Best Way to Invest 100k for Long-Term Growth and a Rich Life

The best way to invest $100,000 is through low-cost index funds in tax-advantaged accounts, after ensuring your financial foundation is solid. This approach maximizes compound interest while minimizing fees and complexity.

First, Get Your Financial Foundation in Order

A solid financial foundation makes the difference between your investments growing steadily or crumbling at the first sign of trouble. Without this groundwork, even the best investment strategy can fall apart.

Pay off high-interest debt first

Any debt with interest rates above 7% should be paid off before investing your $100k. The guaranteed return from eliminating high-interest debt often beats what you could earn in the market.

Credit card debt typically carries 15-24% interest rates, making it extremely expensive. Each month you keep this debt, you're essentially losing money that could be growing through investments instead.

Keep low-interest debt like mortgages or student loans below 4-5%, as your investment returns will likely exceed these rates over time. This balance allows you to build wealth while still paying off debt.

Consider refinancing any high-interest debt you can't immediately pay off to secure lower rates before investing the rest of your money.

Ensure your emergency fund is fully funded

Set aside 3-6 months of essential expenses in a high-yield savings account before investing your $100k.

For those with variable income or in less stable industries, aim for 6-9 months of expenses in your emergency fund. The less predictable your income stream, the more protection you need against financial surprises.

Keep your emergency fund in a high-yield savings account where it remains liquid but still earns some interest, not in volatile investments. This balance gives you both accessibility and some growth to offset inflation.

Check that your retirement accounts are properly set up

Max out tax-advantaged accounts before investing in taxable accounts. This means first contributing the full amount to your 401(k), IRA, or other retirement vehicles.

For 2025, you can contribute up to $23,000 to a 401(k) and $7,000 to an IRA ($8,000 if you're over 50). These limits change annually, so always check the current year's maximum contribution limits.

If your employer offers a 401(k) match, ensure you get every penny of that free money before investing elsewhere. Also, set up automatic contributions to these accounts so they happen without you having to think about it each month. Automation removes the temptation to skip contributions when you feel like spending instead.

To better prepare for retirement while investing, check out my guids:

- My Simple Retirement Guide (real life story inside)

- How Much Do I Need to Retire (simple guide + real life story)

Before You Invest: Ask Yourself These Critical Questions

Once you've got your financial foundation set, it's time to think about the right way to invest your $100k. But before jumping in, you need to answer a few key questions.

What's your timeline for this money?

Your timeline determines how much risk you can safely take. The longer you can leave your money invested, the more growth potential you have. Consider these common timelines and what they mean for your strategy:

- Short-term goals (1-3 years), like a house down payment or a wedding, need safer investments that won't bounce up and down in value.

- Medium-term goals (3-7 years), like starting a business or paying for college, can handle some risk with a mix of growth and safer investments.

- Long-term goals (7+ years) like retirement can handle more risk for bigger growth since you have time to recover from market drops.

Be honest with yourself about when you'll need this money to avoid taking either too much or too little risk. The biggest mistake people make is putting short-term money in long-term investments.

What does this money mean for your Rich Life?

A Rich Life is about living life on your own terms, spending lavishly on things you love while cutting costs mercilessly on things you don't care about. It's not about following someone else's script but creating a life that brings you joy and fulfillment.

Think about what "rich" truly means to you:

- Is it having the freedom to quit a job you don't like without money worries?

- Is it traveling the world and experiencing different cultures on your own terms?

- Is it helping causes you care about and making a difference in the world?

- Is it providing security for your family or leaving a legacy for future generations?

Your answers to these questions should shape your investment approach. If travel is your passion, your strategy might look different than someone saving for early retirement.

The clearer you are about your personal goals, the easier it becomes to ignore market noise and stick to your plan when things get rocky. Your investment strategy will also vary based on your income level, so check out the best financial strategies whether you're earning $35k, $75k, or $100k+:

Are you prepared for the psychological challenges?

Why do you want to be rich and are you ready for the challenges?

Investing $100k means watching larger gains and losses than you might be used to. When the market drops 10%, that's $10,000 temporarily gone from your account.

Think now about how you'll handle market ups and downs. Will you check your investments daily (bad idea) or just a few times a year (much better)? Most bad investment decisions happen when emotions take over because people often sell when prices are down and buy when prices are high.

The Simplest, Most Effective Way to Invest 100k

Let me share the most straightforward approach to investing your $100k effectively. You don't need fancy tactics or insider knowledge to grow your wealth effectively.

Step 1: Choose low-cost index funds for superior returns

Index funds consistently outperform actively managed funds over long periods while charging much lower fees. The data on this is clear and compelling.

These funds offer instant diversification by holding hundreds or thousands of stocks:

- They reduce your risk if any single company fails

- You get exposure to entire market sectors without picking winners

- They require minimal research or financial expertise

- They typically have lower tax impacts than actively traded funds

Look for broad market index funds that track the total US stock market, international markets, and bond markets. Popular options include Vanguard Total Stock Market Index (VTSAX), Fidelity Zero Total Market Index (FZROX), or Schwab Total Stock Market Index (SWTSX).

For more information about getting started with these investments, check out my simple guide to investing in index funds, including the best options and practical tips for beginners:

- My Simple Guide to Investing in Index Funds (best options & tips)

- Best Vanguard Index Stock & Bond Funds: How To Invest (+ tips)

Step 2: Consider target-date funds for hands-off management

If you want to simplify things even further, target-date funds automatically adjust your investment mix as you approach your goal date, becoming more conservative when you need the money.

These all-in-one funds handle diversification and rebalancing for you, making them perfect if you want to set it and forget it.

Simply pick a fund with a year close to when you'll need the money (usually retirement) and let the fund managers handle the rest. For example, if you plan to retire around 2050, you'd choose a "Target Retirement 2050" fund.

This approach works especially well if you know you won't keep up with rebalancing or if you might make emotional decisions during market volatility.

Step 3: Avoid funds with high expense ratios (over 0.25%)

The difference between a fund charging 0.05% and one charging 1% in fees can cost you over $100,000 over 30 years on your $100k investment. Small fee differences compound into enormous amounts over time.

Here's why you should care about expense ratios:

- Even a fraction of a percentage point in fees adds up to massive amounts over time

- The compounding effect of fees works against you just as powerfully as returns work for you

- Most high-fee funds don't deliver better performance to justify their cost

- Low-cost options are widely available from major brokerages

Vanguard, Fidelity, and Schwab all offer index funds with expense ratios under 0.1%, sometimes as low as 0.03%. Actively managed funds charging 1% or more rarely outperform index funds over time.

The true cost of high fees

You invest $100k for 30 years and earn 8% annual returns before fees. With a 0.1% fee index fund, you'd have about $1,002,000.

The same investment with a 1% fee (typically for actively managed funds or advisors) would leave you only $761,000. That 0.9% difference in fees costs you $241,000 over 30 years, more than twice your original investment.

Step 4: Set up automatic monthly investments

Beyond your initial $100k, set up automatic monthly contributions to keep building your wealth. This is how ordinary people become millionaires – through consistency, not one-time windfalls.

Automating investments removes emotion from the process and prevents you from trying to time the market. You'll buy regardless of market conditions, which is exactly the discipline you need.

Start with 10-15% of your income, and increase this percentage annually or whenever you get a raise. This dollar-cost averaging approach means you naturally buy more shares when prices are low and fewer when they're high.

Step 5: Ignore market fluctuations and stick to your plan

Once your investment plan is in place, the best strategy is often to do nothing, even during market downturns. This is counterintuitive but incredibly powerful.

Set a schedule to review your investments 1-4 times per year, not daily or weekly, when emotions can run high. Most people who check their investments frequently make worse decisions and earn lower returns.

Remember that market timing doesn't work – even professional investors fail at it consistently. The investors who do best are often those who set up their accounts and then forget about them for years.

If you want to learn more about building a diversified investment portfolio or get specific suggestions for investing smaller amounts, you can explore my beginner's guide to investing and easy guide to building a diversified portfolio:

- Investing for Beginners: A Quick and Easy Guide to Investment

- Diversified Investment Portfolios: How To Build One (+ examples)

- How to Invest $10k: Specific suggestions from a personal finance expert

The Power of Compound Interest for Your $100K

Compound interest is like a financial superpower that transforms your money over time. It's what separates people who become wealthy from those who just dream about it.

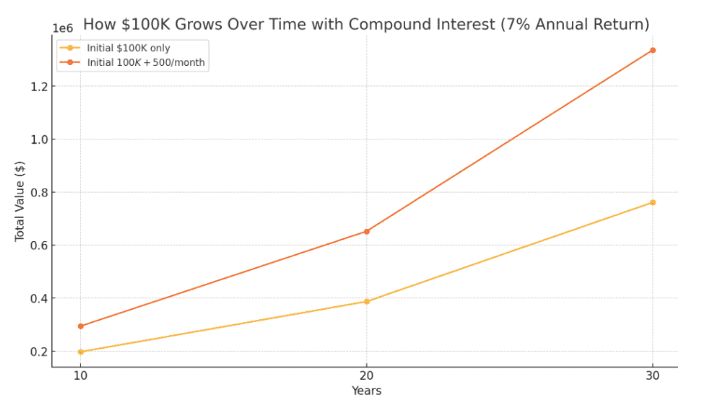

How your $100K can grow over 10, 20, and 30 years

At a 7% average annual return (what you might reasonably expect from the stock market over time), your $100k doesn't just grow – it multiplies:

- After 10 years, your $100k becomes $197,000

- After 20 years, it grows to $387,000

- After 30 years, it balloons to $761,000

These aren't made-up numbers. This is the mathematical reality of investing over time, assuming a diversified portfolio with reinvested dividends. And these figures don't even account for any additional money you might add along the way.

What happens if you add just $500 monthly to your initial $100k investment? The growth becomes even more impressive:

- Your total reaches $294,000 after 10 years

- It grows to $652,000 after 20 years

- And after 30 years, you're looking at $1,336,000

The longer your money stays invested, the steeper the growth curve becomes. Those final years deliver the biggest gains because you're earning returns on your returns on your returns – that's the magic of compounding.

The tipping point: When interest exceeds your contributions

There's a magical moment in your investing journey that few people talk about. It's when the interest earned in a year surpasses what you contribute that year.

Let's say you contribute $10,000 annually to your investments. With a 7% return, you'll hit this tipping point when your portfolio reaches about $143,000. Beyond this threshold, your money starts working harder than you do.

This is when wealth-building shifts from the "hard work phase" to the "momentum phase." You're no longer the primary driver of your portfolio's growth, your earlier investments are.

I call this the "money machine" moment, when your financial engine runs largely on its own power. This is why people who start investing early have such an advantage – they reach this tipping point sooner and enjoy the benefits longer.

Why starting now matters more than the perfect strategy

The most important investment decision isn't which fund to pick or what asset allocation to use. It's simply getting started today.

If you invest $100k today at 7% returns, you'll have $197,000 in 10 years. But if you wait just 3 years to start, you'll only have $153,000 after 7 years. That 3-year delay costs you $44,000, and the gap only widens with time.

Too many people waste years looking for the "perfect" investment or waiting for the "right" market conditions. Meanwhile, the person who started with a "good enough" plan years ago is already watching their money multiply.

The best time to plant a tree was 20 years ago. The second best time is today. The same applies to your $100k; get it working for you now, even if your approach isn't perfect. If you're curious about why the $100k mark is so significant for wealth building and how to reach it, check out my video on why net worth skyrockets after you hit $100k.

Beyond the Basics: Smart Allocation Strategies

Once you understand the power of compound interest and low-cost index funds, you can tailor your investment approach to match your specific timeline and goals. Different time horizons call for different allocation strategies.

For short-term goals (1-3 years)

Keep most of your money in stable, accessible investments if you need it within the next three years. This might be for a house down payment, a wedding, or starting a business soon.

Aim for 70-80% in cash-like investments such as high-yield savings accounts, money market funds, or CDs. The remaining 20-30% could go into short-term bond funds at most.

Your priority here is protecting your principal rather than seeking growth. When you need money soon, you cannot risk a market decline right before you need to withdraw funds.

For medium-term goals (3-7 years)

A balanced approach works best for medium-term goals like funding college education or buying a property in 5 years. You have some time to weather market fluctuations but not enough for an aggressive strategy.

Consider allocating 40-60% in stocks and 40-60% in bonds. This gives you growth potential while limiting the risk of major losses when you eventually need the money.

Look at balanced index funds or moderate-risk target-date funds that match your time horizon. These ready-made solutions automatically maintain appropriate risk levels for medium-term goals.

For long-term wealth building (7+ years)

Younger investors with 10 or more years before needing the money should consider allocations of 80-100% stocks through low-cost index funds. Time is your greatest advantage for handling market volatility.

As you age or get closer to your goal, gradually shift toward more bonds and stable investments. This protects your gains and reduces the impact of market drops when you need the money.

A simple three-fund portfolio can work wonderfully here: a US total market index fund, an international index fund, and a bond index fund. This gives you global diversification with minimal complexity.

With this longer timeframe, you can ride out market volatility and capture the higher returns stocks have historically provided. The extra decades of compound growth make an enormous difference in your final results.

Common Investing Mistakes to Avoid With Your 100k

Having $100k to invest puts you ahead of most Americans, but it doesn't make you immune to costly mistakes, here are some of the biggest ones to avoid:

Trying to time the market

Ever notice how everyone claims they can predict market moves? They can't. Not even professional traders consistently get it right.

Many people hold cash waiting for the "perfect" moment to invest, only to miss out on years of growth. Others panic-sell during downturns, locking in losses when they should be buying more.

Instead of playing this losing game, adopt a systematic approach. Invest consistently through good markets and bad. The evidence is overwhelming that staying invested beats jumping in and out based on predictions or feelings.

Chasing hot investment trends

Cryptocurrency, meme stocks, tech startups, cannabis companies—there's always something "revolutionary" promising quick riches. By the time these trends hit mainstream news, smart money has usually moved on.

I've watched people abandon solid investment plans to chase whatever's currently hot. They buy at peak hype, then lose interest (and money) when the trend inevitably cools. If you absolutely must scratch the itch to chase trends, do it with no more than 5-10% of your portfolio. Consider this your "Vegas money" that you can afford to lose entirely.

The boring, consistent approach of broad market index investing has created far more millionaires than chasing the next big thing. Remember, investing shouldn't be exciting—exciting investments usually lead to disappointing results.

Paying excessive advisor fees

Many financial advisors charge around 1% annually to manage your portfolio. On $100k, that's $1,000 per year. What are you getting for that money?

Often, these advisors simply put you in a basic portfolio you could build yourself in 30 minutes. That 1% might seem small, but over decades it can reduce your ending balance by hundreds of thousands of dollars.

If your situation is straightforward, you probably don't need an advisor at all. A target-date fund costs a fraction of the price and handles allocation for you automatically.

Overthinking your investment strategy

You can easily get bogged down and spend years researching investments without ever actually investing. They read every book, followed every guru, and still couldn't pull the trigger because they feared making the "wrong" choice.

Simple strategies often outperform complex ones that require constant monitoring and adjustment. Once you've set up a solid, diversified portfolio, additional tinkering rarely improves returns and often hurts them.

Don't fall into the trap of analysis paralysis. A good-enough plan you actually implement will beat a perfect plan that never leaves the drawing board every single time.

Align Your Investments With Your Rich Life

Investing isn't just about maximizing a number in your account. It's about funding the life you actually want to live. Your $100k should be working toward your unique vision of a Rich Life.

Focus on what actually matters to you

Money is a tool to create the life you want, not just a score to be maximized for its own sake. I've seen people with modest portfolios living incredible lives, and miserable millionaires trapped by fear of spending their money.

Your investments should support your definition of a Rich Life, whether that's early retirement, extensive travel, starting a business, or supporting causes you care about. There's no single "right" way to use your money.

Too many people get caught up in outdated rules or copying what others do with their money. Instead, ask what truly brings you joy and fulfillment, then align your investment strategy accordingly.

Stop asking "$3 questions" and focus on "$30,000 questions"

Many people obsess over small financial decisions (the "$3 questions") while ignoring the big ones that actually build wealth. This misplaced focus can cost you hundreds of thousands over your lifetime.

Here's what I mean:

| Don't ask: "Should I buy coffee at Starbucks or make it at home?"

Ask instead: "Am I maximizing my earning potential in my career?" Don't ask: "How can I save $20 on groceries this week?" Ask instead: "Is my investment fee structure costing me tens of thousands in the long run?" Don't ask: "Should I cancel my streaming subscriptions?" Ask instead: "Am I living in the right city for my financial goals?" Don't ask: "Paper or plastic?" Ask instead: "House or no house? One kid or two? Job or entrepreneurship?" |

Your investment returns, tax strategies, housing decisions, and income growth will impact your wealth far more than small daily purchases. Put your mental energy into the few financial decisions that create 80% of your results.

The coffee isn't keeping you from financial freedom. You can build wealth and still enjoy your daily pleasures when you focus on what truly matters.

Measuring true investment success

True investment success isn't just about maximizing returns but meeting your specific life goals on your timeline.

If your investments allow you to retire when you want, send your kids to college, or start that business you've dreamed of, that's success—regardless of whether you beat the S&P 500 in any given year.

Compare your results to your goals, not what others do or claim to achieve. Someone else's financial path might look impressive on social media but could be completely wrong for your life priorities.

If you want a deeper dive into creating a comprehensive plan for your money, check out my NYT bestselling book, I Will Teach You To Be Rich, and for couples, Money for Couples.