Minimum variance portfolio: Definition, examples, and breakdowns

A minimum variance portfolio is a portfolio model made up of investments that are volatile individually but are seen by some as low risk when put together.

This portfolio model might not be right for individual investors though. In fact, we don’t recommend you build a minimum variance portfolio especially if you’re a beginner.

But we believe that you should get a full look at what a minimum variance portfolio is before you make a decision.

- What is a minimum variance portfolio?

- Examples of minimum variance portfolios

- The most important thing when it comes to investing

- The simple solution: Lifecycle funds

Personal finance is FILLED with varying perspectives when it comes to these advanced topics. It’s important you understand how and why certain things are before you jump into them.

What is a minimum variance portfolio?

At its core, a minimum variance portfolio mixes investments with low correlation.

Correlation measures how much two investments move with one another. For example, a very simple minimum variance portfolio could be 50% stocks and 50% bonds, as they are two investments with very low correlation to one another (stocks are highly volatile where bonds are mostly consistent).

Finding the exact correlation (known as R2 or “R squared” for you math wizards) requires advanced knowledge of data and mathematics, so we won’t get into it in this article. However, it’s good to know about its utility when it comes to minimum variance portfolios (and it’s a fun term to throw around at cocktail parties so you sound smart).

Most minimum variance portfolios vary from a traditional portfolio mix of bonds and stocks. Rather than investing in a mix of low risk (bonds) and high risk (stocks), it’s a mix of highly volatile individual securities with low correlation.

The logic goes: By mixing a set of volatile securities that don’t tend to move with one another, an investor can hedge against losses while maximizing earnings.

Let’s take a look at a few examples of minimum variance portfolios now to see it in action.

Examples of minimum variance portfolios

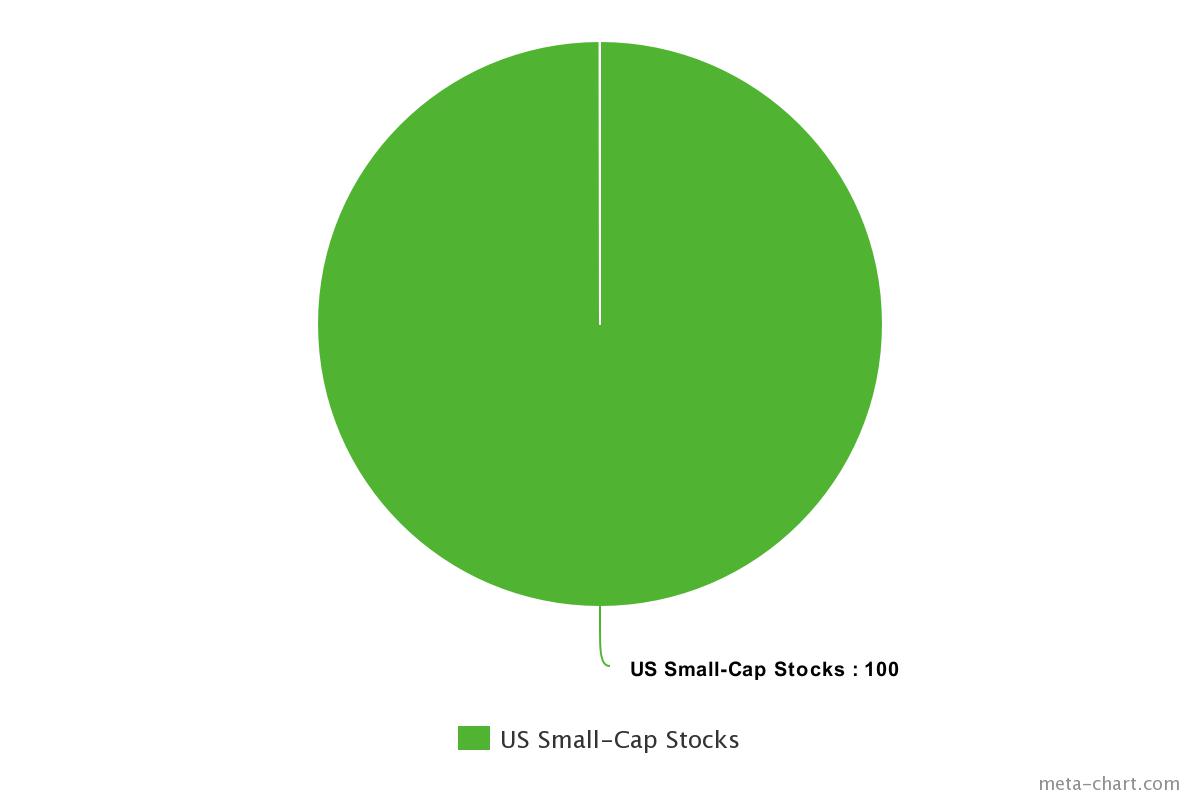

If you had a portfolio that was 100% U.S. small-cap stocks, or 100% U.S. large-cap stocks, or 100% international market stocks, that would be considered a very volatile portfolio as those are risky investments individually.

Not a minimum variance portfolio.

