Active vs Passive Investing: A No-Fluff Guide for Beginners

Active investing is when you try to beat the market by handpicking stocks, bonds, or other investments. Passive investing is when you buy broad funds like index funds or ETFs to simply match the market. For almost every beginner, passive wins because it’s cheaper, easier, and has historically outperformed most active strategies.

The Reality of Active Investing

Active investing is all about trying to outperform the market by selecting investments: buying individual stocks, timing trades, or focusing on specific sectors you believe will outperform. The goal sounds simple: Do more research, make smarter choices, and earn higher returns. But the truth is that consistently outperforming the market is incredibly difficult, even for professionals who spend their entire careers analyzing data and trends. Most of them still fall short of matching basic index funds over time.

Active investing also takes a lot of time and emotional energy. Markets move unpredictably, and even solid research can’t account for every surprise. For most beginners, trying to outsmart full-time investors while balancing work and life quickly turns into stress, not profit. It’s not impossible to succeed, just highly unlikely to be worth the effort.

How people "actively invest"

Active investing usually starts with good intentions; you want to be smart with your money and make informed choices. But what begins as curiosity often turns into a time-consuming and stressful habit. In practice, here’s what active investing often looks like:

Step 1: The research rabbit hole

It starts innocently enough: reading financial blogs, scrolling through market news, watching YouTube stock analyses, and following “expert” predictions online. But before long, you’re spending hours every week trying to find the next big opportunity. What once felt productive quickly starts feeling like unpaid part-time work.

Step 2: The emotional buying spree

Once you feel informed, you start picking stocks; maybe something your friend mentioned, a company that’s been trending, or a brand you personally love. You convince yourself you’ve spotted the next breakout winner before everyone else.

Step 3: The psychological torture chamber

Then comes the emotional rollercoaster. You check your portfolio constantly, celebrating when stocks rise and panicking when they fall. You might sell out of fear or buy impulsively when excitement hits. Even sleep can feel optional because markets are always open somewhere in the world.

Here’s my take on this active investing fantasy: Even professional fund managers with massive research budgets, advanced tools, and years of experience fail to beat the market around 75% of the time. If the experts can’t reliably win at this game, what makes you think you can do it in your spare time while juggling a career and life?

What Passive Investing Really Means

Passive investing flips the whole game on its head. Instead of trying to outsmart the market, you simply invest in it by buying index funds, ETFs, or target-date funds that automatically spread your money across hundreds or even thousands of companies. You’re not guessing which stocks will win or lose; you’re owning a piece of the entire market and letting long-term growth do the heavy lifting.

This approach is simple, low-maintenance, and proven to work. Passive investors pay lower fees, spend less time managing their portfolios, and, over decades, typically outperform the majority of active investors. For beginners, it’s the most straightforward way to build wealth without turning investing into a second job.

How to “passively invest” (it’s embarrassingly simple)

If you’ve followed me for a while, you already know I recommend passive investing almost 100% of the time, especially for beginners. The beauty of it is that it doesn’t require perfect timing or deep financial knowledge. You just need a solid setup, consistency, and a little patience.

Step 1: Set up your investment accounts

Start by opening a brokerage account with a reputable firm like Vanguard, Fidelity, or Schwab. Choose between a taxable account, a Roth IRA, or a traditional IRA, depending on your situation. Most beginners do best starting with a Roth IRA because it allows your investments to grow tax free.

Step 2: Choose your broad-market funds

Pick two to four index funds or ETFs that give you exposure to the total US stock market, international markets, and bonds. You’re not trying to find the “best” funds; you’re choosing the ones that own everything and charge the lowest possible fees. The goal is broad, automatic diversification.

Step 3: Automate everything

Set up automatic transfers from your checking account to your investment account each month, then have that money automatically buy more shares of your chosen funds. This “set it and forget it” system builds wealth quietly in the background while you focus on living your life.

And that’s really it. No stock picking, no timing the market, and no constant decision-making. You just keep investing on autopilot, slowly building ownership across the global economy.

Next, let’s look at the specific funds that can set you up for long-term success.

The only index funds you’ll ever need

When it comes to passive investing, you don’t need dozens of funds or complicated strategies. The simplest portfolios are often the most effective and the easiest to stick with. Index funds, ETFs, and target-date funds all give you broad exposure to the market, but for most beginners, a few well-chosen index funds from Vanguard are more than enough. They’re low cost, diversified, and handle the heavy lifting automatically.

A total stock market index fund gives you exposure to nearly all US companies, from massive corporations like Apple and Microsoft to smaller firms you’ve never heard of. As the market changes, the fund adjusts automatically, so you don’t have to manage anything yourself.

If we’re talking specifics, here’s what I recommend:

- Vanguard Total Stock Market Index Fund (VTSMX): Covers nearly the entire US market (large, mid, and small companies) in a single fund. It’s a one-stop shop for broad domestic diversification.

- Vanguard Total International Stock Index (VTIAX): Includes thousands of companies outside the US, across both developed and emerging markets. This reduces your dependence on the US economy and gives you global exposure.

- Vanguard Total Bond Market Index Fund (VBMFX): Holds US government and corporate bonds, providing stability and income that help balance out stock market swings.

Together, these three funds create a globally diversified portfolio across both stocks and bonds, all with total annual fees under 0.15%. That’s a fraction of what most actively managed funds charge (often 1–2%), meaning more of your money stays invested and compounding for your future.

How to Decide Between Active and Passive Investing

Let me be totally honest with you: I’m a die-hard fan of passive investing. My own retirement money sits in plain, boring index funds that I check maybe once a quarter, and they quietly grow in the background while I live my life. The only time I’d ever consider active investing is with a small amount of “play money” (maybe 5–10% of my portfolio) that I can afford to lose if my stock picks flop.

That said, I know some people can’t resist the thrill of picking individual stocks or trying to outsmart the market. If that’s you, fine, but go in with your eyes open. Active investing isn’t just about making smart bets; it’s about understanding the trade-offs in time, cost, and emotion.

Here are the main things to consider before deciding which path fits you best:

1. The cost of investment fees

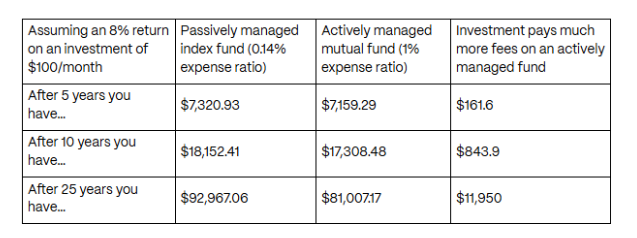

Actively managed mutual funds typically charge 1–2% in annual fees, while index funds often charge just 0.05–0.15%. That small difference adds up over time; a 2% annual fee can reduce your total wealth by more than 60% over a 50-year investing career.

Even a 1% fee can eat up nearly 40% of your potential gains. Those percentages might seem tiny, but in the long run, they can literally cost you hundreds of thousands of dollars in lost growth. This is why I'm obsessed with keeping fees as low as possible; every percentage point you pay in fees is money that's not compounding and growing for your future.

2. The time required

Active investing can easily become a 10- to 15-hour-a-week commitment. You’re researching companies, watching markets, and constantly adjusting your positions. Passive investing, on the other hand, runs almost entirely on autopilot once you’ve set it up. The funds rebalance automatically, and you can spend that time focusing on other priorities instead of watching stock charts.

3. The emotional demands

Markets move fast and not always in your favor. Active investors often get caught in emotional cycles of fear and excitement, leading to bad timing and impulsive decisions. Passive investors skip the stress because they’re not reacting to every market move; they just keep investing consistently, rain or shine.

4. The track record of the strategy

Here’s the reality check: About 75% of professional fund managers fail to beat the market over time, and that’s before factoring in their higher fees. If trained professionals with research teams and deep market access can’t reliably outperform, it’s even less likely that casual investors will be able to. Passive investing, meanwhile, simply matches market performance with far less effort, stress, and cost.

At the end of the day, both approaches are available to you, but only one consistently helps people build wealth without turning investing into a full-time job.

Living Your Rich Life Without Stressing About Stocks

At the end of the day, investing is about building the life you actually want. Too many people get so caught up chasing returns or reacting to every market swing that they forget the real goal: creating lasting financial freedom.

Active investing might sound exciting, but it often comes at the cost of your time, energy, and peace of mind. Constantly researching and monitoring the market can be exhausting, and even professional fund managers make costly mistakes一but when that happens in your own portfolio, it’s your savings on the line.

Passive investing offers the opposite experience. It’s simple, steady, and runs quietly in the background while your money compounds. You’re not glued to the news or second-guessing yourself, but rather following a plan that works over time.

The best investing strategy isn’t the one that promises the highest short-term returns; it’s the one you can stick with for decades without stress. Automate it, stay consistent, and let time do the work. You live your Rich Life by letting your money grow while you focus on what actually matters, not by chasing stock tips.