How to Lower Your Credit Card Interest Rate (Scripts Included)

- What are credit card interest rates?

- The exact script to lower your credit card interest rates

- Why it doesn’t matter if your credit card interest rate is 20% or 80%

- Frequently Asked Questions

- Bonus: Get my best credit card tips

Credit cards can be an absolute nightmare. Practically, everyone has a story about falling into debt, paying late fees, or dealing with unauthorized charges.

That’s why it’s so important you optimize your credit cards to make them work for you instead of the other way around.

And while there are many different systems you can put in place to achieve this, I want to talk to you about one element of your credit card that can potentially save you hundreds a year: credit card interest rates.

Why is your credit card interest rate so important? Check out this email I got from a reader named Aaron a while back:

I was fortunate enough to come out of school with no student loans, but do have $4,364.11 in credit card debt over 2 cards. One is $999.03 and the other is $3,365.08. I just started reading your book yesterday, today I called the card with the higher balance to lower my APR from 19.99%. I have had this card for almost 4 years. My Mom had been paying the minimum for a year or so, but since I became full time I took over any other bills my parents were paying. I have paid $200 the last 3 months and my minimum payment is around $89.

Anyways, I just called and asked, (I had to do no negotiating really, I just followed the script you have in your book) and I got my APR lowered from 19.99% to 14.24%, effective immediately.

Basically, the $13.95 my girlfriend paid for your book will more than pay for itself by the time I get my next bill.

AWESOME!!

By lowering his credit card’s interest rate down just a few percentage points, he’s able to pay down his credit card balance much faster. Now THAT’S a Big Win.

Today, I want to give you a breakdown of your credit interest rate and the exact script you can use to lower your interest rate today.

What are credit card interest rates?

A credit card basically gives you a short loan for the month. If you pay it off completely during that monthly period, you don’t pay for the loan — it’s an interest-free loan.

Pretty useful, right? Well, if you don’t pay off the loan in its entirety — let’s say you spend $1,000 on your credit card but can only pay off $500 that month — then you have a balance on your card of $500.

Your credit card balance then has an interest charge. The size of that interest depends on what’s called the Annual Percentage Rate (APR). Don’t be fooled by that name either. Your credit card company uses your APR to find out how much to charge you on your statement each month.

So in the example above, you’d be charged $8.33 that month based off a 20% APR.

($500 balance x 20% interest) / (12 months) = $8.33

Your APR will vary depending on a number of factors such as what kind of card you have and how long you’ve been building credit. According to a Federal Reserve report, the average credit card interest rate is 13.8%.

If you’re a weirdo like me and REALLY want to get into the weeds of your APR, you can even calculate your daily APR. Doing so is simple: Take your credit card interest rate and divide it by 365. Voila! You have your daily credit card interest rate.

You can take that percentage and apply it to your credit card balance at the end of the day. That’ll give you an accurate reflection of how much you owe the credit card company based off of your balance.

If you’re currently working to get out of credit card debt, this number could make a world of difference in how much you’re paying off each month. That’s why you’re going to want to lower your credit card interest rates. Lucky for you, I have the exact script to do it.

The world wants you to be vanilla…

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

The exact script to lower your credit card interest rates

Since the average APR is typically somewhere between 12% and 15%, it can be extremely expensive to carry a balance on your card.

Think of it like this: The average long-term return on investments in the stock market is around 8%. If you could get a 14% return on your investments, you’d be thrilled!

That’s exactly what credit card companies all over the world are doing. You want to avoid the black hole of credit card interest payments so you can earn money — and not give it to the credit card companies.

That’s why you should call your credit card company and ask them to lower your APR.

Here’s a simple script you can follow to help you.

YOU: Hello, I’d like to lower the APR on my credit card, please.

CREDIT CARD REP: Umm...why?

YOU: I’ve been a loyal customer to you for X years. Also, I’ve paid my bill in full and on time for the past few months. I know a few other credit cards offering better rates than what I’m getting right now, and I’d hate for this interest rate to drive me away from your service. What can you do for me?

CREDIT CARD REP: Hmm. Let me check...Mr. Sethi, I just discovered that I can lower your rate from 15% to 12%. Will this work?

When the conversation is finished, follow these three very important steps:

- Step 1: Hang up the phone.

- Step 2: Hold up one hand above your head.

- Step 3: Use your other hand to high five yourself because you just successfully negotiated a lower APR.

This is a quick and easy way to get a Big Win with one phone call, BUT it’s also completely unnecessary.

BONUS: If you want even more tactics you can use to optimize your credit cards, check out the 2-minute video below, which was recorded in approx. 1976.

It’s important to note: Your credit card interest rates don’t matter. I’ve gotten some heat for this idea but I don’t care. At the end of the day, it shouldn’t matter how much your APR is.

Why it doesn’t matter if your credit card interest rate is 20% or 80%

It’s simple: I never carry a balance on my credit card — and neither should you. When it comes to making purchases, if I can’t pay it off at the end of the month, I don’t buy it.

Let’s say you have a $10,000 balance on your credit card and you pay the minimum amount, which is around 2.5% every month. How much will it actually cost you? The answer is shocking. Get ready!

If you only paid the minimum on your $10,000 balance, it would take you 452 months (over 8 years!) and cost you over $19,000 in interest alone.

In other words, you’d pay around $30,000 for a $10,000 balance.

That’s if you just pay the minimum monthly payment. How about if you pay the same amount every month so that you pay down the balance faster over time?

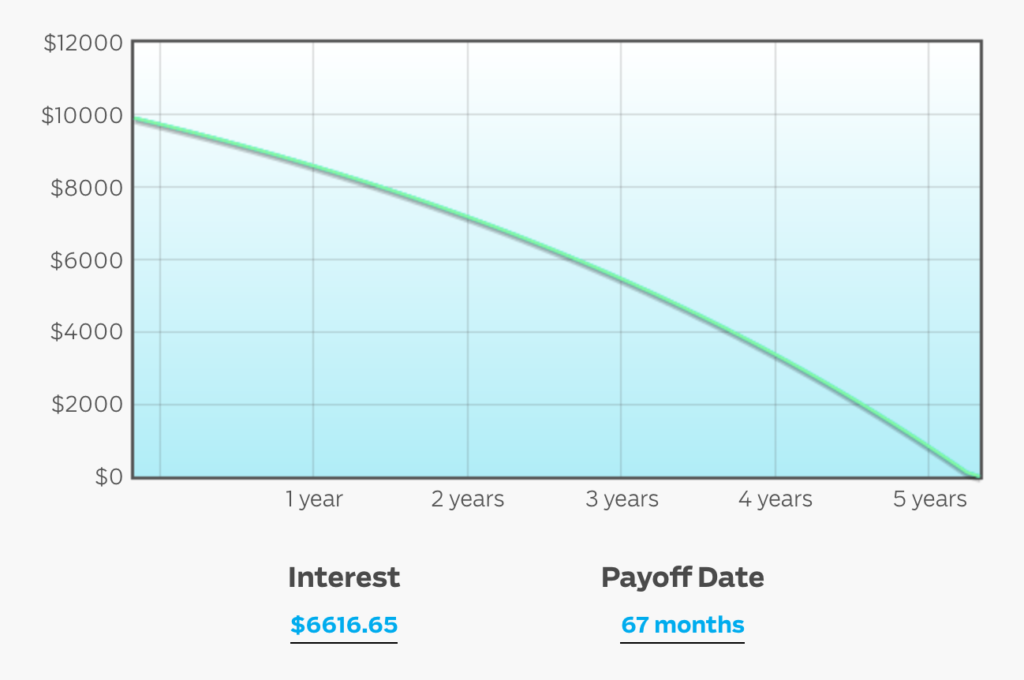

Let’s take the same $10,000 balance and pay $250 off every month.

It will cost you more than $6,000 in interest and take you 67 months to pay off the balance. Even if you don’t buy another thing in that time!

This is why credit card companies are so incredibly profitable, especially with young people who don’t know any better.

The point is pretty obvious:

- Don’t carry a balance (if you do, pay it off as quickly as you can).

- Pay the maximum possible on your balance every time.

- If you can’t pay off a purchase by the end of the month, don’t buy it.

“But Ramit,” people say, “what about homes and college and cars? How can I pay that off in one month?” Yes, true, those very expensive purchases necessitate some kind of longer-term loan. But not with your credit card.

So when I hear people excited about their introductory interest rate (“It’s 0% for 6 months!!”), I’m not really impressed. As long as you pay your balance in full every month, your credit card interest rate is meaningless.

Frequently Asked Questions:

Do you pay APR (Annual Percentage Rate) if you pay on time?

If you pay your credit card bill off on time and in full every month, your APR won't apply. If you pay your bill on time but not in full, you'll be charged interest on your remaining balance.

How fast does your credit build with a credit card?

If you pay your bill on time and otherwise manage your finances responsibly, you can rebuild from a bad credit score (300-639) to a fair credit score (640-699) in approximately 12-18 months.

If you liked this post, you’d LOVE my Ultimate Guide to Personal Finance

It’s one of the best things I've published, and totally free – just tell me where to send it: