Best money market rates and accounts

Money market accounts are a great way to earn a little more interest. Finding the accounts with the best money market rates is important, but it’s not the sole feature you should consider. The best money market account will have two things:

- High rates. While not the most important aspect, a high APY can help boost your savings in the long term.

- Good features. A good money market account will allow you to easily access your money. That means convenient, easy-to-use web access and even things like checks and ATM cards.

These things combined allow you to save effortlessly while having easy access to your money. But with so many money market accounts out there, which do you choose?

Below are a few of my favorite money market accounts and rates for 2018.

Best money market rates & accounts of 2024

Capital One 360 money market account

I’ve always been a HUGE fan of the Capital One 360 savings account — and their money market account is no exception.

- No fees, no minimums

- 1.6% APY

- You can do everything online in an ultra-simple interface

- No annoying upsells sent via postal mail

- Links to your checking account via electronic transfer

- BEST PART: Multiple accounts (or sub-savings accounts)

Discover Bank money market account

Discover does all of its banking online and comes with an excellent and highly rated app to help with your banking needs. Not only that, but it also comes with a debit card and checks — though you’ll only be able to use them six times a month.

- 1.50% APY for balances less than $100,000 and 1.55% APY for balances more than $100,000

- $2,500 minimum balance and deposit

- $10 monthly fee

- 60,000 ATM network

- Debit card and checks

CIT Bank money market account

Aside from its crazy high APY, the CIT Bank money market account also requires a smaller minimum deposit than other banks. Adding to the draw is the lack of monthly fees as well. An all around great money market account.

- 1.85% APY

- No monthly fees

- Handy mobile app for convenient banking

- Minimum $100 to open for account

Ally Bank money market account

Ally is another online bank — and they’re a great choice for anyone looking for a solid savings account.

- .9% APY for less than $5,000 balance, 1% APY for $25,000 balance or more

- No fees, no minimums

- Can create multiple accounts

- Easy online interface

- Interest compounded daily

Like Capital One 360, Ally doesn’t technically have sub-savings accounts. However, it does allow you to create multiple accounts that effectively do the same thing.

.

.

What is a money market account?

At first glance, a money market account seems a lot like a glorified savings account — but that’s not a case.

Though they share a lot of similarities, the big difference is how easy it is to access your funds. In a savings account, you’ll typically need to wait three to five business days in order to withdraw or transfer your money.

However, money market accounts allow you to use ATM or debit cards to access your money. Often, you also receive check writing abilities.

If a checking account and savings account had a baby, that baby would be a money market account. Only a money market account will typically have a higher APY than both checkings and savings, and is also FDIC insured.

There is a trade-off: Money market accounts often require a high minimum deposit and balance in order to maintain it.

The important thing to remember…

A money market account is great for anyone who values ease of access to their money — but also doesn’t mind having to maintain a minimum balance.

Let me offer you another word of advice though: Don’t chase rates.

This is important for a few reasons. For one, interest rates are variable. That means they are always changing depending on the economy. So even the rates I outlined above might change by the time you read this.

Also, the difference between rates is minuscule. So small that they’re not even worth your time.

Consider a 1% difference on a balance of $10,000. That’s just $8.33 a month (aka a latte win).

So if you write me and say, “But Ramit, XYZ bank has 0.2364% higher interest rate. LOL! U R WRONG!” I am going to (1) mock you, (2) make you my “troll of the week” on Instagram so everyone can join in.

Instead, you should be looking at three things when searching for a good bank:

- Trust. This is one big thing Big Banks (e.g., Bank of America, Wells Fargo, Chase) lack. I know because I had a Wells Fargo account (aka Wells “Let’s open millions of fake accounts” Fargo) for YEARS because their ATMs were in my area — but I’ve since learned better. You can’t trust banks that do skeezy things like double charging you for using other ATMs or nickel-and-diming you through minimums and fees. Their offers should be clear and easy to set up.

- Convenience. Your bank needs to be convenient — otherwise you’re not going to be able to take full advantage of it. You need to be able to get money in and out and also transfer it easily. You can make sure that a bank is convenient by browsing around its website and making sure that they have a reliable customer support team.

- Features. The best high interest savings account is going to be the one with other great features like prepaid envelopes for depositing money, sub-savings accounts, and online savings goals tools.

Find a bank with those three things and you’re set for life. Once you do, it’s time for you to automate your finances to optimize your savings potential.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

Check out this video where I analyze the economy, how Gen Z feels about it, and offer three easy steps to get ahead financially.

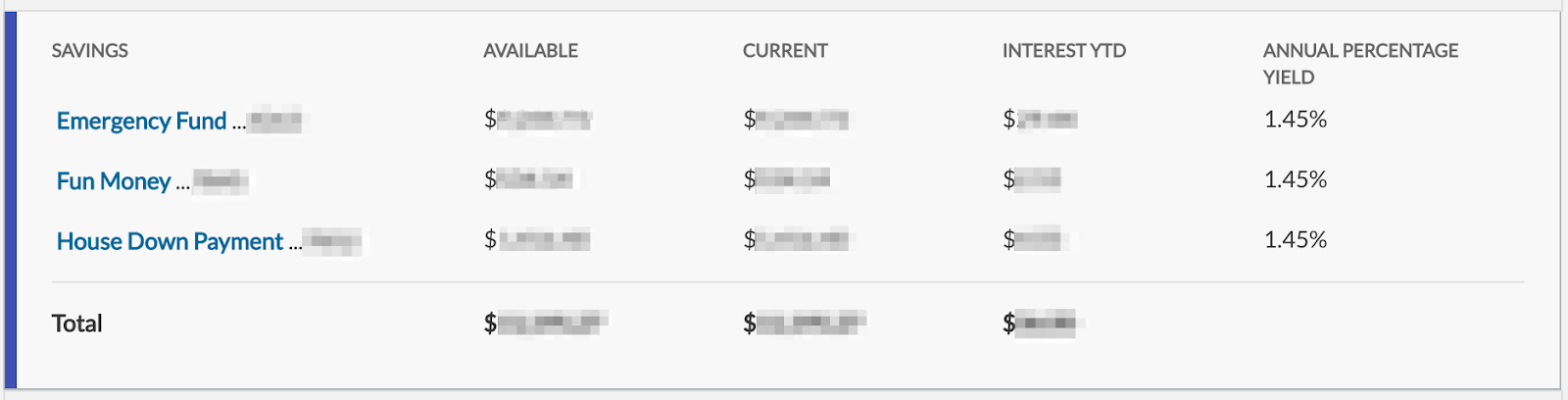

The importance of sub-savings accounts

A few of the accounts above offer sub-savings accounts, or at least the ability to create multiple accounts — and this is crucial if you want to be able to save for anything.

Here’s a screenshot of my old sub-savings accounts:

Using my automated personal finance system, I use monthly automatic transfers to funnel money into each of my sub-accounts. Now that these transfers are in place, I’m getting closer to each of my goals automatically, month after month, without having to remember to set money aside.

This is how people get rich “passively.” You don’t see the money when it’s automatically withdrawn from your checking account and shunted to specific savings goals — you will never miss it. However, a few months later, you’ll be amazed at how fast you’re accomplishing your goals.

By the way, it’s possible to simulate sub-savings accounts with any savings account (for example, by manually creating your own “sub accounts” in Excel).

But I like Capital One 360 and Ally because they just do it for me. Why give yourself another financial chore to think about? Don’t take more than five minutes deciding. Just pick one and move on.

I cover the use of sub-savings accounts in more detail in my blog post “Sub-savings accounts: How to save for anything in 3 steps.” It’s an incredibly powerful way to make your savings more streamlined and purposeful.

Automate your money market account

I. Talk. About. This. A. LOT. But that’s only because it’s the best way to invest, save, and earn money. This system allows you to automatically send your money where it needs to go as soon as you receive your paycheck.

And it’s simple: Each month, your paycheck is automatically divvied up and sent exactly where it needs to go (pay bills, pay rent, invest, save, etc.) without you needing to touch it. This allows you to save for any goals passively, making it easier to save than ever.

Some spending recommendations for your system:

- 50%-60% fixed costs: This includes things like utilities, rent, internet, and debt.

- 10% investments: This includes your Roth IRA and 401k plan.

- 5%-10% savings: This is money that goes towards things like vacations, weddings, home down payments, and unexpected expenses.

- 20-35% guilt-free spending: Fun money! Spend this on anything you want from nice dinners to movies.

To find out more on how to automate your finances, check out my 12-minute video explaining it here:

If you liked this post, you’d LOVE my Ultimate Guide to Personal Finance

It’s one of the best things I’ve published, and totally free – just tell me where to send it:

Written by Ramit Sethi

Host of Netflix's "How to Get Rich", NYT Bestselling Author & host of the hit I Will Teach You To Be Rich Podcast. For over 20 years, Ramit has been sharing proven strategies to help people like you take control of their money and live a Rich Life.