All About Stocks and Bonds: What You Need to Know

Investing is the single most crucial thing you can do to ensure your financial future — and the sooner you start, the easier it is to get rich. There is more than 100 years of evidence in the stock market that suggests this.

Stocks and bonds are a great place to start, so we’re going to dig into that in this post. But first, let’s talk about the typical perceptions of investing.

People still don’t understand what investing is exactly. Folks seem to think there is some magical way to make a fortune with stocks and bonds. From what I’ve seen, the two things people get most wrong about investing are thinking:

- It’s a 24-hour Wolf-of-Wall-Street—style party where traders make millions of dollars daily while screaming “SELL! SELL!!” into a phone.

- Investments are incredibly risky because all the pundits scream “financial crisis!” at even the slightest dips in the markets.

And, frankly, you have every reason to believe this.

Thanks to Hollywood and the (annoying) talking heads on cable news, we’ve come to think of investment as a maniacal creature that’s not suited for the average person... and many of us just don’t understand exactly how investing works.

That’s why we want to dispel some of those myths and notions surrounding investing by focusing on some of the most common topics you’ll hear when it comes to investments:

How do stocks and bonds work? How can you balance them in your portfolio? What’s the difference between stocks and bonds?

This article isn’t going to be about which stocks are hot right now or what sort of investment strategy is going to make you into a zillionaire today. If you’re looking for something like that, I suggest you go back to watching the pundits on cable news.

SPOILER ALERT: Cramer has done much worse than the S&P 500 since 2008.

Instead, stick around for a no-BS lesson all about stocks and bonds, what they are and what part they can play in your investment future.

How do stocks work?

When you own a company’s stock, you own part of that company. Stocks are also called equity for that reason — you own a tiny piece of the company.

Stock basics

If the company does well, your stock will do well. So, ideally, you want to invest in strong-performing companies.

You can buy and sell whenever you want through your broker or self-serve sites like E*Trade or TD Ameritrade.

Inevitably, whenever I’m teaching someone about the basics of stocks, someone will pipe up with a myriad of questions like these:

- “What stocks should I buy?”

- “Is X company a good investment?”

- “Is $XX too much for this stock?”

First thing’s first: SLOW DOWN.

Before you make an investment in any sort of stock, you’re going to want to stop and ensure you understand how to go about deciding what stocks to buy. Understanding stocks is the first step before you start piling your money on whatever looks good on the day.

Choosing the right stock

The simplest way to narrow down the universe of stock options is to think of companies you like and use.

Take some time right now to write down 15 companies you use and return to time after time.

Think of everything. For example:

- Food: Whole Foods, Conagra, Shake Shack

- Clothing: Under Armour, Limited Brands, Etsy

- Services: IBM, UPS

- Technology: Apple, Microsoft, Snap

- Entertainment: Disney, Live Nation, Netflix

- Transportation: Tesla, Ford, CSX Corporation

Instead of 5,000 stock options to choose from, you now have 15 companies you could possibly invest in.

Remember: A good company isn’t necessarily a good stock!

For any stock, you’re going to need a deeper analysis than “I think khakis from Gap are awesome, so I’ll buy stock from them!”

Instead, you’re going to want to look at 5 different areas:

- Trends: Are sales increasing from this time last year? 2 years ago? 5 years ago?

- Products: Is the future bright in terms of upcoming product development? What news have you heard about their future products?

- Revenues/profits/growth/earnings per share: The real financial nuts and bolts of a stock. These are intimidating at first. Luckily, many sites will guide you through it.

- Insider trading: Are senior executives at the company buying more stocks (indicating they have confidence in the company) or selling?

- Management: Is management good? What is the turnover? What is their philosophy and ability to execute?

You can get all of this information online for free — and you’d be wise to do as much research as you possibly can. If you see a reason to doubt a company based on any of the areas above, avoid that stock.

Stock research resources

Here are some great websites to help you start out:

- Investopedia: The be-all-end-all investment resource for beginners

- Yahoo Finance: Lets you view the standard details about any stock

- The Motley Fool: Great for first-time investors

At first, all of the charts, earnings, and balance sheets will be incredibly confusing — but the more you look into them the more you’ll start to get a good sense of what’s going on. It just takes practice.

Advantages of investing in stocks

- You can really make some money if your stock is good. If your stock is excellent, you can really beat the market. You can pick the stock in an industry you understand.

