What to do if a customer doesn’t pay up on monthly payments

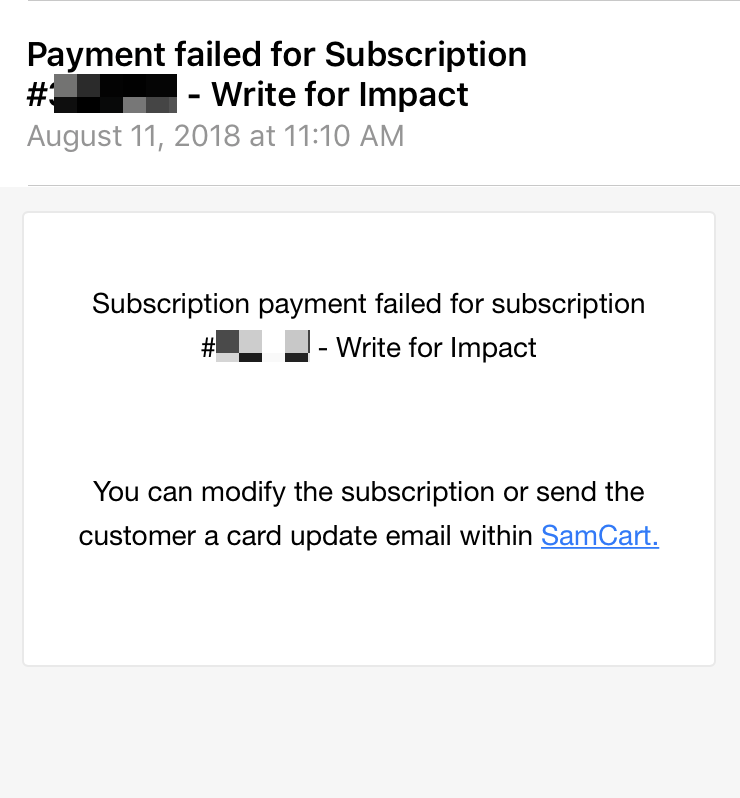

It had been only less than six weeks into my eight-week advanced writing course when SamCart, the checkout platform that I use to let people pay for my course, alerted me to a failed credit card charge. It looked like this:

This email has made unwelcome appearances a handful of times already, but getting it the first time felt like a nightmare-brought-to-life. My first completely irrational thought: “OMG, this customer just ran off and gave you the finger, Stephanie! GET THEM!” And then I briefly thought about sending a pitchfork-wielding mob that I so obviously have on speed dial.

That non-payment often cuts deeper than not getting the customer in the first place, because not only is this a breach of contract.

It’s…*whispers into an empty bottle* …a breach of trust.

It’s also frustrating for us solopreneurs and small businesses starting out, and happens more often than I’d like.

It’s part of business, a friend tells me. Yippee, I guess?

Thankfully, I was able to act rationally, hold off on the angry mob, and take a few steps to recoup most of these losses, and in many of the cases I encountered, rectify the situation. Here’s what I did.

Step 1. Always give the customer the benefit of the doubt

After hearing about the pain of collecting late payments or addressing declined credit cards from friends, I feared the worst when I got that first “payment failed” email. But once I calmed down and actually looked into the issue, I realized that the cause could come down to any number of things. Examples:

- The credit card expired or was canceled

- Customer’s balance is too low (if debit card)

- There’s a “hold” on the card

- A bank is refusing to charge due to possible fraud prevention

As an aside, platforms like Stripe have built-in ways for you to automate your attempts to charge cards and send customer prompts to update their cards if needed (see here).

There are also programs, like Authorize.net through their Account Updater service, that are designed to automatically update expiration dates on credit cards. Keep in mind also that some updaters will not update international cards or cards from certain carriers.

All I knew was that the credit card on file needed to be updated, and in my experience so far, it’s been typically an issue with the expiry date. No one likes to be accused of being a terrible person, so give the customer the benefit of the doubt and assume that they didn’t mean for this to happen. That all you need to do is reach out with a gentle reminder.

But the tricky thing here is: How exactly do you relay this to the customer? Well…

Step 2. Send a personalized courtesy email

When these failed charges happened to me, SamCart had already sent emails to the customer to remind them to update their credit card information. I also sent personalized emails during the workday to be in their face about it. About 80% of my cases of declined charges were resolved with this simple email. Something like:

Hey <insert name>,

How are things with you? Popping in here to let you know that my payment processor seems to be having issues making the usual monthly charge to the credit card you have on file.

Easy fix though! You should’ve received another email through my payment processor SamCart prompting you to update your credit card information on your end. Once you do, I should be out of your hair.

Thanks again for joining the course, and holler if you need anything. : )

The email you send doesn’t have to sound so casual, but the point is to be courteous and avoid being accusatory — you have no idea about their circumstances.

That first email is usually enough to get people to act, all the meanwhile your third-party cart will attempt to charge their card a couple more times.

But if still nothing…

Step 3. Send a polite follow-up email

Sometimes emails get intercepted by annoying email gremlins or people just forget. Simply follow up after a week with something like:

Hey <insert name>,

A friendly reminder that the credit card information you’ve inputted for <name of your product> needs to be updated. I’ve sent a separate email with a secure link for you to change to another credit card.

If you’ve done this already, feel free to ignore this email. Thanks!

Outside of dragging them to court (which you have to think about if it’s worth it), working with a collections agency, or hiring Dwayne “The Rock” Johnson to kick down their door, it’s hard to coerce your customer into doing exactly what you want (i.e., to pay up!).

If you feel so inclined, this comprehensive guide offers advanced tactics you can try implementing at various points in your “payment failure cycle.”

Before all hope is lost, there’s one more thing you can do.

Want to build a business that enables you to live YOUR Rich Life? Get my FREE guide on finding your first profitable idea.

Step 4. Get them on the phone

If you’ve sent those two personal emails (AND whatever payment processor you’re using is also sending automated reminders) and you STILL haven’t heard anything, consider calling them, an entrepreneur friend told me.

Hopefully, at some point in the checkout process you were able to capture their phone number or address to drive directly to their home… ( ͡° ͜ʖ ͡°). (JK, don’t do that.)

Call at a time that seems reasonable (e.g., not when they’re having dinner with family, not while they’re at work, and certainly not at 3 in the morning). In my experience, when you get customers on the phone, they are less likely to be dodgy. Again, don’t be accusatory. It might go something like this:

You: “Hey, <name>, this is <who you are> from <name of your company>. I’m calling about <name of your product> and when you signed up, you’d agreed to six monthly payments, but there were issues with the last payment…”

Them: “Uhhh … yeah, I’ve been busy, sorry.”

You: “Totally understandable! As I said in the emails, it seems your credit card needs to be updated. I can do that for you right now over the phone if you’re OK with reading me your info.”

Them: “Oh, sure.”

At this point, you manually update the credit card information for them on your own computer. It probably won’t go that smoothly, but make sure you give clear context to why you’re calling and you state plainly who you are and which product you’re referring to.

If they claim they’re having dinner or whatever, ask them when would be a good time to call back. If after all this, the customer manages to wriggle away, it’s time to move on and prepare a contingency plan for failed payments for next time.

2 ways to buffer future defaulted monthly payments

Expect to encounter more and more dreaded failed payments as your business grows, so it’d save you a world of headache to set up a system that makes the credit card renewal process and re-attempts at collection easy breezy. A few things to think about:

