Work Less, Make More, and Dominate Using the 80/20 Rule

There isn’t a single person on the planet who wouldn’t like to work less and make more money.

But the very idea of making more while working less is totally absurd to some people.

In a world where so many of us trade our time for money (clock in, clock out), it might be hard to see just how easy it is to work less and make more money for yourself, but we’re here to tell you: It’s not as hard as you think.

You don’t have to spend the rest of your life feeling exhausted from your work, waiting for the weekend, and barely making financial ends meet every month.

Instead, there are some smart choices you can make now to set yourself up to work fewer hours each week and make more money at the same time. Whether you’re a full-time employee, a side hustler, or building your own business, these principles can make a major impact on your time, happiness, and income.

If having more money AND having more free time is part of your vision for a Rich Life, then read on for 7 great ways to work less and make more money starting today:

1. Front-Load Your Efforts

I talk a lot about investing. Smart investors know they’re doing themselves a massive favor by investing as much as possible as early as possible.

The same goes for your work.

Most people have a lot more ambition, drive, passion, and energy in their twenties and thirties than later in life. Plan for that nearly inevitable scenario by front-loading your work.

By working weekends, long nights, and extra hours earlier in your life, you’ll set yourself up nicely to work less and make more money later in life.

The efforts you make in a career or your own business today become amplified and compounded as the years continue.

Driving your energy into these early years of your working life might lead you to make some money mistakes too, but that’s OK. I talk about the importance of making small mistakes early in your Rich Life rather than later in this interview with Men’s Health.

A wise person once said: the best time to plant a tree is 20 years ago. The second-best time is today. So, if you’re still feeling the energy and drive to make something happen for yourself, give it all you’ve got while you still can, and you’ll reap the rewards later in life.

You may not work less and make more money immediately, but over time, you’ll begin to see a powerful shift.

2. Develop Multiple Income Streams

If you’re serious about working less and making more money, then you’ve got to focus on developing multiple income streams.

“Wait a second,” you might be thinking, “does multiple income streams mean MORE work, not LESS?”

It can—especially in the beginning (see point #1). But the idea behind multiple income streams is to reduce your dependency on just one.

Picture this scenario:

Your boss calls you into her office to give you the news that you’ll be expected to work more hours on a tough project next quarter. Naturally, you assume you’ll be given a raise or a promotion with all this added work. You assumed wrong. Not only will you work more hours, but you’ll also get paid the same salary as always (which is too low anyway).

Without multiple income streams, you’re pretty much stuck.

You have rent or a mortgage to pay, maybe mouths to feed, and a car payment. You’ve got student loans and credit card debt (even though you shouldn’t), and there’s no way out but to stay at your job.

Now, picture this instead:

Your boss knows you’ve been working on a side hustle for the last few years, and it’s been going really well. You’re making almost as much on the side as you do at your day job. She calls you into her office to dump that extra work on you. You immediately ask for a raise to go along with the extra work because you can’t lose.

If she says “no,” you can quit. You’re making enough on the side to support you until you find a new job (or take the side hustle full-time).

If she says “yes,” score. You just got a raise and will now make more money to compensate for your extra hours. When the project is over, you’ll start to work less and make more money.

You can’t go wrong.

Add to side hustles other income streams like passive income, residual income, or interest on investments, and suddenly you’re in charge—not someone else.

Watch this video about how to find your best business idea—i.e. the one you’ll definitely make money from.

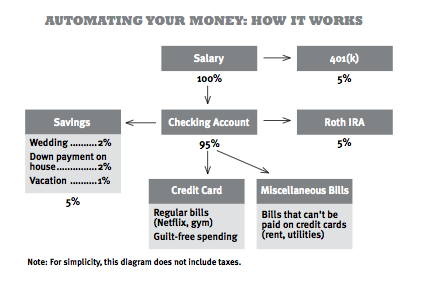

3. Automate Your Finances

One of the best ways to work less and make more money is to let your money do the work for you.

Automating your finances is one of the best time and effort investments you can make as you strive to work less and make more. That’s because the more automatic your money is, the more it can work for you.

As I suggest in my book, set up automation to withdraw money from your paycheck directly into a Roth IRA or stock investments. Define a set amount monthly and have your bank or an app do it on autopilot so you don’t even have to think about it.

The 3 steps to automate your money are simple:

- Log into all of your accounts

- Set up automatic transfers

- Get all of your bills on the same schedule

You can learn more about these three steps in detail here.

As your investments grow and compound on each other, you’ll literally be making money with zero work—helping you slowly work less and make more money at the same time.

Here’s a practical example of what it might look like to automate your own personal or business cash flow:

By automating your finances, you also avoid unnecessary fees and debt. How many times have you paid a late fee, an overdraft fee, or some other penalty because you simply forgot?

Answer: too many times. With the technology available today, there’s no reason you can’t always pay your bills on time, as long as you have funds in the bank.

As you make timely payments and reduce debt, you’ll also see a rise in your credit score, which can allow you to make investment purchases such as buying a home or starting a business.

4. Stop Doing 80% of the Stuff You Do

If you want to work less and make more money, you’ve got to leverage the power of the 80/20 rule. This is called Pareto’s Principle and it demonstrates that in most things you do, 80% of your results come from 20% of your efforts.

It can be pretty powerful. But it also means that only 20% of your results come from 80% of your efforts. Ouch.

Success with the Pareto Principle comes in two simple steps:

First, eliminate 80% of all your hard work. Cut out unnecessary meetings. Filter out unwanted emails. Outsource or delegate unimportant tasks.

Then, scale up the remaining 20%. Identify what’s really driving results in your life, job, or business, and do MORE of that with the time you’ve just unlocked.

What does this look like in principle? Let’s say you’ve just started freelancing as a dog walker, and you charge your 10 clients $20 per dog.

Pretty soon you realize that 8 of your clients have just one dog and are paying you $20/walk while the others each own a dog shelter with 10 dogs each. They’re each paying $200/walk.

Twenty minutes is twenty minutes, whether you’ve got 1 dog on a leash or 10. You work less and make more money with the 20% of clients with 10 dogs.

So what’s the smart thing to do?

You drop all 8 of those single dog owners, quit taking new clients with only one dog, and start looking for just one more client that has at least 8. She’s harder to find, but you’ve got plenty of time now because you just dropped 80% of your commitments and didn’t lose much, relatively.

Whether you have a full-time job, a side hustle, or your own business, chances are 80% of your results currently come from stuff you spend 20% of your time on. One of the quickest ways to work less and make more money is to cut out the 80% of tasks you simply don’t get your best results from.

5. Move Somewhere That’s Cheaper to Live & Work

Most people who feel stuck in their job feel stuck because of bills. Rent, mortgage, car payment, debt repayment, utilities, internet, phone bills, and the list goes on.

Imagine for a moment that you’re living in New York City or San Francisco (two of the most expensive cities to live in at the time of writing).

Now, imagine you can convince your boss to let you work from anywhere you want as long as you get your work done. If you’re not sure how to do this, read Tim Ferris’ landmark book, The Four-Hour Workweek.

Why not pick up your laptop, move out of that tiny NYC apartment, and move to somewhere infinitely more beautiful and much cheaper? There are dozens of great options in industrialized, modern cities at a fraction of the price.

Places like Cambodia, Thailand, Mexico, Argentina, or Peru offer beautiful scenery, kind people, and a MUCH lower cost of living.

With all the money you save, you could invest more, work fewer hours, or start your own business.

Yes, it’s hard to move away from what you know—and possibly people you care about. This tip definitely isn’t for everyone, especially if you LOVE living in the big city with your friends and family.

But if you want to work less and make more money, you have to consider just how much of your hard-earned cash is getting eaten up by everyday expenses.

Self-made entrepreneur Sean Ogle got fed up with his corporate job in finance and wanted to do some traveling. When his boss turned down his proposal to work remotely, he quit.

He had some savings, but not enough to make it for long with a home base in Portland, so he bought a 1-way ticket to Bangkok and set up shop over there, where it’s far cheaper to live—geo-arbitrage.

Sean found a part-time gig when he got over there, and after 6 months of hanging out in Thailand and visiting the rest of Southeastern Asia, he came home with the same amount of money that he left with.

Free 6-month vacation. Nice.

No matter how you look at it, there are ways around paying your bills and being stuck in your same clock-in, clock-out routine every day.

Understand and Leverage the Motivations of Others

Let me introduce you to a guy named Matt. By age 25, Matt had worked his way into an executive finance position with UPS, and at the age of 26, he said goodbye to that job in order to double his salary and move to Europe and work at a tech company.

To achieve such a salary so early in life, you might think Matt sleeps under his desk at night.

Not so. He really doesn’t work that much harder than anyone else with a little ambition.

So how did he work his way up the ladder so fast? Here’s exactly what Matt said about working less and making more:

“I focus on figuring out how systems work and where people’s motivations are coming from. Understanding how and why something works the way it does is amazingly powerful.

“This is my fundamental starting point for working smarter. Investing the time to build relationships, dissect processes, and ask why builds a solid platform to base all other activities off of.”

Here’s a guy who makes well over $100,000 a year, and the #1 thing he does to be effective at his job is understand others’ motivations.

How much further could you get in your own career or business if you spent less time on menial tasks and more time understanding the motivations of your boss, coworkers, customers, or clients?

7. Get a More Flexible Job so You Can Focus on High-Impact Work

If you’re in a job where your boss expects you to be in a chair every minute of every day, you’re just never going to be able to work less and make more money.

If you have to clock in and clock out and perform menial tasks the entire time between, then it’s time to switch to a more flexible job so you can focus on high-impact work.

People who work less and make more money are the people who identify the most important work (either what their boss cares most about or what drives the most revenue for their own business) and put the bulk of their effort into it.

If the 2020 pandemic taught us anything about work, it’s that you don’t have to be physically present at your job in order to be productive.

Study after study shows that employees who work from home are almost always more productive.

Why? Because when we’re free to choose our schedule and daily tasks, we prioritize the most important things, get them done, and then move on with life.

No more playing solitaire until 5 pm just so your boss can see you in your seat. No more eating lunch at your desk in order to appear busy.

If your job isn’t flexible enough to allow you the freedom to work less and make more money by prioritizing the most important tasks, then you should seek out a new job. We recommend looking into jobs at ROWE companies (Results Only Work Environment).

At a ROWE company, no one cares how many hours you put in or when you put them in. They only care about results.

And when your boss only cares about results, you’ve made a good step toward working less and making more money.

If you are your own boss, consider what work actually has to be done by YOU and which tasks you can outsource or delegate. Focus on getting the most important work done, and your business will thrive.

Even a “side hustle” like a YouTube channel can yield huge results. Meet a couple that has seen incredible results but is still struggling to find balance in their relationship.

Next Steps to Work Less & Make More Money

As you review this list of ways to make more money while working less, some will stand out to you while others won’t.

The key is taking action. Try one or two of the ideas in this article as quickly as possible and see what kinds of results you get.

The sad truth is that 99% of people who read this will never change anything in order to work less and make more money. They’ll just keep complaining about their boss, whining about their long hours, and living paycheck to paycheck.

But not you. You’re going to take action. And within a few years, you’ll be working less. You’ll be making more money. And you’ll be that much closer to your Rich Life.

If you liked this post, you’d LOVE our Ultimate Guide to Finding Your First Profitable Idea

It’s one of the best things we’ve published, and totally free—just tell us where to send it: