Want to grow your launches? Talk to the people who didn’t buy from you.

So you just launched a brand-new online course. You followed all the steps: you spent weeks immersed with your target customers. You took the exact words you heard from your audience. You built a beautiful, in-depth online course that addresses the exact problems you heard from your audience…

And you launch to … not crickets, exactly. But not as many sales as you’d hoped for based on your list and how receptive people seemed to the content.

What the heck happened? Was it the positioning? The price?

You can drive yourself crazy trying to figure it out on your own. The truth is, you’ll never really know why people didn’t buy, until you ask the people who know exactly why: non-buyers.

Talking to non-buyers is not about dwelling on what you did wrong. It’s about discovering what you can get right for next time. You’re like the investigators in your favorite CSI procedural or true crime series — only instead of solving a murder, you’re solving the mystery of what’s going on in your business, and what you need to do next to keep progress moving the way you want it to (onward and upward).

In this post, we’re breaking down the non-buyer survey we sent after a recent launch for our product, Behind the Sales Email — a brand-new course that we were launching for the very first time. You’ll see how, using the survey, we figured out something we got wrong in the positioning and are incorporating into the next time we launch this product.

Each non-buyer survey has two parts: The email asking the non-buyer to take the survey and the survey itself. Let’s take a look at each part and highlight what you need to keep in mind.

The email: Ask subscribers to help you help them

Keep the copy simple

Be grateful for your readers’ time. Don’t get mopey or reproachful about the fact that they didn’t buy your product. (Don’t be the needy girlfriend/boyfriend.)

Above all: keep the focus on what’s in it for them. Let them know that you care about what they think, and that the reason you’re gathering feedback is to create better content for them.

Here’s the email that went out to non-buyers from GrowthLab a few days after our latest course, Behind the Sales Email, closed:

A couple things to note here:

- We remind the recipient what we’re talking about — we don’t assume that they remember what “Behind the Sales Email” is.

- We let them know that we respect their decision not to buy — we’re not here for a guilt trip!

- We tell them that we’re looking for feedback in order to make better products for them.

- We link them to the survey and tell them how much of their time we’re asking for (1-2 minutes — not much!)

- We thank them for their time — they’re doing us a huge favor!

Send the survey email out as soon as possible

One of our favorite sayings at GrowthLab is this: “We are but a moment in their day.” Sure, you’ve spent the last few weeks or months of your life agonizing over your course content and gearing up for the launch. It’s easy to forget that your audience hasn’t been living and breathing your product the way you have. What they’ve seen is a handful of emails, maybe a sales page — all interspersed between the 1,001 other things they have going on in their lives.

You want to capture their feedback while it’s still fresh in their mind — and before it gets buried by 500 other emails and the next 50 other items on their to-do list.

The survey: Ask questions that help you understand their decision

Keep your questions consistent

We have a template with a standard set of questions that we include in every non-buyer survey, which we update slightly for each launch that we do. When we keep our questions standard, it gives us the chance to compare and contrast between launches and even between products.

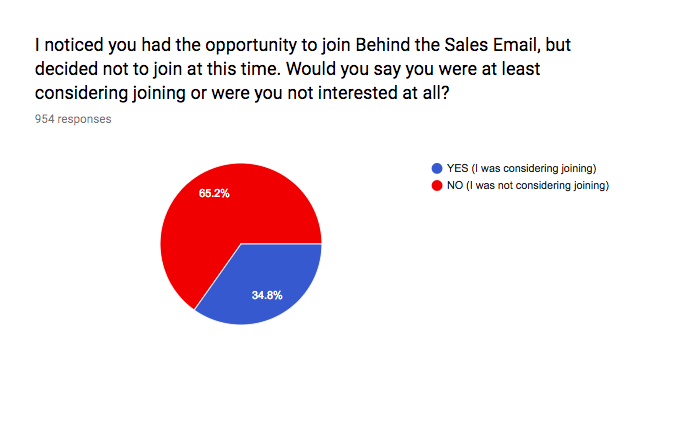

For example: we saw that about 33% of the people who responded to the non-buyer survey for Behind the Sales Email were at least considering joining the program. That’s about on par with what we’ve seen from previous launches, which tells us we were on the right track as far as what we were pitching, and to whom.

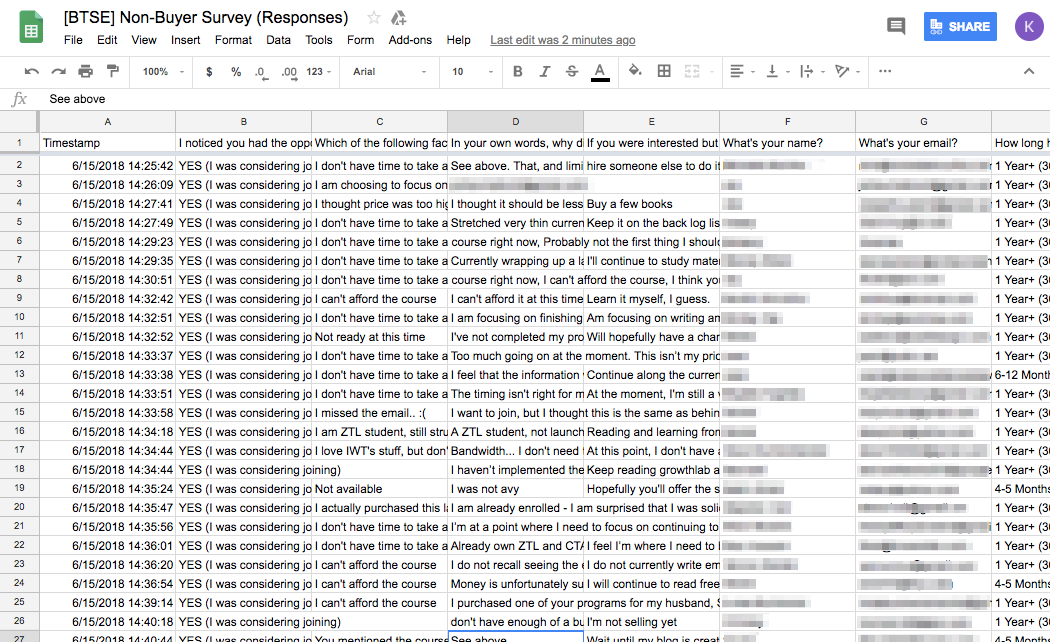

Use Google Forms (or another simple solution)

The survey is a Google Form, which gets linked directly in the email. Once the responses are in, we export them to Google Sheets for storage and easy sorting to draw connections and get the deep, earned insight into what our customers want — and that knowledge is worth way more than fancy graphs and charts.

Useful link: How to export Google Form responses to Google Sheets

.

Like this blog post? Learn how to create amazing content like this that attracts and engages your target buyers with our FREE Ultimate Guide To Remarkable Content.

Sample questions you should include in your survey

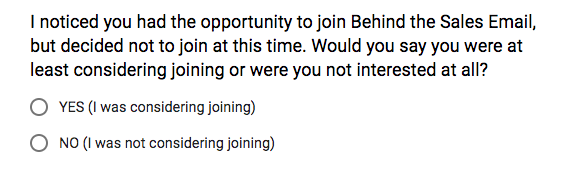

Question 1

What that tells us:

The name of the game with this first question: segmenting. We want to be able to group the responses together based on whether they were seriously thinking about joining the course … or not.

We are most interested in the responses from people who were on the fence about joining and decided not to. If people were dead set on not buying this product, there’s probably not a lot we can do about that. But the people on the fence? There’s a chance, with the right tweaks based on their feedback, we could change their mind — or the minds of future would-be customers like them.

An example from one of our launches: on the non-buyer survey for Behind the Sales Page, our course showing students how to write an amazing sales page, respondents told us they didn’t buy Behind the Sales Page because they already had another one of our courses, Call to Action, and thought the content was the same. That told us that we needed to be clearer in our sales materials about how the two are different, and how Behind the Sales Page could help students build on the lessons they learned in Call to Action.

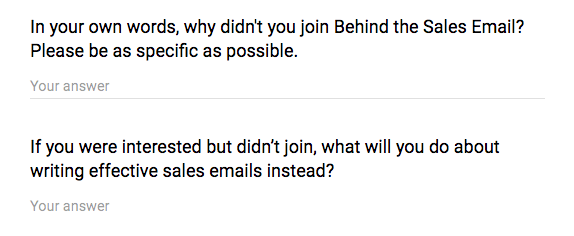

Questions 2 & 3

What that tells us:

It’s time for everybody’s favorite part of the standardized test: the essay section.

Oh, was that just me?

These open-ended survey questions are where the real gold is, in non-buyer surveys and in surveys more generally.

A couple of things we’re looking for in particular when we’re reviewing the open-ended questions:

Trends.

If the same ideas are coming up again and again in open-ended responses, that’s a sign that something’s going on that we hadn’t anticipated. For example: a response that came up again and again in the Behind the Sales Email survey was people telling us they’re not ready to think about sales emails yet — they’re still working on finding an idea and building their list.

What that tells us:

If we want to meet these customers where they are, we need to look at developing more content that gets them past that initial idea hurdle.

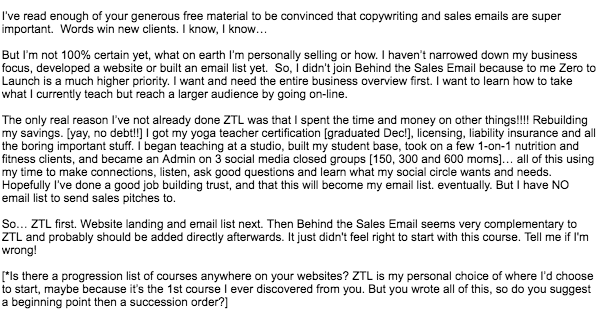

Long responses.

We told people in the email that we were asking for 1-2 minutes of their time. If they take longer than that to write lengthy, thoughtful responses, that’s a sign that they’ve thought long and hard about this problem and our proposed solution — and that’s thinking we want to capture!

What that tells us:

Lengthy responses like this gave us some added context around the “my business isn’t ready” trend we spotted in the responses overall. This respondent is focused on getting their idea homed in first — then they’ll work on their website, THEN they’ll be ready to think about how to write killer sales emails to send to that list. Details like this help us better understand where our students’ priorities are, so we can make sure we’re delivering content that matches those priorities.

Emotionally charged language.

Just like in the immersion and validation phases, emotional language is a dead giveaway that prospective customers feel strongly about this problem and this product.

What that tells us:

The person is ready to talk in depth about their thoughts. So we may follow up with that respondent for more information via email, or maybe even a quick call.

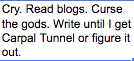

Ask for name and email

Don’t forget to ask for respondents’ names and emails in your survey. Otherwise, you’ll have no way of knowing where those intriguing responses came from or who to reach out to learn more!

What next?

Once the feedback is in and you’ve reviewed the responses, you’re ready to decide: What does this mean for my business, and where do I go from here?

In our case, the big takeaway from the Behind the Sales Email non-buyer survey is that we need to do more to help our Zero to Launch students get their businesses to a point where they’re ready to think about things like sales emails. What that means for us: if we want to grow our sales for this course, we need to help more students get to a point where they are ready.

Some other possibilities for how you can turn non-buyer feedback into measurable steps for your business:

- If respondents don’t understand the value of the product or how it can help them, revisit your sales page and emails and see whether a few copy tweaks can make the offer even more irresistible.

- If they didn’t need this kind of help right now, but will need it in a couple of months, consider switching your course from launch mode to direct sale mode (something we’re also considering doing with Behind the Sales Email).

- If they tell you they’re thinking about something else instead of the subject of this course, maybe there’s an opportunity there for a new product. Time to dig in, do some immersion, and see what you can learn!

The non-buyer survey is an important part of the post-mortem picture, but it’s only one part. It’s like pieces of a never-ending puzzle: the more information you gain, the more complete the picture becomes