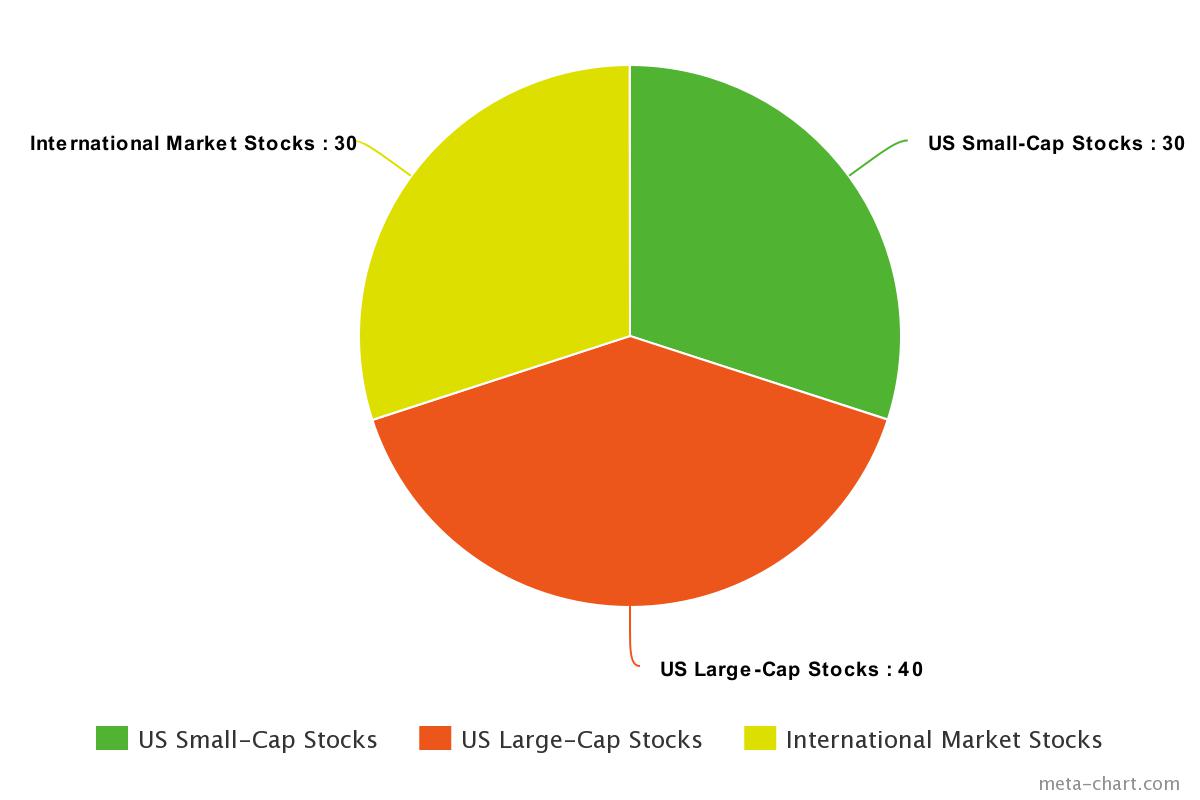

However, if you had a portfolio that was:

- 30% U.S. small-cap stocks

- 40% U.S. large-cap stocks

- 30% international market stocks

… you’d hedge your risks since those investments have a low correlation to one another. That means that this portfolio is built on the belief that if small cap goes down, it likely won’t affect the international market.

A minimum variance portfolio.

Remember: You don’t necessarily need to have a mix of highly volatile investments to have a minimum variance portfolio. You just need to have low correlation between your investments. However, that’s what people refer to when they talk about minimum variance portfolios.

The most important thing when it comes to investing

Like we said before, we don’t recommend this for the typical investor. This is a highly advanced topic for investors who really want to get into the nitty-gritty of their portfolios.

The returns you stand to gain just aren’t worth building it — especially when there are simpler approaches to investing that will still help you get rich.

Instead, what we recommend is focusing on one of the most important things when it comes to investing: Asset allocation.

While it’s important to diversify within individual assets like stocks, it’s even more important to allocate across different asset classes like stocks, bonds, and cash.

When you invest in any one of those asset classes, it’s a dangerous game — especially over the long term. This is why asset allocation is so important.

When you consider how you want to set up your asset allocation, you need to think about the returns of each asset class. Higher risk generally means higher potential for reward.

This means two things:

- If you want to get rich quick, you’ll probably fail — and big.

- You need to have a variety of assets in your portfolio.

A 1991 study discovered that 91.5% of the results from long-term portfolio performance came from how the investments were allocated. This means that asset allocation is CRUCIAL to how your portfolio performs.

The simple solution: Lifecycle funds

Knowing that asset allocation is crucial, I highly suggest getting lifecycle funds (or target date funds).

These are funds that diversify and allocate your assets based on your age. As you age, they automatically adjust for you.

Example:

If you plan to retire in about 30 years, a good target date fund for you might be the Vanguard Target Retirement 2050 Fund (VFIFX). The 2050 represents the year in which you’ll likely retire.

Since 2050 is still a ways away, this fund will contain more risky investment such as stocks. However, as it gets closer and closer to 2050, the fund will automatically adjust to contain safer investments such as bonds, because you’re getting closer to retirement age.

These funds aren’t for everyone though. You might have a different level of risk or different goals. (At a certain point, you may want to choose individual index funds inside and outside of retirement accounts for tax advantages.)

However, they are designed for people who don’t want to mess around with rebalancing their portfolio at all. For you, the ease of use that comes with lifecycle funds might outweigh the loss of returns.

I spent years getting my asset allocation right — and that’s why I’m happy you’re here.

If you’re interested in things like diversifying your portfolio, I want to give you something that can help you start building that portfolio today.

In it, you’ll learn how to:

- Master your 401k: Take advantage of free money offered to you by your company … and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Spend the money you have — guilt-free: By leveraging the systems in this book, you’ll learn exactly how you’ll be able to save money to spend without the guilt.

Learn to take control of your finances and spend your money GUILT-FREE with our free Ultimate Guide To Personal Finance below:

Written by Ramit Sethi

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.