Stock Market Goes Down: How To Prepare and Not Panic (+ tips)

When the stock market crashes, so can your stomach right down to your shoes. Seeing all that money disappear at once can be frightening to anyone, no matter how stoic or optimistic you are. It isn't easy to know what to do when stocks are down.

It might be cliche, but as the saying goes, "What goes up must come down."

However, when your stocks dip, it isn't the time to panic and drop out. For anyone who has invested in the stock market, drops aren't ideal. However, you have to know that stocks going down is to be expected since they can't always go up.

If you are worried about your stocks and their value as you watch the stock market crash, here is our advice for what to do when stocks go down.

Why do stocks go down?

First, let's start by outlining why stocks go down in the first place. Stock market prices go up and down every day because of market forces. The share prices end up changing due to supply and demand. When the company is doing well, more people want to buy the stock instead of selling it. If the company starts to do worse, then more people stock selling it, and the price falls.

In the end, the stock market might be driven by various factors, but the demand for them majorly determines the prices of stock at any moment. So, for example, if something bad happens to the company that seems to put it in a worse financial situation, people won't want to buy stock, so the price will go down and down until people are comfortable trading it back and forth again.

What should you do with your portfolio if stocks go down?

Of course, if you had your choice, your stocks would always be in demand. However, that isn't always how it works. If your stocks start to take a hit, here's what you should do.

Don't panic

Don't panic and sell everything! Instead, take a couple of deep breaths and relax. Although it doesn't always work out for the better, more often than not, the best thing to do is to hold out. You read that right. Don't do anything. Most importantly, don't panic sell. Instead, hold onto the stocks and re-evaluate the situation.

Think about the companies you have invested in and whether the companies still suit your investment priorities. Are the companies you put your money into still one's that suit your portfolio criteria? If they are, hold out and wait for the light at the end of the tunnel. If not, then take a couple more deep breaths before taking the next step.

It is also beneficial to keep in mind that investing with a long-term mindset can help you make much more money in the long run.

Here's an interesting image for you:

This chart shows what happens if you pull your money out and end up missing the best 5 or 10 days the company stocks experience. The only way to make sure you hit the best 5 days in a 10 year period is to stay invested the entire time.

Make sure you're diversified

The next step you should be considering is diversification. Diversifying your portfolio is the best way to keep you and your money safe.

Diversification involves holding a wider variety of investments in all kinds of industries, not just a variety of companies. That means you might invest in IT companies, hold some international stock, index funds or some bond funds, or invest in real estate investment trusts. There are so many places and areas in which you can put your money. The more you spread the wealth, the less you will lose if one of the industries or companies crashes for a time.

The truth is that picking your asset allocation is more important than making any individual stock choice will ever be. However, even if you have bought all kinds of different stocks, you still have only invested in stocks and aren't truly diversified. If you are interested in taking this step and learning more about diversifying your portfolio, check out this article.

Consider buying in the dip

The other side of a dip in the market is the opportunity it gives you to take advantage of certain stocks and buy them up. This is how to make money when stocks go down. Market dips are often when fortunes are made. However, they can be tricky since you need to be ready for their fall and then be willing to sacrifice that money if all they do is keep falling.

The best way to be ready to buy in a dip is to be specific about it and save for it. Our suggestion is to keep a running list of the individual stocks you would someday like to own. Call this your "stock wish list." Although it might not be something you will send off to the North Pole, you can make your own wishes come true. Keep an eye on the companies to watch for moments when they dip.

It is also essential to make sure that you only use money that you have set aside for investing. If you see what you think is an opportunity during a market dip and decide to invest your emergency funds, you are putting a lot more at risk than just getting unlucky on one stock selection. Likewise, you should never invest money that you think you will have to use in the next few years. Sometimes it might pay off for people, but the risk of finding yourself penniless in the future is never worth it.

We typically recommend for people to invest most of their money into 401ks, index funds, and Roth IRAs. Then, if you want to take 5-10% of your investment money and put it into individual stocks, it will only be a small percentage of your portfolio if you lose it.

Don't try to time the market

When you are a long-term investor, you need to manage your stocks so that you will be able to maintain them for years to come. If you are constantly checking in to try to spot a low period for certain stocks so that you can buy them up, you will end up going crazy. A watched pot never boils and all that.

Instead, regular investing over time will end up yielding you more solid returns. It is rarely a good idea to try to go into something to make quick money. Being smart about it and patient is the best combination to make the most money in the long term. Don't feel pressured to buy in a low. Just take advantage of it when it becomes available.

Stay calm and remember the long haul

Although it is difficult for us to think long-term, it is necessary if you want to invest successfully. Some people might invest for the short-term, but unless done well, this doesn't always end well. Think long-term and invest for the long term. Over years of investments, a dip now will not matter. Low points are all part of the process.

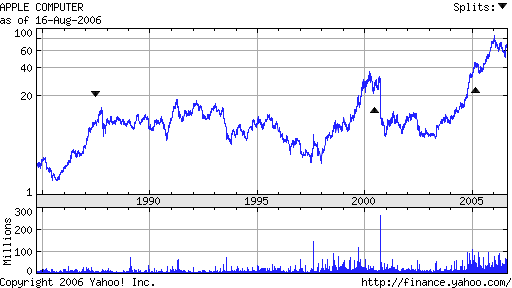

Consider Apple as a good example of this. Those that have invested long-term have seen huge returns come back from it. From 1995 to 1998, the company saw some hard-hitting dips, at one point experiencing a whopping loss of about 41%. Since then, they have closed at $188 and have split twice since that terrible low point from 1998. Long-term investors in the company have seen their stocks rise dramatically over the last 20 years but will have been extremely disappointed all those years ago.

The name of the game is... risk tolerance. You have to ask yourself how much risk you are willing to take and invest accordingly.

FAQs About What To Do When Stock Market Goes Down

Do you lose all the money if the stock market goes down?

No, a stock market crash occurs when the price of stocks drops dramatically but does not entirely wipe out all of a person's investments. The money is lost only if he/she sells their stocks during or after the crash. The stock market's volatility means that prices will rise again soon after a fall. Patience is important for investors in such situations.

What causes the Stock Market to go down?

Several factors contributed to the stock market crash, including economic changes, geopolitical issues, and external economic events.

Can you make money when the Stock Market goes down?

Investors can also profit from a bear market by short-selling stocks or shorting equity index futures. In this strategy, an investor borrows shares that they do not already own and sells them in the expectation of repurchasing them at a lower price.

Just breathe

When you are ready to panic, pack up, and leave, take a deep breath, and realize that a dip in stocks is all part of the process. If you haven't diversified already, you need to get on it to spread the wealth and lower the overall risk. You should consider buying when there is a dip but don't go crazy looking for one. And remember, you should be investing for the long term.

If this still seems overwhelming for you, check out this article on investing for beginners to better wrap your mind around the stock market. If you want more guidance on what to do when stocks go down and any other money management issues you currently have, check out our free resource below, The Ultimate Guide to Personal Finance, to make your money start doing what you want it to do.