How To Send a Credit Report Dispute Letter (with scripts) [2025]

![How To Send a Credit Report Dispute Letter (with scripts) [2025]](https://www.iwillteachyoutoberich.com/wp-content/uploads/2023/02/390-1024x683.jpg)

Your credit report dispute letter is a letter you send to credit bureaus to dispute any errors that are on your credit report.

And it can be CRUCIAL to improving your credit score. Because the smallest error can affect your score.

For instance, if your credit report says that you were late on your payments when you actually paid them on time, that affects nearly a third of your credit score, since 30% of it is determined by the amount you owe.

That’s why it’s so important to dispute any errors you find on your report.

With so many credit report dispute letter scripts out there, which do you choose?

This one:

Hello,

I want to dispute the following information in my file. The items I dispute also are encircled on the attached copy of the report I received.

- X is wrong because Y. I have attached a receipt showing this.

- A is wrong because B. On December 21st, I sent an email (“Correct my record”) requesting the change.

- C is wrong because D.

I have also included my payment records. Please make sure that these errors are rectified soon.

-Ramit

BUT let’s take a step back and get a bird’s-eye view of this letter, why it works, and the exact steps you need to take in order to dispute errors on your credit report.

How to dispute errors on your credit report (with scripts)

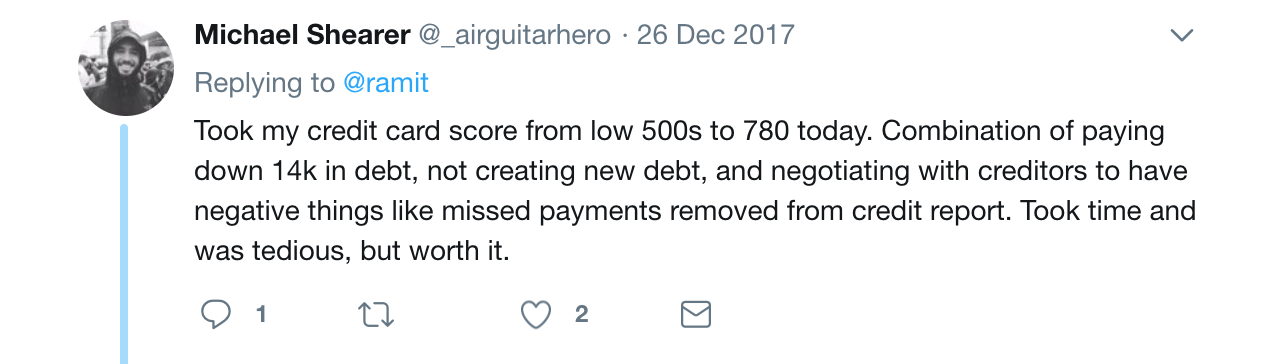

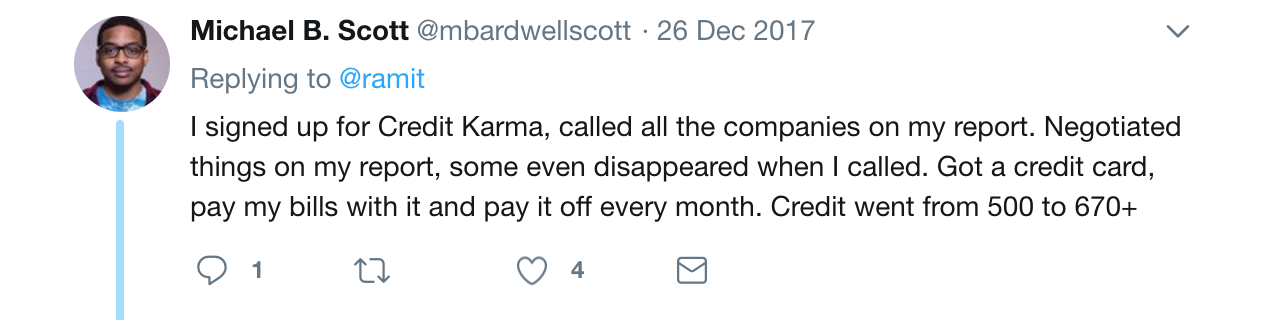

I asked my readers how they improved their credit scores a while back — and disputing errors on their credit reports was one tactic that kept coming up.

You can turbocharge your credit score by finding and disputing the errors in your credit report.

The process is going to be fraught with tense negotiations, countless emails sent, and late nights slaving over a hot spreadsheet while screaming into a telephone with your credit card company’s outsourced customer support line.

Just kidding! It just takes four steps:

- Step 1: Get your credit report

- Step 2: Find all errors on your credit report

- Step 3: Send this credit report dispute letter script

- Step 4: Receive the credit report dispute results

Step 1: Get your credit report

To dispute any errors on your credit report you must first get your credit report.

Your credit report is an all-inclusive record detailing your credit history and information such as your:

- Loan history

- Accounts opened and closed

- Payment history

- Credit balance

Credit bureaus issue your credit report based on information they receive from “data furnishers,” or creditors you’ve worked with (more on this later).

There are three major credit bureaus that will provide credit reports for you:

These are the primary credit bureaus — and the same ones that creditors, lenders, employers, and even potential landlords use to make sure that you’re good about paying back debt on time.

If your credit score is good (700+), you are fine just checking your credit report once a year.

If you find yourself with bad credit (<700) or if you think you’ve been unjustly denied anything due to your credit score, though, you’ll want to get your credit report to dispute anything erroneous in there.

Luckily, you’re entitled to a free credit report each year from each of the three major credit bureaus, per the Fair Credit Reporting Act. To attain it, head to AnnualCreditReport.com (a site recommended by the Federal Trade Commission).

NOTE: If you’ve already used up your free credit report for the year, you’ll still be able to attain it — you’ll just have to pay a fee through the specific credit bureau.

Sites like Credit Karma will allow you to view your TransUnion and Equifax credit report for free. However, in exchange, you’ll have to view advertisements for their credit offers.

When requesting your credit report, you’ll fill out a form online that includes basic information (name, address, DOB, etc.) and also your social security number. Once the form is filled out, you’ll send that information in and receive your credit report in minutes.

Alternatively, you can also order a physical copy of your report by calling the toll-free number 1-877-322-8228. You’ll be asked to provide the same information as if you did it online.

If you ordered your credit report via phone, you’ll receive a copy of it “within 15 days of receipt,” according to the FTC.

If you ordered your credit report through the website, though, you’ll be able to view your credit report right away.

BONUS: Check out this quick video I made a while back explaining how you can check your credit score and get your credit report.

Once you receive your report, it’s now time to find any and all errors that might be in there.

The world wants you to be vanilla...

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

Step 2: Find any errors

A credit report error is simply anything that’s wrong in your credit report. That means making sure that everything on your credit report accurately reflects your actions as a borrower.

The Consumer Financial Protection Bureau provides a substantive list of common errors that you might encounter in your report.

They include:

- Identity errors. These are any issues with erroneous identity. Example: The report got your name or address wrong, they mixed you up with a person with your name, or even cases of identity theft.

- Incorrect reporting of account status. These are errors within your individual accounts. Example: When the report says you have an account closed/open when it isn’t, it says you were late on an account payment when you weren’t, or when they report the same debt multiple times.

- Data management errors. This happens when you’ve disputed your credit report already and the same errors appear on your next report. Example: You’ve sent a credit report dispute letter about an account you’ve already closed but your next report still contains the error.

- Balance errors. It shows the wrong balance in your accounts. Example: It says you owe $500 when you really owe $300.

Identifying these errors is crucial to your credit report dispute letter. So go through your credit report, line by line, and note any and all errors you find.

And there’s no one way to do this. You can print out the credit report and mark it up with a pen and highlighter, or you can just go through it and make notes in a notebook or a Google Doc. Any method works as long as you note all of the errors.

Once you’ve found all of the errors, it’s now time to draft your credit report dispute letter.

Step 3: Send this credit report dispute letter script

Now it’s time to use that email script I gave you at the top.

This one:

Hello,

I want to dispute the following information in my file. The items I dispute also are encircled on the attached copy of the report I received.

- X is wrong because Y. I have attached a receipt showing this.

- A is wrong because B. On December 21st, I sent an email (“Correct my record”) requesting the change.

- C is wrong because D.

I have also included my payment records. Please make sure that these errors are rectified soon.

-Ramit

A few notes:

- Just get straight to the point. Just like when you’re writing a cover letter or your resume, each word needs to earn its spot on the page. Your credit report dispute letter should be the same. No messing around. Just get straight to the damn point!

- Give them their exact errors with evidence. Note exactly what you are disputing and provide evidence to make your case. Be as comprehensive as you need to be and include specific dates, payment amounts, and account names.

- Enclose your copy of the credit report. Include your own copy of the report wherein you’ve highlighted the errors. If you’ve already marked up your own copy of the report for step two, this is a perfect place to send in your handiwork.

Also, remember to keep a copy of the credit report for your records. If there’s another data management error in the future, you’ll be able to use it to dispute the error.

Now it’s time to decide where you want to send your credit report dispute letter. You have three options:

- The credit bureau

- The data furnisher

- Both

Guess which one will increase your chances of having the dispute work?

If you want to send your credit report dispute letter to a specific credit bureau, here are the links to exactly where you can send your dispute.

- Experian: https://www.experian.com/disputes/main.html

- Equifax: https://www.equifax.com/personal/disputes/

- TransUnion: https://www.transunion.com/credit-disputes/dispute-your-credit

If you want to send your credit report dispute letter to a data furnisher, you’re going to have to handle that yourself since it’s specific to you and your financial situation.

Once you’ve sent in your credit report dispute letter, it’s time to play the waiting game (everyone’s most favorite game of course).

Step 4: Receive the credit report dispute results

Luckily, you don’t generally have to wait too long. The Consumer Financial Protection Bureau requires credit bureaus and data furnishers to “investigate the dispute within 30 days of receiving it.” After completing the investigation, they have five days to send you the results.

However, there are a few things to note:

- If you send in additional pieces of information regarding the dispute during the first 30-day investigation, they can extend it for 15 more days.

- They have 45 days if you send in your credit report dispute letter AFTER receiving your free yearly credit report.

Once the investigation period is up, though, congrats! You’ve successfully disputed with the credit bureaus using a great credit report dispute letter!

You’ll now receive a few things. First, you’re going to get a complete summary on what the credit bureau discovered and the actions they decided to take to rectify the errors.

If they decided that what was in the previous credit report was correct, then they’ll tell you that as well.

The credit bureau will also send you a brand new updated copy of your credit report (Note: This is NOT your annual free credit report) and you can frame it and put it on your office wall so you can let everyone know how much of a weirdo you are. I like to put them on my mantle like hunting trophies.

What to do if your credit report dispute didn’t work

You might run into a case where your credit dispute didn’t work and you didn’t get the changes you wanted reflected on your report.

It typically means that the issue you were trying to report wasn’t actually an error when this happens — and that’s okay. There are still many different ways you can improve your credit.

Here are a few resources you can use to get started doing that today:

Getting out of debt and improving your credit score is crazy important. I cannot stress that enough.

There’s a reason it’s on the second rung of my ladder of personal finance.

To help you even more, I’d like to offer you something: The first chapter of my New York Times best-seller “I Will Teach You to Be Rich.”

It’ll help you tap into even more perks, max out your rewards, and beat the credit card companies at their own game.

I want you to have the tools and word-for-word scripts to fight back against the huge credit card companies. To download it free now, enter your name and email below.

If you liked this post, you’d LOVE my Ultimate Guide to Personal Finance

It’s one of the best things I’ve published (and 100% free), just tell me where to send it: