Hourly to annual salary calculator (find your yearly vs. per hour income)

For those looking for an hourly to annual salary calculator, we're going to show you how to convert hourly to annual salary. But before we get there, let's talk about why you'd want to do that in the first place.

I think everyone can agree: Getting paid for your hard work is AWESOME.

But it doesn't matter if you're an entrepreneur or if you're working for someone else, you're probably going to be asking yourself a LOT of questions:

- How much am I being paid per hour?

- How do I calculate my pay from hourly to salary?

- How long will it take me to make X% more?

- How much should I expect for payment?

That's why I wanted to share with you two cool back-of-the-napkin tricks that I use to help me answer some of these questions quickly so I'm not wasting a bunch of time.

You can even do these tricks at parties and impress everyone with your awesome personal finance tricks!*

*Results from this claim may vary.

Cool financial trick #1: Find out your yearly salary using your hourly rate

Your hourly to annual salary calculator: doing the math yourself

This one’s simple: just take your hourly rate, double it, and add a thousand to the end. That’s how you convert hourly to annual salary.

If you make $20/hour, you make $40,000/year. ($20 x 2 = 40. Add 000 to the end for $40,000.)

If you make $25/hour, you make approximately $50,000/year.

Working backwards, $60,000 a year is $30 an hour ($60,000/1,000 = $60. 60/2 = $30!)

This can also work in the reverse if you want to find out your hourly rate. Simply divide by two and drop the thousand.

So $50,000/year becomes approximately $25/hour.

Of course, this is based on the typical 40-hour workweek and doesn’t include taxes.

Why this trick is great

For two reasons:

One, sometimes you have an hourly job and need to compare it to a salaried one (or vice versa) while applying to possible jobs. That’s the most common case for an hourly to annual salary calculator.

Two: When you’re a beginner freelancer and you really don’t know how much to charge, this can help. Use Google or Glassdoor to find out the salary a full-time person would earn – then convert it to hourly to figure out what you should charge. Once you’re established, you should charge way more because you’re worth it.

I often get questions like:

- “How much should I charge?”

- “Is $XX/hour too much or too little?”

- “Should I be charging by the hour or by the project?”

By looking at your ideal (read: realistic) salary, you’ll be able to figure out how much you should be charging per hour quickly and easily.

If you’re still wondering how much you should be charging, here are two other great methods I’ve used to find a rate that’s good for me.

That’s right. You get three tricks for the price of one. Consider yourself LUCKY.

- Double your “resentment number”. I love this one because it’s both really interesting and effective. Ask yourself: What’s the lowest rate you’ll work for that’ll leave you resentful of your work? Say you’ll work for $15/hour at the VERY LEAST but hate the job. Just double that number so now you’ll earn $30/hour.

- Do what the next guy does. This method is incredibly simple: Go to Google and search for the average hourly rate for whatever service you’re providing. You’ll get a good sense of where to start when you’re charging your clients.

And after you earn your first $1,000, it’s incredibly easy to start dialing your prices up and tuning your rate.

Were you making $30/hour? Start charging $40 or even $50. There’s no hard and set rule for how much you should be charging.

Cool financial trick #2: Use the rule of 72 to see how long it’ll take to double your money

The formula

What is the rule of 72? Simply take 72 and divide it by your return rate percentage. The result is the number of years it takes to double your money. That’s the rule of 72.

When you put it together, it looks like this:

72 / [return rate you’re getting] = # of years to double your money.

Imagine you’re getting a 10% interest rate from an index fund.

Divide 72 by 10, and you have approximately 7 years to double your money.

So if you invested $5000 today, and earned a 10% return, you’d have $10,000 in 7 years.

Of course, it doubles from there too. In other words, as long as the return rate is constant, the money will double every 7 years.

Why this trick is great

With the rule of 72, you can see how easy it is to DOUBLE your investment by investing just a little bit of money.

To give you an example of how much money you can earn this way, I'll tell you about when I put away $1000 in an index fund as a gift to my friend's new baby.

Yes, I know. I'm such a sentimentalist.

Assuming the index fund earns 10% annualized during the kid's life, guess how much it would be worth?

Age 1: $1,000

Age 7: $2,000

Age 14: $4,000

Age 21: $8,000 (This is where I come in and tell her not to spend it all on her spring break trip to Cabo.)

Age 28: $16,000

Age 35: $32,000

Age 42: $64,000

Age 49: $128,000

Age 56: $256,000

Age 63: $512,000

Basically, you can see that Uncle Ramit's $1,000 gift would leave the kid rolling in money 60 years later.

As singer-songwriter and greatest-poet-of-this-generation-and-the-next Celine Dion once said, 'My heart will go on.'

And it grows from there. Note how much the money grows towards the end.

Yes, this is a simplistic model that assumes a 10% return rate. And yes, it leaves out inflation/taxes.

BUT it shows that even a small investment of $1,000 can grow with time, even though you don't add a penny to it.

The critical factors are time, minimizing fees/taxes, and picking sensible, long-term investments.

So the question is now: What are you going to do about this? Are you going to keep your money sitting in a bank account where it's NOT making appreciable returns, or are you going to start investing that money?

The sooner you start, the easier it is to get rich.

This isn't BS either. There are over 100 years of evidence in the stock market that suggests this.

Still don't believe me? Let's look at another real-world example.

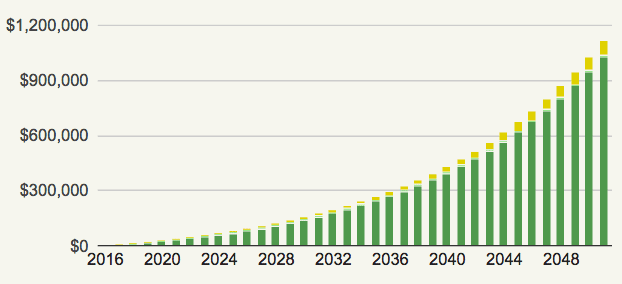

Say you're 25 years old and you decide to invest $500/month in a low-cost, diversified index fund. If you do that until you're 60, how much money do you think you'd have?

Take a look:

$1,116,612.89.

That’s right. You’d be a millionaire after only investing a few thousand dollars per year.

Notice, I’m not talking about the Hollywood type of investing where hot-shot stockbrokers make huge multi-million dollar trades while yelling “SELL” into a phone for some reason.

I said you should invest in low-cost, diversified index funds over time. That’s because smart investments are about consistency more than anything else — not chasing hot stocks. Or other weird investments.

By using these two tricks, you’ll be able to really get started on your journey to live a Rich Life. Use the hourly to salary trick to figure out how much to charge so you can invest in an index fund. Then use the rule of 72 to figure out when that index fund sets you up for retirement.

Now you no longer need an hourly to annual salary calculator and you’re set up to make more money than you imagined possible. Not bad for a blog post.