A Sneak Peek of Money Coaching with Ramit Sethi

No, money doesn't have to be stressful

Money stress is one of those things that’s so common that we think it’s normal. We think money HAS to be stressful.

Here’s why: Most money advice just adds stress and worry to our lives. “Keep a budget!” “Cut back on lattes!” “Disable your oven light and save $0.43. A YEAR!” “Buy crypto! Everyone’s doing it.” And perhaps my all-time favorite, “If you rent, you’re just throwing your money away.”

No thanks.

Here’s the kind of personal finance I care about: How to USE my money to build MY Rich Life.

My philosophy on money is built on a small number of simple but life-changing ideas:

We need to create SYSTEMS for our money rather than continuously having to choose how much to spend or save. Get it right once, then let it run on autopilot.

Most of us leave thousands of dollars on the table every month. And you can put that money back in your pocket with just a few phone calls and the right questions.

When it comes to investing, you don’t need to try to beat the market (despite what financial “gurus” think…).

We can use money to ENHANCE our lives. One of the secrets is consciously choosing what we love to spend on and cutting back on the things we don’t care about.

And most important of all…

Money is a small but vital part of living a fulfilling life. Getting your money in control gives you the power and flexibility to make major improvements in all areas of your life.

Time with family and friends, travel, experiences, personal growth, your health and fitness, hobbies, giving — ALL of these parts of your life can become bigger, easier, more exciting, and richer when your money is under control and working FOR you, not AGAINST you.

The only catch: You can’t reach your Rich Life by accident.

Nor can you keep following the broken, stressful, frugality-obsessed money advice you hear everywhere. It doesn’t work. And even if you make more money, you still won’t know how to USE it to build your Rich Life. (Not to mention how to automate it so you take care of all your saving, investing, tracking, and tweaks in less than 1 hour per month.)

If you’re ready to finally take control of your money and start building your Rich Life, you need a new system — and you need someone to help you along the way.

Introducing…

Think about any kind of coach. What do they do?

- Teach you the fundamentals

- Kick your ass when you’re not doing what you should be

- Encourage you and cheer you on

- Celebrate your success

That’s exactly what I do in Money Coaching.

Here’s what I promise you’ll get when you enroll:

- You’ll identify problem areas in your finances — and fix them once and for all

- You’ll create a simple money plan that fits you like a handmade glove

- And, most importantly, you’ll gain the quiet confidence to know your money is on track through monthly check-ins and guided lessons

Sneak Peek: What's inside Money Coaching with Ramit Sethi

First, you get a live coaching call with me each month.

Each call has three parts:

- Coaching — I go in-depth on one topic each month. Examples include “How an ordinary person can become a millionaire,” “Where can I find an extra $100, $500, $1,000 per month?” and “How Ramit does an Annual Rich Life Review”

- Money Makeovers — a 1-on-1 opportunity for me to help you fix a trouble spot in your finances

- Q&A — members of Money Coaching can get their questions answered live on the call

I want to share with you three excerpts from our first coaching call.

Money Coaching Excerpt #1

In this video, Crystal shares her current investments with us: $175k in assets and 20 years left to contribute. She wonders if she’ll have enough when she retires.

Key Takeaways:

- You can find out the exact date when you’ll be a millionaire. Students were shocked at how soon they would become a millionaire — and how a few small adjustments in the amount saved or the time invested could significantly change their savings amounts.

- Crystal made a mistake that many people make — that could cost you up to $1 million! Watch as I help her realize this live on the call.

Money Coaching Excerpt #2

In this video, Sunny asks how she can make more money with a teacher’s salary. (Right before this on the call, we helped her see that contributing $100/month will not give her enough in retirement. She’ll need to save more.) Another student on the call is a former teacher who significantly escalated her salary, and she shares with Sunny how she did it.

Key Takeaways:

- Don’t get trapped by thinking small. No matter what your current salary, current job, or current whatever — you can earn more money.

- I love how my students help each other. It’s one thing for me to talk about how to make more money; it’s another for Sunny to hear it directly from Jessica.

Money Coaching Excerpt #3

How many of us think that what we want to spend our money on is just natural? That we’re not really influenced by anything else (other than Starbucks and Apple ads.) Wrong!

Key Takeaways:

- In this exercise, I help students see just how much spending is influenced by the people around us. I can almost guess where people are from based on their answers.

- The diversity of careers, economic backgrounds, and physical locations of students is great. Having a wide variety of fellow students shows you how profoundly psychology and social forces influence money.

You’ll also be invited to join our thriving members-only Slack community.

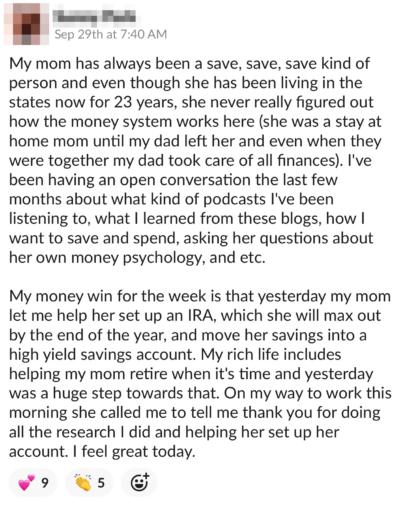

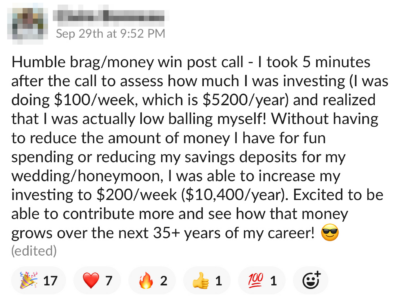

Here are a few examples of the kind of posts you’ll find in the Money Coaching private community.

You’ll also get my program Automate Your Money, a $197 value, for free.

Automate Your Money shows you:

- What accounts you need to set up your system. (Your current accounts may already work. I’ll call out what to look for.)

- How to link all of your accounts and set up the transfers so your system runs on autopilot. (This is the bulk of the work and only takes 1-2 hours. Do it once and enjoy it forever.)

- How to time your Automated Money System so every bill gets paid in full on time, hassle-free. No more late payments.

- How to handle irregular income. Yes, this system works for freelancers and business owners, too.

- How to monitor your money in less than 1 hour per month (but still have complete control and visibility).

- Some little-known quirks and perks to automating your money — inside the psychology of automation.

If you follow the program step by step, you should have your money fully automated in less than two weeks! (The actual work only takes a few hours, but you may need to wait a few business days for test transactions when you link your accounts.)

Stop feeling stressed about your money!

Stop trying to figure out money on your own, without a coach, without a team!