How to Become a Business Owner in 5 Steps

Becoming a business owner doesn’t have to be overwhelming. With these five steps, you’ll learn how to find a profitable idea, set up a simple foundation, manage your finances, make your first sale, and build systems that let the business run without you.

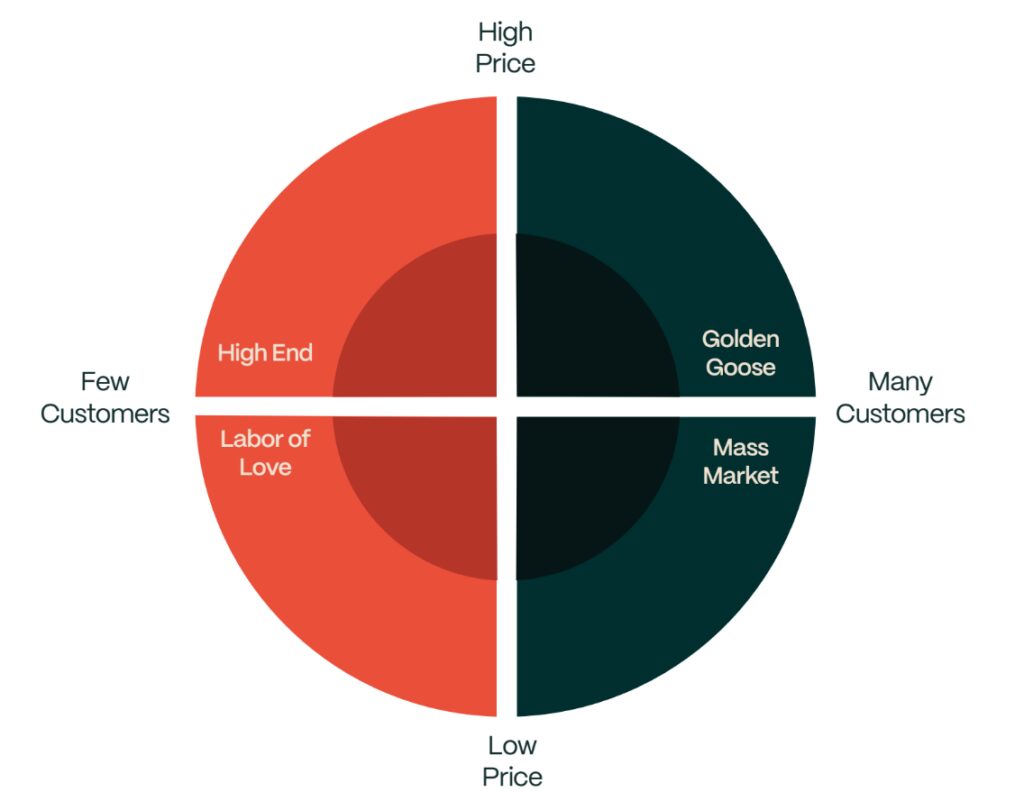

Step 1: Find Your Golden Goose Idea (Using the Demand Matrix)

Not every idea is worth pursuing. The sooner you accept that, the less time you’ll waste trying to turn a mediocre concept into something profitable.

The Demand Matrix helps cut through the noise by categorizing ideas based on two key factors: how many people want the product and how much they’re willing to pay for it. Plot your ideas across this grid, and you'll immediately see which ones are worth your time.

Golden goose (high price, many customers)

This is the sweet spot. If your idea falls here, you’re solving a problem for a large audience and charging a premium for it. Think iPhones, professional software, or high-end online courses. These are scalable, profitable, and in demand.

Mass market (low price, many customers)

These ideas are built on volume. They appeal to a wide audience but depend on lower prices. These are repeatable subscriptions like Netflix or everyday products like coffee. You need to reach a lot of people to make the margins work, but if you do, the concept scales fast.

High end (high price, few customers)

This space is all about niche expertise and premium positioning. Luxury goods, elite coaching programs, or specialized consulting services fit here. These ideas work only if your product or service provides enough value to justify the price tag.

Labor of love (low price, few customers)

This is the danger zone, and where passion projects often land—low demand and low pricing. These can be creatively fulfilling but are rarely sustainable unless you pivot them into one of the other categories. Otherwise, they’re better suited as hobbies.

But how do I come up with the “right” idea?

Most people get stuck trying to brainstorm their way into the perfect business. The problem isn’t a lack of creativity—it’s looking in the wrong places. Instead of browsing generic lists of "hot" business ideas, focus on your own life. Real demand lives in what people are already paying for, what you’re naturally good at, and what your friends turn to you for.

Ask yourself these four questions:

1. What do I already pay for?

If you regularly pay for something—fitness coaching, house cleaning, meal prep, online learning—you’re likely not alone in doing so. That’s a clear sign there's a market.

List three to five services or products you use; these are areas where demand already exists and people are happy to spend.

2. What skills do I have?

You don’t need a breakthrough invention. You need to apply what you already know. Whether it’s public speaking, organizing chaos, teaching, or building trust quickly, you already have leverageable skills.

Make a list of 10 things you're genuinely good at. Don’t worry if they seem small. If they solve a problem, they have value.

3. What do my friends say I'm great at?

Sometimes it takes someone else to point out your blind spots. Ask a few friends or colleagues what they think you do better than most. Their feedback can point you toward talents you take for granted, and therefore potential business opportunities—like always knowing the right thing to say, planning incredible trips, or styling outfits on a budget.

4. What do I do on Saturday mornings?

Your free time says a lot. If you're spending weekends diving into skincare research, tweaking your home setup, or editing videos just for fun, those are natural interests you won't burn out on. When you enjoy the process, it's a lot easier to stay consistent long enough to succeed.

Step 2: Set up Your Foundation Without Overthinking

Most new entrepreneurs get stuck here. They either overdo it with endless planning or skip the basics entirely. You don’t need a 40-page business plan, but you do need a solid foundation. Keep it simple.

The only business structure you need to know

Start with an LLC. It’s affordable, easy to set up, and protects your personal assets. If you plan to seek funding or sell the business later, a C-corp might make sense, but for most people, LLC is the way to go.

Once you’re making consistent income, consider switching to an S-corp to reduce your tax burden. Apply for an EIN right away as you’ll need it to open a business bank account, work with vendors, and file taxes.

Register your business name, check local license or permit requirements, and file a DBA if you’re using a brand name that’s different from your legal one. If you're serious about your brand long-term, consider trademarking it.

Investing in tools and build systems

Choose tools that improve how you work, not just what's trendy. Start with the basics: a professional email address, cloud file storage, and a video conferencing setup that doesn’t make you look like you’re working from a closet. Document your processes as you go—onboarding, client comms, invoicing, even how you manage your to-do list. These become the systems that keep things running smoothly as you scale.

Templates are your best friend at this early stage, so be sure to create reusable email scripts, proposals, and task checklists. They save time, reduce mistakes, and keep your messaging consistent. Finally, track more than just money. Pay attention to time spent, conversion rates, and customer feedback. That’s how you spot problems early and tighten up what matters.

Step 3: Plan Your Business’ Finances

A huge part of running a real business is managing money like a pro. Here are a few tips to remember as you’re starting out:

Calculate your startup costs realistically

List everything—software, equipment, licenses, even your desk chair. Then add 30% to cover what you forgot. Separate one-time setup costs from monthly expenses so you know your true runway. And don’t forget to include personal living costs if you’re quitting a job to start this venture. Being realistic now helps you avoid panic later.

Consider different funding options

There’s no perfect way to fund a business, just the best fit for your situation. Every funding source comes with tradeoffs; you’re either giving up control, taking on risk, or proving your offer in real time. Whatever you choose, know what you’re trading for that money—make the choice that fits your situation, not someone else’s advice.

Bootstrapping

Bootstrapping means starting your business with your own money instead of borrowing or taking on investors. It keeps things simple—no pitch decks, no debt, no outside pressure. You stay in control and learn to spend wisely, which is a skill that’ll serve you long term. Bootstrapping keeps things lean and focused, but it’s not the only path.

Outside funding (bank loans or investors)

If you don’t have savings to lean on, be clear about the tradeoffs that come with outside funding.

Bank loans carry personal risk, and investors will expect a say in how you run the business. That doesn’t mean these options are bad—it just means you need to understand what you’re giving up in exchange for cash.

Crowdfunding

Crowdfunding lets you raise money from a crowd of backers, usually online, in exchange for early access, perks, or support. It’s a great way to test demand before building a full product. If people are willing to pay up front, that’s a strong signal you’re on the right track.

It’s also a marketing test. To pull it off, you have to explain your offer clearly, rally interest, and hit a deadline—all valuable practice for running a business. Crowdfunding takes effort, but when it works, you get both funding and validation at the same time.

Create a financial safety net

Set up two emergency funds: one personal, one for the business. That way, when things go sideways (and they will), you won’t be draining your rent money to cover expenses. Secure funding options before you need them—a line of credit is a lifeline when sales slow—and diversify your income; don’t let one product or client hold your entire business hostage.

Set up the three financial systems that prevent disasters

One of the biggest mistakes new business owners make is treating money as an afterthought. Without clear systems in place from the start, it’s easy to end up overwhelmed—buried in taxes, lost in financial confusion, or facing mounting debt. These three systems are essential so be sure to set them up early, or you’ll be dealing with the consequences later.

1. Separate business and personal accounts

Start by opening a dedicated business bank account and credit card. Keeping your personal and business finances separate isn’t just good practice—it protects you from tax headaches and potential legal issues. Treat your business like a business from day one: if it can’t afford the expense, neither can you.

2. Track every expense

It doesn’t matter whether you’re using a spreadsheet, QuickBooks, or even a shoebox full of receipts—the important thing is to be consistent. Track every dollar coming in and going out because having a clear picture of expenses will give you an idea of what’s actually working in your business and where things need to change.

3. Plan to pay yourself a real salary

Even if it’s a small amount, make it a habit to pay yourself regularly. It draws a clear line between your personal finances and the business—and more importantly, it reinforces that you’re building a real company, not just indulging in a hobby. This simple step shifts your mindset and sets the tone for treating the business with the seriousness it deserves.

Step 4: Making Your First Dollar

Before you spend weeks building out a polished product or service, first confirm that someone actually wants what you’re offering—and that they’re willing to pay for it.

The pre-sale test that saves you months

Instead of building something and hoping people show up, flip the script. Test demand by pre-selling your product or service. Create a simple landing page that clearly explains what you offer and why it matters. Include a call to action where people can put down a deposit, sign up for early access, or commit to a waitlist.

Your goal? Get 10 people to vote with their wallets. If you can’t get that, it’s not a marketing problem—it’s a product issue. This small test can save you months of work and help you adjust before going all in.

Build your minimum viable product (MVP)

Once you’ve confirmed interest, build the simplest version of your offer that solves one real problem well. That’s your MVP. If you’re a copywriter, don’t offer an entire content marketing suite; start with email sequences. If you’re building software, make one tool that actually works instead of five half-baked features.

A good MVP doesn’t try to do everything, it just proves your solution works. Set a fair price from day one. Underpricing to get customers will just attract bargain hunters and skew your feedback.

Track everything your early users say, what they ask for, and what they ignore; this will be the roadmap for version two.

Finding your first five paying customers

Start where trust already exists: your network. But don’t just blast out vague messages. Get specific about what problem you solve and who it’s for. “I help coaches build email funnels that convert” is much more effective than “I do marketing.”

Reach out to past colleagues, friends, or mentors—people who can either benefit directly or introduce you to someone who can. You don’t need a fancy website. A polished LinkedIn profile, a decent landing page, and a clear offer are enough. Show that you can deliver results for a specific group of people, and your first handful of clients will come faster than you think.

Step 5: Create Systems That Work Without You

A real business doesn’t rely on you to keep it running. The more you remove yourself from the day-to-day, the more freedom and scalability you’ll gain. Systems, tools, and people should carry the weight so you can focus on growth instead of fighting fires.

The automation hierarchy

Start by automating tasks that don’t require judgment: scheduling, email replies, form responses, invoice reminders. Use affordable tools like Calendly, Zapier, or email templates to get time back without hiring anyone.

But don’t go getting all the software tools without running the numbers. If a tool saves you 10 hours a month and your time is worth $30/hour, it should cost far less than $300 monthly. Automations can save time, but it’s not a set-it-and-forget-it solution. Revisit your workflows regularly to make sure they still align with how your business actually runs—because things change, and your systems should keep up.

When to make your first hire

You’ll know it’s time to hire when the admin work starts cutting into revenue-generating activities. If you're spending hours on bookkeeping instead of closing sales, that's a signal you should consider outsourcing. Start with contractors so you can test what you need without committing to paying someone a full-time salary.

Before bringing anyone on, document everything you’ve been doing. Standard operating procedures (SOPs) let someone step in and succeed without constant guidance. Think of your first hire as a systems test: If they can’t thrive without you micromanaging, it’s the process—not the person—that needs work.

Building systems that scale

As you grow, your systems need to grow with you. Every recurring task—onboarding, delivery, support—should run without you in the loop. Be upfront about expectations and make sure everyone on your team knows exactly what “done right” looks like.

Don’t wait until you’re overwhelmed to put these systems in place. Build them while things are still manageable, so when growth hits, you’re ready.

The Five Brutal Truths About Business You Need to Know to Succeed

No matter how smart or prepared you are, running a business will teach you things the hard way. Most people quit because they weren’t ready for the unglamorous parts. These five truths give you a clear view of what actually happens in the first year.

Truth #1: Your "unique" idea doesn't matter

Originality is overrated. Execution is everything. Facebook wasn’t the first social network, Netflix didn’t invent streaming, and Apple didn’t invent the smartphone—they just did it better.

Your job isn’t to come up with something no one’s seen before. It’s to improve on something that already exists with sharper positioning, better service, or clearer messaging. Stop waiting for a one-in-a-million idea and start with something proven. Then make it your own.

Need inspiration? Here’s a list of business ideas to get you started.

Truth #2: You'll work harder than any employee (at first)

The early days of being a business owner will not be glamorous. You’ll wear every hat: marketing, customer support, billing, even IT. You’ll answer emails at midnight and fix broken links before breakfast. Those early, scrappy days teach you what works, what doesn’t, and where your systems break.

Over time, the grind eases as you build leverage through automation and hiring. But early on, expect to outwork any employee you’ll end up hiring down the line. That’s the tradeoff for building something that’s yours.

Truth #3: Most people will think you're crazy

Friends, family, even colleagues will raise eyebrows. They’ll ask why you don’t just stick with a steady job. Some will assume you’re “playing entrepreneur” or avoiding real responsibility. That’s normal. You’re doing something most people don’t have the guts to try. Get comfortable with their discomfort. You’re not here to explain yourself—you’re here to build. Let your results do the talking.

Truth #4: Your customers are the boss, not you

Running a business doesn’t make you your own boss; it makes your customers the boss. You’re now responsible for results, not just effort. That means delivering consistently, solving real problems, and fixing what breaks without excuses.

The upside is that if you build strong systems, you can serve your customers well without being chained to your laptop. But make no mistake: This is more responsibility, not less. You have to earn the freedom you’re chasing.

Truth #5: Modern business ownership is all about change

Everything changes constantly. The platform that worked last year might flop this year. Customers expect more, faster. Tools evolve, markets shift. Running a business today means staying flexible and learning constantly. It also means blending life and work in ways most jobs don’t. You might be reviewing analytics on a Saturday or responding to client messages from your phone after dinner. It’s not always pretty—but it’s yours. And that tradeoff is worth it.

The Real Reasons Most People Never Start (And How to Be Different)

You don’t need more permission. You don’t need another course or certification. You need to start. Most people stay stuck in preparation mode, thinking they’re being smart. If you want to be different, start before you’re comfortable and treat the early stumbles as part of the process.

Your fear of failure is keeping you broke

People convince themselves they need to “get everything in order” before they start. But the truth is, failure is the teacher, not the enemy. Every business owner who’s made it has failed at something. What matters is how fast you learn and adapt.

Start small, test often, and treat every stumble as data. While you're still researching, someone else is out there building—and winning.

You’re stuck with analysis paralysis

We love to believe we’re being productive when we’re buried in research, podcasts, and endless YouTube videos. But at some point, that knowledge hoarding becomes a security blanket. You tell yourself you’re preparing—but what you’re really doing is avoiding the discomfort of starting.

Real business decisions come with uncertainty, and no amount of Googling will eliminate that. If you want momentum, you have to force it. Set tight deadlines for yourself—one week to pick your structure, two weeks to choose a niche. Launch a simple version, get real feedback, and course-correct from there. Business isn’t theoretical; you learn by doing.

You're waiting for permission that will never come

No one is going to show up and tell you it’s time to start your business. There’s no boss to approve your idea, no degree that makes you “ready,” and no magical sign from the universe saying, “Now you’re good enough.”

The truth is, successful entrepreneurs start messy. They build while they learn. Yes, they make mistakes, but that’s part of the job. If you’re waiting until you feel qualified, you’ll be waiting forever.

You’re worried about financial security

One of the smartest ways to start a business is by not quitting your job right away. Keeping your 9-to-5 gives you stability while you test your offer, learn the ropes, and work out the kinks without panicking about bills. That paycheck becomes your built-in investor, funding your early expenses and giving you the freedom to experiment without desperation.

Use evenings, weekends, or even your lunch break to work on the business. Focus on validating your offer, building consistent revenue, and setting up basic systems before going all in.

A good rule of thumb: When your business consistently brings in 50% or more of your salary for a few months, then you can start planning your exit.

You think you need lots of startup capital

A lot of people never start because they think they need a giant cash reserve or a $50,000 loan. In reality, most successful businesses don’t need a massive investment—they need validation and execution. Restaurants and retail stores require high capital and often have slim margins, which is why they fail so frequently. Meanwhile, service-based businesses, coaching, freelancing, and selling digital products can start lean and scale sustainably.

You can build a real business with less than $1,000 if you’re resourceful and focused. Reinvest your first sales back into better tools, improved offers, and more reach. Don’t let lack of funding become your scapegoat—money can’t fix a weak offer or a market that doesn’t care. Focus on solving a problem, getting your first customers, and building systems that actually work. The capital will follow once the business proves itself.

Living Your Rich Life as a Business Owner

Success as a business owner isn’t just about generating a lot of revenue. It’s about building something that fits the life you actually want. Too many entrepreneurs grind their way into a business they secretly hate because they skipped the step where they defined what a good life looks like.

How do you want to spend your days? What kind of clients energize you? What kind of work makes you feel proud? Build a business that supports those answers.

While these five steps will give you the foundation to get your business off the ground, creating a life you genuinely want to live requires something more. When you begin with intention and stay aligned with your values, you won’t just build a source of income—you’ll build a path to lasting freedom.