What Are Mutual Funds and How Do They Work: All The Basics

Want to know how mutual funds work? Mutual funds are baskets filled with different types of investments (usually stocks) that allow people to invest while mitigating the risk of choosing individual securities.

Instead of requiring investors to pick individual stocks themselves, mutual funds allow investors to simply choose types of funds that would suit them.

And theyre typically one of those personal finance topics people pretend they know about but dont actually have any idea what they are.

Here’s what we’ll cover in this article:

How Mutual Funds Work

Mutual funds work by pooling your money with the money of other investors and investing it in a portfolio of other assets (e.g. stocks, bonds). This means youll be able to invest in portfolios that you wouldnt be able to afford alone because youre investing alongside other investors.

For example, there are large-cap, mid-cap, and small-cap mutual funds, but also mutual funds that focus on biotechnology, communication, and even Europe or Asia.

Mutual funds are extremely popular because they allow you to pick one fund, which contains different stocks, and not worry about putting too many eggs in one basket (as you likely would if you bought individual stocks), monitoring prospectuses, or keeping up with industry news.

The funds provide instant diversification because they hold many different stocks. Most peoples first encounter with mutual funds is through their 401k, where they choose from an array of options.

Mutual funds are typically managed by a fund manager, who picks all the investments in the portfolio. This is often a big selling point for beginner investors who dont have much experience and would rather place their faith in an expert in the mutual fund world.

(Anyone who tells you theyre an expert and can out-play the market is lying because they cant actually predict what will happen.)

Because these fund managers actively manage your money, youll sometimes hear mutual funds referred to as actively managed funds. Theyll also charge a variety of fees for their work (which Ill go into more later).

And if you want to invest in a mutual fund, the mutual fund manager is important. Youre essentially investing in them by putting your money in their fund. They have A LOT of incentive to do a good job for you, as their jobs literally depend on how well the funds perform. They also receive bonuses in the millions if they do a good job.

How Mutual Funds Pay

Mutual funds pay out two different ways:

- Distributions. If a mutual fund contains an asset that pays dividends (i.e., money a company pays out to shareholders), the fund manager must distribute the dividends to the fund owners. The distributions can also come in the form of interest and capital gains which brings us to …

- Capital gains. You accrue capital gains money when you sell your mutual fund for more than you initially paid for it.

How are mutual fund returns calculated

Mutual funds pay out two different ways:

- Distributions. If a mutual fund contains an asset that pays dividends (i.e., money a company pays out to shareholders), the fund manager must distribute the dividends to the fund owners. The distributions can also come in the form of interest and capital gains — which brings us to …

- Capital gains. You accrue capital gains money when you sell your mutual fund for more than you initially paid for it.

The dollar amount you earn from each depends on a variety of factors. One of the most important factors is your mutual fund manager.

As I mentioned before, the manager has a vested interest in doing well and choosing great assets for the mutual fund — but does that mean that the majority of mutual fund managers are able to beat the market?

NOPE.