- Your money is liquid, which means you can access it at any time by selling your stock.

Disadvantages of investing in stocks

- Unfortunately, if a company does poorly, so does your stock. Because a stock isn’t diversified, that can mean disaster for you (although you can easily reduce your risk by picking bigger, solid companies).

- There’s no guarantee on your investment, unlike with bonds. You could make no money or even lose money in the market.

What are bonds?

Bonds are like IOUs that you get from banks. You are lending them money in exchange for a fixed amount of interest.

Bond basics

If you buy a 1-year bond, the bank says, “Hey, if you lend me $100, we’ll give you $102 back in a year.”

The approximate current rate of return for a 2-year bond is about 2%. (Check here for the up-to-the-second number.) Overall, bonds are:

- Extremely stable

- Guaranteed to have a return

- Smaller in their returns

With these qualities, what kind of person would invest in bonds?

Well, anyone who wants to know exactly how much they’re getting next month should invest in bonds. It doesn’t matter if you’re in your twenties or if you’re in your seventies. If you want a stable investment — despite the lower returns — then bonds are for you.

After all, some people just don’t want the kind of volatility the stock market offers. And that’s fine.

Advantages of bonds

- You know exactly how much you’ll get when you invest in a bond.

- You can choose the amount you want a bond for (1 year, 2 years, 5 years, etc).

- Longer time periods can yield you higher return rates.

- Bonds are extremely stable, especially government bonds. The only way you’d lose money on a government bond is if the government defaulted on its loans — and it doesn’t do that. It just prints more money.

Disadvantages of bonds

- Because they’re so stable, the reward on an excellent bond is dramatically less than an excellent stock.

- Investing in a bond also renders your money illiquid, meaning it’s locked away and inaccessible for a period of time unless you’re willing to incur a big penalty to take it out early.

- Unlike stocks, bonds are hard to buy and sell as an individual.

What’s the difference between stocks and bonds?

Now we’ve covered the basics of what stocks and bonds are, let’s take a closer look at the main differences between them.

The main ways stocks and bonds differ are in three ways:

- Type of return

- Return guarantee

- Benefits

Type of return

The first way that stocks and bonds differ is in how the owner gets a return on their investment. With stocks, because you own a piece of a company, you can receive dividends. These are company profits handed out to shareholders.

With bonds, you receive a return through interest gained, because what you’ve bought is basically a debt.

Another way to make money with either stocks or bonds is to sell them for a higher price than you bought them, but this depends on a lot of different factors.

Return guarantee

The one thing that pretty much everyone knows about the stock market is that it’s risky. There are zero guarantees that you will make your money back, never mind more on top of that. That’s the main thing that puts people off from investing in the stock market.

Those who are especially risk-averse might have a happier time with bonds though. As bonds are debt investments, the company or government you buy the bond from has to pay you back. There’s no way around it, so this is good news for you.

You get a guaranteed return on your investment in the form of interest. The downside is that the returns are usually much lower than stocks.

Benefits

The third way stocks and bonds differ is with benefits. The good thing about stocks is that you’re a shareholder, which means you could have voting rights within that company.

This does depend on the shareholder setup, however. So, don’t expect to waltz through the doors at Apple HQ and make big changes because you bought one share.

With bonds, on the other hand, the main benefit you can get is preferential treatment when that bond matures.

The world wants you to be vanilla...

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

What is equity vs. debt?

The two types of investment you need to know about are the equity and debt markets. These refer to two different ways investments are bought and sold. In the debt market aka the bond market, investments in loans are bought and sold. In the equity market or stock market, it’s equity in a company that’s bought and sold. Generally, the equity market is deemed a higher risk than the debt market.

How does the bond market work?

The bond market or debt market works by a company taking a loan out. Instead of heading over to the bank, they’ll get that funding from investors who buy bonds.

The company then pays an “interest coupon” which is the annual interest rate paid on a bond.

Bonds fall into either short-term, medium-term, and long-term. Short-term bonds “mature” or are paid off essentially within one to three years. Medium-term bonds last around ten years and long-term bonds mature over much longer periods of time.

Do you earn capital gains on bonds?

Capital gains are what you earn after you sell an asset for more than you bought it for. For example, if you purchase a house and it shoots up in value by the time you sell it, you just made a capital gain. In the stock market, if you sell a stock for a higher price than you bought it, congratulations, you just made a capital gain.

But what about bonds?

Bonds are a little trickier because they’re typically a bit harder to sell than stocks. With bonds, your source of income is related to interest rather than equity income.

Bonds are often not held until they hit maturity and are sold before then. If you do this, you might earn a capital gain (or loss) depending on what has happened to the company that sold you the bond. If you manage to sell your bond for higher than you bought it, this is a capital gain.

How does the stock market work?

The stock market or equity market is a market where the share of ownership in a company is bought and sold.

There are two main ways to make money from stocks—dividends and selling.

Owners of stocks can profit from dividends, a percentage of company profits that shareholders receive. It might be a bit weird to think of yourself as a shareholder... but that’s exactly what you are if you own a stock.

Depending on a myriad of factors, whoever owns stock can also profit when they sell it. But this only works if the market price has increased since you bought it.

The stock market is a bit more volatile than bonds. Stocks can shoot up in value or plummet for a whole range of reasons. Stocks can be affected by social changes, politics, economic events, or even the CEO tweeting (eye roll emoji).

This makes them a riskier investment, but that’s why you need to educate yourself on them. And if you’re still here congratulations!

How should you balance stocks and bonds in your portfolio?

So now we’ve covered the basics of stocks and bonds, the question is: What do you invest in? You can do either stocks or bonds but a mix of the two is a popular choice. It spreads your risk and diversifies your portfolio—something you should always aim for.

But which should you invest more in? The safer, guaranteed but low returns of bonds or the higher risk, higher reward stocks?

Well, there’s no clear-cut answer here. It all depends on…

- Your attitude to risk

- How close to retirement you are

Investment portfolios all fall somewhere on a scale of super aggressive to conservative.

A super aggressive investment strategy would be to put 100% of your money into stocks. A conservative portfolio would have no more than 50% in stocks.

For moderate growth, you’ll want to look at more of a 60/40 split of stocks and bonds.

How does that relate to retirement?

If your portfolio is a key part of your retirement strategy, then the amount of risk you should take depends on how close you are to retirement. In other words, if you’re nearing retirement, you don’t want to dump all your money on high-risk stocks. You’ll want to rebalance your portfolio to be a bit safer and predictable. In this case, you’d probably opt for the more conservative split.

Those who are younger have a bit more flexibility because generally, the more time in the market, the more time your portfolio has to recover if it takes a dip.

How do you start investing in stocks or bonds?

So now you’re all filled in on what stocks and bonds are, how do you start investing in them? As the taste for investing grows, so do the options available to us. Now it’s easier and more accessible than ever. Here are a few popular options to get started:

Use an online brokerage

Possibly the most popular method of investing is to use an online brokerage. This works much in the same way as a traditional in-person broker does but the fees are lower and you can do it all through your smartphone.

Online brokerages let you buy all types of investments including individual stocks, funds, and bonds through a website or app.

Mutual funds

Another popular way to invest is to use a mutual fund instead of investing in individual stocks. Mutual funds are made up of several different companies so the risk of investment is spread rather than targeted and risky.

Unlike many online brokerages, mutual funds typically have a dedicated fund manager who picks the best investments for you. This means they come with much higher fees as a result.

Index funds

Index funds are made up of a group of companies so the risk is spread. The main difference between index and mutual funds is that index funds are passively managed.

This means they’re the cheaper option and they’re also the less volatile option. Rather than trying to beat the market, index funds watch it and make sensible investments.

Robo-advisors

It might sound a bit sci-fi, but it’s pretty simple. A robo-advisor is a digital platform that invests your money through automation and algorithms. There’s little or no human contact involved (great for introverts) so it’s a very hands-off type of investing.

Investment managers

Finally, if you have the cash to splash and want to make some serious investments, hiring a dedicated investment manager is another option. This is the most expensive option as you’ll be getting advice and tailored service. So it’s not ideal for those who want to save money on fees.

IWT's investment philosophy

When it comes to what you want to invest in, stocks and bonds are both solid investments — as long as you do your research.

What I think EVERYBODY should be doing when it comes to their investments is simple: low-cost, diversified index funds.

Let’s look at a real-world example.

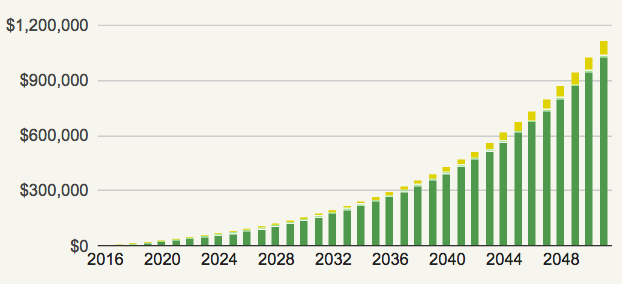

Say you’re 25 years old and you decide to invest $500/month in a low-cost, diversified index fund. If you do that until you’re 60, how much money do you think you’d have?

Take a look:

[insert graph from original article]

$1,116,612.89.

That’s right. You’d be a millionaire after only investing a few thousand dollars per year.

Smart investments are about consistency more than chasing hot stocks or anything else:

The two essential ways to invest your money are straightforward:

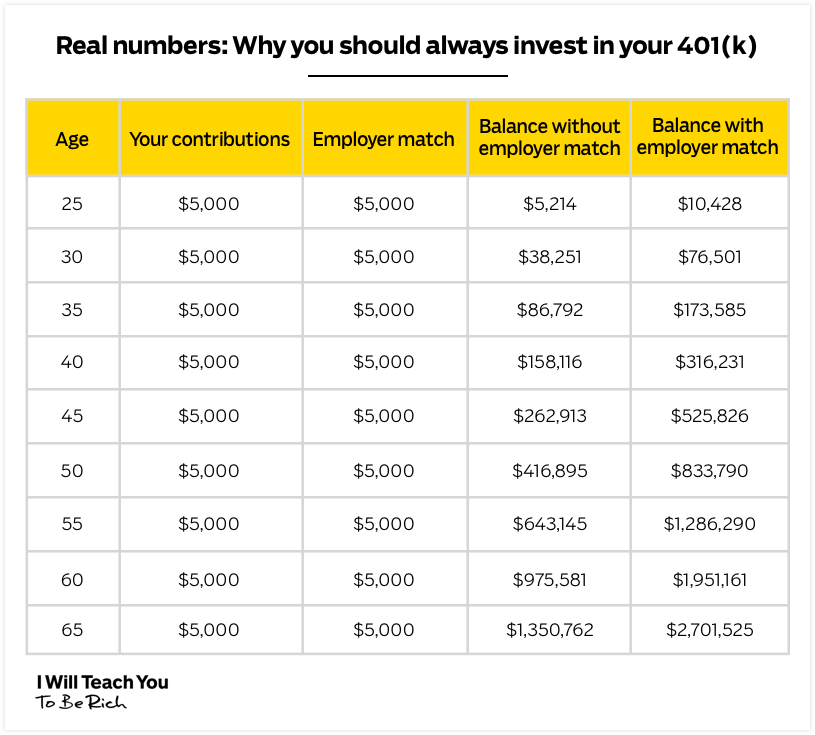

- 401k: Take advantage of your employer’s 401k plan by putting at least enough money to collect the employer match into it. This basically means that for every dollar you contribute, your company will match that (pre-tax!). This ensures you’re taking full advantage of what is essentially free money from your employer. That match is POWERFUL and can double your money over the course of your working life:

- Roth IRA: Like your 401k, you’re going to want to max it out as much as possible. The amount you are allowed to contribute goes up occasionally. Currently, you can contribute up to $6,000 each year.

Note: If $500/month sounds like a lot, read all the ways you can free up that money with just a few phone calls.

If you are just starting out, it’s so awesome that you’re here.

For financial security, it’s more important than anything else to start early. And don’t worry if you think you’re a little late to the game. After all, the best time to plant a tree was 20 years ago…the second-best time is NOW.

Man, I’m starting to sound like a fortune cookie.

Get started on your personal finance journey

If you’re looking into investment, congratulations! You’re making an important step in securing your financial future. Investment isn’t the only thing to think about though. Nor are stocks and bonds.

For a full-picture approach to personal finance, be sure to check out The Ultimate Guide to Personal Finance.

In it, you’ll learn not only how to understand stocks and bonds, but also how to:

- Master your 401k: Take advantage of free money offered to you by your company…and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Automate your expenses: Take advantage of the wonderful magic of automation and make investing pain-free.

If you liked this post, you’d LOVE our Ultimate Guide to Personal Finance

It’s one of the best things I’ve published (and 100% free), just tell me where to send it: