s like cleaning your gutters: Something you know you “should” do but never really get around to. So we put it off or just forget to do it altogether.

So how can you get the benefit of asset allocation without the constant maintenance? Simple: Choose funds that do the rebalancing for you.

Automatic Portfolio Rebalancing With Target Date Funds

I wrote about this in my article on strategic asset allocation, but it’s worth mentioning again: Target date funds (or lifecycle funds) are great funds for people who don’t want to worry about rebalancing their portfolio every year.

They work by diversifying your investments for you based on your age. And, as you get older, target date funds automatically adjust your asset allocation for you.

Let’s look at an example:

If you plan to retire in about 30 years, a good target date fund for you might be the Vanguard Target Retirement 2050 Fund (VFIFX). The 2050 represents the year in which you’ll likely retire.

Since 2050 is still a ways away, this fund will contain more risky investment such as stocks. However, as it gets closer and closer to 2050 the fund will automatically adjust to contain safer investments such as bonds because you’re getting closer to retirement age.

These funds aren’t for everyone though. You might have a different level of risk or different goals.

However, they are designed for people who don’t want to mess around with rebalancing their portfolio at all. For you, the ease of use that comes with lifecycle funds might outweigh the loss of returns.

One thing you should note: Most lifecycle funds need between $1,000 to $3,000 to buy into them. If you don’t have that kind of money, don’t worry. I have something for you at the end of this article that can help you get there.

To recap: No matter how motivated you are about investing right now, you will find other things more urgent and important later. We are all cognitive misers with limited cognition and willpower.

Investing in a target date fund lets you compensate for your natural weaknesses and biases by automating complex asset allocation decisions.

For a more in-depth explanation, check out my video all about lifecycle funds.

Master Your Personal Finances

Asset allocation isn’t hard.

What IS hard is getting started — which is why I’m happy you’re here.

If you’re interested in tactical asset allocation, chances are you already have a good idea of how you want to approach your investments.

However, if you want to earn MORE money so you can invest even more, I have something for you:

The Ultimate Guide to Making Money

I’ve included my best strategies to:

- Create multiple income streams so you always have a consistent source of revenue.

- Start your own business and escape the 9-to-5 for good.

- Increase your income by thousands of dollars a year through side hustles like freelancing.

Bonus: The One Thing You Need To Know About Taxes And Investments

Invest as much as possible into tax-deferred accounts like your 401(k) and IRA. Because retirement accounts are tax advantaged, you’ll enjoy significant rewards. Your 401(k) money won’t be taxed until you withdraw it many years down the line, and your Roth IRA earnings won’t be taxed at all. More important, you won’t have to worry about the minutiae, including picking tax-efficient funds or knowing when to sell to beat end-of-year distributions. By moving toward investing in tax-advantaged retirement accounts, you’ll sidestep the vast majority of tax concerns.

Investing in tax-advantaged retirement accounts is the 85 Percent Solution for taxes. Set it up, then move on.

Learn to take control of your finances and spend your money GUILT-FREE with our free Ultimate Guide To Personal Finance below:

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.

Written by Ramit Sethi

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.