The US average inflation rate (and what to do about it)

Average inflation rate: The silent killer

There’s a killer out there that works quietly and strikes when people least expect it.

I’m talking about average inflation rates.

The average inflation rate in the US over the past 60 years is 3.7% — and while that might not seem like a lot, this number is actually a silent killer to many people’s money.

Basically, the inflation rate lessons the purchasing power of each dollar you own by an average of 3.7% each year. It’s the reason candy bars used to cost $0.50 cents and now they are $1, and the reason that keeping your money under your mattress is a bad idea (more on that below).

If you want to find out why exactly that is and how to protect your money against the dreaded inflation rate, stay close. Keep quiet. And whatever you do, don’t get separated from the group.

What is inflation?

Inflation is the price increase of purchased products over time. This happens in countries as the purchasing power of their currency decreases.

Imagine you’re paying $1,000 a month for your apartment. Over the next year, there’s an inflation rate of 5%. Just for the sake of argument, this means that to maintain the same purchasing power — assuming your landlord is perfectly rational and there are no other variables at play — your landlord would account for that in next year’s rent by increasing it to $1,050.

Why does inflation happen? There are actually a lot of different reasons it can occur:

- When supply decreases and demand increases. You know how your Uber price surges when more people in your area try to use it at one time? That’s a good example of supply/demand inflation. When more people want a product/service but there’s a small amount of that product/service, inflation occurs.

- When production cost increases. When the cost to produce a product/service increases, supply decreases. This happened in the 1970s when the cost of oil increased, which affected the production process of any industry that used oil to transport their goods. Which was a LOT of different industries. Those industries reacted by increasing the price of their products, resulting in inflation.

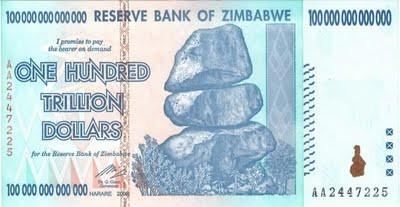

- When too much money is printed. The most famous example of this happened in post-WWII Germany when the country began to print enormous amounts of money to pay back war reparations. It got so bad that some German families literally burned cash for warmth because it was cheaper than firewood.

Bottom line: Inflation happens when the price of products increase. Though it can get out of hand as “hyperinflation,” like in post-WWII Germany or Zimbabwe in the 2000s, inflation is also a very typical occurrence for any national economy.

Zimbabwe had to print a one hundred trillion–dollar note to keep up with hyperinflation

Inflation: The silent killer

Inflation can be scary. Hell, when we look at how it has impacted countries like Germany, Zimbabwe, or Hungary, inflation can be downright terrifying.

But inflation isn’t that bad. Economist John Maynard Keynes (you know, of Keynesian economics) even suggested that a small amount of inflation was the sign of a thriving economy.

However, inflation can be bad for individuals though — particularly, when you just keep your money sitting in a bank account and do nothing else with it.

I often hear people say things like, “I’m afraid of losing money,” as an excuse for not investing. That’s fair. After the 2008 financial crisis, many people got shaken by the effect it had on their finances.

However, you need to take a long-term view of your personal finances. You can choose among different investment options that allow you to make money despite events like recessions.

And because of inflation, you’re actually losing money every day your money is sitting in your bank account.

For example, Big Banks (Wells Fargo, Bank of America, etc.) pay about 0.01% interest on savings accounts in 2018. This means that if you put $1,000 in a savings account, you’d earn a whopping $0.10 per year. I find more than $0.10 in pennies on my way to the bathroom each morning, so I’m not very impressed by that kind of return.

So if your money were sitting in one of these Big Banks, you’d actually be losing money every day because inflation is 3%. So, you MAY be earning .01% interest on your savings account but you’re essentially losing 3% every year in terms of real purchasing power.

And yet, many people still opt to keep their money in a bank account or in their mattresses instead of putting it to work for them.

I won’t let that happen to you. In fact, I’m going to show you a few things you can do with your money today rather than let your finances get murdered by the average inflation rate.

What can you do about the average inflation rate?

While it is a good idea to have some cash on hand for things like your emergency fund, your money should be put to work through investing.

Investing is the single most effective way to get rich. By opening an investment account, you give yourself access to the biggest money making vehicle in the world: the stock market.

Your money won’t get lost to inflation over the long term. In fact, the average return on the S&P 500 is nearly 10%.

What should you be investing in though — and how? To answer that, you simply have to have your Ladder of Personal Finance handy.

No, it’s not something you can buy at Home Depot. The Ladder of Personal Finance takes a look at three essential areas you should be investing your money towards:

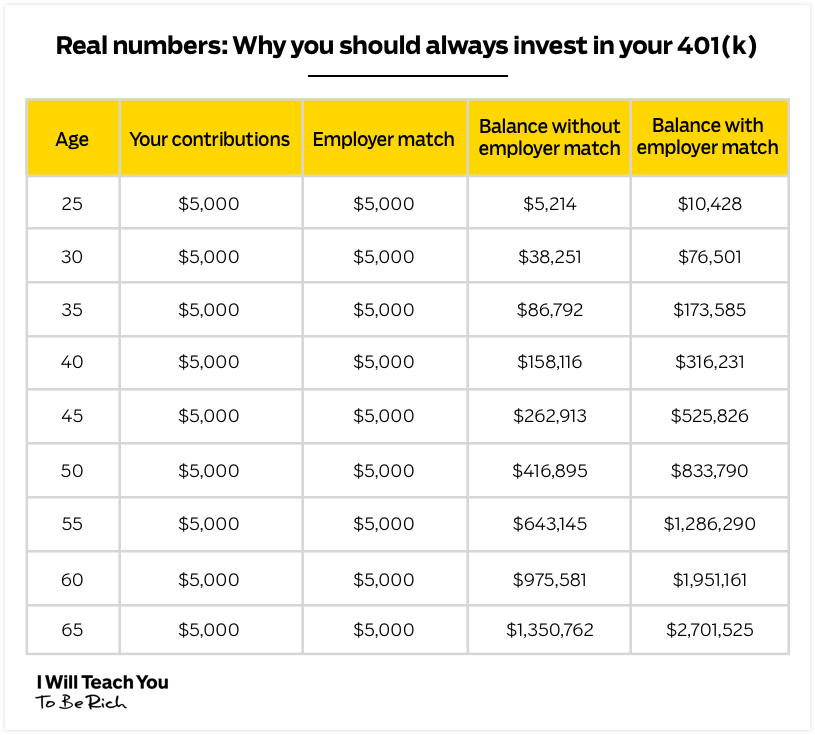

- 401k. Take advantage of your employer’s 401k plan by putting at least enough money to collect the employer match into it. This basically means that for every dollar you contribute, your company will match that (pre-tax!). This ensures you’re taking full advantage of what is essentially free money from your employer. That match is POWERFUL and can double your money over the course of your working life.

- Debt. Once you’ve committed yourself to contributing at least the employer match for your 401k, you need to make sure you don’t have any debt. If you don’t, great! If you do, that’s okay. You can check out my system on eliminating debt fast to help you.

- Roth IRA. Once you’ve started contributing to your 401k and eliminated your debt, you can start investing into a Roth IRA. Unlike your 401k, this investment account allows you to invest after-tax money and you collect no taxes on the earnings. As of writing this, you can contribute up to $6,000/year.

You can also watch this video to learn more about the Ladder of Personal Finance.

Once you’ve contributed up to that $6,000 limit on your Roth IRA, go back to your 401k and start contributing beyond the match. You can contribute up to $18,000/year on your 401k if you’re under 50. So you should have no issue continuing to invest in your 401k.

Check out how much money you stand to earn by just investing enough to get the employer’s match:

Note: If $500/month sounds like a lot, read all the ways you can free up that money with just a few phone calls.

For financial security, it’s more important than anything else to start early. And don’t worry if you think you’re a little late to the game.

My team has worked hard on something I think will help ease you into the world of investing: The Ultimate Guide to Personal Finance.

In it, you’ll learn how to:

- Master your 401k. Take advantage of free money offered to you by your company … and get rich while doing it.

- Manage Roth IRAs. Start saving for retirement in a worthwhile long-term investment account.

- Automate your expenses. Take advantage of the wonderful magic of automation and make investing pain-free.

Want to build a business that enables you to live YOUR Rich Life? Get my FREE guide on finding your first profitable idea.

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.

Written by Ramit Sethi

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.