1. Charge more for each monthly installment

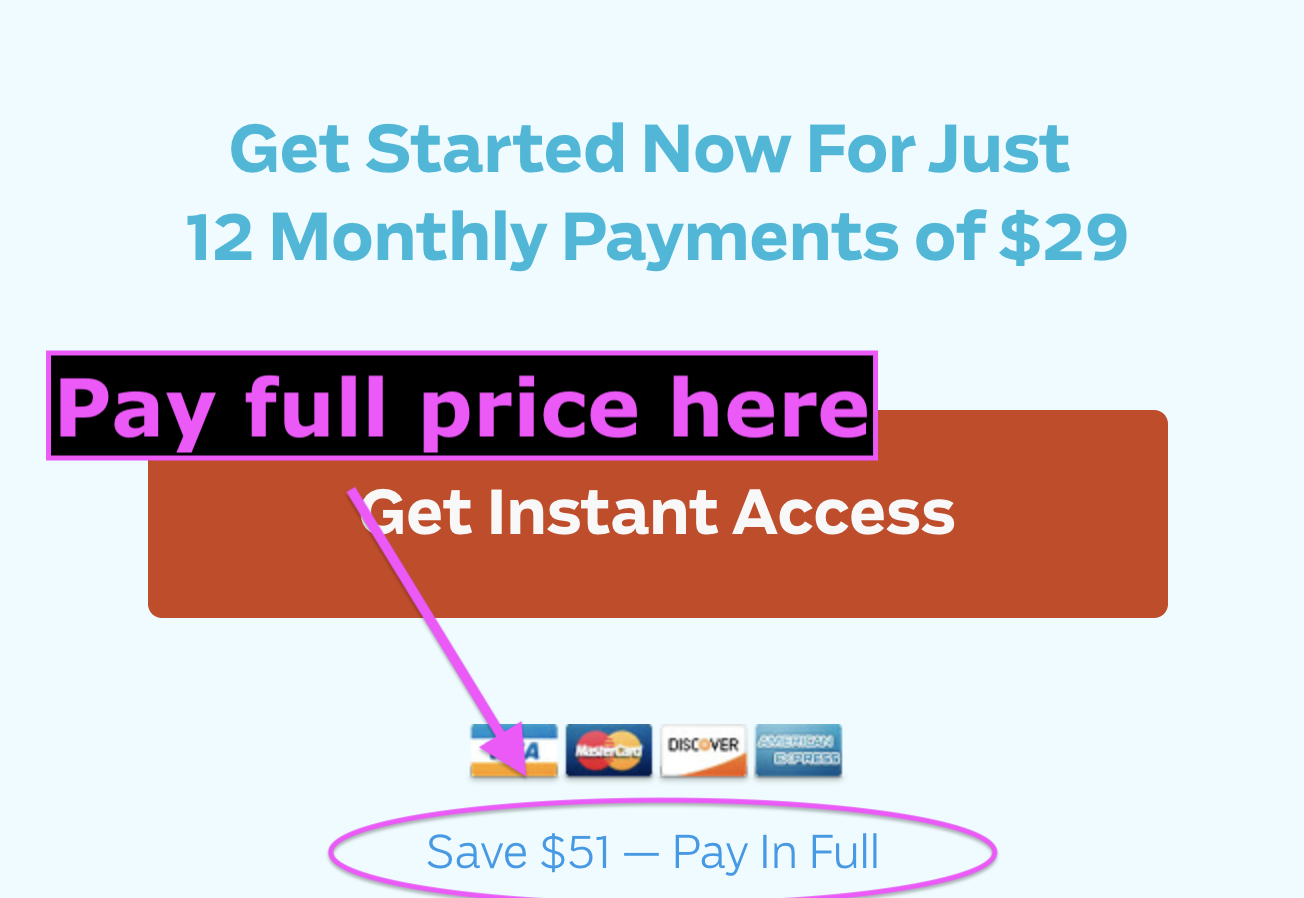

Let’s say your product costs $1,500 when paid in full, and you give customers the option to join your course for 12 monthly installments. Ideally, you’d like your customers to pay in full so you never have to worry about failed payments. On the other hand, monthly installments present a lower barrier for the customer and seem appealing.

As you’ve seen, there’s an inherent risk in 12 recurring monthly charges. The compromise here is to charge a bit more for each monthly payment. This means that you lower the barrier, making paying for your product more manageable for the customer, while at the same time encouraging the customer to pay in full (which could be better for you). Here’s what that might look like:

First divide $1,500 by 12, which comes out to $125. Then you add 10% on top of that, so each of the 12 payments is about $138.

One thing to note: Be mindful of your verbiage. Normally, we’d say that to join one of our courses you can “get started now for just 12 monthly payments of $X!” Note that we don’t say: “You can buy the course for $1,500 OR pay 12 monthly installments of $138!”

Instead we insist that you SAVE however much by paying the full amount.

In the end, your customers get to save some scratch, and you never have to worry about breathing down someone’s neck for a failed monthly charge. Everybody wins.

2. Have a “dunning” system in place

Dunning is a systematic process of reminding customers to pay down or off what they owe to you.

Here’s an example order of action steps you can take to attempt collection over the course of however many weeks you want and adapt as needed (e.g., 14 days, 30 days, or even 90 days).

- Payment fails

- An email is sent to the customer (and a separate notification email is sent to you, like it was for me by SamCart)

- Payment attempt #1

- Send personalized email

- Payment attempt #2 a few days later

- Payment attempt #3 a few days after

- Send follow-up email

- Payment attempt #4 a few days after

- Pick up the phone and call

- Lie on the floor and give up

You’ll have to look into the features you have at your disposal, depending on what third-party carts you’re using. SamCart, for example, sends an email after every attempt to charge the customer fails.

If you’re dealing with a lot of customers, chances are your email service provider can be integrated with SamCart, so you can tag those customers whose payment has failed and initiate an automated email sequence.

Additionally, Stripe has guides on how to handle credit card updates. (It’s also worth checking out this handy guide to tweaking your credit card update page to make sure customers actually do it and stick around.)

If failed payments are a HUGE issue for you, you might want to look into specific dunning services to help you collect payments. Some options include ProfitWell and Stunning.co. ***

Sometimes you may have to just cut your losses. It sucks, but as my friend told me once before, “it’s just business.”

Learn to take control of your finances and spend your money GUILT-FREE with our free Ultimate Guide To Personal Finance below: