5 Ways to Make Extra Money (without quitting your day job)

Have you ever wondered how some people seem to effortlessly create extra streams of income, while others are stuck in the same old paycheck-to-paycheck cycle? I once met someone who transformed their financial life through a simple side gig. What began as a small project to cover unexpected bills soon grew into a substantial income source.

In this post, I’ll break down the top five ways to help you make more money, gain more flexibility, and build a Rich Life on your terms.

1. Maximizing your income by advancing your career

First, let’s talk about how to make extra money without actually doing additional work.

Beyond the gig economy, there’s immense potential to grow your income through your primary career. It’s not just about working harder; it’s about working smarter, negotiating better, and strategically aligning your career trajectory with your financial goals.

Begin by taking stock of your accomplishments. Have you saved your company money and driven substantial revenue? Improved processes? Document these successes—they’re your leverage in salary negotiations.

Using my negotiation tactics, you can confidently approach your next salary discussion. Prepare by understanding your industry’s salary standards, then use my proven steps to articulate your value compellingly. Remember, negotiation is not confrontation; it’s about finding mutual value for both you and your company.

Next, continuous professional development ensures your skills stay in demand. Stay current with your industry’s trends, invest in learning new skills, and seek growth opportunities. This isn’t just about adding bullet points to your resume—it’s about becoming so good they can’t ignore you.

By systematically advancing your career and mastering negotiation, you’re not just waiting for opportunities—you’re creating them. Each step forward in your career not only increases your immediate income but also sets a higher baseline for your future earning potential.

2. Explore online side hustles

With just an internet connection and a dash of entrepreneurial spirit, you can embark on online side hustles that offer flexibility and can be pretty lucrative.

Exploring opportunities to make money online

There are countless ways to earn extra money online, from selling old clothes on platforms like Poshmark or Depop to tapping into other legitimate income streams from the comfort of your home. Here are some of the most popular online gigs that have low barriers to entry and can start bringing in extra cash.

- Freelance Writing: There’s a big world out there hungry for your words. Whether it’s businesses craving compelling copy, bloggers seeking engaging posts, or marketers needing persuasive content, your writing skills can unlock doors to lucrative opportunities online. Think of every word you write as a seed that grows into your financial garden.

- Virtual Assistance: The digital transformation has escalated the demand for virtual assistants, making it a prime avenue for earning online. If you’re adept at organization, communication, and administrative skills, consider leveraging these on platforms like Upwork or Belay. Proactively connect with potential clients by highlighting how your services can solve their specific administrative challenges.

- Online Tutoring: Sharing your knowledge on a global scale has never been easier. If you’re an expert in a specific field, language, or skill, online tutoring allows you to connect with learners worldwide, turning your expertise into a profitable and fulfilling online venture.

- Data Entry Jobs: For those looking for flexible side gigs or part-time work, data entry jobs offer a pathway to utilize technology in processing information. Platforms like Upwork or Freelancer.com are excellent places to find opportunities as a data entry clerk, entering data from paperwork into computer systems.

- Web Design: Every business seeks a compelling online presence, making web design and development skills incredibly valuable. Platforms like Toptal, 99designs, and Fiverr provide arenas to showcase your talent. Building a strong portfolio and grasping UX/UI principles are key to attracting clients eager to invest in your ability to bring their brand to life online. Additionally, flipping old furniture or engaging in retail arbitrage can be lucrative, with online marketplaces as the platform for selling products. Utilizing price checker apps can ensure smart buys.

Tip to start earning online

If you're considering online gigs like freelance writing, virtual assistance, or web design, starting on a freelance platform such as Upwork, Fiverr, or Freelancer can be a great way to gain initial traction. These platforms provide access to a wide range of clients looking for your skills. To help you get started, here are four simple steps to maximize your chances of success and build a steady stream of online income.

- Choose the right platform: Identify where your skills can best be utilized and where there is a demand for your services. Selecting the appropriate platform is critical in aligning your talents with potential clients’ needs.

- Create a compelling online profile: Your profile is your digital introduction. It should effectively communicate your skills, experiences, and what differentiates you in your field. This compelling profile will serve as your foundational tool in attracting clients.

- Engage actively on the platform: Don’t just exist on the platform; be an active participant. Regular engagement, timely responses, and proactive outreach demonstrate your commitment and can increase your visibility and attractiveness to potential clients.

- Build a strong track record/portfolio: Focus on delivering outstanding results with every task you undertake. Your reputation online is crucial. High-quality work that consistently meets or exceeds client expectations will help you build a positive reputation, essential for long-term success and growth in online earnings.

Monetizing personal interests as a side hustle

Turning your hobbies into profitable ventures isn’t just fulfilling—it’s financially savvy. This transition from leisure to income requires a strategic approach, focusing on market demand and community engagement to ensure your passion aligns with potential earnings.

Start by evaluating your hobbies for their market potential. Whether it’s crafting, photography, gaming, or any other interest, there’s likely a way to monetize it. The key is to identify where your passion meets a market need.

I know what it’s like to build a business around something you’re passionate about. To save you time, check out my video where I share the lessons I’ve learned from growing my own business over the past 20 years. You’ll find strategies on creating a sustainable venture that aligns with your values and goals, helping you turn your passion into a profitable, long-lasting endeavor.

Hobbies to monetize

Many hobbies have the potential to become lucrative side hustles. The key is knowing how to leverage your passion effectively and find the right platforms to showcase your talents. Here are a few popular hobbies that can be turned into income-generating ventures:

- Crafting: Platforms like Etsy have revolutionized the way handmade goods are sold online. To stand out, focus on high-quality product photos and utilize social media to share your creations and connect with potential customers.

- Photography: Your lens can capture more than just memories—it can earn income. Sell your photos to stock websites, offer your services for events, or build an online portfolio to showcase your work to prospective clients.

- Gaming: The gaming world offers various income avenues, from live streaming on Twitch to creating engaging content on YouTube or participating in competitive gaming events.

Strategies for successful monetization

To turn your hobby into a profitable venture, focus on strategies that maximize your reach and appeal. Here are some effective approaches to help you get started:

- Understand your market: Conduct market research to understand what similar hobbyists are doing and what customers are seeking. Analyze your competition and pinpoint what you can offer that’s unique or of higher value.

- Build your community: A strong community can be the backbone of your hobby-turned-business. Engage with your audience on social media, participate in forums related to your hobby, and consider organizing or joining local meetups to grow your network.

- Build a strong personal brand: If you want to build a good community, you also want to have a strong brand that is easily recognizable. Develop a unique brand identity around your hobby that resonates with your target audience.

- Diversify income streams: Don’t rely on just one method to make money. For instance, a photographer could sell stock photos, offer event services, and teach online classes. A gamer might live stream, create content, and participate in tournaments.

With a strategic approach, your hobby can evolve into a rewarding side hustle or even a full-fledged business, making every moment spent doing what you love even more worthwhile.

To explore more about transforming your passion into a profitable venture, check out our guide on 50+ side hustle ideas to make money fast.

3. Earn while you sleep with passive income

Passive income represents the holy grail of financial freedom—earning money with minimal ongoing effort. Many online businesses can seamlessly integrate passive income streams to enhance profitability without extra work. For instance, if you build a photography gallery on your website, you can sell your photos to a global audience with little to no additional effort, provided you’ve established a solid reputation and brand.

It’s not about getting rich quickly; it’s about investing upfront time or capital to create income streams that will pay off in the long run. Here are a few popular ways to generate passive income:

- Advertising Revenue: Generating advertising revenue through platforms like YouTube and blogs can be a lucrative path for those with a knack for content creation. Creators can monetize their content by joining the YouTube Partner Program or utilizing Google AdSense. These platforms offer a way to earn from your videos or blog posts by meeting specific eligibility requirements, adhering to the platforms’ guidelines, and reaching payment thresholds.

- Real Estate Investing: It’s not just for moguls. With platforms like Fundrise or Roofstock, you can start investing in rental properties or REITs with a relatively modest initial investment, tapping into the real estate market’s potential for steady income.

- Dividend Stocks: By investing in companies that pay dividends, you earn a share of their profits. Platforms like Robinhood or Vanguard make it easy for beginners to start, but remember, diversification is key to managing potential risks.

- Digital Products: Leverage your knowledge or creativity by creating digital products such as eBooks, online courses, or software. Platforms like Gumroad or Teachable facilitate the sales process, allowing you to focus on continually creating value that customers are willing to pay for.

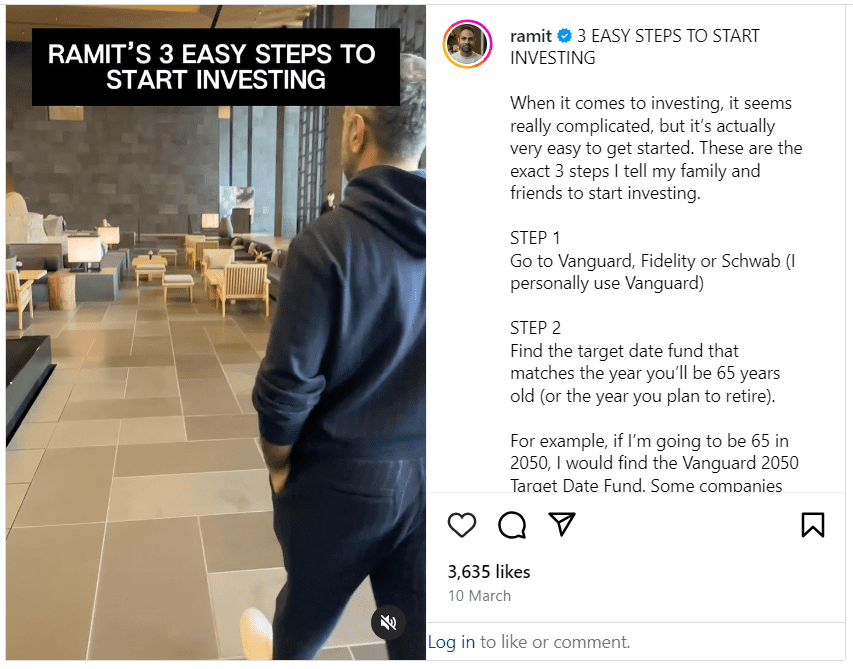

Building passive income streams often begins with smart investing. If you’re curious about how to start, here are three easy steps you can use to get started with investing.

Steps to start a passive income stream

To successfully build a passive income stream, you need more than just an idea—you need a strategy. By thoughtfully choosing your approach and planning carefully, you can create income that continues to flow with minimal ongoing effort. Here are 5 essential steps to set you on the path to passive income success:

- Research: Identify a niche or area you’re passionate about or have expertise in. Understand the market demand and potential competition.

- Plan: Develop a clear plan outlining your passive income venture, including goals, required investments, and expected ROI.

- Launch: Execute your plan, leveraging digital platforms or investment channels to kickstart your passive income stream.

- Optimize: Continuously monitor and refine your strategy to maximize earnings and ensure long-term sustainability.

- Risk Assessment: Understanding and mitigating risks is super important. Assess financial risks, market stability, and time investment. Remember, not all passive income streams are created equal, and what works for one may not work for another.

4. Find extra work in the gig economy

The gig economy has grown exponentially, offering many opportunities across various sectors. It appeals particularly to those seeking flexibility and independence from traditional employment paths, allowing individuals to choose when, where, and how they work. The gig economy is an umbrella of several types of jobs, from freelance digital tasks to on-the-ground services. Its expansion has opened doors for many to tailor their work life to personal preferences and life commitments, offering a level of autonomy that’s hard to find in conventional jobs.

Leveraging gig economy platforms

To make the most of the gig economy, choosing the right platforms and understanding how to maximize your presence on them is crucial. Whether you're driving for Uber, completing tasks on TaskRabbit, or hosting on Airbnb, each platform has its own set of strategies to help you stand out and increase your earnings. Here are some of the top platforms and how to leverage them effectively:

- Uber: Success for aspiring Uber drivers lies in understanding the nuances of the platform. Knowing the peak hours can significantly boost earnings, while excellent customer service and keeping your vehicle in top condition can enhance your ratings and, consequently, your income.

- TaskRabbit: Create a profile that highlights your skills and reliability. Select tasks that align with your expertise and deliver quality work promptly. Efficiency and a strong work ethic can set you apart in a crowded marketplace.

- Airbnb: To succeed on Airbnb, focus on creating unique guest experiences and maintaining your property well. Effective listing management and responsive communication can help you achieve higher occupancy rates and, therefore, higher earnings.

Benefits and challenges

Gig workers revel in the freedom to mold their schedules, which can improve the balance between personal and professional life. For example, someone might choose gig work to allocate more time to pursue further education or nurture a hobby, which is harder to achieve in a rigid 9-to-5 job. This flexibility also extends to income, as gig workers can directly influence their earnings through the amount and type of work they take on.

Yet, this independence comes with its own set of challenges. Income can fluctuate wildly, making financial planning a bit like navigating a boat on choppy waters. For instance, a freelancer might have a booming business one month and then face a drought of projects the next.

The absence of traditional benefits means gig workers often need to independently manage aspects of their financial security, like health insurance or retirement savings, which can be daunting without the proper knowledge or resources.

Maximizing earnings in the gig economy

Focus on enhancing your service quality and personalizing the customer experience. For example, as an Uber driver, maintaining a clean car and offering exceptional service can set you apart. On platforms like TaskRabbit or Airbnb, tailor your offerings to stand out—be the best at a specific task or create memorable stays for guests.

Treat each gig as an opportunity to build your reputation, focusing on reliability and excellence. Diversify across platforms to stabilize income and tap into different customer bases. In essence, success hinges on delivering superior service, carving out a niche, and consistently exceeding customer expectations.

5. Pursue offline opportunities for extra cash

In this era where screens often dominate our attention, engaging in physical side hustles offers a refreshing and profitable way to connect with your community and utilize your skills directly and effectively.

Explore traditional side hustles

Discover a variety of offline side hustles that cater to your unique skills and interests. Dog enthusiasts can explore dog walking through platforms like Rover, while those with expertise in a subject can share their knowledge through tutoring. Wyzant facilitates connections to students.

Event planning could be your niche if you enjoy organizing and creativity. Local bulletin boards and community centers can be excellent resources for uncovering these opportunities. Embrace these chances to turn your passions into a lucrative venture.

Setting competitive rates

Conducting thorough research to understand what others charge for similar services in your area is vital for setting competitive yet fair rates. Your rates should mirror the quality and value you provide, ensuring you are fairly compensated for your time and expertise. Effective pricing reflects your worth and attracts the right clientele, setting the stage for a fulfilling and prosperous side hustle.

Avoid scams and time wasters

In your quest for extra income, beware of pitfalls like scams and time-wasting ventures. Scams often come in the form of job offers that require upfront payments, vague descriptions, or promises of easy, high earnings. Pyramid schemes and phishing scams prey on those looking for quick opportunities, so be cautious of any offers that ask you to recruit others or share sensitive information.

Similarly, not every side hustle is worth your time—always evaluate whether an opportunity aligns with your skills and offers a scalable return on investment. If it doesn’t pass these tests, it’s likely just a waste of your time.

Take David and Halima, for example. They were a couple who came to me seeking advice on how to improve their financial situation. Both had experienced difficult first marriages that left them with significant emotional and financial scars. They hoped this union would be a fresh start, but they found themselves weighed down by debt.

One issue they faced was being drawn into get-rich-quick schemes, which added yet another layer of complexity to their financial challenges. While these schemes weren't the root cause of their struggles, they did make it harder for them to move forward.

David: [00:16:05] I joined two different MLMs.

Ramit Sethi: [00:16:12] What? Two? You know what? That doesn’t surprise me. Because when someone joins one, they usually end up in another. It’s very similar to why somebody who joins a cult is susceptible to joining another cult. But I want to know which MLMs. Tell us.

David: [00:16:27] First one started with an A.

Ramit Sethi: [00:16:32] Amway?

David: [00:16:33] Yeah, Amway. And then the other one, I think it’s called GirlVentures.

Ramit Sethi: [00:16:39] What do they sell?

David: [00:16:42] Packaging deals for traveling.

Ramit Sethi: [00:16:47] Oh, okay. All right. So what drew you to those?

David: [00:16:51] Actually, also Primerica.

Ramit Sethi: [00:16:54] Fuck. They’re the worst. Wait, you were a sales rep for Primerica?

David: [00:17:00] Yes.

Ramit Sethi: [00:17:00] By the way, do you know how many people are watching and listening to this podcast right now who are getting so fucking mad because they’re involved in one of those. And they’re about to write me these messages. Primerica is not actually an MLM. If you technically define– I fucking have a Netflix show where I talk about what an MLM is. Don’t tell me what an MLM is. I know. Don’t send me messages. Just unsubscribe. All right, so you got out. What was the thing that initially drew you there?

David: [00:17:27] Basically that I would be my own boss, and I determine how much money I make. So I can determine whether I am going to be continuing at, they call– the WorldVentures one is the one that I got mostly involved with. Yeah. Basically, they were saying you are your own boss. You determine your destiny. You determine if you’re going to be financially successful or not.

Ramit Sethi: [00:18:04] It’s a powerful vision.

David: [00:18:05] Yes.

Ramit Sethi: [00:18:06] It just happens to be a complete scam that over 99% of people fail at. And just to do a quick statistical check, David, did you make a lot of money with one, two, three MLMs?

David: [00:18:19] No.

Ramit Sethi: [00:18:19] Shocking, shocking. All these MLM people about to send me messages on social media. They’re like, David just didn’t work hard enough. If you put the time in, you can get the results out. I have the statistics. All right. So you got out. So that was one get-rich-quick thing you joined. What else?

David: [00:18:37] I tried doing the whole cryptocurrency thing.

Ramit Sethi: [00:18:42] How’d that go?

David: [00:18:44] Terrible. I held on when I should have sold.

David's experience shows how easily chasing quick money schemes can lead to financial trouble. Instead of getting caught up in these traps, focus on opportunities that match what you're good at and offer real, long-term growth. Building wealth takes time, patience, and smart financial decisions.

Time management strategies

Managing multiple income streams demands concrete strategies, not just good intentions. Start by clearly defining your goals for each side hustle, ensuring they’re specific, measurable, achievable, relevant, and time-bound (SMART). Use a digital calendar or planner to allocate dedicated time slots to each task, treating your side hustles with the same respect as a full-time job.

Prioritize tasks based on their importance and deadlines, focusing on high-impact activities that drive the most value or income. Utilize tools like time-tracking apps to gain insights into where your time goes, allowing you to cut down on inefficiencies. And crucially, schedule downtime. It’s tempting to fill every spare minute with work, but rest is a non-negotiable component of sustained productivity and creativity.

Handle the gig economy like a pro: stay sharp, stay informed, and don’t let the glitter distract you from the gold. Armed with insight and the right strategies, you can pinpoint top-notch opportunities and dodge the duds.

Getting Started (your action plan for extra income)

Now that you’re brimming with ideas and inspiration for making extra money, it's time to put those thoughts into action. The journey from idea to income starts with clear steps that guide you through the process, from understanding your strengths to launching your first venture. Here’s a simple action plan to help you get started and keep the momentum going.

Step 1: Self-assessment

Kick off with a thorough self-assessment. What are your strengths? What do you enjoy doing? How much time can you commit each week? Revisit the downloadable worksheet provided earlier to get a clear picture of your starting point.

Step 2: Idea generation

Now, get creative. Based on your self-assessment, brainstorm potential income streams. Mix it up with digital, passive, and hands-on opportunities. Think about how you can convert your skills and interests into income.

Step 3: Market research

Before diving in, understand the market. Who needs what you’re offering? What’s the competition like? Use tools like Google Trends or engage in forums related to your field to gauge demand.

Step 4: Planning and preparation

Craft a straightforward plan. What’s your goal? What resources will you need? Set a timeline. This plan doesn’t need to be a novel—keep it concise and actionable.

Step 5: Launch

Get your side hustle off the ground. Set up any necessary accounts or profiles. Use social media and your personal network to spread the word. Remember, the start doesn’t have to be perfect. It just needs to happen.

Step 6: Review and refine

Once you’re up and running, keep tabs on your progress. What’s working? What isn’t? Be ready to pivot and refine your approach. Adaptability is key to growth and success.

Persistency is crucial. Dedicate regular, small blocks of time to your side hustle. These consistent efforts compound over time, leading to significant outcomes. And when you hit a roadblock, see it as a learning curve, not a stop sign. Resilience and flexibility are your allies on this journey to additional income.

Your complete toolkit to make extra money

We’ve explored powerful strategies for creating extra income, from leveraging online platforms to building passive income and transforming your passions into profit. But remember, this isn’t just about increasing your bank balance—it’s about aligning your financial goals with the life you truly want.

So, I challenge you: pick one strategy that resonates with you and take that first step today. Don’t wait for the perfect moment; start building your richer life one action at a time. This post isn’t just a collection of ideas; it’s your complete toolkit for making money online.

If you liked this post, you’d LOVE our Ultimate Guide to Making Money