How Much Do I Really Need to Save to Retire Comfortably?

Knowing how much you need to retire can be the first step to saving for the future. For many people, this can create anxiety and fear about the unknown. The amount of money you save now can have a huge impact on your quality of life after retirement, and even impact the age in which you can retire.

This begs the question: How much do I need to retire?

If you’re the average American? $1,432,775.

Table of Contents

This means:

- You could automatically have $57,311 / year and never touch your principal (in other words, you could live off the interest and never touch the $1,432,775).

- This is calculated with something called The 4% Rule, which means you can safely withdraw 4% / year without running out of money.

- This rule accounts for average longevity, inflation, and returns.

In short — $1.4 million will generate $57,311 / year in retirement for as long as The 4% Rule stays true.

So what if you don’t have that much? Or what if you want more?

Finances are like fingerprints: Everyone is unique. How much you need to retire is going to differ from person to person.

Let’s take a look at how we got to that number then, and how YOU can calculate your own retirement savings goals.

- How much do I need to retire comfortably?

- Do I have enough savings for retirement?

- How to start saving for retirement today

- Earn more money for retirement

- FAQs About how much do I need to retire?

How much do I need to retire comfortably?

To understand how much you need, you’ll need to know about The 4% Rule: This means you should be able to withdraw 4% of your savings each year when you retire without touching the principal.

This rule is based on a study from Trinity University that determined 4% is a good rate to withdraw per year for 30-year retirements.

To find out how much YOU need to retire with The 4% Rule, you simply need to:

- Find out how much you spend yearly. This includes everything that you might possibly spend in a year including rent, utilities, groceries, gas, etc.

- Multiply it by 25. Or however many years you anticipate being retired.

| ANNUAL EXPENSES | HOW MUCH YOU NEED TO SAVE |

| $20,000 | $500,000 |

| $30,000 | $750,000 |

| $40,000 | $1,000,000 |

| $50,000 | $1,250,000 |

| $60,000 | $1,500,000 |

| $70,000 | $1,750,000 |

| $80,000 | $2,000,000 |

Knowing that the average expenses for Americans total $57,311 (per HowMuch.net, using data from the Bureau of Labor Statistics), we can find the safe withdrawal rate by multiplying that by 25.

So the average American requires roughly $1,432,775 in order to retire comfortably. If your annual expenses are more or less than that, here’s the general calculator:

Average annual expenses x 25 = Amount you need to retire

Remember: This is just a rule of thumb. In fact, many are quick to point out the flaws of The 4% Rule. That said, it can give you a good idea of roughly how much you need to save.

Do I have enough savings for retirement?

Like a good yoga instructor, all these numbers are flexible. This means your plans will probably change as the years pass by. You could get sick and have to take time off from work. You could win the lottery. (It probably won’t happen … but I’ve got your back if you do.)

What matters is that you roll with the changes and adjust your plan accordingly — even if that means your retirement plans are pushed back a bit. Knowing your monthly savings rate removes the guesswork when life throws you a curveball.

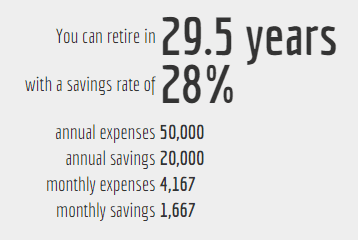

Luckily, you don’t have to strain too hard with back-of-the-napkin math to figure it out, as there are trillions of retirement calculators online. This one is great. It outlines exactly how many years it’ll take to save depending on your savings rate.

How long until I can retire with an income of $70,000?

How to start saving for retirement today

There are two main retirement vehicles:

- Company-matched 401k. This is a powerful retirement account offered to you by your employer. With each pay period, you put a portion of your pre-tax paycheck into the account. Your company might match your contribution up to a certain percentage.

- Roth IRA. A Roth IRA uses after-tax dollars to give you an even better deal. That means you put already taxed income into stocks, bonds, or index funds and pay no taxes when you withdraw it.

Within each account, you can invest in a variety of different funds that’ll earn money for you. Which do I suggest? I’m glad you asked…

Automatic retirement savings with lifecycle funds

Target date funds (or lifecycle funds) are great funds for people who don’t want to worry about rebalancing their portfolio every year.

They work by diversifying your investments for you based on your age. And as you get older, target date funds automatically adjust your asset allocation for you.

Let’s look at an example:

If you plan to retire in about 30 years, a good target date fund for you might be the Vanguard Target Retirement 2050 Fund (VFIFX). The 2050 represents the year in which you’ll likely retire.

Since we’re still years and years away from 2050, this fund invests more in investments like stocks that are higher risk but with the potential to earn more. As we get closer to 2050 the fund automatically adjusts to invest in things like bonds, which are lower risk.

These funds aren’t for everyone though. You might have a different level of risk or different goals with your investing. However, they are designed for people who don’t want to mess around with rebalancing their portfolio at all. For you, the ease of use that comes with lifecycle funds might outweigh the loss of returns.

One thing you should note: Most lifecycle funds need between $1,000 to $3,000 to buy into them. If you don’t have that kind of money, don’t worry. I have something for you at the end that can help you get there.

For a more in-depth explanation, check out my video all about lifecycle funds.

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

Where should I focus my retirement investing?

How much you should actually be investing each month depends on a system I call the Ladder of Personal Finance. It looks at three areas:

- Your employer’s 401k match. Each month you should be contributing as much as you need to in order to get the most out of your company’s 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

- Whether you’re in debt. Once you’ve committed yourself to contribute at least the employer match for your 401k, you need to make sure you don’t have any debt. If you don’t, great! If you do, that’s okay. You can check out my system for eliminating debt fast to help you.

- Your Roth IRA contribution. Once you’ve started contributing to your 401k and eliminated your debt, you can start investing in a Roth IRA. Unlike your 401k, this investment account allows you to invest after-tax money and you collect no taxes on the earnings. As of writing this, you can contribute up to $6,000/year.

Once you’ve contributed up to that $6,000 limit on your Roth IRA, go back to your 401k and start contributing beyond the match.

Remember, you can contribute up to $18,500/year on your 401k if you’re under 50. So you should have no issue continuing to invest in your 401k.

“But Ramit, why would I max out my Roth IRA before my 401k if it’s so good?”

There’s a lot of nerdy debate in the personal finance sphere about this very question, but my position is based on taxes and policy.

Assuming your career goes well, you’ll be in a higher tax bracket when you retire, meaning that you’d have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

Once you have your accounts set up, it’s time to start investing — and there’s no better way to do this than with an automated system.

Automating your finances is a system that allows you to invest passively instead of you constantly wondering if you have enough money to spend.

And it’s simple: At the beginning of the month, when you receive your paycheck, the money is immediately sent to where it needs to go through automatic systems that you have set up already.

If you want to find out more about how to automate your finances to properly save for retirement, I spoke with Good Morning America about some saving techniques.

Earn more money for retirement

Knowing how much you need to retire is just the first step to saving for your future.

If you really want to ramp up your investing you need to earn more money.

Doing so will put you in the best position to retire comfortably. That’s why we here at IWT have a gift for you: The Ultimate Guide to Making Money.

In it, we’ve included our best strategies to:

- Create multiple income streams so you always have a consistent source of revenue

- Start your own business and escape the 9-to-5 for good

- Increase your income by thousands of dollars a year through side hustles like freelancing

FAQs About how much do I need to retire

Can you retire on 500k?

Yes, $500,000 is sufficient for many retirees. The question is how that will work out for you. With an income source like Social Security, relatively low spending, and a bit of good luck, this is feasible.

The key to making this work is to be conservative with your spending and investments. A good rule of thumb is to spend 4% of your portfolio per year. If you can keep your spending down to that level, you should be able to live off your portfolio alone.

How much money do you need to retire at age 60?

The amount you will need to save for retirement depends on many factors, including your current income, expenses, life expectancy, and retirement savings goals.

For example, if you want to retire at age 60 and receive $100,000 each year for the rest of your life, you will need $3.8 million saved in an annuity. This money will give you a guaranteed monthly income for the rest of your life. Plus, any leftover money in the account will be passed down to your beneficiaries when you die.

How much money do I need in my 401(k) to retire?

This isn’t easy to answer without knowing more about your specific situation. But, generally speaking, you will need enough money saved in your retirement account to cover your living expenses. This includes housing, food, medical care, and other expenses.

It’s important to have a budget in place so that you know how much money you’re spending on these things now, so that when you retire, you can figure out how much more it will cost you and plan accordingly.

If you liked this post, you’d LOVE my Ultimate Guide to Personal Finance

It’s one of the best things I’ve published, and totally free – just tell me where to send it: