What is Personal Finance (The 4 Things That Matter)

The skill of personal finances comes down to four simple things: saving, investing, earning, and spending. Each one plays a specific role; automate your savings, invest to outpace inflation, grow your income strategically, and spend intentionally without guilt.

The Four Personal Finance Pillars

Personal finance is literally just how you manage your money. That's it.

Most people screw this up because they think there's some magical formula that works for everyone. There isn't. Your approach will be completely different from your friends, your family, and that guy on TikTok giving money advice.

To make things easy for you, I've broken personal finance into four core pillars:

- Saving: How much money you set aside and keep for emergencies and goals.

- Investing: How you grow your money over time to beat inflation and build wealth.

- Earning: How you make more money through salary increases and additional income streams.

- Spending: How you use your money intentionally to purchase things that matter to you.

These strategies are timeless. They work when the economy is booming, crashing, or doing whatever weird thing it's doing this week. Master these four pillars and you'll have a financial system that works even when your willpower doesn't.

Financial Pillar #1: Saving

Most people think saving is about cutting out everything fun and living like a monk. It's not. Smart saving is about building systems that work automatically, allowing you to enjoy life while building wealth.

Why traditional saving advice doesn’t work

Saving is the pillar that people often mess up. It's because they've been following completely wrong advice their entire lives.

You've probably heard classic advice like cutting out lattes, sticking to your budget, and cooking at home instead of eating out. On paper, this makes perfect sense. Spend less, save more.

But in reality, this advice doesn't work. I see people try this approach over and over, yet still struggle to reach their financial goals.

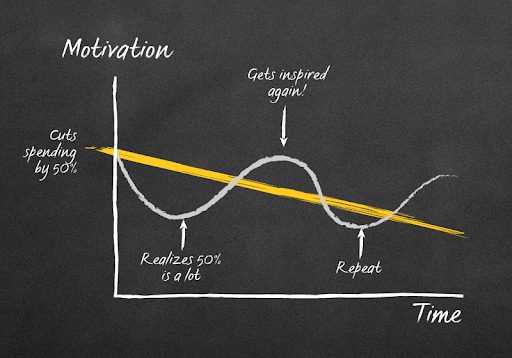

Traditional saving advice doesn't work because it's built entirely on willpower. Human willpower is limited. When you force yourself to give up small pleasures, obsess over budget spreadsheets every day, and constantly tell yourself "no," you're going to burn out. It looks something like this:

You start strong for a few weeks, maybe even months. Then life gets busy or stressful. You'll eventually crack and abandon saving altogether. That's exactly why I've created three simple steps that actually work without destroying your willpower.

Step #1: Pay yourself first

The easiest way to save money is to pay yourself first. The second your paycheck hits your account, you automatically move money straight into savings. You're not giving yourself the chance to spend it on random stuff.

Start with 5-10% of every paycheck. Make it easier by automating the whole thing. Set up an automatic transfer that happens on payday.

Once you automate it, saving happens in the background while you're living your life. You're not making daily decisions about whether to save or spend. The system handles it for you.

Step #2: Build an emergency fund

Your first savings goal is building an emergency fund. An emergency fund is money you set aside to cover unexpected expenses like car repairs, home maintenance, medical bills, or losing your job.

Save at least six months of living expenses in your emergency fund. This gives you time to find another job without drowning financially. If your monthly expenses are $4,000, aim for a $24,000 emergency fund.

Keep your emergency fund in a high-yield savings account. It earns more interest while staying safe and accessible when you need it. You can read my full emergency fund guide: Emergency Fund: how a few thousand dollars can save your life.

Step #3: Create separate saving buckets

Once you have established your emergency fund, the next step is to create separate savings accounts or buckets. Each bucket gets tied to a specific goal. House down payment, new car, dream vacation to Japan or whatever matters to you.

Keeping these buckets separate lets you see exactly how close you are to each goal. Save until you hit your target, then buy it confidently without going into debt. No more wondering if you can afford something or putting it on a credit card and hoping for the best.

Financial Pillar #2: Investing

Saving money is a great start, but it's only half the equation. If you want your money to actually grow and build real wealth over time, you need to make it work for you through investing.

Why saving isn’t enough

Saving is powerful for building your financial future, but it's not enough on its own. Inflation is the problem. It runs about 3-4% per year, even when the economy is doing well.

If you only save money, you will slowly lose purchasing power over time. Your money buys less and less each year. That $1,000 you saved five years ago doesn't buy what $1,000 buys today.

Investing is essential for long-term financial success. It helps your money grow at a rate that beats inflation. Investing makes your money work for you, even while you sleep.

Your 401(k) and Roth IRA are great places to start. These tax-advantaged accounts give you the biggest bang for your investment buck.

Investment #1: 401K

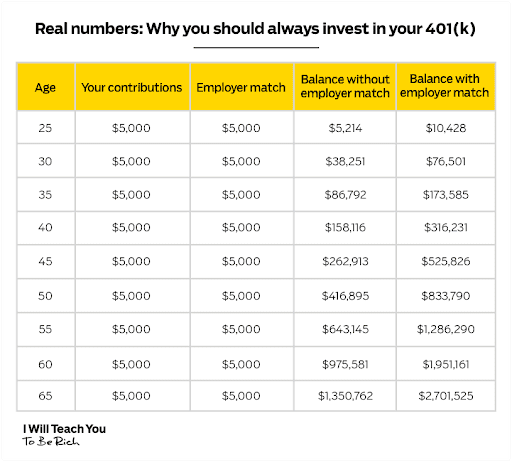

Your 401(k) is a powerful investment plan offered by most employers. Most plans come with something called a match. Your employer will match you dollar-for-dollar up to a certain percentage when you invest.

It's free money from your employer. If your employer offers a 5% match and you contribute 5% of your paycheck, you're saving 10% toward retirement. Over your working life, that match can double your money.

Contributions are made pre-tax. You only pay taxes when you withdraw the money in retirement. Taking money before retirement age can result in penalties and a loss of part of your savings. Leave your money in the account until you retire.

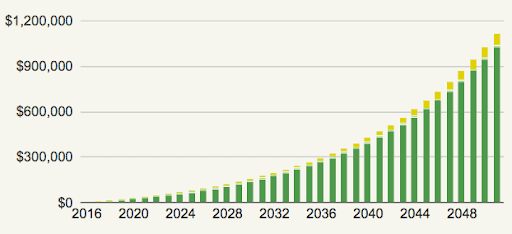

The longer your money stays invested, the more time it has to compound and maximize your returns. Even small contributions early in your career can grow into hundreds of thousands of dollars by retirement.

Contribution limits as of 2025:

- Individuals under 50 can contribute up to $23,500 per year.

- Individuals 50 and older can contribute more through catch-up contributions.

- These limits apply only to your contributions; your employer can add more through their matching contribution.

- Always contribute enough to receive the full employer match before investing elsewhere.

This is the foundation of your retirement savings. Max out your employer match first, then consider adding other investment accounts to diversify your strategy.

Investment #2: Roth IRA

A Roth IRA is another tax-advantaged retirement plan. Here are the main differences compared to a 401(k):

- It's a personal investment account you open yourself, not through your employer. That means there's no company match, but you have complete control over your investment choices.

- Contribution limits are lower at $7,000 per year if you're under 50 as of 2025. Much less than a 401(k), but it's still important for diversifying your retirement savings.

- Taxes work in reverse since you contribute after-tax income. You pay taxes now, but when you withdraw the money in retirement, it's completely tax-free.

Since tax rates often rise over time, this setup can save you thousands of dollars during retirement compared to relying only on a 401(k).