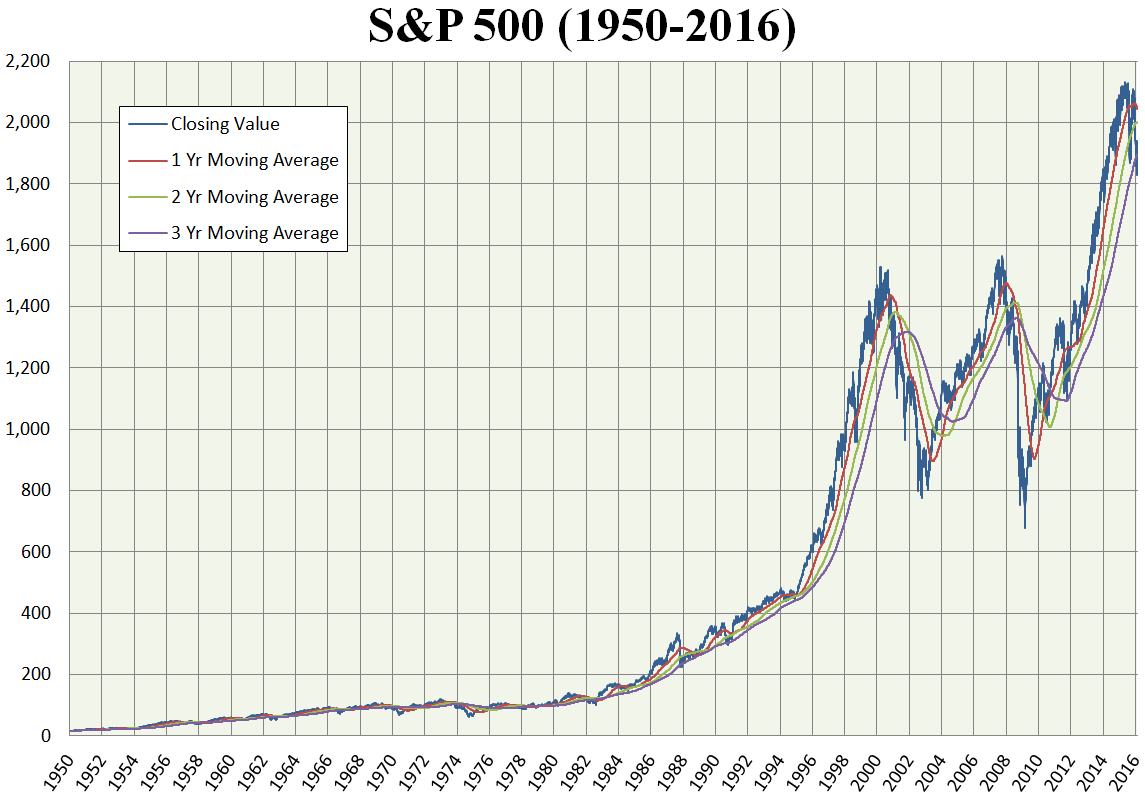

According to Dow Jones, 66% of large-cap (big company) mutual fund managers failed to beat the S&P 500 in 2016 (the numbers are even worse for mid- and small-cap managers).

And when that same study looked at actively managed mutual fund performance over 15 years (you know, close to the length of time you’d keep your money in to save for retirement), more than 90% failed to beat the market.

So let’s recap:

Advantages of how mutual funds work:

- Mutual funds are very hands-off when it comes to investing. This means you don’t have to worry about actively managing your funds on a day-to-day basis.

- These funds hold many stocks, so if one company tanks in your fund, it all doesn’t go down as well.

- Mutual funds are an easy way to make a diversified investment.

Disadvantages of how mutual funds work:

- Many funds charge an expense ratio as well as possible upfront fees in order to be run by an “expert” (the next section explains this more).

- If you invest in two mutual funds that overlap investments, you’ll get a less diversified portfolio (e.g., if you have two funds that both hold Microsoft, and Microsoft implodes, then you get hit twice). You can fix this by getting an index fund that invests in the entire market though.

- You’re paying an “expert” to manage your hard-earned money — and they rarely ever beat the market.

If you’re not careful, you might end up investing in a mutual fund that:

- Charges you a bunch of fees.

- Is managed by someone who could lose you your money.

Boy, I wish there was a way to get all the pros and barely any of the cons. *STROKES BEARD*

The Types of Mutual Funds

Mutual funds are like the different scents at a Yankee Candle store there are an INSANE amount of different kinds. Each with their own benefits and drawbacks.

You can pick a mutual fund based on a variety of different factors including risk, return, sector, geographic area of investment, and more. For example, you can invest in a fund focused on different energy services, or a fund focused on emerging-markets, or even a fund for medical devices.

These funds tend to fall into even bigger buckets. Each one comes with their own benefits, drawbacks, and stipulations before you can invest in them. Lets take a look at four of them now:

- Money market funds. These are high-quality, short-term (less than one year) investments in securities issued by the government (who issue US Treasury securities like CDs), or corporations (who issue commercial papers). They have the lowest returns because they have the lowest risk.

- Bond funds. Otherwise known as fixed income funds. As the name implies, these funds invest and trade different kinds of bonds (investments in the form of debt a company owes to an investor with a fixed interest rate). They typically have higher returns than money market funds but come with more risks, since all bond funds are affected by interest rate risks (if rates go up, bond fund value drops).

- Equity funds. Also known as stock funds because they invest in well, stocks of many different companies. They come in three different ways: Large-cap (big blue-chip companies like Apple or Google), mid-cap (companies that arent behemoths but arent start-ups either), and small-cap (smaller companies).

- Hybrid funds. These are a mix of stocks, bonds, and other investments. Many of these funds can even invest in other mutual funds. Thats right. Its mutual funds in mutual funds.

And theres actually a fifth type of fund I havent gone over yet and its the best one.

Can you guess what it is?

Why Index Funds Rock

Index funds are my favorite type of mutual funds. Period.

Most mutual funds charge a fee called an expense ratio (or management expense ratio). This is an annual fee thats typically around .25% to 2%. Its paid out through the returns of your fund.

This money goes towards a variety of areas that are mostly BS, including the fund manager, administrative costs, and a distribution fee thats used to advertise your fund.

Also, when you purchase a mutual fund, you may be asked for a commission called a sales load that comes in two forms:

- Front-end load. Paying a fee when you purchase a fund.

- Back-end load. Paying a fee when you sell the fund.

AVOID BOTH OF THESE.

Instead, you want a no-load fund. Why? Loads cut into your profits and theres zero evidence they produce any results. In fact, no-load funds tend to outperform load funds. Seriously, its just silly that anyone goes with them.

So what kind of mutual fund offers no sales loads, low expense ratios, and doesnt require an active money manager?

(Psst, index funds!)

Index funds are a special type of mutual fund that, instead of being actively managed by an expert, is tracked using software that matches the stocks in the market. And remember how almost no actively managed mutual funds beat the market? Well, an index fund is essentially betting on the market.

For example, Charles Schwab has their Schwab S&P 500 Index Fund that has every stock in the actual S&P 500.

How much do you think the expense ratio is?

.03%

…but you don’t have to take the same path as everyone else. How would it look if you designed a Rich Life on your own terms? Take our quiz and find out:

Thats it! No front- or back-loading fees, and no money manager who might screw up your investments. Just the opportunity for you to invest directly into the market.

Many brokers such as Schwab also have index funds that invest in an international market as well as the 1,000 largest publicly traded companies in the United States.

Since index funds invest in the entire market, theyll be less volatile which means youll earn money slower. But if you keep your money in the market over your lifetime, I promise you youll make money.

I LOVE index funds and Im in good company:

[Most investors would] be better off in an index fund. -Peter Lynch

Just buy the damn index funds. -John Bogle

Consistently buy an S&P low-cost index fund. Its the thing that makes the most sense practically all of the time.”

There’s a reason index funds are a favorite of financial leaders and thinkers out there. Its because they WORK.

So lets recap. Again.

Advantages of index funds:

- With less risk, you stand to make a lot more money with index funds.

- You save money on dumb costs because index funds dont have money managers or sales-loading costs. Your expense ratio is also much lower.

Disadvantages of index funds:

- Slower gains in funds.

- Thats it.

Okay, Im sold. How do I invest in a mutual fund?

When it comes to actually purchasing a mutual fund and investing, I suggest two places.

Roth IRA and 401k

Your retirement accounts (Roth IRA and 401k) let you purchase index funds. To do so through your 401k, youll have to speak to your companys HR department to set up an investment plan through the mutual fund you want. And, as Ive written, the S&P 500 index fund is a great place to start.

If you want to invest through your Roth IRA, youll have to set it up through a brokerage.

Check out my video below, where I suggest a few good ones to help you get started with your Roth IRA.

Banks, credit unions, and stockbrokers (oh, my!)

Banks, credit unions, and stockbrokers offer avenues to invest in mutual funds. In fact, there are plenty of fantastic brokers that offer a wide variety of mutual funds for you to choose from.

My suggestions:

- Vanguard (This is the one I use)

Phone #: 877-662-7447 - TIAA

Phone #: 800-842-2252 - Charles Schwab

Phone #: 800-435-4000

All of these places offer an excellent variety of index funds to choose from, so you cant go wrong with them.

Signing up is ludicrously easy. Just follow the 7-step guide Ive outlined below (the wording and order of the steps will vary from broker to broker but the steps are essentially the same).

NOTE: Make sure you have your social security number, employer address, and bank info (account number and routing number) available when you sign up, as theyll come in handy during the application process.

- Step 1: Go to the website for the brokerage of your choice.

- Step 2: Click on the Open an account button. Each of the above websites has one.

- Step 3: Start an application for an Individual brokerage account.

- Step 4: Enter information about yourself name, address, birth date, employer info, social security.

- Step 5: Set up an initial deposit by entering in your bank information. Some brokers require you to make a minimum deposit, so use a separate bank account to deposit money into the brokerage account.

- Step 6: Wait. The initial transfer will take anywhere from 3 to 7 days to complete. After that, youll get a notification via email or phone call telling you youre ready to invest.

- Step 7: Log into your brokerage account and start investing!

The application process can be as quick as 15 minutes. In the same time it would take to watch half an episode of Rick and Morty, you can be well on your way to financial success.

If you have any questions about funds or trading, call up the numbers provided above. Theyll connect you with a fiduciary who works for the bank to give you the best advice and guidance they can.

Beyond Mutual Funds

If you want even more actionable tactics to help you manage AND make more money, youre in luck. I wrote a FREE guide that goes into detail on how you can get started doing just that.

Join the hundreds of thousands of people who have read it and benefitted from it already by entering your information below to receive a PDF copy of the guide.

When youre done, read it, apply the lessons, and shoot me an email with your successes I read every email.

FAQs About Mutual Funds

What is the best mutual fund?

A mutual fund’s viability depends on the investor’s goals, risk tolerance, and investment objectives. To help you find appropriate funds, we have researched leading options and identified the best mutual funds.

How are mutual funds are taxed?

Whether you hold your mutual fund shares as cash or reinvest them in additional shares, you must pay taxes on distributions, including on capital gains and dividends. In a registered plan such as an RRSP, an RRIF or an RESP, you don’t pay tax on your investment income as long as the money stays in the plan. When money is withdrawn from a registered plan, it will be taxed as income.

If you aren’t sure how to handle your taxes, consult a tax professional.

Are mutual funds safe?

Mutual funds are considered a lower-risk investment than individual stocks. Their diversification allows the average investor to participate in a greater number of company stocks without taking on unnecessary risk.

If you liked this post, you’d LOVE my New York Times Bestselling book

You can read the first chapter for free – just tell me where to send it:

Written by Ramit Sethi

Host of Netflix’s “How To Get Rich” NYT Bestselling Author, & Host of the I Will Teach You To Be Rich Podcast. I’ll show you how to take control of your money with my proven strategies so you can live your RICH LIFE.