How Often Should You Check Your Stocks? (NOT every day)

If you’re wondering how often you should check your stocks, you’re probably checking them too much. It frustrates me to no end when I see new investors constantly checking their stocks like it’s their Twitter feed. It seems like even the slightest dip in the market causes them to freak out and start selling everything.

I have one piece of advice for all you investment n00bz out there:

STOP CHECKING YOUR DAMN STOCKS EVERY DAY.

Sweating out the slightest variation of your stocks daily is a recipe for an anxiety attack AND poor financial management. I don’t check my stocks that often — they’re long-term investments.

Selling in 2009 would have cut your losses, and your gains – Wikimedia Image

But I get it — television pundits and so-called “investment experts” make you think that every up and down is the end of the world and deserves two hours of coverage.

Also, notice how they only ever cover the “sexy” stocks? Give me a break.

The fact of the matter is you shouldn’t even really “pick” stocks to begin with. Relying on a handful of individual stocks in the hopes of making money is a good recipe for disaster.

After all, you don’t understand a company’s finances. Hell, professional investors, economists, and fund managers — all of whom are paid millions every year — can’t beat the market either!

Remember: Investing isn’t about just picking stocks.

Now, if you actually enjoy reading Forbes and watching the pundits purely for entertainment purposes, then go right ahead. There’s nothing wrong with being entertained by Jim Cramer throwing chairs around on Mad Money.

But you also need to keep in mind that 99.999999% of the advice you see out there is pure fearmongering or entertainment. Ask yourself: do the pundits make money when their readers make money? Or do they make money from ratings and clicks? Exactly.

Two things to always keep in mind when it comes to stocks:

- The professionals are almost always wrong. The stock picks of pundits and so-called professionals are usually no better than pure chance and even professional money managers barely ever beat the market benchmark. In other words, they don’t just underperform, but they do it by A LOT.As William Bernstein, author of The Intelligent Asset Allocator, says: “There are two kinds of investors, be they large or small: Those who don’t know where the market is headed, and those who don’t know they don’t know.”

- It’s mostly just noise. If you’re a long-term investor (and you should be) you don’t need to check your stocks every day. You don’t even need to check your stocks every WEEK. I only check my stocks once or twice a month to make sure the automation is working.The daily changes in stocks are almost always noise — plain and simple. And very few (read: almost none) of your investments will be determined by the news of one day.

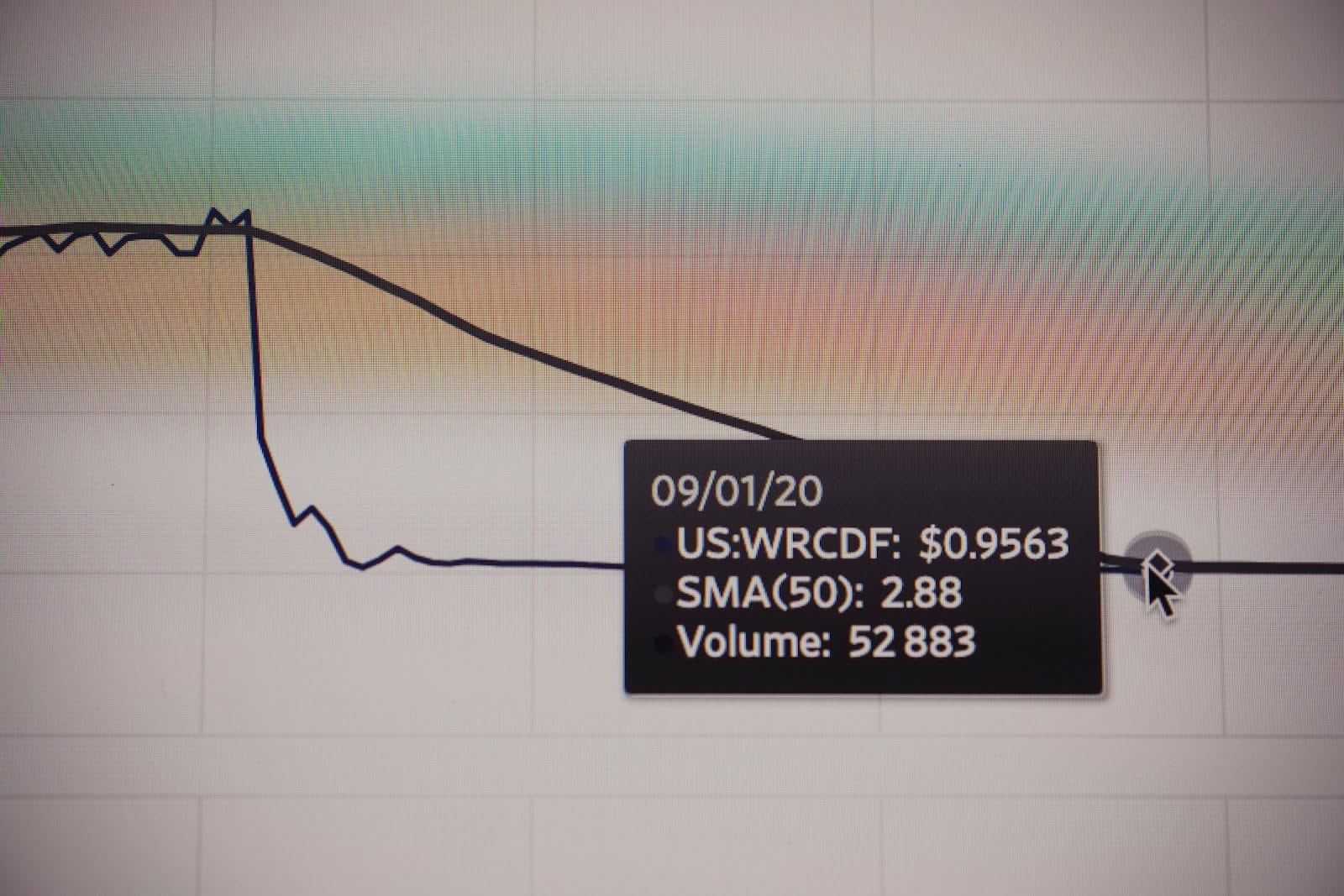

Context is king in evaluating equities

I used to teach a class on investments. I would draw a picture of a rapidly declining stock and ask, “What should I do with my stocks?”

About 25% of the class shouted, “Sell!” and 25% said, “Hold it!” while a couple of people in the class muttered “Buy more.”

None of them were exactly right though. The truth is, you need more context.

If a stock like, say, Apple, falls a bunch, you have to look at the surrounding context and ask questions like:

- Is the general market falling?

- Are its peers (HP, Dell, etc) falling?

- Has Apple performed this way before? What happened then?

Answering these questions provides a LOT more context to the situation and can both put your mind at ease and also help you make better judgements.

If stock is falling but its competitors are fine, it will almost definitely bounce back.

But if companies in that industry are cratering across the board…then you might want to start worrying.

But who REALLY wants to worry? Instead, I’d like to offer you a better solution when it comes to investing.

Managing my stocks in a better way…

Bottom line: I don’t check my stocks every day and you shouldn’t either.

Instead, what I do is rely on a system that allows me to take the set-it-and-forget approach to my investments.

My portfolio guarantees my money is automatically going where it is supposed to.

That’s what I prefer to do — and it’s the same strategy recommended by Nobel Laureates and billionaire investors like Warren Buffett.

All it takes is two simple steps:

- Pick a low-cost, diversified index fund. These funds that invest your money across the whole market, so you don’t need to worry about picking the “best” stock.

- Automate your investing so you do it consistently. That way you can stop chasing stocks and relying on guesswork.

I’ve talked about automating your investments in hundreds of articles already — but I always feel like it needs to be said. It’s one of the easiest ways to ensure you’re investing your money properly and consistently.

Check out my 12-minute video on how you can set up your automatic system today.

If you are just starting out in investments, it’s great that you’re here.

For financial security, it’s more important than anything else to start early. And don’t worry if you think you’re a little late to the game. After all, the best time to plant a tree was 20 years ago…the second best time is today.

Man, I’m starting to sound like a fortune cookie.

FAQS about How often should you check your stocks

What are the risks of checking your stocks too frequently?

Checking your stocks too frequently can lead to emotional investing and impulsive decisions, such as buying or selling based on short-term market fluctuations. This can lead to underperformance and missed opportunities for long-term growth. It can also cause unnecessary stress and anxiety.

Can checking my stocks too frequently hurt my returns?

Checking your stocks too frequently can lead to emotional investing and impulsive decisions, which can hurt your returns over the long term. It’s important to maintain a long-term perspective and avoid reacting to short-term market fluctuations.

Is it okay to ignore my stocks for a long period of time?

While it’s generally not recommended to ignore your stocks for a long period of time, there may be times when it’s appropriate, such as when you have a long-term investment strategy or are invested in a well-diversified portfolio. However, it’s important to check your stocks periodically to ensure that your investment strategy is still aligned with your goals.

Should I check my stocks more frequently if I’m a new investor?

If you’re a new investor, you may want to check your stocks more frequently to get a better understanding of how the market works and how your investments are performing. However, it’s still important to avoid over-checking and making impulsive decisions based on short-term market fluctuations.

If you liked this post, you’d LOVE my Ultimate Guide to Personal Finance

It’s one of the best things I’ve published, and totally free – just tell me where to send it:

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.

Written by Ramit Sethi

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.