How To Make Money Fast: 22 Quick and Proven Ways To Earn

Making money fast has nothing to do with pitting all your hopes and dreams on your local casino’s roulette wheel. Instead, it’s about the money-making skills and tools you can parlay into extra income.

In fact, that’s what I teach in my bestselling course, Earnable. I cover everything from the exact strategies, frameworks, hands-on tactics, and mindsets that helped me succeed to real-world examples, done-for-you templates, word-for-word scripts, and hard-won breakthroughs that will help students start and grow their businesses.

If you’re not ready to earn big money yet, then these 22 fast and proven ways to earn can also help you out. And because our ideas of ‘fast’ might differ, this list ranges from tips that can make you cash in as little as an hour to projects that might take about 3 to 6 months. Let’s begin!

22 Ways To Make Money Fast

Whether you're looking to start up a side hustle or using your skills to improve your income, it's important to remember that there is no ceiling on your ability to earn.

1. Sell all the junk in your garage

Don’t throw away things you no longer need—monetize them.. A word of caution, though: this isn’t a sustainable way to make more money. Why? Unless you’re selling those goods for more than you paid for them, you’re losing money on them.

2. Sell other people’s junk

If you have a knack for finding goods at a steal and selling them at a tidy profit, this may just be a great business idea for you. The best part is it takes very little time to set up and you don’t even need a shopfront to do this—only an internet connection!

3. Start an online store

Building on the previous suggestion, an online store is a fairly simple and inexpensive business to set up. You can decide which items to sell, whether you’re selling your own products or whether you’re an agent for someone else. It might take a while to get established, but if you have the right product for the right market and you have a solid marketing plan, it might just happen faster than you think.

4. Ridesharing

If you have a few hours free every day and have a car that meets the Uber or Lyft criteria, the income you make here can be a nice addition to your take-home pay.

5. Open an Etsy store

If you have a knack for graphic design, illustration, or just all-around crafts, an Etsy store can get customers in the door. Just remember to tag your products correctly, provide awesome service, and market the heck out of your store.

One of my students was able to make over $25,000 dollars by selling his art on Etsy. That could be you!

6. Earn from your photography skills

Photos can make you a lot of money. For instance, stock photos can range from around $4 to hundreds of dollars depending on the license of the photo, its quality, and the subject matter. Just be sure to have waivers in place for models and copyrighted items. Shutterstock, Creative Market, and Flickr offer neat packages and plenty of exposure to potential customers.

7. Become a personal shopper or delivery person

Heading to the mall anyway? Why not sign up with Instacart and Shipt to become a personal shopper? The best part is you can cash out your earnings immediately when you get paid. If the shopping part isn’t for you, how about becoming a delivery person? It’s quick cash and you work on your time.

8. Tutor online or in-person

Tutoring is a great way to use your skills to your financial advantage. You determine the number of lessons you’ll give and those who have pretty neat credentials can charge a worthwhile fee. You also choose whether you’re going to do it in-person or online.

9. Use your existing skills to grow your new business

Marketing whiz at some fancy firm? An accountant by day, financial guru at night? Your existing skills can pave the way for a lucrative side hustle. Other professions that can easily convert to a small business or freelancing career include graphic designers, web developers, copywriters, and personal trainers.

10. Become a transcriber

If you need something that is simple to get started in and doesn’t require a ton of training, transcribing offers fast and good money. While it may not be enough to buy you a Hamptons home, it’ll definitely build on your emergency savings or vacation fund.

11. Expand your current business operations

Small business owners know the value of cross-selling. Customers buying a pair of brogues? Entice them to pair it with an imported leather belt and cardigan to complete the outfit.

But it goes deeper than this. If you’re a shoe store owner, look to sell shoe care items, too. If you do web development for a living, expand that to SEO and digital advertising to generate more income. And if you have the gift of words, you might just be able to throw content writing in the mix, too.

12. Online courses

While selling online courses isn’t exactly quick, if you happen to have a decent following on a blog or YouTube channel, you have the opportunity to let your followers in on your money-making secret.

Other platforms worth exploring include Udemy and Skillshare. While you’re up against other course creators, a solid course and a great marketing plan will allow you to stand out from the rest and open up more earning opportunities in the future.

13. Become a freelance copywriter

Writing is a learnable skill, if you’re willing. There are plenty of courses that will take you through the motions. Once you get started, earnings can start trickling in after just a few weeks.

Freelance writers come in all shapes and sizes and while there is good money in copywriting, you may also want to check out content writing, technical writing, academic writing, and ghostwriting. If you’re interested in copywriting, you can read more about my copywriting strategies in my blog on how to become a copywriter.

14. Unleash your inner java beast

A barista course is one of the quickest training programs and can have you earning in just a week or two. This is a great step for college students who need a part-time job.

Take this a step further and learn unique brewing methods, how to roast your own beans, and start an online business selling coffee paraphernalia. Coffee is a terrific business if you know where to start.

15. Host pop-up kitchens

People are intrigued by the mystery of exclusive pop-up kitchens and want to be part of something unique. If you have organizational skill, marketing flair, and a stellar culinary touch, this might just be your new moneymaker.

A pop-up kitchen is a concept that allows you, the cook, to set up a dining situation in random places. For instance, the roof of a New York apartment building, a local park, or even an old, abandoned mansion. You will need to get the necessary permits and permissions, of course, but if you have what it takes, it’s worth it.

Once these are in place, you send out the invite to a limited guest list and wait for them to secure their reservations.

The best part is you decide the theme of the atmosphere. You can start small and simple, and as your kitchen gains popularity, you can add some more glamor and pizzazz to the event.

16. Become a landlord

If you happen to have a property with decent square footage, you may want to lease your space. Whether it’s a room, a cottage, or a piece of land, make your property work for you.

The world wants you to be vanilla...

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

17. Set up a blog

While there are those who might argue that a blog isn’t fast money, there is no reason you can’t start earning on it immediately. Whether you market printables or products, if you manage to gain foot traffic to your site, it can be a tremendous moneymaker. Do guest posts, or add AdSense or InfoLinks and you’re set.

You can also dedicate your blog to earn from sites such as Amazon through their Amazon Associates program. Once you start gaining regular visitors, making money with affiliate marketing can be a steady source of income and provide your financial freedom.

18. Lead generation

If you have a vast network that is easy to tap into, consider lead generation. Companies are willing to pay good money to get a hand on solid, qualified leads.

For example, you have a news site that runs quizzes now and then. You include a radio button that indicates whether your reader wants to be contacted regarding the topic of the quiz. For instance, “How often do you wash your carpets?” could get your reader into contact with carpet cleaning companies. Those are qualified leads. What’s important is that the reader wants to be contacted and has a preference for the method.

19. Refinance your debt

This is something that you need to approach with caution. When refinancing debt to save money, it can only be for the following reasons:

- Reducing the term (which means increasing your installment) to save on future interest

- Reducing the interest rate

- Reducing the installment because you’ve paid a lump sum into your mortgage

Reducing your installment by extending your term is a BIG NO-GO as you may run the risk of paying more in interest over the total term of the loan.

For instance, on a loan amount of $240,000 at an APR of 3.8%, you’ll pay roughly $1,492.18 per month, excluding property taxes and insurance on a term of 20 years. The total interest paid over the term is $103,004.36.

That same loan at the same rate over a period of 30 years might lower your installment to $1,118.30 before taxes and insurance, but your total interest paid over the term is $162,587.15.

20. Ask your employer for extra work

Find out whether you can pick up extra shifts or work overtime. You can also offer to take on additional roles at a predetermined rate, such as managing their social media accounts.

21. Tap into hidden income

We all have several bills that come through every month that we pay religiously. As for me, my finances are automated so I don’t have to pay attention to it at all. I just check my statement now and then to make sure the amounts are correct.

But when I want to make money fast, this is the first place I look. I take time to dissect each payment to make sure I’m getting the best value for money:

- Cable

- Subscription services

- Insurance

- Gym membership

- Gift cards

You’re going to call them up, tell them what a great customer you are, and ask them to give you a better rate. That’s it! Sure, they might say it can’t be done, but then you’re going to follow that up with, “Your competitor is offering me a better deal, but I’d like to keep my business with you. Is there someone else I can speak to?”.

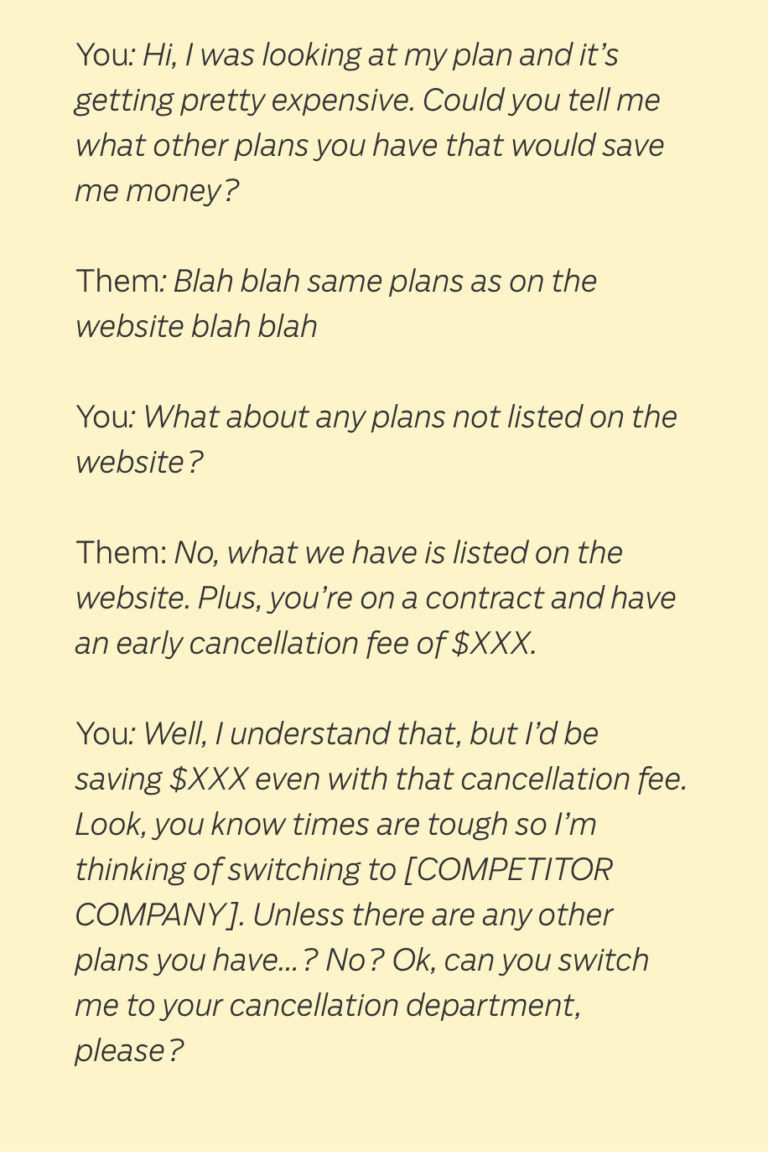

Believe me, it’s far cheaper to retain an existing customer than to sign up a new one. Here’s an example conversation script you can use:

22. Negotiate your salary

With the right preparation, you’d be in a position to negotiate your salary with ease. But that means knowing how to build up to the event. Remember, top performers negotiate regularly.

You’re not just requesting this increase for now. It’s going to affect your future increases and bonuses, too, as these will be based on your new income.

In my experience, it takes around three months to ask for that raise. This is how you do it:

- 3 Months before: You start gathering your portfolio: your contribution to a team effort, ways you improved your role, value you added to the company. You also want to ask your boss for ways to excel in your position.

- 2 Months before: Initiate those changes and ask your boss whether your efforts are in line with the expectations, and how you can improve on those even further. You also want to gently introduce the Briefcase Technique. This is where you pull out your five-page proposal on areas in the company where you can make a difference.

- 1 Month before: Open the conversation of compensation, and that you would like to meet in a month. Ask your boss what they would like you to bring to the meeting that would add value to your request.

- On the day: All your research and preparation culminate in this meeting. Be sure to address the points your boss raised before and make your desired compensation known.

I’ve put together a quick video to break down the basics of salary negotiation:

Ask Ramit: How can I negotiate salary when they tell me they can’t pay more?

How to create extra time to pursue those additional income streams

Fast money is not always easy and you may have to sacrifice some free time (at least for a little while) to increase your earnings. Some tips to get you started:

- Don’t be afraid of the 5-minute work blocks: Whether you’re a parent constantly on the run or a busy exec who simply can’t clear out their inbox, those five-minute lulls between tasks can be pretty helpful. Successful people know that working in the fringe hours of the day is sometimes all you have. While others are idly scrolling on their phones, you’re building your Best Life.

- Schedule a time to work on your additional income stream: If it’s important to you, you’ll make space in your calendar for it. As simple as that.

- Pay for some services that take up too much time: You’re going to want to save on as many services as you possibly can during your startup phase but some are just worth handing it over to the experts. For instance, designing your branding, building your website, or someone to take care of your shop fitting.

FAQs About How To Make Money Fast

How can I make $500 fast?

Making $500 quickly can be done in multiple ways, but selling unwanted goods is likely the easiest way. Selling unwanted items that are just collecting dust around your house may be more profitable than you think.

How can I get immediate money?

There are several options for getting money immediately, depending on your situation. Selling unwanted goods is one way to put money in your pocket immediately; selling items such as unused gift cards or used electronics may be just what you need to put some cash in your wallet today.

What’s the fastest way to make money?

The fastest way to make money is through gig economy jobs like rideshare driving or food delivery, which offer immediate payouts. Quick freelancing tasks in your area of expertise on platforms like Upwork or Fiverr can also provide speedy earnings.

How can I make money right now?

To make money right now, consider selling items you no longer need on platforms like eBay or Facebook Marketplace, completing online surveys through sites like Survey Junkie, or taking on quick freelance gigs. These can provide earnings almost instantly.

How can I make money fast at home?

Making money fast at home is possible through online tutoring, freelance writing, graphic design, or virtual assistant work. Additionally, selling handmade goods or dropshipping products online can yield profits without leaving your house.

What is the easiest way to make money fast?

The easiest way to make money fast might be through participating in paid online surveys, cash-back shopping apps like Rakuten, or selling decluttered items online. These methods require minimal effort and can offer quick financial benefits.

If you liked this post, you’d LOVE my Ultimate Guide to Finding Your First Profitable Idea

It’s one of the best things I've published, and totally free – just tell me where to send it: