Why Idle Cash Is Killing Your Wealth (And What to Do Instead)

Idle cash refers to money sitting around earning zero returns, whether it's stored in a safe, held in a checking account with no interest, or simply accumulating without any productive purpose. If you know me, you know I've strongly advised against letting money sit idle like this because it's one of the biggest wealth-killing mistakes I see people make.

Why People Keep Piles of Idle Cash (And Think They're Being Smart)

Most people think they're being responsible by keeping tons of cash "just in case," but they're actually making a costly mistake. Let me break down the three main reasons people justify hoarding idle cash.

Fear of market volatility makes them cash hoarders

Market volatility is the degree of variation in investment prices over time. When you see the Dow Jones drop 800 points in a single day, or when your portfolio swings from green to red within hours, that's volatility at work. The media amplifies these dramatic movements with alarming headlines about market crashes and economic uncertainty.

People get spooked by these market headlines and think keeping everything in cash is “safe”. They'd rather earn literally nothing than risk any market fluctuations, not realizing they're guaranteeing a loss to inflation.

How people fall into the trash of cash hoarding

Think about how this fear plays out in real life. You might have $25,000 sitting in your checking account earning 0.01% interest because you read an article last month about potential market volatility. The article mentioned recession fears, geopolitical tensions, or concerns about inflation. Instead of staying invested or learning about proper diversification, you pulled everything out and put it in cash.

Meanwhile, the S&P 500 has historically recovered from every downturn and continued to reach new highs over time. By trying to time the market or avoid short-term volatility, you miss out on building long-term wealth. The irony is that cash feels safe in the short term but becomes the riskiest asset class over more extended periods due to inflation erosion.

This fear-based thinking keeps people from building real wealth over time. They end up poorer by trying to play it "safe" because they confuse temporary market movements with permanent loss of capital.

They believe bigger emergency funds equal better security

Emergency funds are absolutely crucial. I recommend 3-6 months of fixed expenses, and I practice this myself. Fixed expenses are your non-negotiable monthly costs that you must pay regardless of your income situation. These include your mortgage or rent payment, minimum debt payments, utilities, insurance premiums, groceries, transportation costs, and basic living necessities.

Let me walk you through how to calculate this properly. If your monthly fixed expenses total $5,000, your emergency fund should contain between $15,000 and $30,000. This calculation provides you with sufficient financial cushion to handle job loss, medical emergencies, or major unexpected expenses without incurring debt or liquidating investments at potentially unfavorable times.

The expensive peace of mind trap

Imagine you've calculated that you need $20,000 for a proper 6-month emergency fund based on your fixed expenses. However, you keep $60,000 in various savings accounts because it makes you feel more secure. That extra $40,000 represents what I call "expensive peace of mind."

That excess $40,000 could potentially grow to approximately $154,000 over 20 years if invested in index funds earning 7% annually. Instead, sitting in a savings account earning 1%, it becomes about $49,000 over the same period. Factor in inflation at 3% annually, and your $40,000 only maintains purchasing power equivalent to about $22,000 in today's money.

They confuse having excessive cash with being prepared, but anything beyond that 6-month number is just expensive peace of mind. That extra money beyond your proper emergency fund should be working for you, not sitting around losing value to inflation.

Poor cash flow forecasting creates accidental cash piles

Cash flow forecasting involves predicting your income and expenses over specific time periods to understand exactly how much liquid cash you actually need. Most people never do this exercise and instead operate on vague feelings about what they might need.

Many people simply don't know how much they actually need for upcoming expenses, so they keep everything liquid “just in case”. They'll have large amounts sitting around because they think they might need it soon, only to find that it's still there months later, doing nothing.

Your “bonus money” that goes nowhere

Consider this typical situation. You receive a $12,000 bonus in January and immediately start thinking about all the ways you might spend it. Maybe you'll need new tires for your car, or you might want to renovate the bathroom, or perhaps you'll take a vacation this summer. Instead of researching actual costs and timeline for these purchases, you leave the entire amount in your checking account.

Six months pass, and you still haven't made any of these purchases. The tire replacement you thought would cost $1,200 actually costs $800 when you finally do it. The bathroom renovation has been pushed to next year because you haven't had time to obtain quotes. The vacation idea fades as you get busy with work projects.

Meanwhile, that $12,000 has been earning essentially nothing while inflation chips away at its purchasing power. A proper cash flow forecast would have identified that you only needed about $3,000 in readily accessible cash for likely near-term expenses. The remaining $9,000 could have been invested immediately and grown while you figured out your actual plans.

Why I'm Strongly Against Idle Cash (Yes, Even After 2008)

In episode 72 of my podcast, I talked about this exact topic and admitted something that might surprise you. During the 2008 recession, I actually wished I had kept more cash aside not for safety, but to take advantage of incredible investment opportunities when everyone else was panicking.

| Conversation adapted from my podcast: Ramit answers your questions: Recessions, getting married, firing an advisor

"Second, I remember saying, 'Wow, I wish I had a bigger war chest to invest, because when everyone was terrified and the news articles were rampant, 10% unemployment, it's never coming back, the world is over, I was thinking this is one of the most amazing investing opportunities in my lifetime. Now, I had cash. I put it in consistently, but I wish I had had a little extra war chest. And so from that day I vowed to myself that I would always have a larger amount of cash sitting waiting for extraordinary opportunities.'" |

A "war chest" in investing terminology refers to a strategic cash reserve specifically earmarked for taking advantage of major market dislocations or extraordinary investment opportunities. This differs fundamentally from idle cash because it serves a specific tactical purpose in your overall wealth-building strategy.

The market was basically on sale during 2008, and I wanted a bigger war chest to buy more quality investments at deeply discounted prices. Companies like Apple, Microsoft, and Amazon were trading at fractions of their intrinsic values simply because fear dominated the market.

Now, I'll admit I do keep a slightly larger cash position than my basic asset allocation suggests, but here's the key difference. This is play money on top of my already-achieved financial goals. For everyone else still building their financial foundation, idle cash represents wealth destruction in slow motion.

Inflation silently steals your wealth every single day

Inflation represents the general increase in prices for goods and services over time, which directly reduces the purchasing power of your money. When inflation runs at 3% annually, a basket of goods costing $100 today will cost $103 next year for the same items.

With inflation running above 3% and most people keeping cash in accounts earning zero, you're losing 3% of your purchasing power annually. That $10,000 sitting in your checking account loses $300 in real value each year. This loss is permanent and irreversible because you can never recapture the lost purchasing power.

The daily impact of inflation becomes clear when you examine specific examples you encounter regularly:

- Your morning coffee, which costs $4.50 today, will likely cost $4.64 next year due to 3% inflation.

- Your weekly grocery bill of $150 becomes $154.50 for the same items.

- Your monthly gas budget of $200 increases to $206 without you driving any additional miles.

- Your annual car insurance premium of $1,200 rises to $1,236 for identical coverage.

Meanwhile, your idle cash buys less coffee, less gas, and fewer groceries with each passing month. It's like watching your wealth evaporate in slow motion while you stand there helplessly.

Opportunity cost compounds against you

Opportunity cost represents what you give up when choosing one option over another. In personal finance, it's the potential returns you sacrifice by not investing your money in growth assets like index funds.

Every dollar sitting idle is a dollar not invested in index funds that have historically returned approximately 10% annually before inflation, or about 7% after adjusting for inflation. Let me demonstrate the true cost with specific numbers. Take $15,000 today and invest it in an S&P 500 index fund. Assuming historical average returns of 7% annually after inflation, that investment grows to approximately $58,100 after 20 years.

Now take that same $15,000 and leave it in a checking account earning zero interest while inflation runs at 3%. After 20 years, you still have $15,000 in nominal terms, but it only buys what $8,310 buys today in real purchasing power. The opportunity cost calculation is staggering. You gave up $58,100 in potential wealth to maintain $8,310 in purchasing power.

You miss out on the magic of compound growth

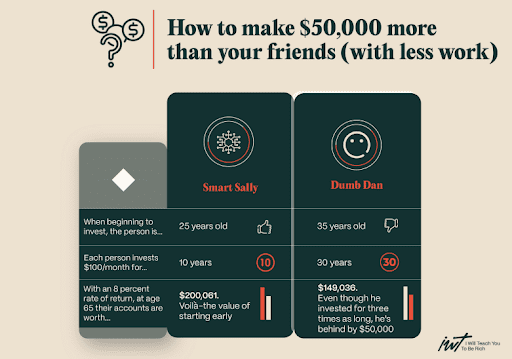

The most painful part about idle cash is that you can't get back the time you lost. I always use the example of Smart Sally and Dumb Dan to illustrate this. Sally invested early and consistently, while Dan kept waiting. Even though Dan invested for 20 more years, he still ended up $50,000 behind.

Time is your biggest asset when building wealth, and idle cash wastes the most precious resource you have. Every year you wait costs you exponentially more than the year before.

Compound growth occurs when you earn returns not just on your original investment, but also on all the accumulated returns that investment has generated over time. The mathematical power of compounding becomes clearer through concrete examples.

If you invest $1,000 earning 7% annually, you have $1,070 after one year.

In year two, you earn 7% on the entire $1,070, giving you $1,144.90.

Year three applies 7% to $1,144.90, creating $1,224.85. Each year, your returns generate their own returns.

The Smart Sally and Dumb Dan example demonstrates this perfectly. Sally starts investing early and consistently builds her wealth through the power of compound growth. Dan procrastinates and thinks he can make up for lost time by investing more money later. Even though Dan invests for 20 additional years beyond Sally's timeline, he still ends up $50,000 behind her.

Here’s What I'd Recommend Instead

Rather than letting your money waste away earning zero, here are two proven strategies that will actually help you build wealth.

1. Put your money in low-cost index funds automatically

An index fund is a type of mutual fund or exchange-traded fund designed to track the performance of a specific market index, such as the S&P 500. Instead of trying to outperform the market through active stock selection, index funds aim to match market returns by buying all the stocks in their target index.

When you purchase shares of an S&P 500 index fund, you're essentially buying tiny ownership stakes in 500 of America's largest publicly traded companies. Your single purchase provides exposure to Apple, Microsoft, Amazon, Google, Tesla, Johnson & Johnson, and hundreds of other major corporations across various industries and sectors.

Index funds deliver several compelling advantages that make them ideal for building long-term wealth:

- They provide instant diversification across hundreds or thousands of companies, reducing the risk that any single company's poor performance would devastate your portfolio.

- They charge significantly lower fees than actively managed funds because they don't require expensive research teams or frequent trading.

- They deliver competitive long-term performance, with studies showing that index funds outperform 80-90% of actively managed funds over 10-15 year periods.

- They require minimal maintenance and monitoring, making them ideal for busy individuals who want to automate their wealth-building efforts.

The expense ratio represents the annual fee you pay to own the fund, expressed as a percentage of your investment. While actively managed funds often charge 0.5% to 2.0% annually, top index funds charge as little as 0.03% to 0.20%. On a $50,000 portfolio, this difference means paying $150 versus $1,000 per year in management fees.

Pick a low-cost index fund that tracks the S&P 500, automate your investments every month, and let compound growth do the heavy lifting.

Low-cost interest funds I recommend

I have always recommended the Vanguard 500 Index Fund Admiral Shares (VFIAX) because it tracks the S&P 500 with an incredibly low expense ratio of 0.04%. Vanguard pioneered index fund investing under founder Jack Bogle, whose philosophy of low-cost, long-term investing has helped millions of ordinary people build substantial wealth over time.

The $3,000 minimum investment might seem high initially. Still, it's worth saving up for because you're getting access to the same institutional-quality fund that billionaires and pension funds use for their portfolios. The Admiral Shares version offers the lowest possible expense ratio and represents Vanguard's premium share class for larger investors.

If you can't meet the $3,000 minimum yet, Schwab's S&P 500 Index Fund (SWPPX) or Fidelity 500 Index Fund (FXAIX) are excellent alternatives with no minimum investment requirements. These funds charge 0.02% and 0.015% respectively, which are even lower than Vanguard's expense ratio. You can start with whatever amount you have available today, even if it's just $100 or $500.

2. Use high-yield savings accounts for your actual emergency fund

A high-yield savings account is a deposit account that pays significantly higher interest rates than traditional savings accounts offered by major banks. While large national banks often pay 0.01% to 0.05% on savings deposits, high-yield accounts from online banks and credit unions currently offer rates between 4% and 5%.

For the money you do need to keep liquid (that 3-6 month emergency fund), don't let it sit in a checking account earning nothing. Move it to a high-yield savings account earning at least 4%. The mathematical difference is substantial even on modest balances.

Brief introduction on how a high-yield savings account can make a difference

Consider a $15,000 emergency fund sitting in a traditional bank savings account earning an annual interest rate of 0.01%. Over one year, you earn approximately $1.50 in interest before taxes. That same $15,000 in a high-yield account earning 4.5% annually generates about $675 in interest income.

The $673.50 difference might not seem life-changing, but it represents meaningful money that compounds over time. More importantly, it demonstrates the principle of making your money work for you even when it needs to remain readily accessible.

High-yield accounts I recommend

I use and recommend accounts from Marcus by Goldman Sachs, Ally Bank, or Capital One 360. These institutions are legitimate banks with full FDIC insurance protection, meaning your deposits are guaranteed by the federal government up to $250,000 per account. They offer competitive rates, user-friendly online platforms, and reasonable customer service.

Check out my detailed recommendations for the best savings accounts with current rate comparisons and account features.

Stop chasing the absolute highest APY as if it were some kind of competitive sport. The difference between 4.2% and 4.5% on $15,000 equals just $45 per year before taxes. Find a solid rate from a reputable institution, set up the account, and focus your energy on bigger wealth-building wins, such as increasing your income, optimizing your investment allocation, or reducing unnecessary expenses.

Living Your Rich Life

I get why having cash lying around feels safe, but the truth is, it's holding you back. Every dollar that just sits there loses the chance to grow and compound, which means you're trading future freedom for short-term comfort.

Picture your Rich Life in specific terms. Maybe it's traveling without guilt, helping your parents, or simply never stressing about bills. These goals become achievable when you invest your money instead of letting it sit idle.

Making the shift from cash hoarding to wealth building requires deliberate action:

- Move your excess cash beyond your 3-6 month emergency fund into low-cost index funds that can grow over time.

- Automate your investments so compound growth works without requiring constant decisions or market timing.

- Accept short-term market volatility as the price you pay for long-term wealth building and financial freedom.

- Focus on increasing your income and career growth rather than obsessing over keeping large cash cushions.

That vision only happens when your money quietly works in the background while you focus on living. The path to wealth isn't complicated, but it requires action over fear and long-term thinking over short-term comfort.