Scared of Money? (Why & How to Overcome Your Fear of Money)

Do you have a fear of money? The more I see people talk about money, the more I see how SCARED we are of it.

How we let others poison our views of money.

And how easily we use negative words to describe it.

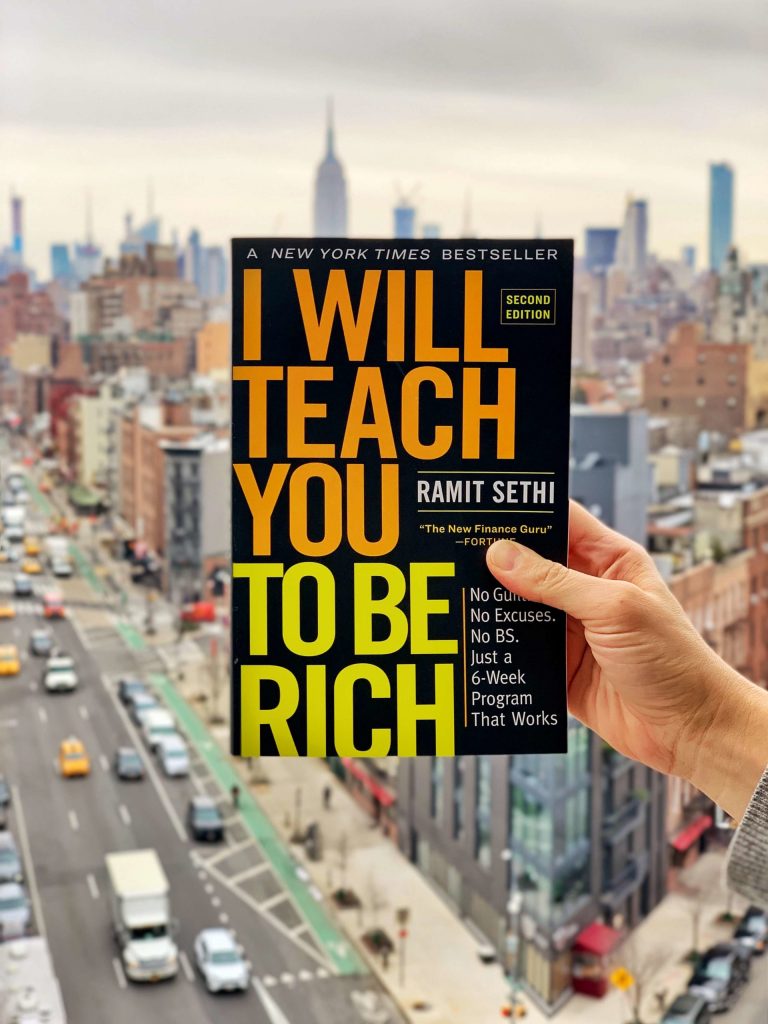

Here’s an email I got from someone who read my book, I Will Teach You To Be Rich. What do you notice?

My response:

His response (notice the skepticism):

6-10 IN A SHORT-ASS EMAIL. (Well, compared to the kinds I write…) Finally, my response:

This guy didn’t even notice his reflexive negativity with money. Its become like a dull toothache, something he gets used to. And since negativity is his worldview — the lens through which he views everything — I guarantee its an invisible drag on his entire life.

I asked him to rewrite his email to be POSITIVE instead of negative because sometimes, it takes someone pointing out your pattern to shake you out of it.

When I talk to people about money, here are the most common words they use to describe it:

Anxious

Stressed

Is it too late

(What words come to mind for you?)

But its even more revealing when you listen to the ways they talk about money.

What they say: What’s my Rich Life? Well, I just want to go on vacation with my kids a couple times a year, nothing fancy…

What they really mean: Notice those last two words — nothing fancy. When people talk about their Rich Lives, they almost always minimize their own dreams. When you’ve spent your entire life worrying about what can go wrong with money, its almost impossible to dream.

What they say: How do I KNOW your programs will work? OR Will this book work for me if I live in Bolivia and I have a lazy left eye and I only eat mussels on Mondays?

What they really mean: I have a finite amount of money. If I spend it here, I need to know it will absolutely work, otherwise, I will have wasted my money and there’s no way for me to ever earn more

What they say: Even if I made $250,000/year, I wouldn’t eat out at a nice restaurant like that. What a waste!

What they really mean: I have never eaten at a place like that and I don’t want to be the kind of person who has to go there to enjoy food. I’m simple. (One level deeper: I’m nervous that if I ate there, I might actually like it. I don’t trust myself to avoid going there every single week and spending all of my money)

What they say: I shouldn’t get a credit card.

What they actually mean: I don’t trust myself to control my spending, therefore I need to restrict myself

What they say: I went to [ANY FOREIGN COUNTRY] and they tried to rip me off because I was an American

What they really mean: Well, yeah, I could have afforded an extra $5 for those postcards but I HATE BEING RIPPED OFF. If someone else is winning and I am losing, I HATE IT

So many of us make day-to-day money decisions, never understanding the invisible scripts that actually guide these decisions. And in America, money is driven by FEAR.

FEAR that well never have enough.

FEAR that we cant make more of it.

And FEAR that someone will judge us for our spending — or even what we want to spend on.

I hate this. That’s why I show you how to identify your Money Dials, the things you LOVE spending on, then I show you how to spend MORE on it.

I also show you how to get psychologically comfortable with the idea of changing your identity. People say Money changes people, in disgust, as if its a bad thing. Money should change you! It should let you dream bigger, it should let you live an easier or more adventurous life, and it should let you bring others with you.

But you cant do that if you’re stuck thinking about money as a source of anxiety and fear.

An interviewer recently asked me what I would change from my 20s. I said, I would have more FUN. I was too rigid. But the times where I had the most fun and I was the most successful was I just loosened up and tried a bunch of new things

With money, try these different approaches.

Table of Contents

- Know That You Can Trust Yourself

- Know That You Can Create More Money

- Stop Being Afraid of Waste

- 3 Things We Noticed From PeopleWho Don’t Worry About Money

- What Else Can You Do to Stop Worrying About Money?

- What are You Going to Do Today?

Know That You Can Trust Yourself

Know that you can eat at a really nice restaurant once for the experience and truly enjoy it but trust that I’m not going to trip and fall and end up going there every single week.

You can also use credit cards without overspending (follow the systems in my book). You can pay off your debt and stay out of debt. You can become Rich and do good. Trust yourself.

Know That You Can Create More Money

You can negotiate your salary — or find an entirely new job. You can start a business, even if you don’t have an idea. You can build your network to sidestep people with 10 years more experience than you — and get perks you’ve never dreamed of.

All of those things can dramatically increase your income. Above all, your money is not a fixed pie that you have to exhaustively guard and protect. You can also expand the size of your pie.

Budgeting is outdated. Build your conscious spending plan to take control of your finances and spend guilt-free on the things you love. Find out how in our FREE guide.

Stop Being Afraid of Waste

In puritanical America, one of the biggest no-no’s is WASTE. Oh no! Ramit, if I start spending more on the things I love, I might waste some of my money!

How do I KNOW that your book will solve my exact, highly specific problem that I worry about every fucking day of my life? If it doesn’t, I’ve wasted $10!!!! Scammer!!!

Oh no! Ramit, what if I hire someone and they don’t handle my SEO, my WordPress uploads, design all my graphics, triple my conversion rates, write my entire email funnel, and create a new webinar system? I might have Wasted the $13/hour I tried to pay them!!

Oh no, there’s so much government waste! We should ONLY focus on cutting government waste. Especially that one thing I really hate. What? It only represents 0.03% of total spend? No, that cant be right. Anyway, we need to handle WASTE. Also, don’t talk about raising my historically low taxes, you socialist.

If you spend your entire life worrying about waste, you miss a simple fact of life: In any system of sufficient complexity, there will always be waste. Yes, you should take measures to control it, but you should also accept that there will be a certain amount of waste — and move on!

I know that I’m going to buy courses and attend conferences that wont be perfect for me. I know I’m going to eat at a restaurant that’s unmemorable. I know I’m going to make bad hires.

SO WHAT?

Id rather try new experiences and learn with each one than to sit back and let the bogeyman of waste scare me from doing anything at all.

So much of personal finance advice take your latent fears and heightens them.

NO! Don’t use a credit card, you might overspend a little!

NO! Don’t eat out at that restaurant, what a waste!

NO! Don’t try to negotiate your salary, you should just be happy you have a job!

If you spent the last ten years worrying about your waste and all the bad things you might do, you’ve accepted the message that you should be SCARED. That you’re an organism that simply reacts to whatever’s around you — that you have no agency or control.

Meanwhile, the people who have gone on offense have taken control of their own finances, their own psychology, started to earn more, and happily spend on the things they love. No anxiety. Just confidence and the systems to back it up.

You listen to these fears and end up frightened and anxious, sitting around worrying about all the things that can go wrong with money.

Or you can go on offense. You can take control of your money.

You can build a plan to spend extravagantly on the things you love.

You can EMBRACE making mistakes, knowing you’ll waste a little money, but its fine, because over the long term, those mistakes are minor, and you can create more wealth for yourselves.

You choose.

In my book, I wrote this:

Play offense, not defense. Too many of us play defense with our finances. We wait until the end of the month, then look at our spending and shrug: I guess I spent that much. We accept onerous fees. We don’t question complicated advice because its given to us in a language we don’t understand.

In this book, Ill teach you to go on offense with your credit cards, your banks, your investments, and even your own money psychology. My goal is for you to craft your own Rich Life by the end of Chapter 9. Get aggressive! No ones going to do it for you.