Less than half of financial advice is considered helpful by those who receive it [Survey]

![Less than half of financial advice is considered helpful by those who receive it [Survey]](https://www.iwillteachyoutoberich.com/wp-content/uploads/2022/01/505.jpeg)

If you’re serious about building wealth, ignore advice that tells you to skip lattes, avoid all debt, or save your way to financial freedom. Focus on growing your income, investing early and consistently, using debt strategically, and filtering out advice that doesn’t match your financial goals or reality.

Why Bad Financial Advice Spreads Like Wildfire

Financial misinformation spreads quickly, mutates, and can cause serious damage before you even realize it. The first step in protecting yourself is understanding why and how bad advice develops.

1. Friends and family are the usual suspects

Your well-meaning aunt who’s never invested a dollar, your cousin who thinks saving means keeping cash under a mattress—these are often the primary sources of financial folklore. Generational advice passed down without verification becomes a dangerous game of telephone.

Stagnant wages, skyrocketing housing costs, and changing job markets have made traditional financial wisdom less reliable than ever. While loved ones’ advice is usually well-intentioned, relying on outdated financial strategies can hold you back from making smarter money decisions that are actually applicable for our modern age.

2. Social media is full of fake money experts

YouTube, TikTok, and Instagram have transformed everyone with a smartphone into a potential financial guru. With just a quick scroll through TikTok or Instagram, you’ll find influencers promising instant wealth through crypto, day trading, or “secret” investment strategies.

The problem? Many of these so-called experts have no real financial credentials or experience. They make money from engagement, sponsorships, and views—not from actually building wealth. As personal finance YouTuber Andrei Jikh warns, anyone claiming to have the single “BEST” investment is probably selling you a fantasy. The best financial strategies aren’t flashy, and they definitely don’t promise overnight success.

3. Outdated money rules no longer work

Remember when buying a house was considered the ultimate financial achievement? Or when people believed you should work the same job for 25 years before retiring? These outdated rules no longer apply in today’s economy, where homeownership and lifelong job loyalty are less practical.

Flexibility, multiple income streams, and strategic investing now play a bigger role in building wealth than simply following outdated, one-size-fits-all advice. The world’s financial landscape is constantly evolving, and sticking to outdated advice can prevent you from making informed, strategic decisions.

Bad Financial Advice That Sounds Deceptively Smart

Some financial advice sounds logical on the surface but can actually do more harm than good. Here are some of the worst offenders—and smarter alternatives:

1. You don’t need to invest—just save

This is one of the most dangerous money myths out there. While saving money is important, it’s not enough to build wealth. Historically, the stock market has averaged around a 10.73% annual return, while savings accounts barely keep up with inflation; in fact, inflation can slowly eat away the value of cash that’s sitting in a savings account, meaning your money loses purchasing power over time.

The truth: The wealthiest individuals don’t just save—they invest. Whether it’s in stocks, real estate, or a retirement account, investing allows your money to grow instead of just sitting there. Yes, an emergency fund is crucial, but relying on savings alone without putting your money to work will leave you behind financially.

2. Buying a house is always better than renting

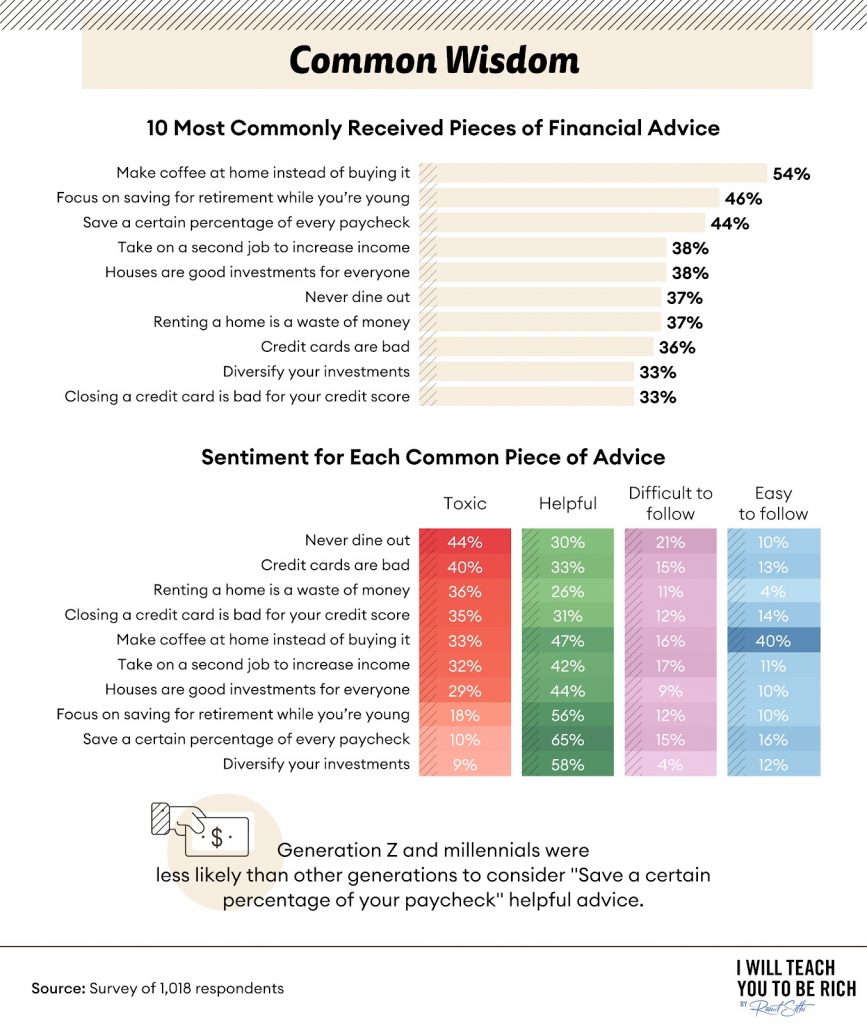

Owning a home is often seen as the ultimate financial goal, but it’s not always the smartest move. While homeownership can be a good long-term investment in some cases, it comes with hidden costs—maintenance, property taxes, and potential market downturns. A survey we conducted revealed that 38% of people heard purchasing a home is always the right move, but that’s dangerously oversimplified advice