ChubbyFIRE Explained (The Comfortable Path to Retirement)

ChubbyFIRE offers a middle path to early retirement, with annual spending between $80,000 and $150,000 and investment targets of $2 million to $3.75 million. This balanced approach lets you enjoy moderate luxuries and quality experiences without requiring extreme frugality or the massive wealth needed for FatFIRE.

What Is ChubbyFIRE And How Much Do You Need?

ChubbyFIRE targets annual spending between $80,000 and $150,000, requiring approximately $2-3.75 million in investments using the 4% withdrawal rule.

This approach offers a lifestyle that includes moderate luxuries without the extreme savings of LeanFIRE (the more frugal version of FIRE) or the wealth requirements of FatFIRE (the luxurious version of FIRE).

Most followers can maintain upper-middle-class comforts like occasional travel, regular dining out, and quality healthcare while still retiring significantly earlier than the traditional retirement age.

How ChubbyFIRE Compares To Other FIRE Approaches

Let’s first compare how ChubbyFIRE compares to other FIRE approaches to figure out if it’s the right route for you.

The spectrum of FIRE lifestyles

The FIRE movement includes several variations, each with different spending levels and required investment amounts.

- FIRE (Financial Independence, Retire Early) is the standard approach with annual spending of $40,000-$80,000, requiring roughly $1-2 million in investments.

- FatFIRE represents luxury early retirement for those who spend $100,000-$300,000+ annually. You should have $2.5-7.5 million or more in investments.

- ChubbyFIRE occupies the sweet spot between traditional FIRE and FatFIRE, with yearly spending of $80,000-$150,000 and investments of $2-3.75 million.

- LeanFIRE focuses on extreme frugality, with annual spending under $40,000 and a need for approximately $1 million or less in investments.

These different approaches show that financial independence comes in many forms. Your personal values and lifestyle goals should determine which path makes the most sense for you.

The main features of ChubbyFIRE

ChubbyFIRE offers several advantages that make it attractive for those seeking balance in their early retirement journey. You gain freedom to enjoy moderate luxuries without constant budget monitoring or feelings of restriction. This means occasional nice restaurant meals, quality clothing, and comfortable living without stress about every dollar.

The approach provides flexibility to handle unexpected expenses without jeopardizing your financial security. With a larger financial cushion than LeanFIRE, you won't panic when the car needs repairs or medical bills arrive.

ChubbyFIRE allows greater geographic freedom than traditional FIRE, letting you live comfortably in moderately expensive areas rather than being forced to low-cost regions. While San Francisco might remain challenging, many desirable cities and suburbs become accessible.

Also, your budget has room for quality experiences, occasional splurges, and important life events without financial stress. You can attend friends' destination weddings, take annual vacations, or enjoy hobbies without derailing your financial plan.

The typical ChubbyFIRE follower

ChubbyFIRE tends to attract certain types of people whose values and circumstances align well with this middle-path approach. The typical ChubbyFIRE follower often fits these characteristics:

- Balanced professionals with solid middle to upper-middle-class incomes who value both work satisfaction and leisure time - engineers, healthcare professionals, and mid-level managers are common in this group

- Quality-focused consumers who enjoy comfortable living without needing luxury brands or status symbols - they invest in what matters to them while avoiding unnecessary extravagance

- Disciplined savers who consistently invest 30-50% of their income without extreme frugality, allowing them to build substantial wealth while enjoying life along the way

- Experience seekers who value meaningful activities, travel, and time freedom more than accumulating possessions or keeping up with trends

These individuals typically aren't trying to escape terrible jobs but rather seeking more freedom and flexibility in mid-life, often planning to exit or reduce hours by their late 40s or 50s.

Common ChubbyFIRE financial targets

Investment portfolios typically range from $2 million to $3.75 million, depending on the desired spending level and withdrawal strategy. This provides $80,000-$150,000 annual income using the 4% rule, or slightly less with more conservative withdrawal rates.

Annual retirement budgets fall between $80,000 and $150,000, providing room for moderate comforts and occasional luxuries. This spending level allows for quality healthcare, regular travel, dining out, and comfortable housing without extravagance.

You should also aim for paid-off homes or low housing costs, accounting for no more than 25% of your annual budget. Eliminating or significantly reducing mortgage payments provides tremendous financial flexibility in retirement.

Healthcare planning includes comprehensive coverage with room for out-of-pocket expenses and future cost increases. ChubbyFIRE budgets typically allocate $12,000-$24,000 annually for quality healthcare before Medicare eligibility.

Is ChubbyFIRE Right For You?

Not everyone is suited for the ChubbyFIRE approach. It takes a lot more discipline than LeanFIRE and even traditional FIRE.

Your lifestyle preferences and priorities

ChubbyFIRE might be the right approach for you if:

- You value quality over quantity and willingly spend on things that truly matter while cutting costs elsewhere - like investing in a well-made kitchen that brings daily joy while skipping trendy electronics

- Moderate comforts matter to you, including occasional travel, regular dining out, and pursuing hobbies that enhance your quality of life without extreme luxuries

- You prefer security with flexibility rather than cutting expenses to the bone, wanting the peace of mind that comes from having financial breathing room

- Community and location hold importance in your life, whether that means living in a pleasant neighborhood, staying near family, or having resources to help others and contribute to causes you care about

These priorities create a natural alignment with the ChubbyFIRE philosophy, where balanced choices lead to both present enjoyment and future freedom without the extremes of either severe frugality or lavish spending.

Why protecting your future spending power matters

Michelle and Ryan’s story highlights what can happen if your current spending habits slowly erode your financial security. Even with a solid net worth, they were living beyond their means.

Their savings were being drained little by little, creating a quiet crisis that grew larger each month. Without adjustments, even a strong financial foundation can crumble over time.

| [00:29:08] Ramit: This is a crisis. What is going through your head when you see 113% going towards fixed costs?

[00:29:17] Michelle: That it’s not sustainable. I don’t have a timeline on that, but I know that it’s not sustainable, that we cannot exist this way. [00:29:25] Ramit: What’s going to happen? [00:29:27] Michelle: We will actually be broke, as in savings will be eaten away to nothing. [00:29:33] Ramit: Correct. You’ll run out of money. [00:29:35] Michelle: Yeah. [00:29:36] Ramit: Okay. Ryan, what do you think my perspective is? [00:29:38] Ryan: It’s a sinking ship. It can’t continue this way because we will run out of money. It’s the numbers. That’s what the numbers are. They don’t lie. |

Their experience shows why planning for sustainable spending is just as important as saving enough to retire. ChubbyFIRE is about finding the balance between enjoying life now and protecting your future. Without careful attention to both sides, you risk reaching your goal only to watch it slip away over time.

Your comfort with financial trade-offs

The ChubbyFIRE approach balances present enjoyment with future freedom, requiring comfort with thoughtful compromises rather than all-or-nothing thinking.

Working a few more years than LeanFIRE followers feels worthwhile for the additional security and lifestyle benefits you'll enjoy. Saving 30-50% of your income strikes you as sustainable - challenging enough to make progress but not so extreme that you feel constantly deprived.

You naturally distinguish between spending that genuinely improves your life versus spending driven by habit or social pressure. This mindfulness about money helps you make consistent progress without feeling restricted, as you're directing resources toward what truly matters.

Your career satisfaction and timeline

ChubbyFIRE works particularly well for those with a healthy relationship with their work. You likely enjoy aspects of your career but want more control over your time and projects as you enter middle age.

Your career provides both satisfaction and solid income that supports your dual goals of current comfort and future security. The skills you've developed could potentially translate to flexible or part-time work after reaching financial independence, creating options for a gradual transition into retirement.

Job stability gives you confidence in projecting 10-15 more years of solid earnings, allowing you to plan with reasonable certainty while maintaining work-life balance along the way.

Your relationship with spending

Your spending habits and attitudes toward money significantly influence whether ChubbyFIRE will feel natural or forced for you.

You appreciate quality and experience without needing the most expensive or prestigious options. This selective approach to spending (investing in what brings genuine joy while avoiding status-driven purchases) aligns perfectly with ChubbyFIRE principles.

Occasional splurges feel appropriate rather than guilt-inducing because they fit within your overall plan. Your spending priorities remain relatively stable, making future expenses predictable and easier to plan for, without dramatic shifts in your lifestyle preferences as your income changes.

Calculate Your Personal ChubbyFIRE Number

Determining exactly how much you need for ChubbyFIRE requires understanding both your desired lifestyle and the investments needed to support it.

Your ideal spending level

Start by tracking current expenses for 3-6 months to establish your baseline spending in a comfortable but not extravagant lifestyle. This provides concrete data rather than guesses about what you actually spend.

Add costs for any upgrades you want in retirement, such as better healthcare, more frequent travel, or quality hobbies. Be specific about what these improvements might cost based on research rather than vague estimates.

Factor in major life changes affecting spending, such as relocating, downsizing, or children becoming independent. These transitions can significantly impact your financial needs in either direction.

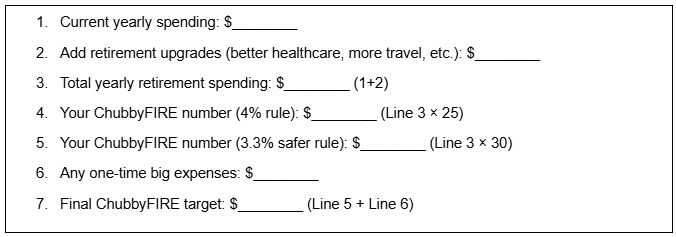

Quick ChubbyFIRE calculation and retirement calculator

Use this simplified template to find your personal ChubbyFIRE target:

For more detailed calculations tailored to your specific situation, try my Retirement Calculator Tool.

Consider regional cost differences if you plan to move in retirement, as $100,000 goes much further in some areas than others. Housing, taxes, healthcare, and food costs vary dramatically by location.

Remember that inflation will affect your calculations too. What costs $100,000 today might cost $150,000 in 15 years, so adjust your targets periodically as you approach your ChubbyFIRE date.

Room for occasional splurges and luxuries

What separates ChubbyFIRE from more restrictive approaches is the intentional space for life's special moments. Your retirement budget should include room for joy, not just necessities.

Allocate 10-15% of your annual budget specifically for discretionary spending that brings significant happiness. For a $100,000 annual budget, this means $10,000-$15,000 dedicated to experiences and purchases that make life richer without guilt or financial stress.

Create separate funds for bigger occasional expenses like celebration trips, home renovations, or helping family members. These planned splurges prevent you from disrupting your regular financial rhythm when special opportunities arise.

The key is being selective about your luxuries rather than trying to upgrade everything. Most ChubbyFIRE retirees find that targeted quality in areas they truly value brings far more satisfaction than attempting premium spending across all categories of life.

Comprehensive healthcare coverage

Healthcare deserves special attention in your ChubbyFIRE planning due to its importance and unpredictability.

Healthcare often becomes the largest expense category for early retirees before Medicare eligibility. Budget generously here. You might want to consider setting aside around $15,000-$25,000 annually for a couple for comprehensive insurance plus out-of-pocket costs.

Plan for healthcare inflation specifically, as medical costs typically rise 5-7% annually, far outpacing general inflation. What costs $20,000 today might reach $40,000 in just 10 years at a 7% growth rate.

Research all your options well before retirement, including ACA plans, health sharing ministries, and part-time work with benefits. Each choice offers different trade-offs between cost, coverage, and flexibility that might shift your overall ChubbyFIRE number.

Practical Paths To ChubbyFIRE

With your target number established, focus on practical strategies to achieve ChubbyFIRE without sacrificing quality of life along the way.

Earn more without work-life sacrifice

Increasing income without proportionally increasing stress or hours provides the ideal path to ChubbyFIRE. Focus on strategies that boost earnings while preserving your quality of life:

- Strategic career positioning: Target roles, companies, or departments where your skills command higher compensation without requiring more hours

- Skill specialization: Develop expertise in high-demand, high-value areas within your industry that naturally command premium pay

- Geographic arbitrage: Consider remote work that lets you earn big-city wages while living in moderate-cost areas

- Selective side work: Choose supplemental income sources that leverage existing skills and genuine interests rather than taking on time-consuming second jobs

These approaches allow you to accelerate your ChubbyFIRE timeline without sacrificing the balance that makes this path attractive in the first place.

Cut costs on low-value expenses

Reducing expenses that don't enhance your life frees up resources for both saving and meaningful spending.

Housing and transportation typically represent your largest expense categories. Even modest optimizations here—like refinancing, downsizing slightly, or keeping vehicles longer—can dramatically impact your savings rate and ChubbyFIRE timeline.

Eliminate recurring subscriptions and services that don't provide regular value. These seemingly small expenses often accumulate into significant drains on your financial progress.

Breaking down your money dials

Money dials represent the spending categories that bring you genuine satisfaction. Identifying your top dials helps prioritize spending where it matters most while cutting back everywhere else.

Common money dials include convenience, travel, health/fitness, experiences, comfort, freedom, relationships, and security. Most people have 2-3 primary dials they care deeply about, with others being much less important.

Turn up spending on your top dials while turning down spending on everything else. Someone who values travel might cut housing costs to fund amazing vacations, while a convenience-focused person might pay for time-saving services while spending modestly on other categories.

Optimize tax strategies through retirement account contributions, HSAs, and other tax-advantaged options. Reducing taxes effectively increases your saving power without requiring additional spending cuts.

Grow your career and skills

Strategic career development provides powerful returns on your ChubbyFIRE journey.

Invest in targeted education and skills that directly translate to income growth. Certifications, specialized training, and demonstrable capabilities often yield better financial returns than general degrees, especially mid-career.

Build relationships within your industry to uncover opportunities that rarely appear in job listings. Professional networks frequently lead to significant career advancements through personal referrals and inside information about potential openings.

Develop secondary marketable skills that could generate income during semi-retirement. These capabilities create options for flexible, enjoyable work later, strengthening your ChubbyFIRE plan while providing purpose beyond the financial benefits.

If you’re looking for a higher paying career or want to pivot towards professional development to begin that journey, you can read my other articles:

- Jobs That Make a Lot of Money (17 high-paying careers)

- How to Learn a New Skill (in 20 hours or less)

- Personal Development Goals: How to Set them & Stick to Them

Find your optimal savings rate

Your savings rate (the percentage of income you invest toward ChubbyFIRE) determines both your timeline and your quality of life along the journey.

Most ChubbyFIRE followers save between 30% and 50% of their gross income. This range balances meaningful progress toward financial independence with maintaining a comfortable lifestyle. At a 40% savings rate, many people reach ChubbyFIRE in 15-20 years of focused effort.

Automate your target savings rate through direct deposits and automatic transfers that happen immediately after payday. This approach removes willpower from the equation and ensures consistent progress toward your goal.

Increase your savings rate with each raise or bonus rather than expanding your lifestyle. This acceleration technique speeds your timeline without requiring cutbacks from your current standard of living.

Smart Investment Strategies For ChubbyFIRE

Your investment approach plays a crucial role in successfully achieving and maintaining ChubbyFIRE status.

A balanced portfolio for steady growth

ChubbyFIRE typically relies on traditional investment vehicles with moderate risk tolerance. Build a core portfolio of low-cost index funds covering domestic and international markets for reliable long-term growth.

Consider a moderate risk allocation appropriate for your timeline, typically 70-80% stocks during accumulation years, gradually shifting as you approach your target. This balance provides growth potential while managing volatility.

A simple ChubbyFIRE portfolio might look like:

- 50% - US total stock market index fund

- 20% - International developed markets index fund

- 10% - US small-cap value index fund

- 10% - Real estate investment trusts (REITs)

- 10% - US total bond market index fund

Focus on keeping investment costs low by minimizing fees and unnecessary trading. Even small percentage differences in fees significantly impact your final portfolio value over decades.

For more detailed investment guidance, check out these articles on building and balancing your portfolio:

- Diversified Investment Portfolios: How To Build One (+ examples)

- Portfolio Rebalancing: What It Really Means & How to Do It

- Investing for Beginners: A Quick and Easy Guide to Investment

Real estate opportunities for ChubbyFIRE

Many ChubbyFIRE followers include real estate in their investment strategy for diversification and income generation.

Consider modest rental properties in stable markets for additional income streams. One or two well-chosen properties can provide significant passive income in retirement without becoming a second job. Alternatively, real estate investment trusts (REITs) offer real estate exposure without the work of direct ownership.

Rental income typically rises with inflation, helping maintain purchasing power over time. A paid-off rental property generating $1,000 monthly provides $12,000 annual income that doesn't require selling investments during market downturns.

Asset class diversification tactics

Diversification simply means spreading your money across different types of assets and investments to reduce risk while potentially improving returns.

Beyond basic stocks and bonds, consider including small portions of your portfolio in areas like small-cap stocks, international markets, and REITs. These investments often perform differently than the broader market, providing stability when other areas decline.

Maintain adequate cash reserves of 6-12 months of expenses for emergencies and market downturns. This prevents forced selling during market lows and provides peace of mind during volatile periods.

Avoid chasing trendy investments or making major changes based on market predictions. Consistently following your long-term strategy typically outperforms reactive changes based on current events or hot investment tips.

Tax efficiency for middle-income wealth

Maximize tax-advantaged accounts like 401(k)s, IRAs, and HSAs before investing in taxable accounts. These vehicles provide immediate tax benefits and tax-free or tax-deferred growth that accelerates your progress.

Consider the tax implications of your investments and withdrawal strategy. Simple approaches like holding tax-efficient index funds in taxable accounts while keeping bonds in retirement accounts can save thousands in taxes over your investment journey.

Design Your ChubbyFIRE Lifestyle

Financial independence means little without a fulfilling life to accompany it. The lifestyle aspects of ChubbyFIRE are just as important as the financial components.

Current enjoyment with future security

ChubbyFIRE's greatest strength lies in balancing today's happiness with tomorrow's freedom. Unlike more extreme approaches, you don't need to postpone all enjoyment until reaching some distant financial milestone.

This balance manifests through conscious spending—directing your money toward what truly matters while skipping what doesn't. While saving 30-50% of your income, you still enjoy quality experiences that align with your personal values.

Don't wait to build the relationships and community connections that research consistently shows contribute more to happiness than material purchases. These social bonds provide both current enjoyment and future support, creating a rich life regardless of your financial stage.

Meaningful post-retirement activities

Looking beyond the numbers, successful ChubbyFIRE retirees plan thoughtfully for how they'll spend their newfound freedom. Without structure or purpose, even financial independence can feel empty.

Many find part-time consulting or teaching offers the perfect middle ground - providing intellectual stimulation, social connection, and supplemental income without the stress of full-time work. Others discover fulfillment through volunteering, mentoring, or creative pursuits that never fit into busy working lives. The financial cushion of ChubbyFIRE creates space to explore these possibilities without pressure for them to generate significant income.

Moderate travel and experiences

Travel is one of those things almost everyone looks forward to in retirement, so of course, we have to talk about that. ChubbyFIRE provides room for meaningful exploration without breaking the bank.

The sweet spot for most ChubbyFIRE travelers comes from quality over quantity - slower-paced trips with deeper cultural immersion rather than frantically checking destinations off a list. Without the constraints of limited vacation days, you can travel during shoulder seasons when prices drop and crowds thin. This approach delivers richer experiences at lower costs, perfectly aligned with ChubbyFIRE principles of thoughtful moderation.

ChubbyFIRE And Your Rich Life Vision

ChubbyFIRE serves as a tool to create your ideal life, not just reach a financial target. It provides security and flexibility without extreme sacrifice.

Define "enough" for yourself to make your journey purposeful. The most successful ChubbyFIRE practitioners:

- Prioritize time freedom over status symbols

- Create space for meaningful experiences and relationships

- Maintain flexibility as their interests evolve

This middle path offers financial security with genuine enjoyment both during the journey and after reaching your goal. It balances thoughtful moderation with your unique vision of a Rich Life.

For more guidance, check out my books I Will Teach You To Be Rich and Money For Couples. These resources will help you align your finances with your values and create a personalized path to financial independence.