Yes, this program will work for international students. While the program does reference US-specific investments like a 401(k) and IRA, the core money frameworks can be easily adapted to other countries. Plus, the Rich Life principles are universal.

There are a lot of other options you could choose, so why this one?

I know Money Coaching isn’t the only choice for getting your finances together. You could…

- Use Excel to make a “better” budget

- Listen to another personal finance podcast

- Watch more Youtube videos

- Try harder

- Buy another book

- Ask your friends and family to tell you what to do

But the truth is these things usually don’t move the needle at all. You’ve probably already tried some of these multiple times!

Budgets don’t work. You don’t stick to them.

Sometimes you need more than a few Youtube videos, a podcast, and some quick tips from your dad.

And sometimes you don’t want to read a 300+ page book and try to apply it all on your own. Are you doing it right? How do you apply it to YOUR situation? How do you even know if you got the right book?

Sometimes you just want someone to tell you exactly what you need to do, from A to Z.

I get it. I spent THOUSANDS OF HOURS studying personal finance, investing, taxes, insurance, psychology, and more to figure this all out — plus more time learning by expensive trial and error. But you don’t have to go through all that.

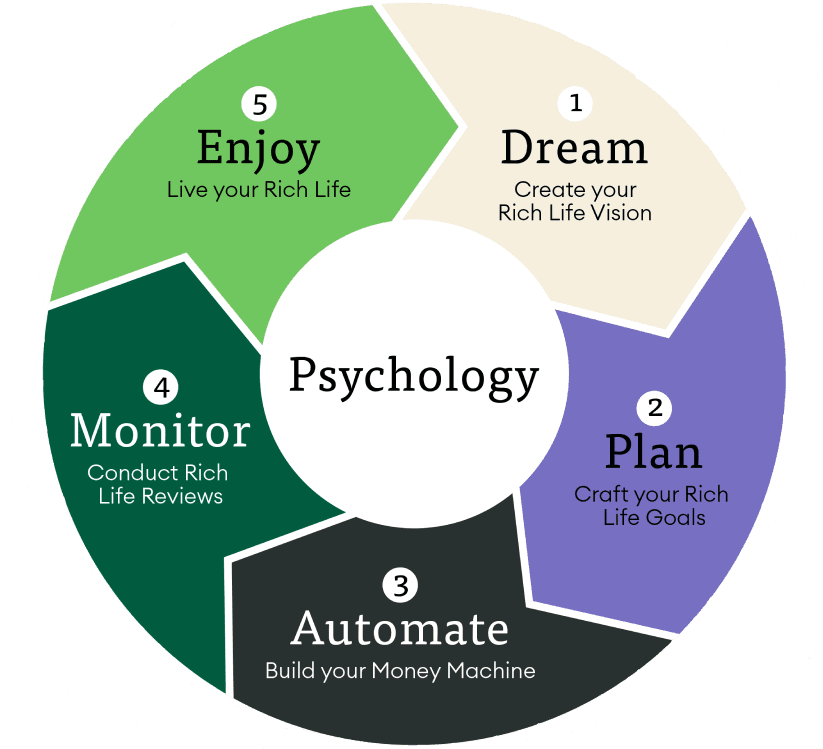

Money Coaching gives you a shortcut to financial freedom, at any income level:

- A simple, step-by-step SYSTEM to get your money in order and build your Rich Life

- Ongoing ANSWERS from someone you can trust

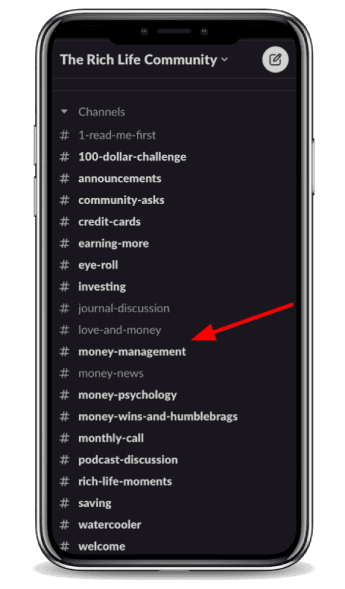

- A COMMUNITY you can turn to when you need answers, motivation, and accountability — or just a non-judgmental place to talk openly about your money concerns and interests

And you get all this without giving up control or losing over a quarter of your total returns to fees, like you would with a financial planner.

With Money Coaching, you’re in control. And there are no hidden fees or surprises. When you join, I’ll help you set up your own, customized, automated Money Machine — then you can get back to living your Rich Life.