Should I Buy A New Or Used Car? Pros, Cons (& getting a great deal)

“Should I buy a new or used car?”

If you asked almost every personal finance pundit that question, they'll give you a bunch of reasons why you should buy a used care instead of a new car.

I disagree.

Used cars can be a good way to go. But it's short-sighted to apply a broad rule that used cars are the best option for everyone.

I think there are many more reasons why people should buy a new car than a used one. Here’s why.

Should I Buy a New Car or a Used Car in the Long Run?

It will depend on the type of car you buy, and the condition you buy it in.

That said, if you're going to buy a decent make that's in really good shape, you might land yourself a bargain.

However, here's the rub.

Do you know enough about cars to know whether you're buying a hole in your pocket?

Even if it's a good make, you can't be sure that the previous owner didn't do donuts in the Best Buy parking lot after dark.

In the long run, a new car might end up costing less because there's less to fix.

All car parts have a life span and eventually, you're going to look at replacing things. Expensive things.

A great way to pay for these unexpected expenses is with a side hustle or your own business.

Earnable gives you all the exact strategies, frameworks, hands-on tactics, real-world examples, mindsets, done-for-you templates, word-for-word scripts, and hard-won breakthroughs to start and grow your own business. Click here to learn more.

Is Buying a New Car Worth It?

New cars get a bad rap from financial pundits because the assumption is that you're going to spend your money on something you can't afford, doesn't make sense, and worse, is over the top.

If you're going to do that, you might end up resenting the purchase. Even worse, it might land you in financial trouble.

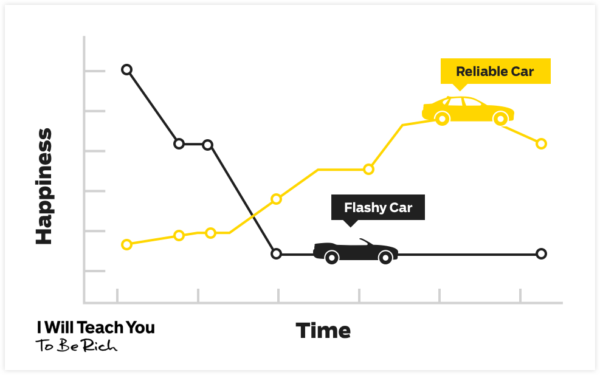

A new car is cheaper when it costs you less in installments and maintenance than a second-hand car. But it's not just about the actual money spent. It's also about your own emotional well-being knowing your car isn't going to overheat and flake out in traffic every Monday morning.

If you're asking, “Should I buy a new car?”, the answer is yes. But, only if it meets your needs and fits within your budget.

Pros of Buying a New Car

- One of the best reasons to buy a new car is, everything’s new, including the parts. Even if something goes wrong, most manufacturers have a warranty for the first year or two.

- Insurance is cheaper. This is because there is less risk of mechanical failure. But it's not a guarantee. When buying a new car, check to see whether it's high-risk in some way. Opt for cars that are in the low-risk category to benefit from an insurance drop.

- Peace of mind. What’s worse than planning a trip away for the weekend and spending half the week fixing the car to get it ready? Or having your mechanic on speed dial instead of your spouse? A new car shouldn’t give you gears, and when it does, there's the manufacturer’s warranty to fall back on. The point is, you know that if you fill it with gas and perform routine maintenance, the car should get you from point A to point B. Can you say that about the oldie-but-cheapie being punted by the second-hand car salesman?

- Resale value. This is where you take out your Kelley Blue Book and compare the car you're looking to buy. If you happen to choose the right make, you might end up with a good deal. I have a friend who bought an Acura Integra for $20,000. She drove it for seven years and managed to sell it for 50% of the purchase price. She got incredible value in the long run with her new car purchase.

- Latest technology. The latest technology ensures access to advanced safety features, and enhanced connectivity options, providing a more secure, efficient, and enjoyable driving experience. Additionally, new cars often come with comprehensive warranties and the assurance of updated software and hardware, reducing maintenance costs and providing peace of mind for the long term.

- Fuel economy. Let’s face it, technology has come a long way the last few years and when it comes to cars, fuel efficiency is a hot topic. Spending a few extra dollars at the fuel pump adds up.

- The environment. There is something to be said for driving a car you know passes all those emissions tests. You don’t necessarily have to take the plunge to a Prius unless you want to. Cars built after the nineties are built with the Clean Air Act regulations. However, every year the benchmark drops in order for cities and nations to meet emissions targets. This means that your gas-guzzling truck from the sixties may need to undergo a few modifications to meet modern emissions standards.

- That new car smell. It's evocative and sexy and it doesn't matter whether you go for the Toyota or the Dodge. New car smell is new car smell.

Cons of Buying a New Car

- That downpayment. Car loans generally require a 10% to 20% downpayment and if you're looking at a $25,000 car, the downpayment is quite steep.

- It’s expensive upfront. No matter which way you slice it, a new car is expensive. If you happen to be in a family of six, an entry-level Chevrolet Spark just won’t cut it. You need to aim for the $ 20,000 mark to find a car that suits your needs and that means an affordability check.

- It might not be affordable. Let's do the math and for that, we have the 20/4/10 rule. It works like this:

- 20% down payment: Not being able to put down a 20% downpayment on your car may mean that you're not ready for it yet. It's also worth noting that these savings should be separate from your emergency savings.

- 4-year term or less: The longer you pay for your car, the more interest you pay in the long run. Try to aim for a term that's 4 years or less.

- 10% or less of your gross monthly income: If the car installment and all the other car-related costs are more than 10% of your gross monthly income, you might be biting off more than you can chew.

- The bells and whistles. When you buy a car straight from the dealership, expect to be sold to. That salesman is going to want to hit his sales target which means super fancy rims, that impressive sound system, and the works. Do your homework beforehand and know what you want before you even walk in there. Electric windows, satellite radio, leather seats, whatever you consider the bare minimums you're willing to fork out for.

- It messes with your Rich Life. The minute you feel pressured into buying a new car for reasons other than the most practical (or because buying it new IS part of your Rich Life), it might be time to re-evaluate. Is it societal pressure, will it take you longer to live your Rich Life? If the answer is yes, get outta Dodge (the dealership).

When You’re Better Off Buying Used

Sometimes a new car isn’t worth it in the long haul. Look for a certified pre-owned car that ensures you're getting what you're paying for.

Pros of Buying a Used Car

- It was less expensive initially. If you need small installments and low down payment, then a second-hand car is a better option.

- It's a good choice for the short term. If you're looking to change your car in a few years and simply need a car to fill the gap, a second-hand car might be a good fit. Be sure to put money aside for services and maintenance so you keep it in good running condition until you're ready to sell.

- You’ve bought a car that holds its value. There are some cars that simply hold their value well and even if you buy it second-hand, selling it a few years later won’t be a tremendous loss.

- You don't qualify for finance. This could be due to affordability or a low credit score. A used car is ideal if you're looking to buy a car in cash.

Cons of Buying a Used Car

- No lemon protection. With a new car, when life hands you a lemon you can hand it back to the dealer. Used cars could have a number of things wrong and even when you source from a reputable dealer, there could be underlying issues. If your used ride doesn’t come with a warranty, you’ll be stuck with it. Spend a little extra and have the car looked over by an industry professional.

- Fuel efficiency. If you're going for the car that made all the girls crazy in high school, chances are you're also spending a ton on gas. Modern engines enjoy modifications that make them run better on less fuel.

- Financeability. Not everyone will want to finance your 11-year-old beater. And when they do, they might add on some interest and a larger down payment to reduce their risk.

- Insurability. When you think car insurance, think risk. The older the car, the riskier it becomes to ensure it because its reliability starts declining. What that means for you as an owner is increased insurance premiums.

- Unreliability. Your used car is far more likely to give you up, let you down, and desert you than a new one.

How to Save Money on a Car

In order to make sure that buying a new car is worth it, don't just walk into a dealership and purchase the first car that catches your fancy. Do your research to make sure in the future you will be proud of your purchase.

Pick a good car (and keep it for the long haul)

Buying a car is a serious commitment.

While it may be a depreciating asset, which means that the car value decreases over time, it should still make sense in the long run.

A good car will have more than just great horsepower and top speed.

Great attributes to look out for include:

- Serviceability. Do research on the availability of parts and the cost of services. For instance, car makers such as Nissan and Toyota might be imported, but they're easy to service and the parts are cost-effective.

- Reputation. What do drivers say about their cars? Do they enjoy good ratings on automotive blogs? More importantly, check out the safety rating. If it's below a 4 out of 5, you might want to hold off, especially if you want to keep it for the long term.

- Auto insurance cost. There are some vehicles that have a higher insurance rate purely because they carry a bigger risk, such as theft or mechanical issues. Find out which these are and look the other way.

- Resale value. Look for the cars that are the most popular on the certified pre-owned floor. These cars retain their reputation and dealers are willing to put their stamp on it.

If you’ve read this far, you’d LOVE Ramit's New York Times Bestselling book

You can read the first chapter for free – just tell us where to send it:

Negotiate with dealers

First off, know when to buy a new car and when is the right time to go to a car dealership.

Try towards the end of the year when everyone’s trying to close those final sales for their year-end commissions. But that's not the only reason you want to go towards the end of the year.

Dealers will also want to get rid of the stock for that year to make way for the shiny new stock. This means that if you buy in November 2021, you'll drive a 2021 model.

However, dealers start getting their 2022 stock in December which means you can register your car as a 2022 model. By opting for the 2021 model, you can negotiate a lower price.

Stand firm on this, if you feel like the dealer is trying to strongarm you, walk away. There are plenty of dealers trying to get rid of their stock, even if you need to drive across town to another dealership.

Get A Great Interest Rate

Before you even head out to the dealership you should know what your credit score is. A good credit score is a great bargaining chip for a good interest rate. When you feel like the rate offered isn't as good as it can be, then it's time to shop around.

A difference of 2% can make a tremendous difference.

For instance, a $20,000 loan over a period of 48 months at a rate of 2.39% will cost around $438 per month. At a rate of 4.39%, that installment jumps to $456. That is $864 over the loan period.

Your credit score is at the heart of securing the lowest interest rate possible.

Get a straightforward loan

Don’t bother with shiny finance agreements that leave you confused and possibly out of pocket. The simplest option is often the best. Some of the more common options are:

- Secured auto loan (simplest). This loan type protects the lender by allowing them to secure the asset, which is done by means of a lien over the car. That means that the lender can repossess your car if you fall behind on payments. This is the simplest loan type and works out cheaper because the lowered risk usually means a lowered interest rate.

- Unsecured auto loan. This is much like a personal loan and because there's a higher risk for the lender, tends to be a bit more expensive.

- Lease. This is a no-go for anyone who wants to keep their car for the long haul. A lease might be cheaper in installments, but to own the car at the end of the term, you need to pay a lump sum to assume ownership. This is not for everyone and can be confusing and costly.

Take Good Care of Your Car

Take out a service plan and make sure to keep those services up to date. The better you maintain your car, the less likely you are to run into expensive, avoidable issues such as a seized engine.

Not only will this allow you to keep the car longer, but possibly also retain a good resale value.

Where to Buy: Dealers or Direct?

Deciding whether to buy a car from a dealership or directly from the manufacturer depends on individual preferences and circumstances. Dealerships provide a convenient one-stop shopping experience, offering a range of vehicle options, financing, and after-sales services. On the other hand, buying directly from the manufacturer can sometimes result in lower prices, especially for brand-new models, and may provide more direct access to customization options and factory incentives. Consider personal priorities such as convenience, pricing, and specific vehicle needs when choosing between the two options.

When to Buy a Car

The absolute best time of year to buy a car is December. Like any other salespeople, they have quotas. They often come in the shape of monthly, quarterly, and yearly goals for the number of cars they have to hit.

This means that your car purchase could determine the difference between their dealership hitting their sales goal and the salesperson receiving a nice annual bonus or…well, not doing those things.

That’s why December (more specifically, the last week of the month) is the best time of year to buy a car.

The Bottom Line

A car should be viewed as a worthy asset and as such, it's worth doing the math to make sure your money is not just flying out the exhaust. A new car is not the financial burden it's made out to be when you do the homework and buy responsibly.

Frequently Asked Questions For Buying A New Car

Is it best to buy a new or used car?

It depends on you and what you want. It can absolutely make sense to buy an expensive new car over the long term because of the total value concept. Save even further on a new car by taking advantage of end of the year deals as well.

Is it worth it to buy a new car?

Yes, depending on what you buy. The total value of a new car can be far greater than a used car.

What are the advantages of buying a new car as compared to a used one?

Some of my favorite reasons for buying new are the experience of owning a brand new car, great loan deals (if your credit is good), and potentially greater total value.

How much does depreciation impact the value of a new car?

Depreciation refers to the disparity in a vehicle's worth at the time of purchase compared to its value upon resale. While the degree of depreciation varies depending on the specific make and model, it generally ranges from 15% to 35% within the initial year and can reach 50% or higher over a span of three years.

How does financing differ for new and used cars?

The financing options for new and used cars differ in a few key ways. When it comes to new cars, manufacturers and dealerships often offer special incentives such as low or zero-percent APR financing or rebates. On the other hand, used car financing usually involves higher interest rates due to factors like the vehicle's age, mileage, and overall market value. Additionally, lenders may have stricter requirements for used car loans, including shorter repayment terms and higher down payment percentages.

How do I assess the condition of a used car before buying?

Assessing the condition of a used car before purchase involves several steps. Start by thoroughly inspecting the exterior and interior for signs of wear, damage, or inconsistencies. Next, take the car for a test drive to evaluate its performance, handling, and any potential issues. It's also advisable to obtain a vehicle history report to check for past accidents, maintenance records, and any title issues. Additionally, consider hiring a trusted mechanic to conduct a pre-purchase inspection for a comprehensive evaluation of the car's mechanical and structural condition.

Budgeting is unsustainable. Start “Conscious Spending” instead.

As seen on the IWT podcast, the Conscious Spending Plan helps you buy the things you love, guilt-free.