How to Make a Million Dollars: advice + tips from real millionaires

Making a million dollars is a common goal, but how do you actually do it? To answer that question I’ll share with you my expert insights from my experience making my first million, as well as the insights of two other millionaire entrepreneurs. The road isn’t easy, but if you follow the steps we outline, you can start on your way to your own first million..

The 6 Proven Steps to Making a Million Dollars:

- Step 1: Get out of debt

- Step 2: Save money for when you need it most

- Step 3: Invest in your future

- Step 4: Find a million-dollar business idea (it’s easier than you think)

- Step 5: Find your first client

- Step 6: Invest again—but this time, in yourself

Now let’s meet our millionaires: Erik K. & Shannon B., and me, Ramit Sethi.

Erik

Before starting his own business, Erik was a freelance UX/UI designer. Now he runs an online school called Learn UI Design, where he teaches user interface design to students all over the world and still freelances on the side.

His email newsletter has more than 30,000 subscribers, and the business grew more than 60% last year.

Oh, and did I mention the business had made more than a million dollars?

Erik says:

“It’s incredibly gratifying to not be living my life by someone else’s clock. I enjoy being able to train Brazilian Jiu-Jitsu almost every day, never having to commute, and taking any spur-of-the-moment trips with my wife and kids that we’d like. Right now, my toddler is “packing” for a mid-week trip to Disneyland to “meet some princesses.” I think that basically speaks for itself!”

Shannon

With three kids to take care of, Shannon knew she had to really learn the art of the grind in order to quit her job and take her freelancing seriously.

That’s how she was able to grow her freelance CPA consulting hustle into a full-fledged business (Badger and Badger CPA) that she runs with her husband. It’s helped earn her her first million-dollar year in 2017.

“It was a huge mentality shift to how much can I ramp it up while still working full time in my other job,” she says. “There’s a quote by Dave Ramsey that goes: ‘Live like no one else, so you later can live like no one else.’ My husband and I were really disciplined when we got started, and it made the process less difficult.”

Ramit

I’m Ramit Sethi, New York Times bestselling author and founder & CEO of I Will Teach You To Be Rich. I started this blog from my Stanford dorm room in 2004 and have built it into a multi-million dollar business with more than 10 products on how to start a business, earn more on the side, land a dream job, and live a Rich Life.

Erik, Shannon, and I are going to share our strategies on how we got to where we are — and how you can do it too.

How to Earn Your First Million

All three of us were able to earn our money through a powerful combination of two things:

- Investing and saving

- Earning more money through side hustles

Though you can actually make a million dollars on investing and saving alone, you can watch your net worth explode if you combine them both — which I suggest you do.

Step 1: Get out of debt

The number one barrier preventing people from compounding wealth is debt.

That’s why getting out of debt is step one on the road to becoming a millionaire. Before you even think about investing, saving, or earning more money, you need to take steps to get out of credit card debt.

Getting out of debt was also a priority for Shannon when she and her husband/business partner first got married.

“When my husband and I were first married, we were really disciplined about getting out of debt and saving,” Shannon says. “We paid off all of our debt out of college. We paid off all of our car debt. And now we’re paying off our house.”

Paying off your credit card debt is one of the most important investments you can make into your Rich Life. I’ve written extensively about this before, both on the blog and in my New York Times bestselling book.

If you’re in debt and want to learn more about my system, I highly suggest you read my article on how to get out of debt fast.

Step 2: Save money for when you need it most

By saving money, you give yourself the freedom to earn more money.

Shannon says:

“My husband and I were really good about saving money,” Shannon says. “We created a six-month emergency fund that allowed us to take a small step back financially when I quit my job. But because we saved early, it gave us a lot of freedom to invest and earn.”

That’s why it’s important to set savings goals.

To find out how much you need in your emergency savings fund, you simply have to take into account three to six months worth of:

- Utility bills (internet, water, electricity, etc)

- Rent

- Car/home payments

- Food/groceries

Basically, any living expense that you have should be accounted for.

You should also start an account exclusively for your emergency savings fund. Most banks allow you to create a sub-savings account along with your normal savings account. (You can even name them too!) So create one for your emergency fund.

Step 3: Invest in your future

Investing your money is the best way to guarantee you become a millionaire. In fact, I promise you, if you follow the systems below you will eventually become rich.

Shannon knows that too.

“My husband and I have been putting 10 – 15 percent of our earnings into our retirement accounts for a while now,” she says. “We also have a 529 plan for each of our kids.”

When it comes to accounts for retirement, you have two options:

- 401k

- Roth IRA

These are retirement accounts. That means you’ll be able to accrue gains with big tax advantages with one caveat: you promise to save and invest long term. That means you can buy and sell shares of almost anything as often as you want as long as you leave the money in your account until you get near retirement age.

Let’s take a look at each one.

401k: Free money from your employer

A 401k is a powerful retirement account offered to you by your employer. With each pay period, you put a portion of your pre-tax paycheck into the account. That means you’re able to invest more money into a 401k than you would a regular investment account.

But here’s the best part: Your company will match you 1:1 up to a certain percentage of your paycheck.

Say your company offers 3% matching. If your yearly salary is $150,000 and you invest 3% of your yearly salary (~$5,000) into your 401k, your company would match you that amount — doubling your investment.

Check out the table below that illustrates this.

| Age | Your Contributions | Employer Match | Balance without Employer Match | Balance with Employer Match |

| 25 | $5,000 | $5,000 | $5,214 | $10,428 |

| 30 | $5,000 | $5,000 | $38,251 | $76,501 |

| 35 | $5,000 | $5,000 | $86,792 | $173,585 |

| 40 | $5,000 | $5,000 | $158,116 | $316,231 |

| 45 | $5,000 | $5,000 | $262,913 | $525,826 |

| 50 | $5,000 | $5,000 | $416,895 | $833,790 |

| 55 | $5,000 | $5,000 | $643,145 | $1,286,290 |

| 60 | $5,000 | $5,000 | $975,581 | $1,951,161 |

| 65 | $5,000 | $5,000 | $1,350,762 | $2,701,525 |

This is free money!!! If your company offers a match, you should ABSOLUTELY take part in their 401k plan.

For more on 401k’s, be sure to check out my article on how the account is the best way to grow your money.

But 401k’s are only one part of the equation when you want to start saving for retirement. The other account you should get is a Roth IRA. And ideally, you have both.

Want to build a business that enables you to live YOUR Rich Life? Get my FREE guide on finding your first profitable idea.

Roth IRA: The best long-term investment

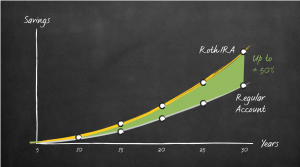

A Roth IRA is simply the best deal I’ve found for long-term investing.

Remember how your 401k uses pre-tax dollars and you pay income tax when you take the money out at retirement? Well, a Roth IRA uses after-tax dollars to give you an even better deal.

With a Roth, you put in already taxed income into stocks, bonds, or index funds and pay no taxes when you withdraw it.

For example, if Roth IRAs had been around in 1970 and you’d invested $10,000 in Southwest Airlines, you’d only have had to pay taxes on the initial $10,000 income. When you withdrew the money 30 years later, you wouldn’t have had to pay any taxes on it.

Oh, and by the way, your $10,000 would have turned into $10 million.

That’s an exceptional example, but when saving for retirement your greatest advantage is time. You have time to weather the bumps in the market. And over years, those tax-free gains are an amazing deal.

NOTE: After you invest in your retirement accounts, you can actually stop right there. After many years, your money will compound and earn you well into the millions if you continue investing.

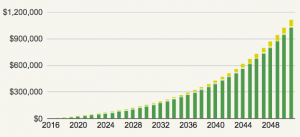

Say you’re 25 years old and you decide to invest $500/month in a low-cost, diversified index fund. If you do that until you’re 60, how much money do you think you’d have?

Take a look:

$1,116,612.89.

However, if you want to be able to hit a million dollars sooner than that, there’s only one really good option: Earning more money.

Why do I focus on earning more instead of saving more? It’s simple:

There’s a limit to how much you can save, but no limit to how much you can earn.

If you’re willing to put in the work and develop a hustle that’ll scale and grow, you can earn as much money as you want. And while there are a lot of ways you can make more money, my favorite way is by starting a freelance hustle.

That’s what Shannon and Erik did, and they’re going to show you how.

Step 4: Find a million-dollar business idea (it’s easier than you think)

One very common misconception about starting your own freelance hustle is that you need to come up with the “perfect” idea to do it — when that couldn’t be further from the case.

I know it’s difficult to imagine that you might have profitable skills already — but you do. In fact, Shannon has a perfect solution to find out those skills: Look at what your friends ask you to help them out with. That’s how she got her start as a freelance CPA consultant.

From Shannon:

“I had a colleague who needed help sorting through her finances. She asked me to help her out, and she became my first client. Then I had another friend who started a law office and needed help, so I helped them out with all of their accounting. I’d meet with them to make sure that they were still compliant and help with their tax returns.

It just started with helping people as a hobby, but then my husband pointed out that I was getting clients without even trying. Eventually, I was able to start a freelancing business from it.”

Sometimes it’s just a matter of trial and error like it was for Erik. He says:

“Before freelancing, I was at a large tech company, and regularly tried my hand at little entrepreneurial side-projects. Come to think of it, I’ve attempted to sell made-to-measure men’s suits, novelty wall clocks, coaching, and both product and digital design services. But nothing really stuck until Learn UI Design.”

Spend about 10 – 20 minutes now writing down five skills that you already have and could charge money for. Once you’re done, congratulations — you now have 5 potential business ideas that you can grow into a flourishing side hustle.

For now, just choose one business idea. It’s okay, you can always change it later. For now, we’re going to just try one out and try to find a client with it.

Step 5: Find your first client

In order to start earning money, you need to find the people who will give you money for your ideas.

But the question is…how? Where do you find these people?

One way to find potential clients is to start an email list. That’s what Erik did after writing his piece on designing user interface, “7 Rules for Creating Gorgeous UI (Part 1).”

“Before Learn UI Design, I had kept a blog for a few years, and if that experience taught me anything, it was the internet does not magically show up on your doorstep. Marketing is hard,” Erik said. “I didn’t actually have a newsletter, but over the next couple years, it collected almost 8,000 emails. By the time I finally built and launched my course, I had a whole bunch of folks ready to learn design! (Although, hilariously, I got a couple replies back “This looks amazing, but who are you again??”)”

Another way to find potential clients is to go online and find out where they live. Ask yourself:

- Who is my client?

- Where do they go when they want to look for a solution to their problems?

- Where are they ALREADY looking for solutions to their problems?

- How can you connect them to your service?

At this point, you’re also going to want to niche down your market in order to really tailor your services and draw in customers.

“Stay in your niche,” Shannon suggests. “We had a few instances where we veered from the niche and we paid for it dearly. It might feel cheesy to sit down and figure out what your target market is or what your goals are for the company, but you have to do that. All that legwork needs to be done upfront. It’s just practical.”

So think about who’s an example of a client who might want to buy your product.

A few questions to jumpstart your research:

- How old are they?

- Where do they live?

- What are their interests?

- How much do they make?

- What books do they read?

Using this information, find out what your clients need by going to the places they go.

For example:

- Want to pitch to moms that blog about children? Go to The Mom Blogs and start with the ones under “Popular Blogs.”

- Looking for physical or massage therapists within 50 miles of your house? Yelp should get you started easily.

- If you want to do large dog grooming and sitting, well there’s probably a local pet store or dog park near you where owners are all congregating just waiting for you to offer them a solution.

Here are a few suggestions of some other great sites freelancers can use to find business online:

- Writers: MediaBistro.com, Upwork.com, FreelanceWritingGigs.com

- Illustrators/Designers: 99designs.com, Designs.net

- Programmers: Toptal.com, SmashingMagazine.com

Step 6: Invest again — but this time, in yourself

Investing takes many shapes. It’s not all stocks, bonds, and retirement accounts. Investing can also be in yourself — and it’s something you need to do if you want to earn a million dollars. Be continually curious.

From Erik:

“I read pretty voraciously. Reading takes time, but if you learn the right lessons now, they pay dividends later. Many of the best books I’ve found I read months or years before I actually used the lessons they taught.

And while it’s not related to Learn UI Design directly, another great book-as-investment that’s helped me in freelancing and life is Chris Voss’s negotiation book “Never Split the Difference”, which cost me $18 and saved me $1797 within two months. That’s a 100x ROI on a book!”

I love this. It hits on an idea that all IWT readers should embrace: Be continually curious.

Ask questions when you don’t understand something and don’t be afraid to seek out more information through books, courses, or schooling. It’s only then that you can hope to truly live your Rich Life.

Want to build a business that enables you to live YOUR Rich Life? Get my FREE guide on finding your first profitable idea.

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.

Written by Ramit Sethi

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.