Let's say you're 25 years old and you invest $500 per month in a low-cost, diversified index fund. You do this until you're 60, assuming a 5% return. How much money do you think you'd have? $1,116,612.89. You'd be a millionaire after investing a few thousand dollars per year.

Please note that there are income limits that may restrict who can contribute to a Roth IRA. Maximize your Roth IRA contributions each year. Even small, consistent contributions compound into a large nest egg over time.

Financial Pillar #3: Earning

Once you've got your saving and investing systems running smoothly, the fastest way to accelerate your financial progress is to make more money. Unlike cutting expenses, your earning potential has no ceiling.

There’s no limit to earning

There's a limit to how much you can save, but there's no limit to how much you can earn. If you're struggling to cover living expenses, save consistently, and invest for the future, earning more money is one of the most effective ways to build wealth.

There are two great ways to increase your income: increasing your salary and earning additional income. Both paths can dramatically accelerate your financial progress.

Method #1: Increase your salary

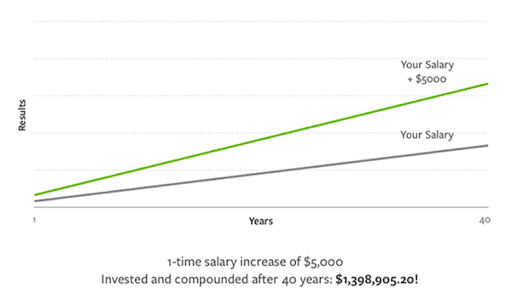

The first step to increasing your earnings is to negotiate a higher salary. You're making more for working your 9-to-5. Just a $5,000 salary increase adds up to serious money over the years. Over a 30-year career, that extra $5,000 annually becomes $150,000 in additional earnings—not counting raises, promotions, and compound growth if you invest the difference.

There are two primary ways to achieve this: negotiate a raise at your current job or transition into a new position with higher pay.

Successfully negotiating a raise comes down to three essential strategies that separate successful negotiators from those who walk away empty-handed.

Know your value

Most people walk into salary negotiations unprepared and wonder why they get turned down. Before you even schedule the meeting, you need to build a compelling case for why you deserve a raise.

Start by documenting your achievements with specific numbers. Instead of saying "I improved efficiency," say "I streamlined the reporting process, saving the team 8 hours per week and reducing errors by 30%." Concrete results make your value undeniable.

Next, prepare what you'll contribute after you get the raise. This is where the Briefcase Technique comes in. You literally bring a briefcase (or folder) containing a detailed plan showing how you'll add even more value moving forward. Maybe you'll take on additional responsibilities, lead new projects, or mentor junior team members. Show your boss they're not just paying you more for past work, they're investing in future results.

Have a number in mind

Never walk into negotiations hoping your boss will magically offer the perfect amount. That's like going grocery shopping and asking the checkout clerk what you should buy. You need to come armed with research and a specific figure.

Use sites like Glassdoor, PayScale, and Salary.com to find the salary range for your role in your geographic area. Look at job postings for similar positions to see what other companies are offering. Reach out to people in your network who hold similar roles.

Once you have the market data, decide on your target number. Ask for 10-15% more than what you actually want to leave room for negotiation. If you want $75,000, ask for $85,000. Be ready to explain why you deserve it based on your performance and market rates.

Practice, practice, practice

I always say: never shoot your first basketball in the NBA. And never go into salary negotiations without having practiced the conversation dozens of times.

Start by rehearsing with friends or family members. Have them play the role of your boss and throw different scenarios at you. What if they say the budget is tight? What if they counteroffer 50% lower than you ask? What if they ask you to wait six months? Prepare responses ahead of time so you're not caught off guard.

Practice in front of a mirror or record yourself on your phone. Watch for nervous habits, such as fidgeting or using "um" excessively. The more comfortable you get with the conversation, the more confident and persuasive you'll sound during the real thing. If you want exact words to use during these conversations, I've put together specific scripts that work for any job or situation.

Method #2: Earn additional income

Some people hit a cap on their earnings at their current job, and moving to a higher-paying role isn't an option. The next best way to increase your income is to earn money outside of your 9-to-5.

There are two common paths: get a second job or start a side hustle. I recommend starting a side hustle because it's more flexible around your 9-to-5. You can work on it in your free time after you finish work.

You can scale your side hustle as much or as little as you want. Your earnings depend on how much effort you put in. The best part is that you probably already have the skills to get started. Begin with your talents, interests, or hobbies and build from there.

A graphic designer might freelance logos on weekends. A teacher could tutor students online. Someone who loves organizing could start a home decluttering service. The possibilities are endless when you start with what you already know.

WARNING: Check your employee handbook first. Some companies have non-compete clauses that restrict you from additional work.

Financial Pillar #4: Guilt-Free Spending

Here's where most financial advice goes wrong: it treats spending like the enemy. Smart spending isn't about depriving yourself, it's about being intentional so you can afford what truly matters to you.

Why traditional budgeting doesn’t work

Finally, let's talk about my favorite pillar: spending. Spending often gets a bad rap because careless spending can lead to unhealthy financial habits. That's why most financial gurus push budgets.

But traditional budgets are ineffective because they're unsustainable. Budgets look backward at what you've already spent, and most people can't stick to them. You need a way to look forward and organize your money around your future goals.

That's why I created a Conscious Spending Plan that helps you live a Rich Life without obsessing over 65 line items and the price of turnips. This system lets you spend freely on what you love while automatically handling your financial responsibilities.

Step #1: Cover your fixed costs

The first step in conscious spending is covering your fixed costs. Fixed costs are your essential, non-negotiable expenses, like:

- Housing (rent or mortgage, utilities, phone, internet)

- Insurance (medical, auto, home, renters)

- Debt payments (student loans, car payments, etc.)

- Groceries

- Other essentials (clothing, toiletries, transportation, etc.)

- Even subscriptions (Netflix, gym membership, Amazon Prime)

These are the basics you need to keep your life running. So they should always be your top priority. Ideally, your fixed costs should take up no more than 50-60% of your take-home pay.

Once your fixed costs are covered, you can step into guilt-free spending. It's truly guilt-free because by this point, you're already building your future through saving, making your money work for you through investing, and covering your essentials. The money left over is meant to be spent. That's how you enjoy your Rich Life while building long-term security.

Step #2: Spend on what you love

Unlike traditional budgeting advice that tells you to skip the latte, my Conscious Spending Plan encourages you to spend on the things you love. If your morning latte is the highlight of your day, don't cut it out. What matters most is prioritizing what brings you joy so you always have money for it.

Maybe you love traveling and would rather skip expensive dinners to save for that trip to Italy. Or perhaps you're a foodie who'd rather cook at home most nights but splurge on a fantastic restaurant experience once a week. There's no right or wrong choice, only what's right for you.

Step #3: Cut mercilessly on what you don’t

When you prioritize what you love, it becomes easier to identify what you don't love and eliminate it. To afford more of what matters, cut mercilessly on what doesn't.

If your local library or Libby already has the books on your reading list, cancel Kindle Unlimited. If you signed up for that premium streaming service but only watched two shows, cut it. Always look for unnecessary expenses and trim them without guilt.

The money you free up can go toward your true priorities. This isn't about depriving yourself, it's about being intentional so you can afford what really matters.

Step #4: Build an enjoyable system

You can make conscious spending easier by setting up automatic systems. Start by creating separate accounts for different types of expenditures. Use one checking account for your fixed costs and another for your guilt-free spending.

Next, set up automatic transfers on payday so the money goes to the right place without you having to think about it. This lets you take control of your money right away and stay on track to live your Rich Life.

When your system runs automatically, you're not constantly making financial decisions. You know your essentials are covered, your future is secured, and the money in your guilt-free spending account is yours to enjoy.

For more details on setting up your own system, check out my Conscious Spending Plan.